The market has been betting against Integra Resources (ITR.V, ITRG) for a while know as the Q1 results already indicated the working capital level had fallen down to US$4.6M. For most non-revenue exploration stage companies that’s still a lot of money but as Integra is advancing the DeLamar project and was looking to enter the permitting phase, a lot more cash was needed: US$20-30M.

The company has been juggling term sheets in the air for a while but as it was difficult to pull off a non-warrant financing, Integra decided to go a more unconventional route by issuing a senior secured convertible debenture at 8.75% while completing a concurrent equity financing.

The equity financing

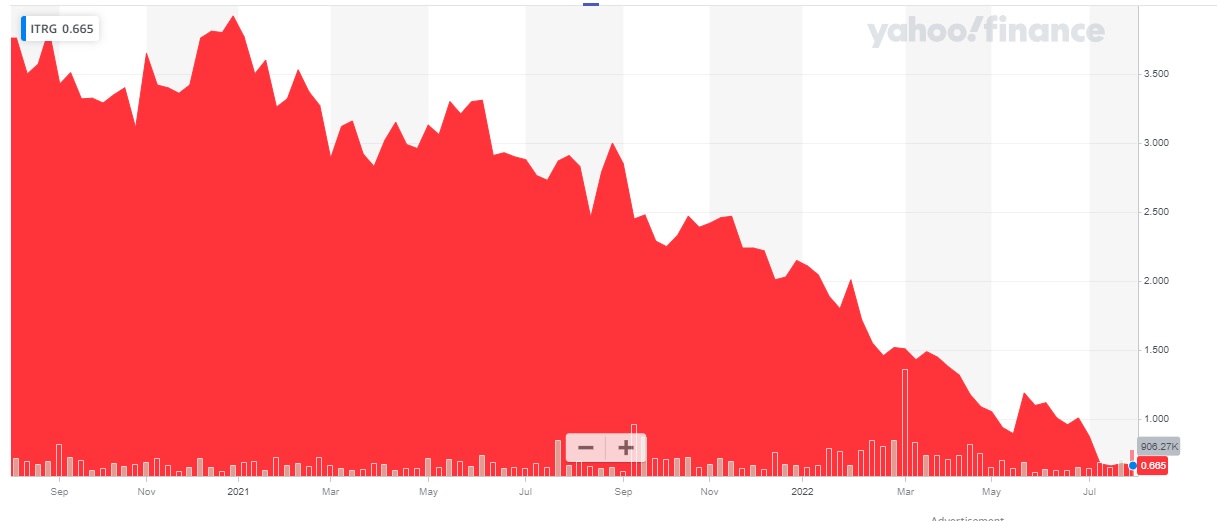

The equity financing is straightforward to explain. Integra has raised a total of US$11M at US$0.66 per share (which is approximately C$0.85). That’s it. No warrants, just a straight share financing. Is the price disappointing? Yes, it is the lowest level Integra has traded at since the formation of the company in 2016. The harsh reality is that Integra had just two options: it either raised the money or would have to greatly reduce its activities which would mean that everything gets pushed out by several quarters or years. It was choosing between two evils and that never is an easy choice. We were also not very impressed with Integra raising cash in September 2021 at US$2.55/share as that also was the lowest level in over a year but in hindsight we were wrong and Integra was right as the current financing is conducted at a discount of almost 75% to the previous financing. Ouch.

According to SEDAR filings, Beedie Capital subscribed for 3.03M shares in the financing for US$2M. This increased the fund’s stake to 6.07M shares.

The convertible debenture

The convertible debenture consists of two tranches of US$10M of which the first tranche will be made available right away while the second tranche will be available upon the approval of a Mining Plan of Operations.

The convertible debentures is secured by the asset (if Integra defaults, Beedie could just take possession of DeLamar in an unlikely worst case scenario) and has an interest rate of 8.75% for the initial three year term (Integra has the option to extend the term by one year ‘subject to conditions’). Those conditions were not mentioned in the press release nor were the prepayment penalties clarified but we would assume those would be in line with the going rates in the market. The interest can be accrued for the first 24 months and will subsequently be payable in cash or stock, at Integra’s discretion.

The initial tranche of the debenture will be convertible at C$1.22 while the subsequent advances will be convertible at a 20% premium to the 30 day VWAP price of the common shares (which is a good feature) as it will allow Integra to potentially capture the upside on the share price: if ITR’s share price would be trading at C$1.50 at a subsequent drawdown, the conversion of the second tranche would happen at C$1.80. Of course this works both ways: if the share price is trading at C$0.50, the next tranche of the convertible could be converted at C$0.60. But let’s for sure hope the worst is behind us on this gold market and for Integra Resources.

