Orla Mining (ORLA, OLA.TO) released its Q4 an FY 2023 results in March, confirming it produced a total of just under 122,000 ounces of gold in 2023 at an AISC of just $736 per ounce. This means the full-year AISC came in at the lower end of the guidance while the gold production exceeded the upper end of the full-year production guidance. The net income in the fourth quarter was approximately US$0.05 per share on an adjusted basis although the company reported a net loss of US$58M due to a $72M impairment charge on the company’s Panama-based project. That impairment charge is the direct result of the Panama Ministry of Commerce and Industry rejecting the request for extension for three mining concessions and the concessions were subsequently cancelled.

The Q4 operating cash flow – before changes in the working capital elements – came in at $24.7M while the company spent $3.3M on capital expenditures. The other $9.3M spent on exploration and the assets was expensed.

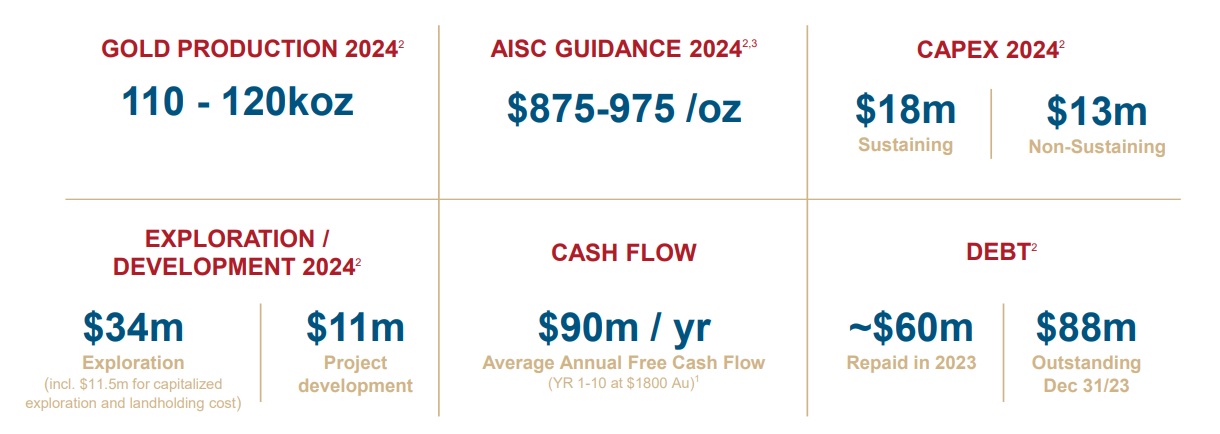

For this year, Orla Mining expects to produce 110,000-120,000 ounces of gold at an all-in sustaining cost of $875-975/oz. The majority of the sustaining capex will be spent in the first half of the year which means the AISC will be higher in H1 and will be lower in the second semester of this year.

Disclosure: The author has no position in Orla Gold but will obtain a long position upon the closing of the sale of Contact Gold to Orla. Please read the disclaimer.