The world needs more copper and the main problem right now is figuring out where the additional pounds of copper will be coming from as most countries are getting stricter when it comes to permitting processes while the average grade of the copper discoveries continues to decrease.

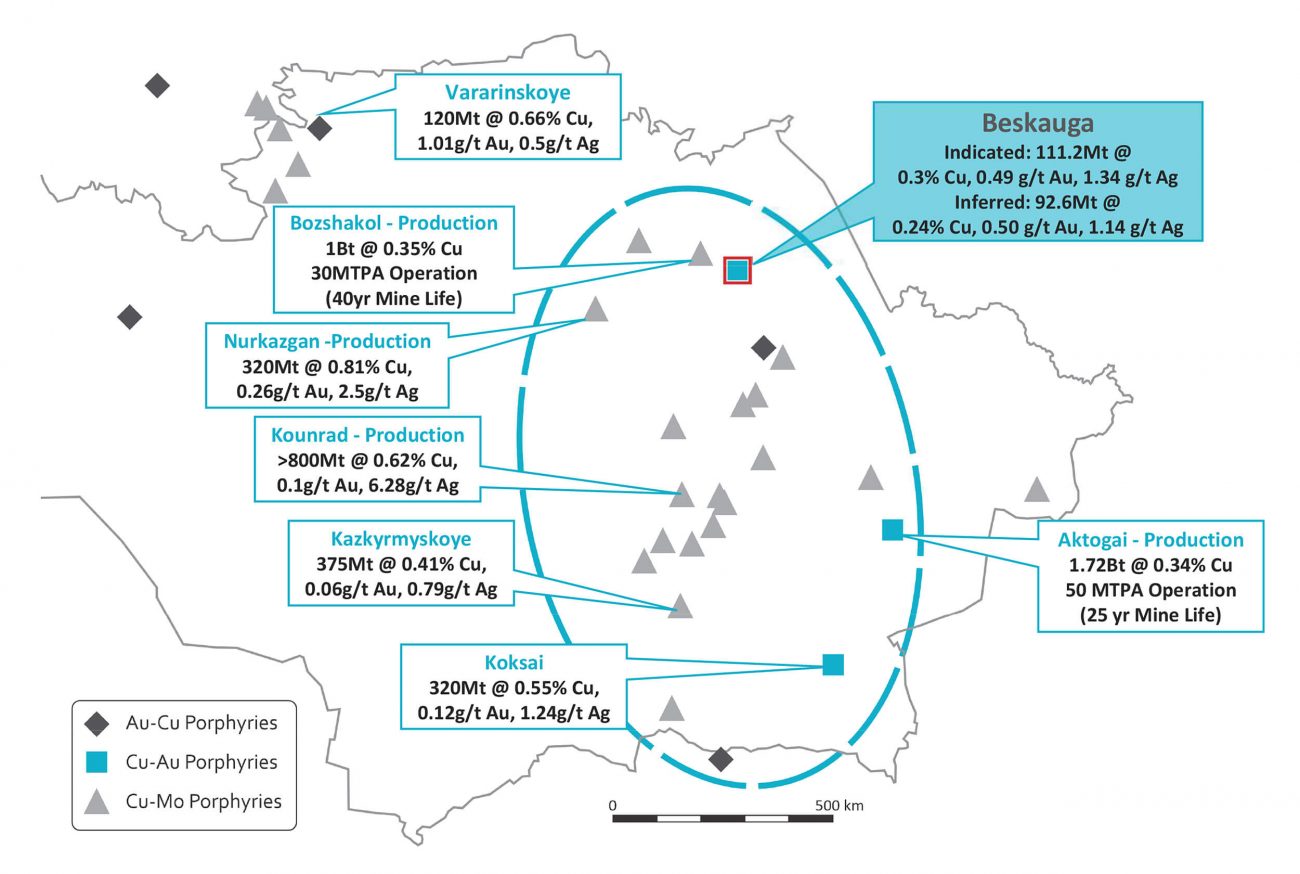

Kazakhstan is a major exporter of copper and is slated to increase its total production to in excess of 1.8 billion pounds in 2023 as several producers are ramping up their output. Although Kazakhstan is best known for its uranium production, the country is an important player in the copper sector and has been largely ignored by the west in the past.

