Great Bear Resources (GBR.V) is doing a good job at ‘taking the money when it’s available’ and quickly raised C$10.9M by issuing new flow-through shares priced at C$5.45 per flow-through share, which will become tradeable on November 4th.

The cash position (which has now been boosted to around C$20M or approximately C$0.50 per share) will help to fund Great Bear’s ongoing 90,000 meter drill program on its Dixie Gold project in the Red Lake District. It had been a while since Great Bear treated us with drill results so we were expecting Great Bear to release drill results after closing the financing but Great Bear was faster than us and put out excellent drill results before we were able to put out this blurb.

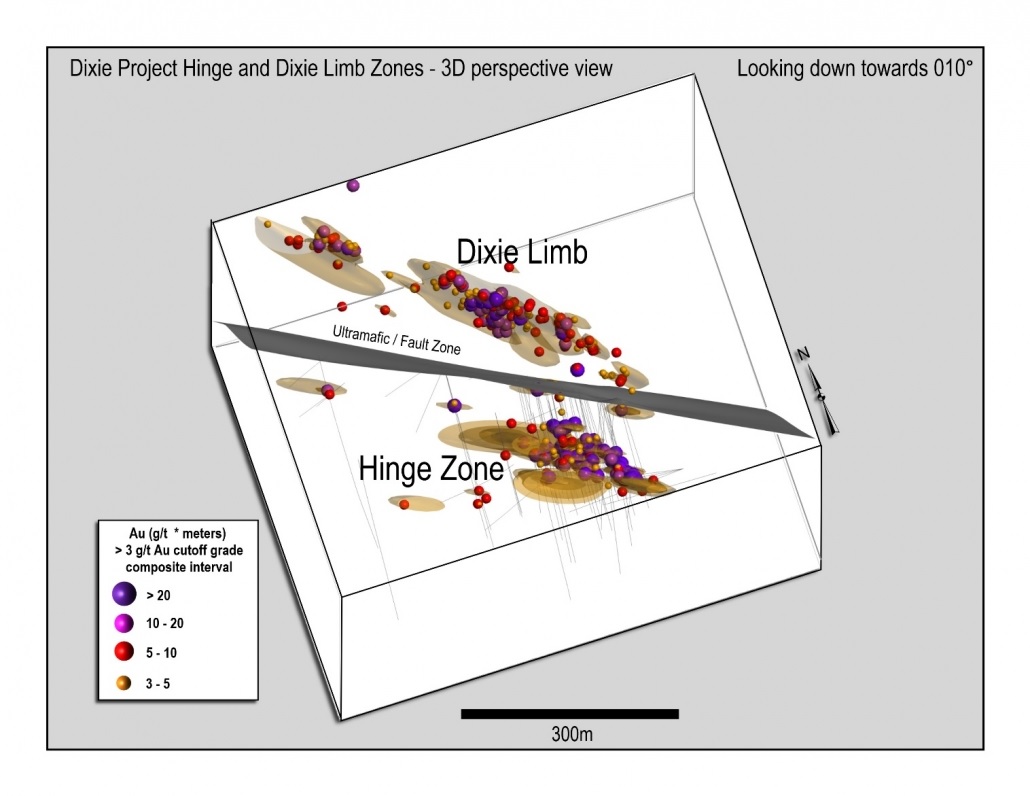

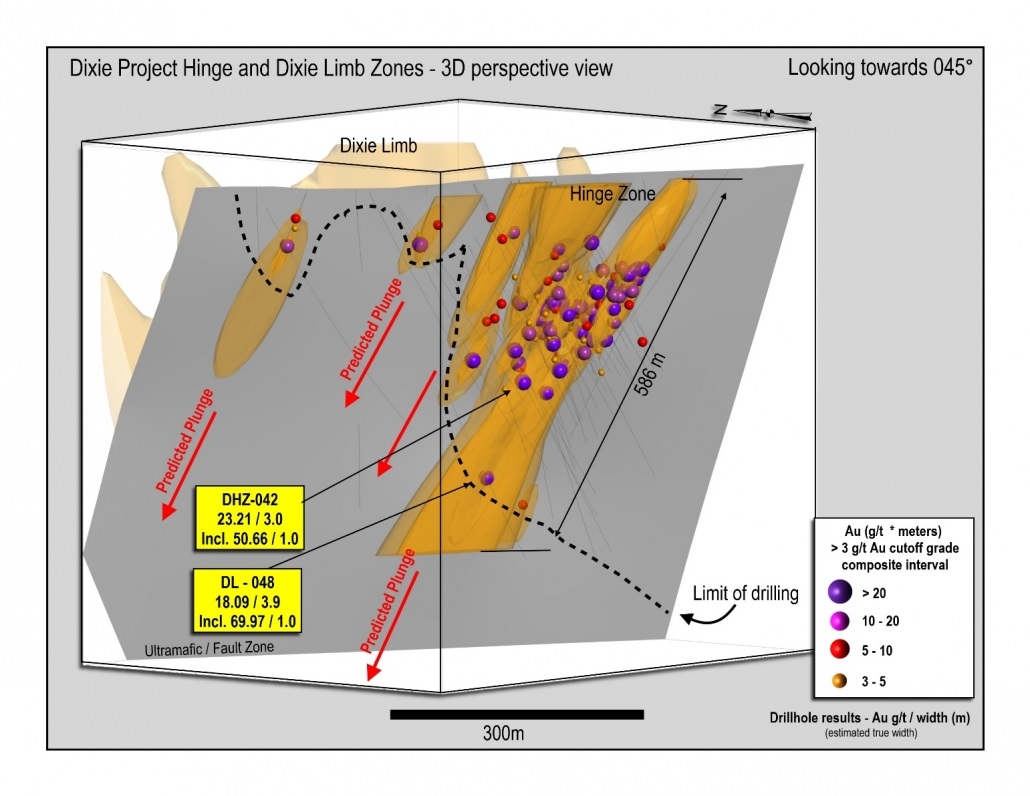

Long story short, the Dixie gold project just keeps on giving. In the most recent exploration update, Great Bear was once again able to report a substantial expansion of what’s currently known as the Hinge Zone. Great Bear had designed a few holes to do some step-down drilling and was once again successful in expanding the currently known gold mineralization at depth: hole 48 encountered almost 4 meters of containing just over 18 g/t gold t a vertical depth of 342 meters, and approximately 150 meters (!) down plunge of the previously reported Hinge Zone gold intervals.

That hole was a very bold move for Great Bear as it doesn’t happen too often to see companies being so aggressive. Fortunately Great Bear didn’t only succeed to encounter more gold, it has now paved the way to increase the tonnage at the Hinge Zone faster than anticipated as drilling