Nevada Copper (NCU.TO) was unable to keep its share price around the C$2-level it was trading at just five weeks ago, and in one month, the share price lost almost 25% of its value due to a weak copper price.

Some people were also underwhelmed by the company’s integrated feasibility study which was based on a base case scenario with a copper price of $3.15/lbs. Understandably, as copper is currently trading at $2.65/lbs, some people thought Nevada Copper’s assumptions were too optimistic. However, we’d like to make two remarks about this copper price assumption. First of all, even in Nevada Copper’s lower case using a copper price of $2.85/lbs, the after-tax NPV5% of the Pumpkin Hollow project is still in excess of $550M (or C$700M), compared to Nevada Copper’s current market capitalization of C$115M.

Secondly, there seems to be a broad consensus in the financial markets the copper price will very likely move up in the next few years. So yes, even though the current copper price would result in unattractive economics at the Pumpkin Hollow project, you’d need to keep a longer term perspective. The integrated feasibility study calls for a production start in 2018, so one would need to make an investment decision based on the expected copper price in 2018 and not on today’s spot price. Do you think copper will still be trading below $2.75/lbs? Fine, then Nevada Copper indeed isn’t a suitable investment for you.

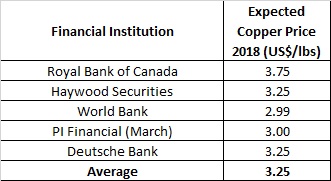

But let’s have a look what the general copper price consensus is in the market for 2018. We found the copper price estimates from the Royal Bank of Canada (RBC), Haywood Securities, PI Financial, Deutsche Bank and the World Bank.

So even if you’d take the most conservative estimate (of the world bank at $2.99/lbs), the NPV would come in at in excess of $750M.

We consider Nevada Copper to be one of the best possibilities to speculate on a higher copper price as its project contains in excess of 5 billion pounds of copper in its reserve estimate, as well as 760,000 ounces of gold and in excess of 25 million ounces of silver. The current drill programs at both the open pit and underground will very likely increase the total resources at Pumpkin Hollow as we are expecting waste rock to be converted to resources at the open pit, and to see additional resources due to higher grade zones at the underground mine.

Finally, we’d like to share one parting thought. For every 10 cent change in the copper price, Nevada Copper’s pre-tax undiscounted cash flow over the life of mine changes by $450M (excluding potential resource increases).

> Click here to go to Nevada Copper’s website

Disclosure: The author holds a long position in Nevada Copper and will increase this position this week. Nevada Copper is a sponsor of the website. Please see our disclaimer for current positions.