Great Bear Resources (GBR.V) completed its bought deal private placement in the final few days of February. The company issued 3.225 million flow-through shares priced at C$18.60 per flow-through share as well as a total of 784,000 common shares (‘hard dollar’) at C$12.75 per share to raise a total of C$70M (with net proceeds of approximately C$66M after taking the 5.5% underwriting fee into account). This capital raise boosts Great Bear’s cash position to in excess of C$100M with just 57 million shares out.

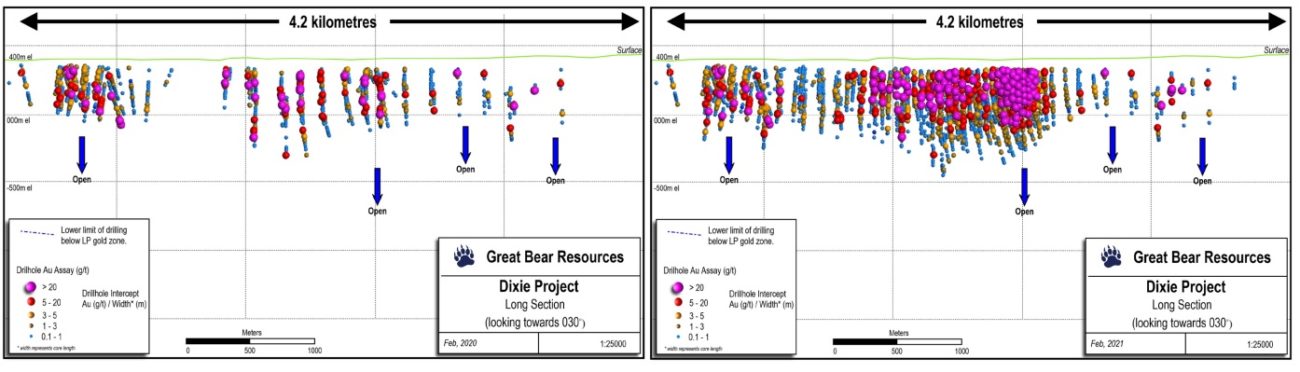

Given the strong cash position and the massive amount of flow-through funds on the balance sheet, it wasn’t really surprising to see Great Bear immediately decided to increase the size of its 2021 exploration program on the Dixie gold project in Ontario’s Red Lake District. Whereas Great Bear was originally expecting to spend C$25M this year, it has now almost doubled its exploration program to C$45M. This will be sufficient to complete about 175,000 meters of drilling in over 200 holes, which will push the total amount of meters drilled on Dixie to 400,000 meters before the end of the year.

Of the 175,000 meters, 80% will be directed to drill out the LP Fault, 15% will be focusing on Dixie Limb and Hine while an additional 5% (which doesn’t sound like much but actually represents about 10,000 meters of drilling) will be completed on high priority regional targets.

Upon the completion of this year’s drill program, Great Bear Resources will likely publish a maiden resource estimate, and that could be an important catalyst as that will be the very first time the Dixie exploration efforts will be underpinned by an amount of ounces in the ground.

Disclosure: The author has a long position in Great Bear Resources. Great Bear is a sponsor of the website. Please read our disclaimer.