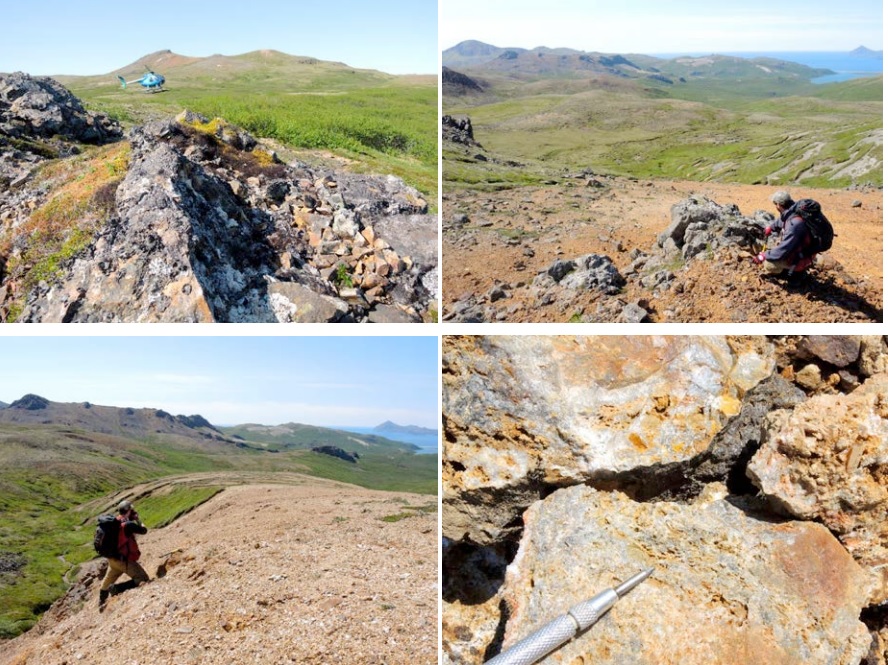

Redstar Gold (RGC.V) has released a substantial in-depth report written by Dr. Jeffrey Hedenquist, one of the world’s leading specialists in epithermal gold deposits. Hedenquist has spent no less than six days at the Unga Gold Property where he focused on the Shumagin-Orange Mountain and the Apollo-Empire ridge gold trends, which total to-date nearly 20 km of strike length.

This 37 page report is freely available on Redstar’s website (click HERE to read the report), and even though we are working on a more extensive update based on this report (with input from other geologists), it’s already very exciting to see that Dr. Hedenquist is making comparisons of the Unga mineralized trends to some of the world’s most prolific mining camps (Cerro Moro, owned by Yamana Gold (AUY, YRI.TO), the Comstock Lode in Nevada,…) and you don’t see it very often a well-known epithermal-focused geologist is making comparisons like this.

The central focus of the Hedenquist report seems to be the excellent exploration potential on Redstar’s land package at Unga Island. Hedenquist confirms there’s a total strike length of in excess of 14 kilometers (!) at the Apollo and Shumagin structures. Only a small fraction of the veins systems, less than 5-10% has been drilled to-date, mostly focused on the Shumagin Gold Zone, and the drilling not been tested the mineralization below the 250 meter level, resulting in several intervals along the strike length with the potential to be mineralized remaining completely untested.

That’s a very encouraging conclusion from someone who’s considered to be one of the world’s top specialists in epithermal deposits (Hedenquist has earned his PhD at the university of Auckland, and was awarded the Doctor Honoris Causa status at the university of Geneva, Switzerland). The simple fact Hedenquist dares to mention Unga Island in one sentence with Cerro Moro and Cerro Bayo confirms the company might be sitting on a gold mine, in all aspects of the word. Hedenquist also states that this project should clearly be looked at a district scale, thus leading to the many other veins systems being included in the model of what we believe is now becoming a very interesting asset to the majors and others with money ready to spend. At the time of writing this quick update, management was heading back up to site for another two property tours with two established gold-focused companies, and they are receiving calls from other groups post reading this Hedenquist report.

We will follow up on the Hedenquist report with a more detailed full report, but there’s definitely a good reason why the market woke up and pushed Redstar’s share price 82% higher since our previous report, highlighting the potential at Unga Island. With warrants potentially being exercised at C$0.10 and C$0.12, which could yield ~$6M and cash up Redstar, we may see a drill program sooner than later.

Go to Redstar’s website

The author has a long position in Redstar Gold. Redstar is a sponsor of the website. Please read the disclaimer