Taiga Gold’s (TGC.C) joint venture partner recently released its Q2 results, and we are always interested to see how SSR Mining (SSRM.TO, SSRM) is performing at the Seabee mine. As you know, the Seabee mine is directly north of the Fisher project where SSR Mining has elected to establish an 80% interest in the project with Taiga Gold owning the balance.

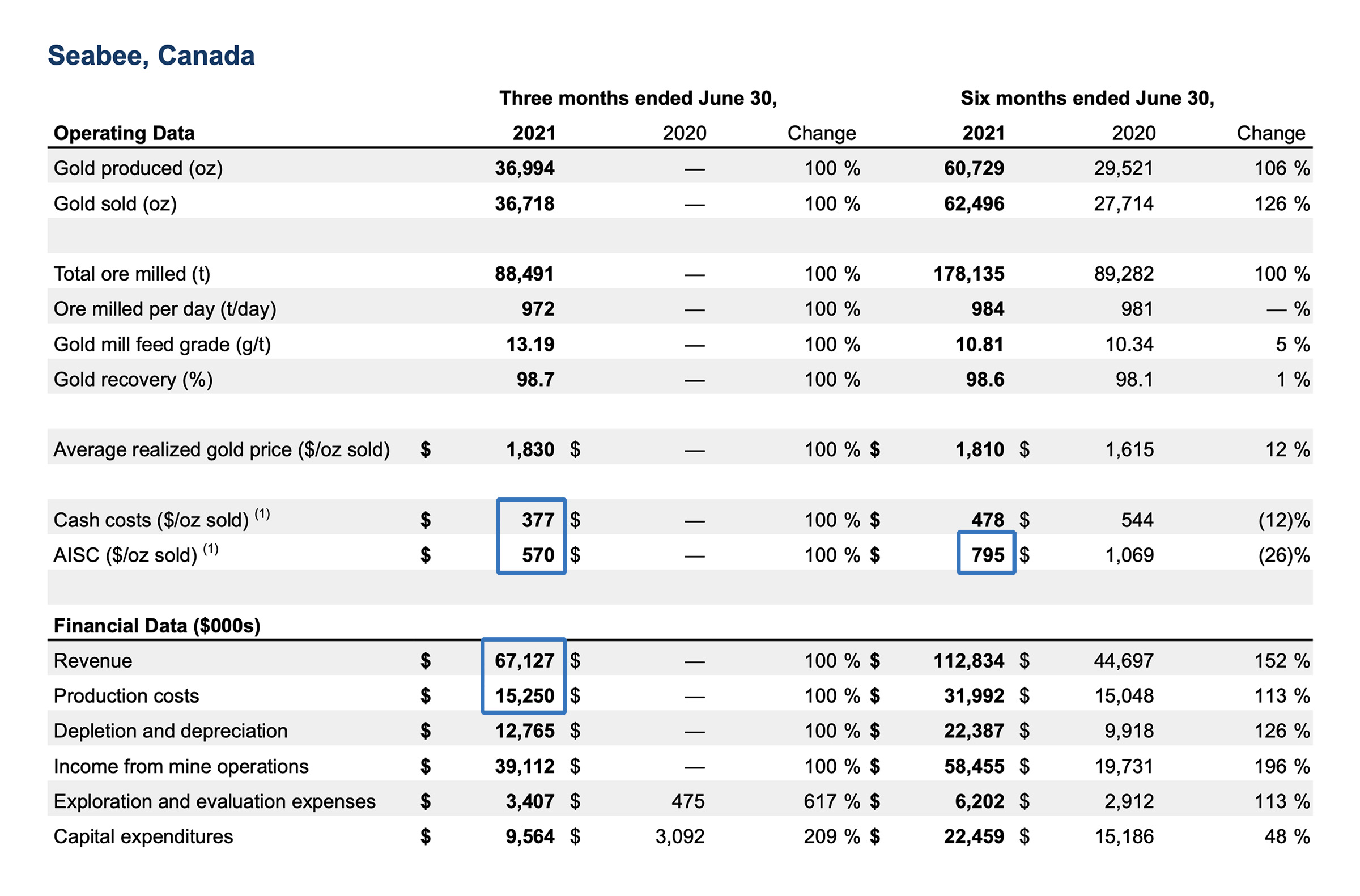

Credit where credit is due, as SSR Mining reported on a truly exceptional performance. SSR produced almost 37,000 ounces of gold thanks to an exceptionally high grade of 13.19 g/t gold. This also had a positive impact on the production cost as the cash cost in Q2 was just $377/oz and the all-in sustaining cost was approximately $570/oz, as you can see in the screenshot below.

