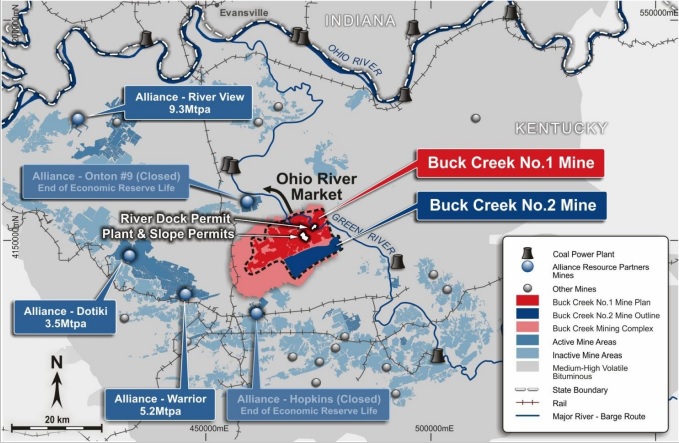

Paringa Resources (ASX:PNL) has released the results of a bankable feasibility study on its Buck Creek mine near the Ohio River in the USA. The initial capex has been reduced from $127M to $105M and this should boost the operating results and economics of the mine given the production rate of 3.8 million tonnes per year remains stable.

The company hopes to start the construction activities in Q1 2016 followed by the production start in the final quarter of 2017 where after it can start to ramp the production rate up to the intended 3.8 million tonnes per year. The timing of Paringa couldn’t be better as three different mining companies have announced a total production cut of 11 million tonnes in 2016, indicating a lot of supply will be removed from the balance, and that’s a gap Paringa could try to fill.

Of course, the coal market is in a horrible shape, but Paringa expects the FOB production costs at the Buck Creek mine to be less than $30/t and assuming an average sales price of $46/t, the mine should generate an annual EBITDA of approximately $61M per year. Additionally, Paringa has already signed an agreement with a utility company in the Ohio River area that have pledged to purchase 750,000 tonnes of coal in 2018, increasing to 1 million tonnes per year in the subsequent 4 years at an increasing price per tonne. Whereas the buyers will pay $44.5/t in 2018, the price paid would increase to $48.2/t by 2022, indicating these buyers are expecting a higher coal price as well.

This $220M offtake agreement will reduce the fears of the potential lenders for this project as the contracted net cash flow (revenue – production cost, but before sustaining capex) will cover approximately 70% of the initial capex, reducing the financial risk of the Buck Creek mine.

Go to Paringa’s website

The author holds no position in Paringa Resources. Please read the disclaimer