deeper holes to test the mineralization at depth. The main Hinge Zone now has a strike length of 300 meters (but Great Bear will undoubtedly try to expand this to the full 500 meters by trying to connect the dots towards the west-northwest of the main Hinge Zone. For now, let’s just say the Hinge Zone is continuous over approximately 300 meters (which could be extended to 500 meters by drilling some holes between the main Hinge Zone and the few holes further west), and assuming a depth of 580 meters and a mineralized width of 3.5 meters (as a reminder, the original Red Lake mine was build on average widths of 2 meters), Great Bear is zeroing in on a total tonnage of 2 million tonnes (at just the Hinge Zone) which could rapidly increase by continuing to test the mineralization at depth and completing some infill drilling to expand the strike length at surface to 500 meters. And of course, you still have Dixie Limb and the newly-discovered Bear-Rimini target that will add to the total tonnage on Great Bear’s land package.

As Great Bear isn’t even halfway its 90,000 meter drill program, we can expect a steady news flow with the continuous release of drill results aimed at expanding the currently known mineralized footprint. Keep in mind it’s still early days at Dixie, and Great Bear is still just scratching the surface.

And perhaps a fun fact to end: Great Bear’s market capitalization of C$183M is now higher than neighbour Pure Gold (PGM.V) (C$179M, including the recently announced bought deal).

Go to Great Bear’s website

The author has a long position in Great Bear Resources. Great Bear is a sponsor of the website. Please read the disclaimer