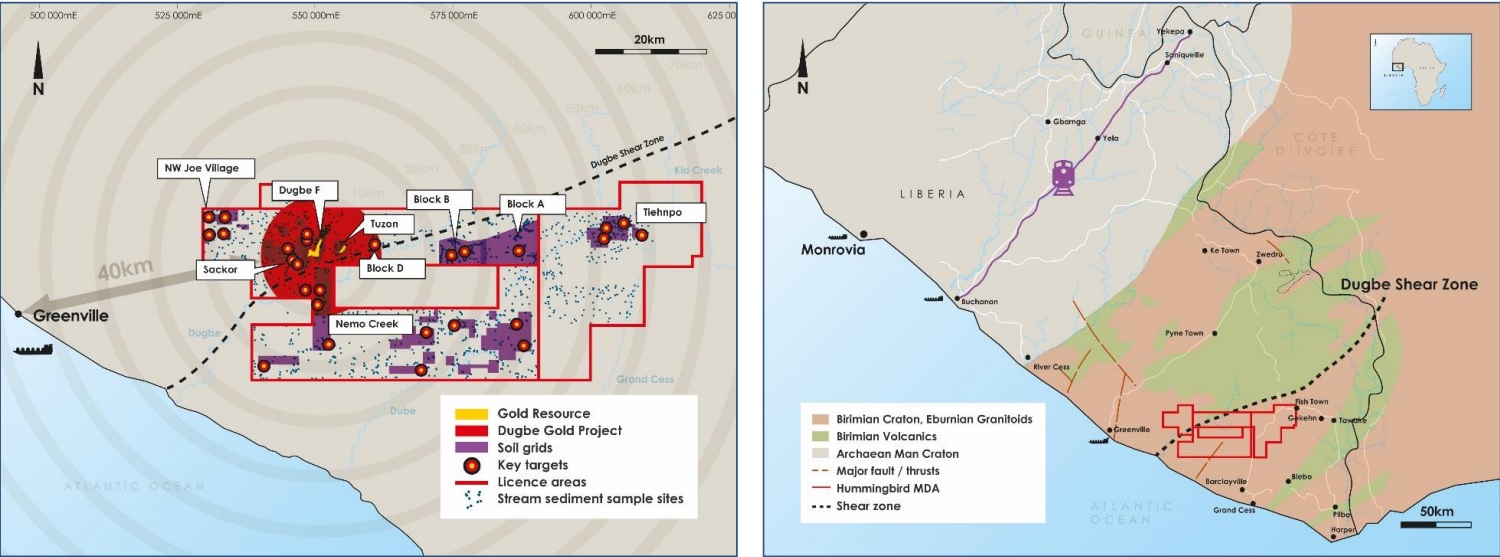

Hummingbird Resources (HUM.L) might be focusing on its project in Mali right now, the company still has the large 4.2 million ounce Dugbe gold project in Liberia in its portfolio. We are always big supporters of companies that are trying to think out of the box, and the final outcome of Hummingbird’s study to find out if a hydro-electric dam might actually work has positively surprised us.

The company has considered five development scenario’s with an installed capacity ranging from 10-30 MW, but as the required average power demand for Dugbe will be 16 MW, we will exclude the 10 MW and 15MW plants from the equation, as these are too small to satisfy the entire need of Dugbe. We would actually be in favor of the large 30 MW plant, because even though this comes at a price tag of $143.5M, it will produce an average of 141.2 GWh per year (which is 141.2M KWh), at a production cost of less than $0.003/KWh. If you’d use a 20 year linear depreciation of the power plant, the total cost would come in at $0.05/KWh (excluding interest payments on the debt financing).

Choosing the biggest plant will have several benefits for Hummingbird Resources. First of all, it will reduce its power cost from $0.28/KWh to $0.05/KWh. Even if we would use a total cost of power of $0.07/KWh, the company would save approximately $200 per produced ounce of gold versus the expected $903 AISC as defined in the 2013 scoping study. Even though the oil prices have come off since that study, and the power cost based on the diesel-powered generators would have come down to the $0.20-mark, we would still be in favor of building the dam as this would ensure a reliable power supply, at a fixed cost.

Secondly, by choosing the largest dam option, the company could sell the surplus power to the surrounding communities. Not only will this improve the standard of living of these communities, it might also help the company’s bottom line to repay the initial investment. If half of the power could be sold to third parties at $0.08/KWh a total revenue of $5.65M would be generated which would cover the annual operating expenses of $0.4M, as well as the majority of the interest expenses associated with the construction of the dam, further reducing the cost to Hummingbird.

And finally, should Hummingbird indeed prefer the 30 MW option, we are pretty sure there would be some subsidies and grants from local and international governments, or the project could be funded by low-cost debt in case a supranational organization would guarantee the loan. Keep in mind the pre-feasibility study of the hydroelectric facility has been funded by the IFC, a sub-division of the World Bank.

Go to Hummingbird’s websiteThe author has no position in Hummingbird Resources but could initiate one at any given time. Please read the disclaimer