Enter the scene, Arras Minerals (ARK.V) which picked up an option to acquire full ownership of the Beskauga copper-silver project in Kazakhstan. The company is almost halfway through an initial 30,000 meter drill program which aims to further increase the current resource of over 1.2 billion pounds of copper and 3.25 million ounces of gold (with approximately 60% of the resource in the indicated resource category).

We sat down with President Darren Klinck to discuss the project, the plans and the ease of doing business in Kazakhstan.

Q&A with President Darren Klinck

The project

You entered into an option agreement to acquire full ownership of the Beskauga flagship project in August 2020. Can you elaborate on how you came across the project and why it piqued your interest?

Tim Barry, Arras’ CEO began evaluating other project opportunities in 2020 in the middle of the COVID pandemic, originally for the parent company (Silver Bull Resources). After reviewing more than 100 project opportunities around the world (geography and metal agnostic), it was through another mining executive that he received the contact details for Copperbelt AG, a private Switzerland based company that controlled the Beskauga copper-gold deposit in NE Kazakhstan.

This person had come very close to a deal in 2011 on the project for one of the majors but their Board backed out in the end and they decided not to move forward. Fast forward to 2020 and the combination of the global pandemic, a copper price trading at just $2.70, while access to Kazakhstan was difficult due to the entry restrictions and combine that with the fact Copperbelt has not been able to raise money and do much work on the license since 2013 (with the exception of some drilling in 2017).

So basically this is a story of ’right place, right time’ and a deal was struck that spelled out that Arras will spend US$15m in exploration over 4 years and then have the option to purchase 100% of the project (no private royalties) for US$15m. In addition, should the deposit move forward into FS and construction then Copperbelt would be potentially eligible for contingent payments up to $32m.

Overall, Kazakhstan is becoming a well-known jurisdiction for investment (not only in mining but it is a top 10 producer of many metals, and the world’s 4th largest exporter of refined copper for example). The country has been actively undertaking significant economic and governance reforms over the past 5 years which is resulting in increased western investment in many sectors. In mining, they adopted a new mining law that is largely based on Western Australia.

They have also adopted to a new mineral license system (“use it or lose it”) to remove the hangover of the past (and is the case in many places where groups sit on licenses without doing work on them in hopes of selling them to the highest bidder). I would urge readers to have a look at the Arras presentation on our website as we have some additional data points and stats there on Kazakhstan that could be useful to gain a better understanding of the country and its potential.

You are coming out of the gate with an existing indicated and inferred resource estimate. It looks good in absolute numbers but the grade may be a bit light. 0.49 g/t gold and 0.3% copper sounds alright but with recovery rates of 85% for the copper and just under 75% for the gold, that grade results in a recoverable rock value per tonne of approximately $44 (based on $1800 gold and $4 copper). The margins will be positive (as nearby mines are processing rock with a lower grade) but it looks like more work needs to be done before moving towards a PEA. You could unlock economies of scale with a high tonnage production scenario but then the current 200 million tonne resource (111Mt indicated, 93Mt inferred) is simply too small to justify building a, say, 60,000 tonnes per day plant. Where do you see the best upside potential? Resource expansion? Recovery improvements?

This is an exploration project. We are here not to start thinking about a PEA or PFS but with the exception of a small exploration program completed in 2017 there hasn’t been much done on this project since 2013. There is a 200MT resource already but we see the potential to make this much larger and realistically it needs to get bigger to be attractive for one of the large caps.

Just to give you an example, down the road from Beskauga, the Bozshakol Copper mine (owned by Kaz Minerals which was taken private last year at a valuation of $5.5B) was only recently built (it started up in 2015) and currently contains 1 Billion tonnes of 0.35% Cu. The mine is producing ~300,000 t of Cu per year and US$1B of EBITDA. Our grades are in the same range but the deposit needs to get bigger.

The majority of our mineralization is in the lower temperature area of a porphyry deposit and thus our objective is to try and locate the “engine room” which will bring higher grades and more tonnes. You won’t see us focusing on metallurgy or mine plans or PEAs for the near term. It’s about making it bigger and equally important, getting out and starting to work up targets on the 2500 square kilometers of mineral tenements we have acquired. We are in a belt of copper-gold porphyries but with limited modern exploration. There are already 3 porphyry deposits so far, ours + 2 operating mines (including Bozshakol). The 20-40m of unconsolidated cover over the area means there are no obvious outcrops at Beskauga so geophysics and other modern exploration techniques truly are key in our exploration programs to grow the deposit and make new discoveries.