The mine generated in excess of $40M in operating cash flow and even after taking the almost $13M in capex and exploration expenditures into consideration, the Seabee mine remained very profitable.

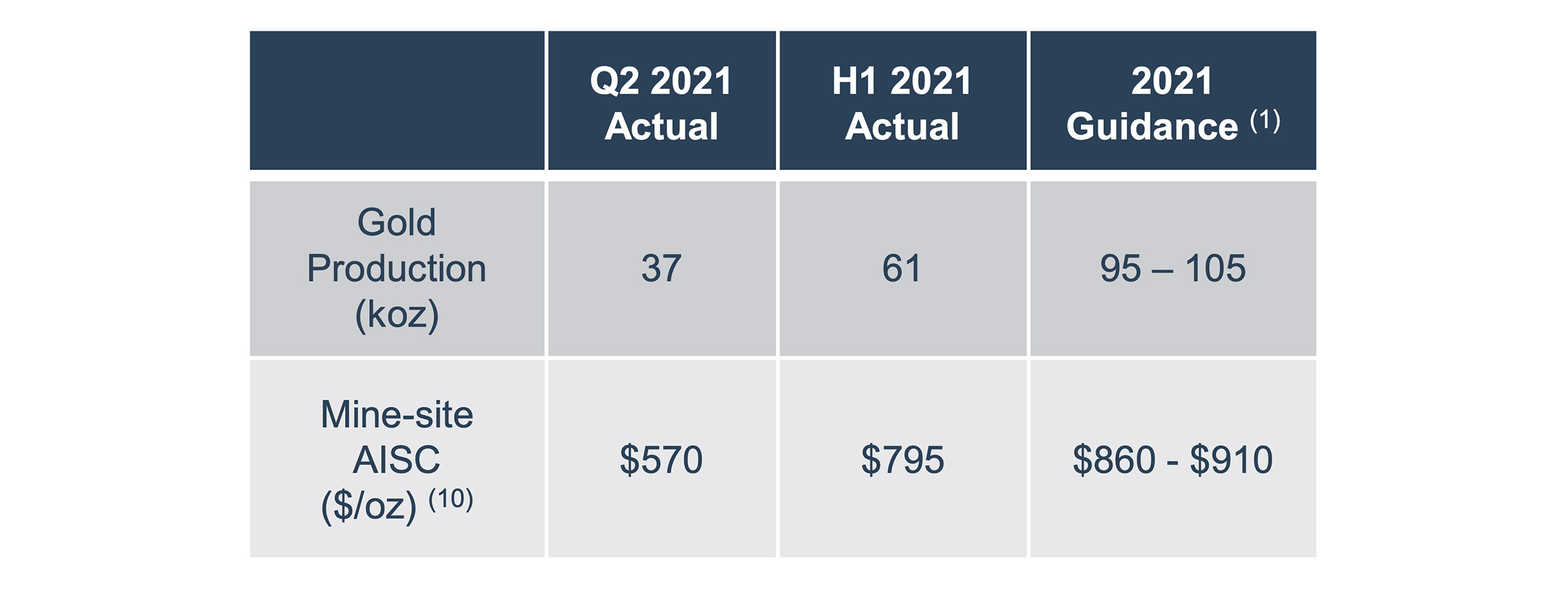

Of course, it would be fundamentally wrong to extrapolate the Q2 result into an annualized result. After all, the Q2 grade was exceptionally high and this will for sure not be continued into the current quarter and semester. SSR’s second half of the year at Seabee will be worse than its first semester as the H2 production will be about 1/3rd lower while the AISC will be approximately 25% higher than in the first half of the year.

The full-year guidance, as shown above, implies an H2 production of approximately 40,000 ounces of gold at an AISC of approximately $1000/oz. The full-year guidance seems to indicate there’s a good shot at keeping the AISC below $900/oz which means the Seabee mine has an all-in sustaining margin of in excess of $800/oz at the current gold price. So while you can’t just rely on the second quarter which was so good it will for sure not be repeated, the full-year guidance at Seabee by itself is worth a good look.

