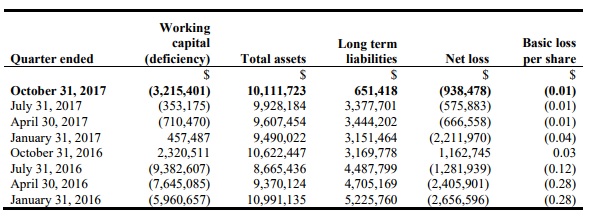

Inca One Gold (IO.V) has filed its financial statements for the quarter ending on October 31st after-hours last Friday. As of at the end of October, Inca One had just C$64,000 in cash left on the balance sheet whilst the working capital position remained negative at C$3.2M despite a C$2.2M capital raise during the summer. The main culprit is the C$2.75M secured debenture which moved from a long-term liability to a current liability as the debenture will mature on September 1st 2018. This debenture will have to be refinanced in 2018, but this could be as simple as agreeing with the debenture holders to extend the maturity date by 1-2 years. Additionally, the C$1.15M in deferred revenue from a pre-paid gold sales agreement also contributed to the working capital deficit.

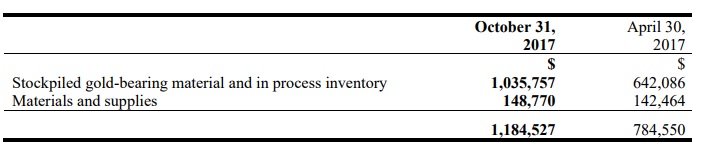

The lower cash position could also be explained by the higher inventory levels, which increased from C$785,000 to $1.185M (+ C$400,000). This C$400,000 was entirely spent on increasing the stockpile of rock which still has to be processed at the Chala One mill. As Inca One’s mill throughput continues to increase, we should be able to see a faster conversion of inventory into cash (although this won’t immediately be visible on the balance sheet as the cash will immediately be used again to purchase more gold-bearing rock.

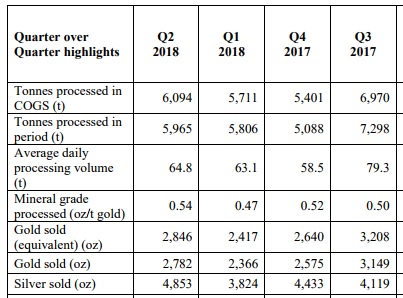

According to the MD&A (which was filed on Friday as well), the average throughput in the second quarter of FY 2018 was almost 65 tonnes per day, a 2.5% increase compared to the previous quarter. The average grade of the rock also increased to 0.54 ounces of gold per tonne (which provides another explanation of the higher inventory levels as higher grade rock obviously has a higher purchase cost as well). The gross margin per tonne increased to C$9/t resulting in a gross margin of C$60,000 for the quarter. This indicates the ‘pure’ milling operations are slightly profitable, but the overhead expenses and interest expenses of the ‘parent company’ are the reason why Inca One is still writing in red numbers.

In other news, director Adrian Morger has acquired almost 9.5 million shares of Inca One in the past twelve months, of which 8.5M shares were received in September 2016 as part of the debt restructuring. These shares have an average cost basis of approximately C$0.40 (considering C$8M of debt was converted into 20.3 million shares), whilst the purchase price of the additional 1 million shares hasn’t been shared.

Go to Inca One’s website

The author has a long position in Inca One. Inca One is a sponsor of the website. Please read the disclaimer