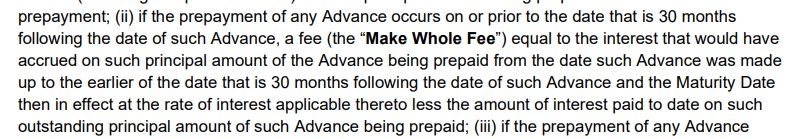

Whether or not Integra should draw down the subsequent tranches will fully depend on the share price and the situation on the markets. If suddenly an equity financing window would open up and Integra is trading at C$1.20 then it would make sense for Integra to just issue shares and even retire the initial tranche to avoid paying the 8.75% per year until the maturity of the loan. This of course depends on the prepayment penalties: the stricter the penalties are, the less sense it makes for Integra to repay the loan ahead of the maturity date. By looking at the loan agreement filed on SEDAR, it looks like the make-whole clause is pretty strict so it doesn’t look like it would make sense for Integra to repay the debt ahead of maturity. It would be on the hook for 30 months in interest payments anyway.

The use of proceeds

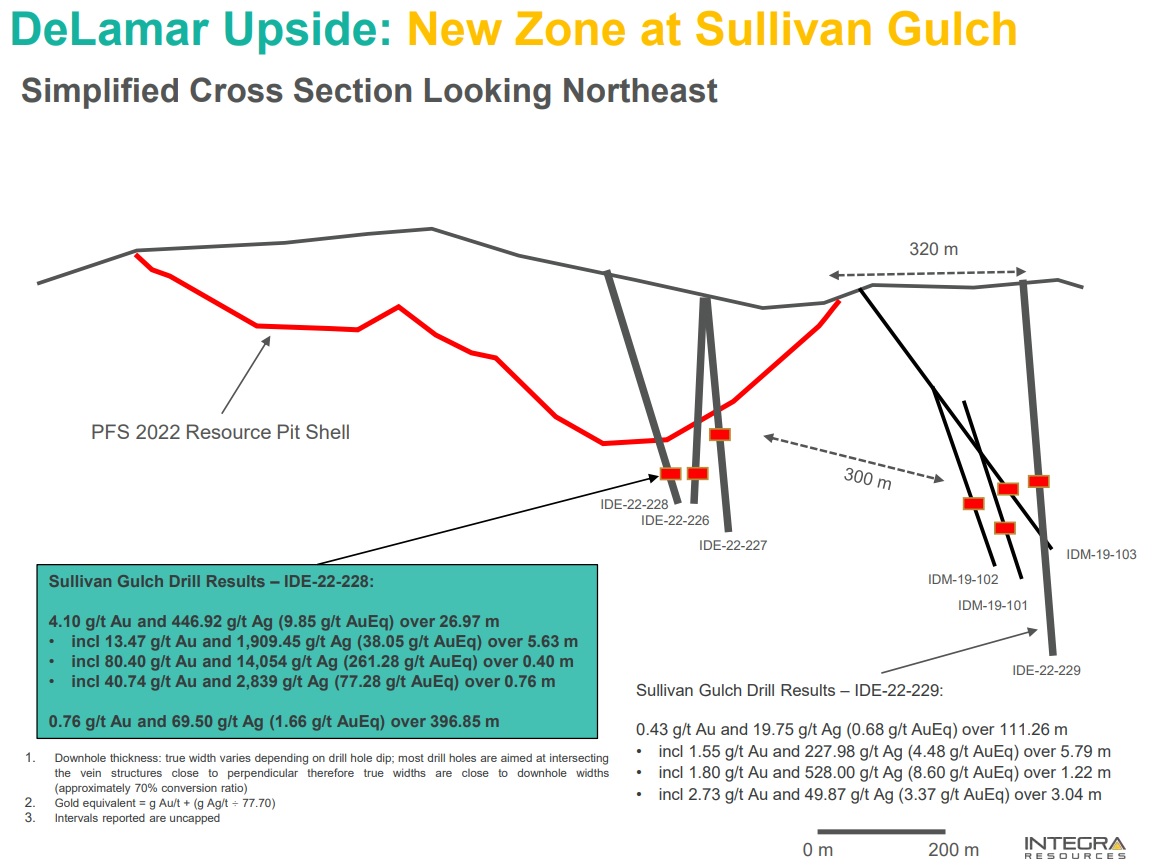

Integra’s press release mentions three bullet points in the ‘use of proceeds’ section. The company will complete 15,000 meters of drilling, surveys and studies to get the mining plan of operations approved. Once the plan of operations has been filed (it doesn’t have to be approved, just filed), Integra can start drawing down from the second tranche of US$10M of the convertible loan. This is expected in Q4 2022.

Disclosure: The author has a long position in Integra Resources. Integra is a sponsor of the website. Please read our disclaimer.