And although SSR Mining currently has a total production rate of almost 800,000 ounces gold-equivalent and Seabee only represents about 10-12% of that output, it is an important contributor to SSR’s free cash flow so you’d like to think SSR Mining would want to keep the mine up and running for as long as possible.

A look at Seabee’s Life of Mine

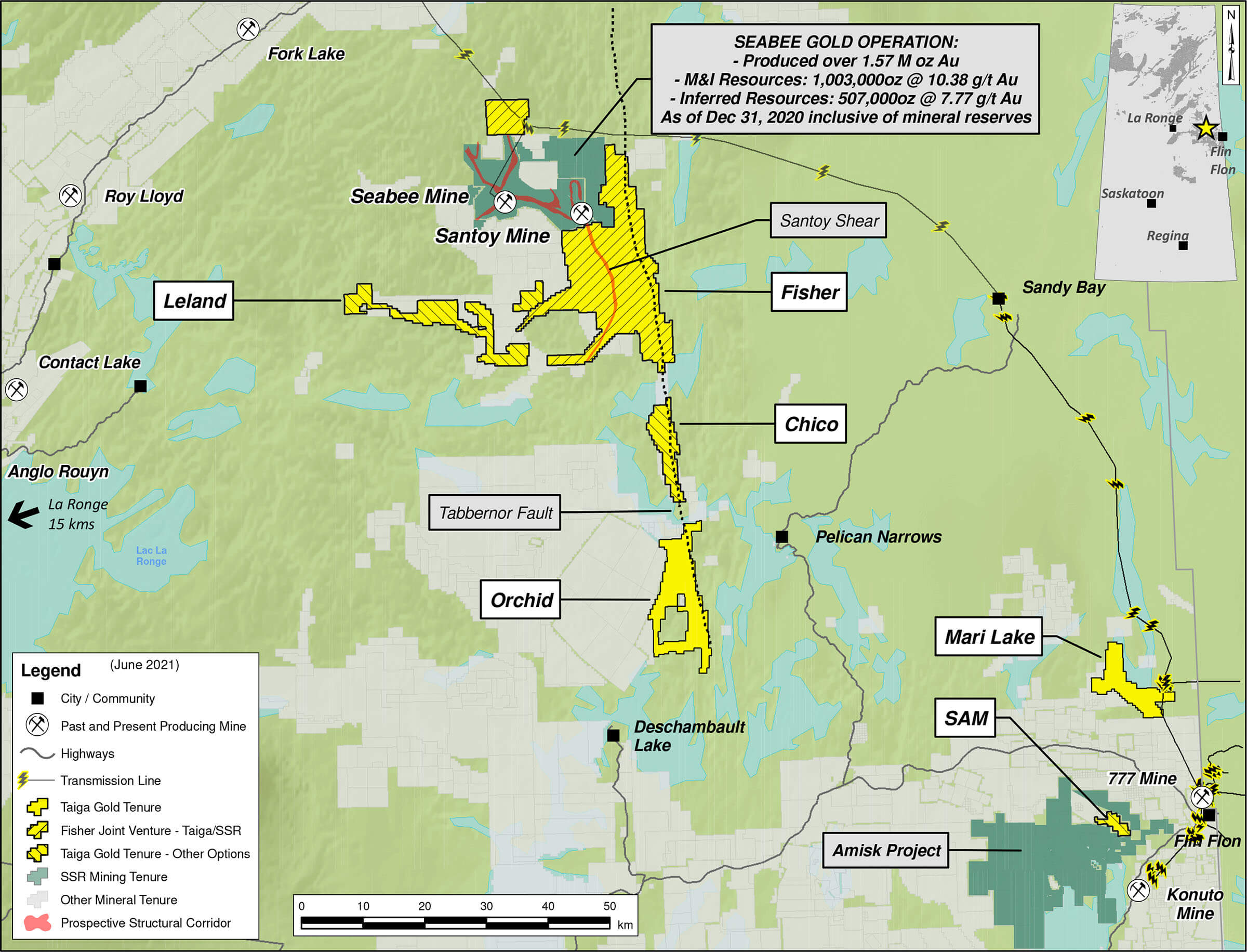

As of the end of last year, the Seabee mine had a total of 494,000 ounces of gold in the reserves (150,000 ounces in the proven category and 344,000 ounces of gold in the probable reserve category) while the total amount of measured and indicated ounces ended up at almost exactly 1 million ounces. That’s including the half a million ounces in reserves, so it’s safer to say SSR Mining’s Seabee mine has about 500,000 ounces in reserves and 500,000 ounces in measured and indicated resources. Seabee also has 507,000 ounces gold in the inferred category, so the total of 1.5 million ounces of gold at Seabee is nicely divided into thirds.

