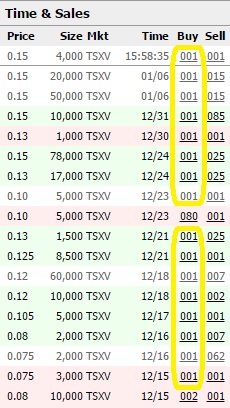

In the past few months we have seen an interesting and intriguing phenomenon at Blackheath Resources’ (BHR.V) trading pattern. The company’s share price was trading relatively flattish during November and even fell to a single-digit share price in early December, before suddenly someone seems to have stepped up the plate and has been buying all stock that became available up to C$0.15/share.

It’s impossible to find out who’s behind these deals, but whenever there’s a package offered for sale, our Anonymous buyer is taking it all. The buyer was cautious in the first half of December, as it seemed to be waiting for weak hands that wanted to take advantage of the tax loss selling season (purchasing a bunch of shares at a price range between C$0.075-0.09), but has become more aggressive in the second half of the month. As you can see in the next image (courtesy of Stockhouse), the anonymous buyer suddenly shifted into a higher gear right before Christmas.

In fact, ALL shares that were purchased since December 23rd were bought by ‘Anonymous’ and the buyer had no problem pushing the share price almost 90% higher just to acquire more shares. In the past two weeks, ‘Anonymous’ acquired 181,000 shares at a double-digit share price and the moment more stock becomes available, it’s pulling the trigger. We saw this on Wednesday when suddenly a sale order of 70,000 shares at C$0.15 popped up and was immediately bought by Anonymous.

We have no idea who the secret buyer is, but what we do know is that ‘Anonymous’ buyers now have acquired 547,500 shares at an average price of C$0.121 since November 15th. That’s almost 2% of the total amount of Blackheath’s outstanding shares, so there’s definitely ‘something’ going on here, as for instance on Friday someone else offered up 4,000 shares for sale at C$0.15. What happened? Less than two minutes before the closing bell, the offered shares were bought. By whom? Yep, the ‘anonymous’ buyer.

Go to Blackheath’s website

The author holds a long position in Blackheath Resources. Blackheath is a sponsor of this website. Please read the disclaimer