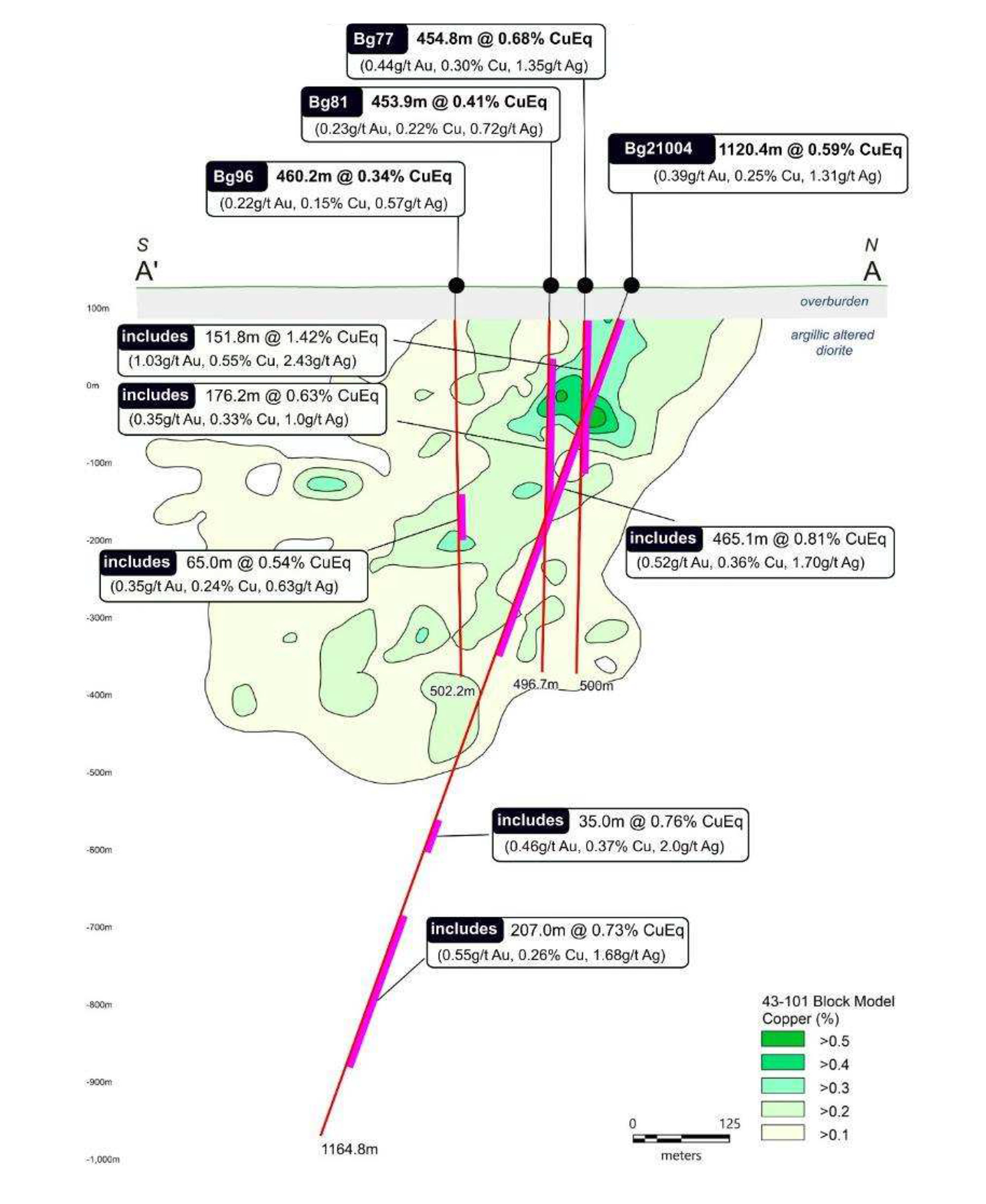

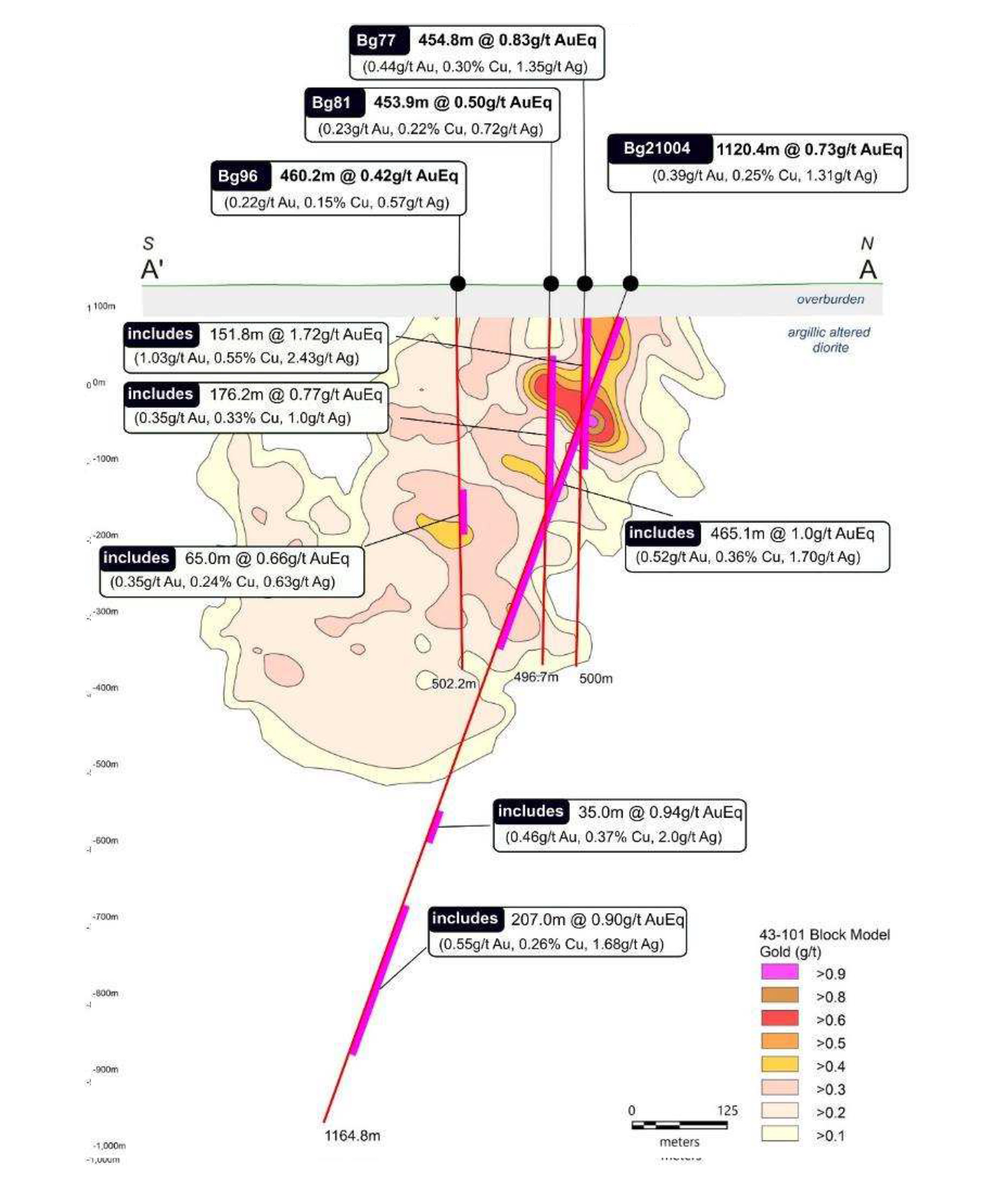

It’s our understanding the majority of the porphyry system hasn’t been drilled. Do you see the potential for the grade to pick up? The drill results you published last week contained a 1,120 meter interval with 0.25% copper, 0.39 g/t and some silver and moly. This interval contained a higher grade portion of just over 465 meters at an average grade of 0.52 g/t gold and 0.36% copper which is slightly higher than your resource grade but hole Bg21003 came in below. Is that because you may have reached the edge of the system in that section?

The current Beskauga resource appears to have a 400 meter corridor or pipe that we have extended down now more than 1000m and is stil lopen at depth. Now we see the potential to continue to adding mineralization on the perimeter of the current resource as well but we obviously will start to have drilling more pure exploration holes in the 5 km corridor that we have identified and contain gold and copper all along it but virtually no drilling. Remember, Oyu Tolgoi in Mongolia which is on the same belt of rocks was drilled by BHP and then Ivanhoe and it wasn’t until after the geophysics and stepping back that the discovery was made 4 kilometers away from the initial area. Dan Kunz was President of Ivanhoe at that time and is on our Board.