Of course, it would be fundamentally wrong to expect a 1:1 conversion from resources to reserves. Generally speaking, about half of the resources tend to be converted into reserves at underground mining operations. This means that Seabee currently has a remaining mine life of about 4.5 years based on the reserves, and perhaps another 2.5-3 years including the additional measured and indicated resources assuming a 50% conversion ratio. It’s likely some of the inferred ounces may make it into the mine plan as well, but that obviously remains to be seen.

This means SSR Mining needs to start thinking about the latter part of the 2020s to ensure it can continue to fill the mill. While the existing reserves and resources are sufficient to keep the mill operating at full capacity in the foreseeable future, SSR will likely try hard to extend the mine life by as much as possible. Not only because the Seabee mine is generating an attractive free cash flow at the current gold price, but also because SSR will want to delay reclamation of the mine site and tailings facilities for as long as possible. In the final stages of a mine, some operators (in general, we are not referring to SSR Mining per se) prefer to keep the mill running even if they are just breaking even on the operations, just to make sure they can kick the reclamation expenses a few years further down the road.

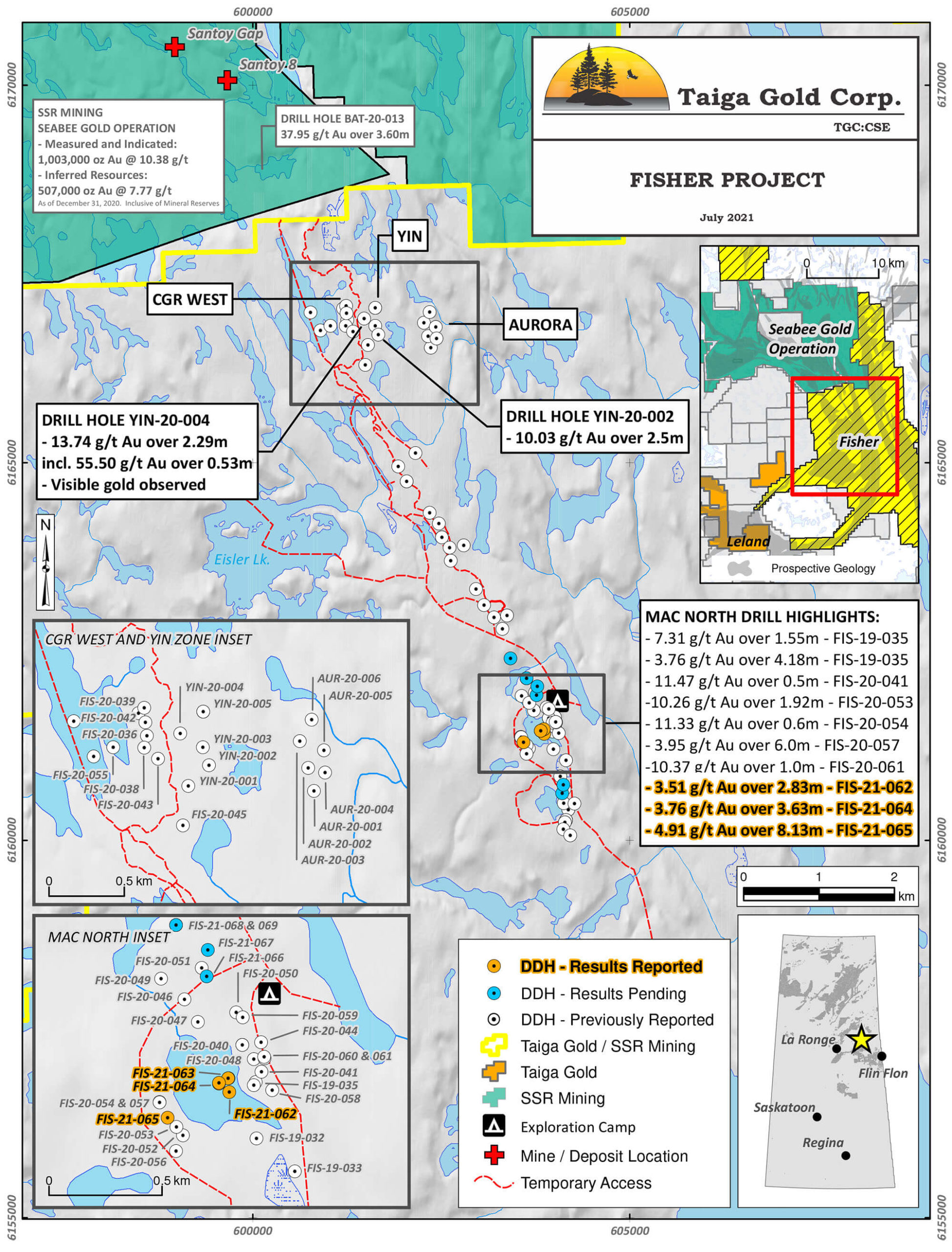

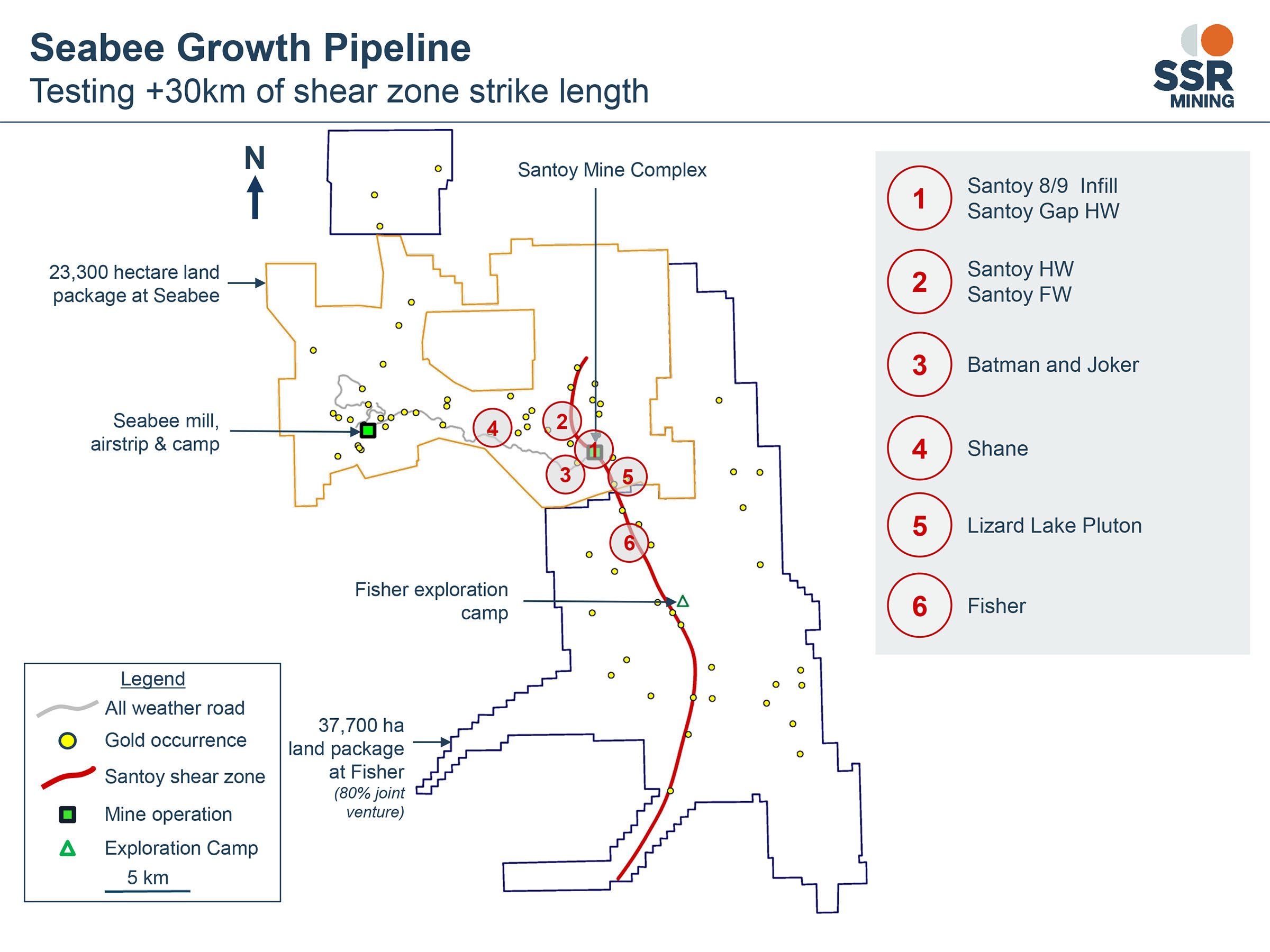

That’s why SSR Mining has been very active at and around the deposits that form the Seabee mine complex. SSR has been successful there, but what could likely be the joker is the Santoy shear zone which extends from the Santoy mine onto the Fisher property. In fact, when you look at the next image, which is taken from the recent SSR Mining presentation, you see that their technical team is projecting the Santoy shear to be pretty continuous, and the majority of the shear zone is actually located on the Fisher project wherein Taiga Gold owns a 20% stake and a 2.5% NSR (which can be reduced to 1.5% NSR upon making a C$1M cash payment by the joint venture).

