Eagle Plains Resources (EPL.V) seems to be determined to get as much work as possible done on its uranium project and just a few months after entering into an agreement with Xcite Resources (XRI.C), the company announced a new option partner for another one of its Uranium properties.

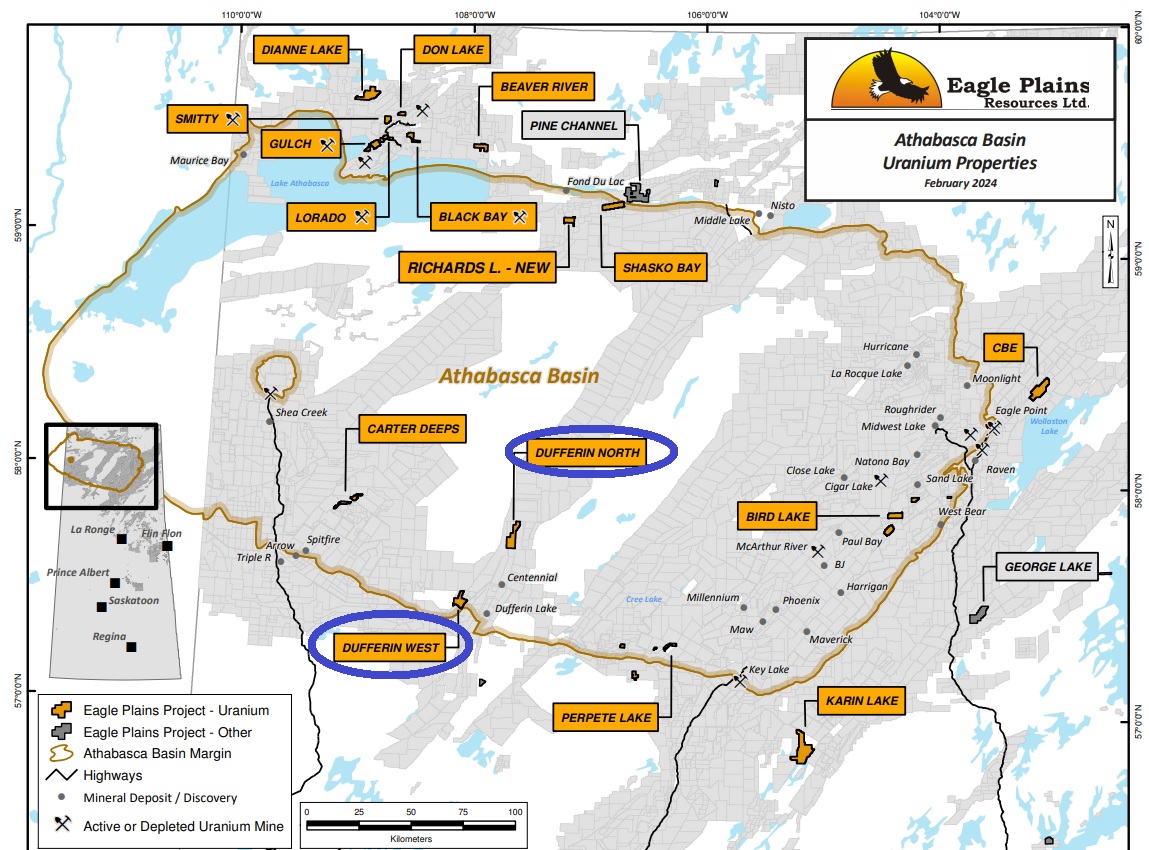

Eagle Plains has granted Refined Metals (RMC.C) the option to acquire up to 75% of the Dufferin uranium project, which is located less than 20 kilometers away from the Centennial uranium project owned by Cameco (CCO.TO, CCJ). As per Eagle Plains modus operandi, the optionee will be required to make cash and share payments while completing a substantial amount of work on the property.

Refined is allowed to acquire an initial 60% interest in the project by making C$275,000 in cash payments and issue 1 million post-consolidated shares to Eagle Plains while spending C$2.6M on exploration by the end of 2026. The second phase of the option will require Refined to pay an additional C$0.5M in cash and issue an additional 500,000 shares while an additional C$3M in exploration expenditures will have to be completed by the end of 2028 before it vests a 75% interest. Eagle Plains will also retain a 2% Net Smelter Royalty, of which 1% can be repurchased for C$2M.

Eagle Plains will be the operator during the first phase and will likely generate an interesting management fee. And as explained in a previous report on Eagle Plains, the TerraLogic subsidiary generates a positive cash flow to the consolidated entity, and represents an important part of the value.

Disclosure: The author has no position in Eagle Plains Resources but plans to initiate a long position in the near future. Eagle Plains is a sponsor of the website. Please read the disclaimer.