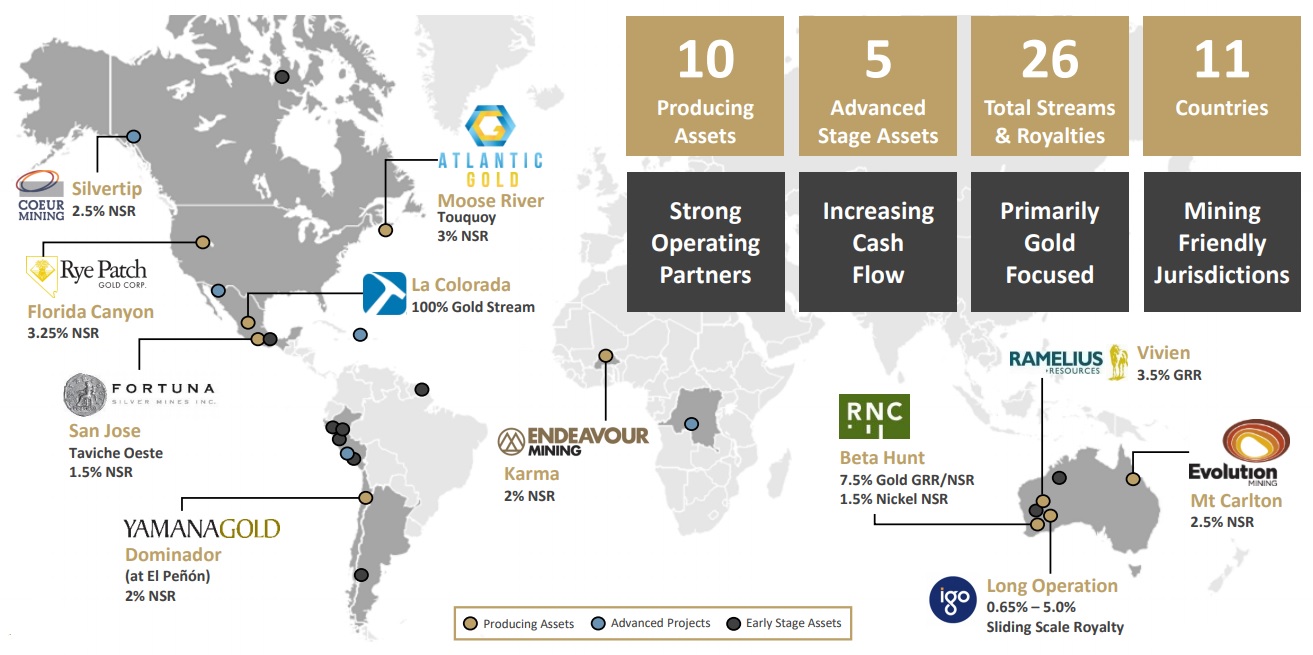

A few weeks ago, Maverix Metals (MMX.V) surprised us with the announcement it was acquiring a 2% Net Smelter Royalty on the Karma gold mine in Burkina Faso, owned and operated by Endeavour Mining (EDV.TO). Very surprising as A) the Karma mine is already in production and B) Endeavour Mining definitely isn’t cash strapped as its balance sheet contained US$97M in cash, and a working capital position of US$142M.

Maverix is paying just US$20M, which makes this deal even more intriguing, as the mine will probably produce approximately 100,000 ounces of gold next year, resulting in a cash payment of $2.5M to Maverix Metals. This deal definitely catapults Maverix into a higher league as the economies of scale of the different streams are now really kicking in, allowing it to reinvest in new streams, helped by its increased street cred.

With a mine life of in excess of 10 years (which will be extended by an additional few years once the Q1 2018 resource estimate will be published), it’s very surprising to see Endeavour Mining giving up 2% of its revenue for a lump sum payment of US$20M. Keep in mind just 30% of the total resources have been upgraded into the reserve category, and whilst we obviously don’t expect all resources to be upgraded in the future, it looks like Endeavour is leaving money on the table here. But why?

Go to Maverix’ website

The author has no position in Maverix Metals or Endeavour Mining. Please read the disclaimer