SSR officially included Fisher in what it now calls the ‘Seabee Growth Pipeline’

What’s even more important is how SSR Mining approaches the Fisher project. Until the end of last year, SSR just casually mentioned the Fisher project as an ‘opportunity’ but the tone changed earlier this year when SSR officially included Fisher in what it now calls the ‘Seabee Growth Pipeline’.

So while there’s a lot going on at the SSR-owned Seabee land package, SSR Mining has stepped up its activities on the Fisher project as well and we would like to encourage you to read our recent report on the Fisher drill results here.

SSR Mining is counting on Fisher for additional mill feed. We aren’t just saying that because SSR Mining elected to acquire an 80% stake in the project (it could have walked away), but it says so in its own Q2 MD&A:

Fisher, located immediately to the south of the 100% SSR Mining owned Seabee claims, are 80% owned by SSR Mining and 20% by Taiga Gold Corporation. Targets at Fisher have the potential to provide additional plant feed beyond the Seabee license area. Early exploration at Fisher has been encouraging.

SSR Mining – 2021 Q2 MD&A

Of course, this is the mining sector and there are no guarantees or certainties. But SSR Mining appears to be cautiously optimistic on the future and potential of the Fisher project, and that means Taiga Gold is in the pole position to monetize its remaining 20% stake in the project, as well as the 1.5% NSR (should Fisher indeed be a useful source of mill feed, we expect the current 2.5% NSR to be reduced to 1.5%, that would only make sense).

Share performance

