Focus Ventures (FCV.V) has published a shareholder letter wherein the company is providing more background information regarding its pre-feasibility study where the economics were a bit worse than what we were expecting. We would strongly recommend you to read the letter (click HERE), and we would like to highlight an excerpt;

We received the first draft of the discounted cash flow (DCF) model in early December; the initial numbers indicated an IRR percentage in the 20s and a payback of about 5 years. However, cost inputs were still being revised and omissions in the DCF model were still being ironed out as late as mid-December, all which had the effect of bringing the final numbers in the model down (rather than up) with no time for optimization studies. Although the DCF model numbers demonstrate a viable project, the Study recommends several areas of opportunity to improve the project economics.

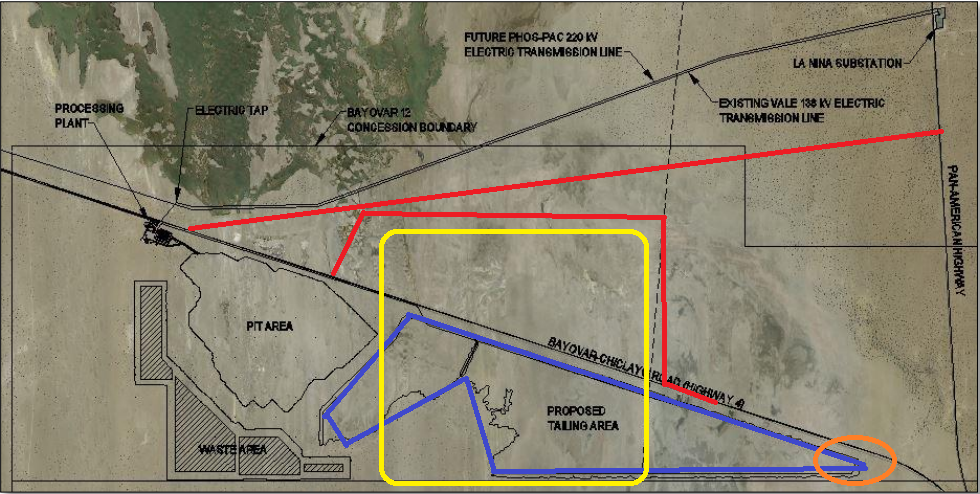

As Focus Ventures was unable to implement any potential optimization of the mine plan and flow sheet, we’d like to think the current pre-feasibility study actually builds a worst case scenario. There seem to be a lot of possibilities to either reduce the capital expenditures or the operating expenses, and one of the possibilities would be to move the currently existing paved road to the north of the mine site which would reduce the haulage distance for the trucks to truck the waste to build the Tailings facility. The next image might explain this a bit better:

The blue area is the currently planned location of the tailing area, and the distance to the furthest point (in the orange circle) is quite far. It’s very likely that a re-designed tailings area (in yellow) would reduce the haulage distance and the TSF costs. In order to do this, the road might have to be re-constructed (the red lines). Keep in mind this is just a theoretical assumption from us and more studies will be needed to discuss the trade-off scenarios. The updated road could either bypass the potential new tailings facility, or an entirely new connection point with the Pan American Highway could be created.

It will be very important for Focus Ventures to try to optimize the economics of the project as fast as possible to regain the confidence from the market. The first study is indeed not as good as we expected, but we feel there’s a lot of potential to further improve the economics, and Focus Ventures should have just two priorities this year: working calmly and thoroughly to be able to publish an improved feasibility study as the company can now take all the time it needs to further optimize the project.

Secondly, Focus will have to find a solution for the loan payable to Sprott by the end of September. Extending the maturity date of the debt is always a possibility, but the main question will be whether or not that will be the cheapest option, as Sprott will undoubtedly ask for a restructuring fee on top of keeping the interest rates as a double digit percentage.

2016 will be an important year for Focus Ventures. The Pre-Feasibility Study is the first official document studying the economics of the project, and it will be a good basis to further improve the Bayovar 12 project.

Go to Focus’ website

The author holds a long position in Focus Ventures and has added more shares at 8 cents. Focus is a sponsor of the website. Please read the disclaimer