Vendetta Mining (VTT.V) has now closed its private placement after it had to increase the size of the placement twice due to strong investor demand. The $2.5 million financing comprised 50 million units at C$0.05 with a full warrant attached for two years at C$0.10. Almost half the financing was placed with Resource Capital Funds (‘RCF’), Solitario Exploration and Management. Whereas the original intention was to raise ‘just’ C$1-1.5M in a first round, Vendetta Mining was benefiting from investors starting to realize the zinc crunch is now really coming, as the zinc price was pushed towards US$0.87/lbs. A lot of interest, but more importantly, the interest came from the right people/companies. Solitario Exploration and Royalty (SLR.TO, XPL) now owns 9.97% of Vendetta Mining, and only had very nice things to say in its press release:

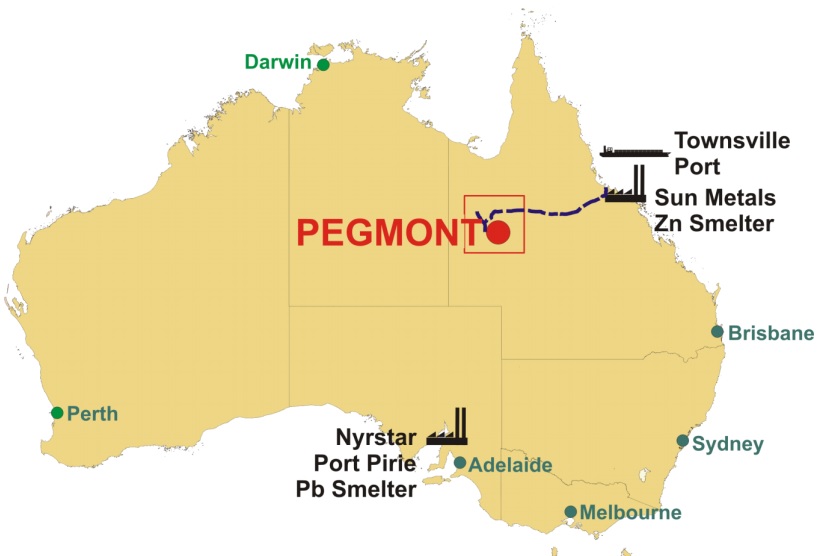

‘Vendetta’s Pegmont project is a quality asset with outstanding potential for resource growth. It is situated in one of the world’s best mining jurisdictions – North Queensland, Australia. Moreover, the mining infrastructure that exists both locally and regionally allows for expedited development in the future.’

This does sound like Solitario is definitely convinced about the potential of the project, and so are we, as we also participated in the private placement. There just aren’t a lot of ‘new’ zinc stories out there, and the Trevali Mining’s (TV.TO) and Nevsun Resources’ (NSU.TO, NSU) of this world won’t produce enough zinc to cover the expected supply deficit. We will release an in-depth report on Vendetta Mining shortly and will also discuss why we think 2017 will be THE year for zinc companies.

Go to Vendetta’s website

The author has participated in the placement and now has a long position in Vendetta Mining. Vendetta is a sponsor of the website. Please read the disclaimer