In the past few days and weeks, the share price of Taiga Gold has been a bit under pressure. Not only because the entire sector of gold exploration companies is seeing a sell-off throughout the summer, but likely also because the company’s April placement became free trading last week. Back in April, Taiga Gold raised about C$2.5M in flow-through financing at C$0.20 (so 12.5 million units were issued with each unit consisting of one flow-through share and one full warrant with an exercise price of C$0.30 valid for a period of 2.5 years after the issue date – meaning the warrants expire in October 2023). The back-end portion of this financing was priced at just under C$0.15 so it shouldn’t really come as a surprise to see the stock has fallen back to approximately that level.

In fact, there are some encouraging signs as well as the share price decreased gradually on the volume of just a couple hundred thousand shares. While the share price has been a bit under pressure, it’s slightly positive that only a fraction of those 12.5 million shares seems to have hit the market so far. And perhaps the recent Orchid gold project drill results helped to keep a lid on it.

Conclusion

While Taiga Gold has a few projects under its umbrella, the 20%-owned Fisher gold project still is the flagship project, and it’s encouraging to see the joint venture partner, a major gold producer, confirming Fisher has the potential to provide additional mill feed to the Seabee mill. And if you were a cash-flowing senior producer, how much would it be worth to acquire the final 20% of the project and a 1.5% NSR on almost the entire property? That’s an open question that will likely be answered as additional Fisher drill results start to come in.

Disclosure: The author has a long position in Taiga Gold. Taiga Gold is a sponsor of the website. Please read our disclaimer.