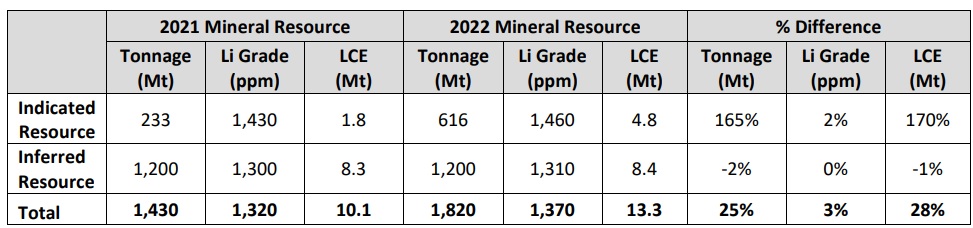

Jindalee Resources (JRL.AX) has released an updated resource estimate for its flagship McDermitt lithium project in Oregon. The total resource has now been boosted to 1.82 billion tonnes at 1,370 ppm Lithium for a total lithium content of 13.3 million tonnes LCE. That’s a total tonnage increase of 25% while the average grade increased by approximately 3% as well, highlighting the importance of the resource upgrade.

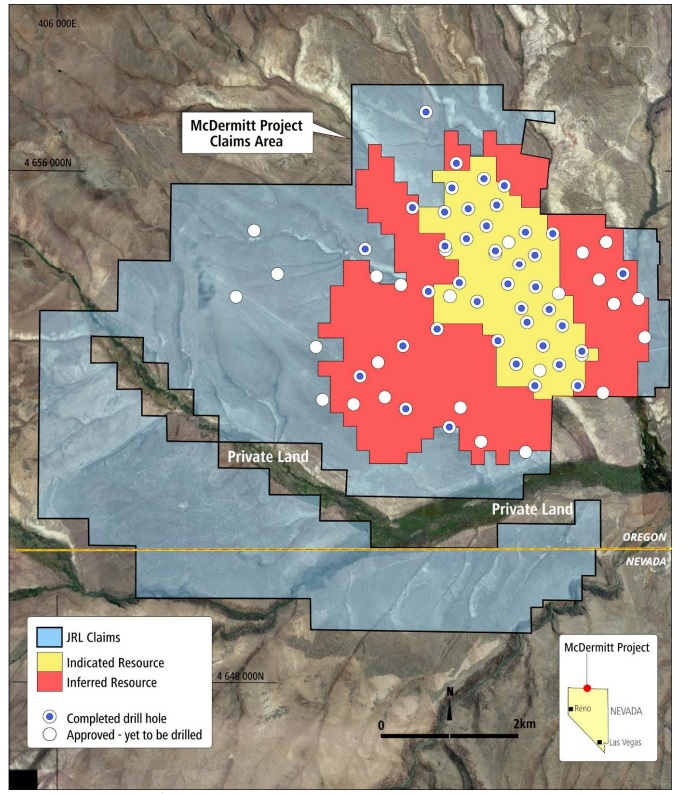

There’s one issue though: the location of the project. If McDermitt would have been a few more kilometers to the south, in Nevada, permitting would have been much easier versus trying to get a large open pit permitted in Oregon (the resource spans a 5 kilometer by 5 kilometer area, so it would be an massive earth-moving operation).

Never say never, but permitting will likely be an uphill battle for Jindalee and that makes it even more interesting to see the company currently has a market capitalization of C$128M (the current equivalent of A$145M). Surprising, as a much more advanced project like Clayton Valley owned by Cypress Development (CYP.V) which is getting close to completing its definitive feasibility study is only valued at C$183M despite its far more advanced stage on the development curve.

Jindalee’s updated resource is great as it confirms McDermitt as a very large lithium project. But Oregon is a tough jurisdiction. And showing an image of a permitted open pit just a few dozen kilometers further south is irrelevant as Lithium Americas’ (LAC, LAC.TO) Thacker Pass project is located in a different state.

Disclosure: The author has no position in Jindalee Resources and is unlikely to initiate a position until there’s more clarity on the permitting process. Please read our disclaimer.