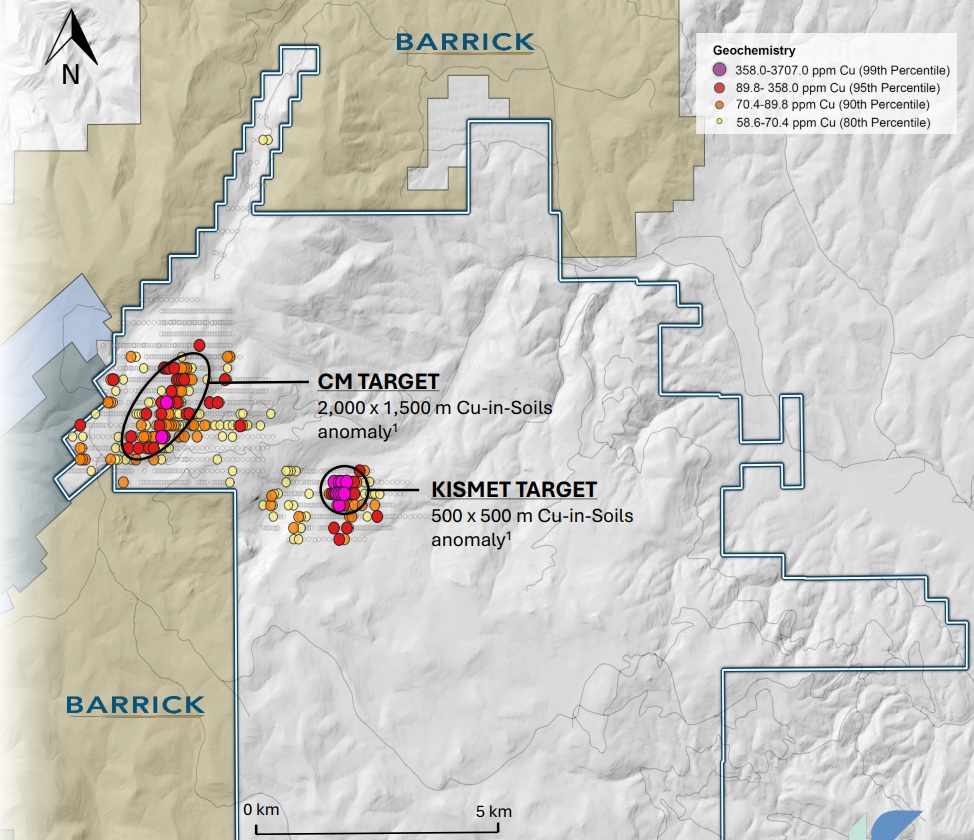

IDEX Metals (IDEX.V) has announced that the US Forest Service has approved the company’s plan of operations. This will now allow the company to start exploration activities on the western part of its flagship Freeze project in Idaho. CEO Clayton Fisher mentioned the company has been very eager to drill-test the big CM target, and hopefully we will see exploration activities kicking off in the very near future.

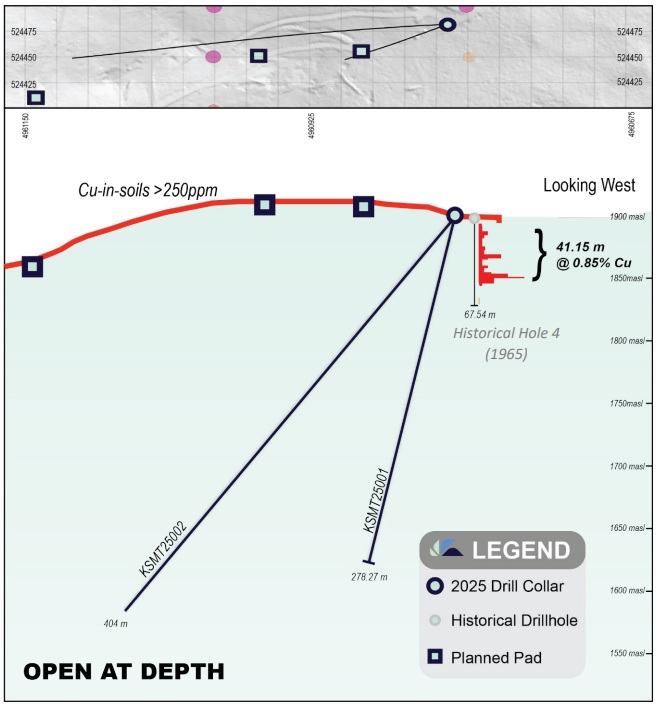

The company also provided an update on its drill program at the Kismet target, where the first hole has been completed. That hole was designed to test the extent of a tourmaline breccia that was encountered in 1965 when a previous operator intersected 41 meters of 0.85% copper including almost 9 meters containing 1.87% copper. The first hole of the drill campaign reached a total depth of 278 meters which is approximately four times deeper than where the hole drilled in the Sixties ended. As per the company’s statement, the hole encountered both oxide and sulphide mineralization and ended in mineralization before it was stopped due to challenging drilling conditions.

The share price has reacted very well to the update and the stock is currently trading at approximately twice the IPO price and at almost three times the 52 week low (which was C$0.36 per share). Exploration isn’t easy and although IDEX Metals is doing all the right things and we haven’t seen any assay results yet, it sometimes could makes sense to take some money off the table. We have sold about half of our total exposure and for now we are retaining the ‘free’ shares (i.e. we have recouped almost our initial investment and have thus reduced the risk for the remaining exposure to almost zero).

Disclosure: The author has a long position in IDEX Metals, but recently sold a portion of his position. IDEX Metals is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.