In your recently released drill results, you also mention molybdenum. Were the original holes samples for molybdenum or is this the first time?

There wasn’t much moly to report in the earlier holes but this one had some. Finding molybdenum can sometimes mean you are getting into higher temperatures areas so let’s see how things progress.

You started a 30,000 meter drill program in 2021. How far along are you and what is the main purpose of this drill program?

We are about 1/3 the way through it and still have plenty of holes that are being assayed and in the lab. Our main focus on the permitted program was at Beskauga to expand and extend the resource and to start to test the proximal targets we have been identifying since starting geology and geophysics work in H2 last year.

How expensive is it to drill in Kazakhstan? What is your approximate cost per meter, and how will the deeper holes impact the drill cost?

It has to be one of the most economic places in the world to undertake exploration. We are paying approximately US$100/meter and an additional $25/meter for assays. Interestingly, the depth of the hole doesn’t matter as we just pay a fixed price per meter we drill. Our cost of drilling is much lower than pretty much anywhere else in the world where you easily pay 2-3 times as much per meter.

The copper market

The copper prices have been bumpy lately but at a copper price of close to $4/ pound, most producers are still doing well. The demand for copper remains strong and the construction of new mines now seems to be more uncertain than ever before as inflation will negatively impact the ability to build mines. How are you looking at copper as a metal?

I have spent the majority of my career in the gold space with some exposure to copper in the Philippines. I’m at Arras largely because I (along with most commodity analysts much smarter than me) see copper going only one direction. The world needs more of it.

Deposits are harder to find, permit and develop. Even when we build large scale deposits we struggle to keep them running consistently for non mining related issues (the labour strikes in Chile are a good example), blockades in Peru (Las Bambas has been blockaded or suspended 1 out of 6 days since it was first commissioned), or pressure on related resources such as water is causing countries like Chile to pause on new mines or expansions.

BHP’s Chief Economist stated earlier this year the industry needs to invest $250B by 2030 if it wants to keep up with the projected copper demand! That’s a lot of dollars but the question really is, where are the assets to be built and expanded? There hasn’t been a new copper mine of size built in the last 2 years (I think Cobre Panama was the last one).

We really like Kazakhstan for this reason too (and so do the majors who are already there (Glencore (GLEN.L) for instance had 20% of their EBITDA last year globally from Kazakhstan) as you can build mines here. The government sees the mining industry as a top priority and the country already is a top 10 producer in many metals, including copper. Just around our project, within a 300 kilometer radius there are coal, copper and gold mines (past producing, current producers) all over the place.

Yes a global recession will impact copper demand likely no doubt, but there isn’t much for stockpiles anymore in virtually all the “molecules”. Copper has a bright future, most are pretty certain of it.

The country

How would you describe working in Kazakhstan? Of course, the past two years were likely ‘special’ due to COVID regulations and restrictions but how are you anticipating working in and with Kazakhstan will be?

Our presentation contains a few slides on the country. You’ll see Kazakhstan ranks equal with Canada and Ireland globally on “ease of doing business”. The past 5 years have been transformational. I can share more stories of discussions I’ve had with expats that have lived in the country for 10 years, working in our space and how things have evolved and changed during that time. We love it are both boots focused on Kazakhstan. Tim Barry our CEO and my business partner here is moving his family there next month. We’re committed and are pretty certain that in 2 years it will be a much more crowded place – and this is already starting to happen.

The company

You currently have just under 53 million shares outstanding for a market capitalization of just around C$42M. How much cash do you currently still have in the bank, and what kind of runway do you have with that?

Our current cash position is approximately C$3.5M. We are obviously still drilling and the teams are out on the licenses now working up new targets. Our current cash position could take us into 2023 but we are working on some strategic initiatives that will potentially create some further opportunities for us which would help to enhance our ability to accelerate some of the work. Stay tuned.

Conclusion

As the company is only about halfway through a 30,000 meter drill program, we can expect more assay results to be published on a continuous basis now. As explained by President Klinck, the company’s strategy is to further expand the resource to reach the critical mass needed to even consider the development of the project but also to start testing some of the additional targets in this highly prospective belt that is a proven producer of copper mines. Reading between the lines, it doesn’t sound like Arras Minerals’ primary strategy is to develop and build the project themselves but sees its mandate to expand the resource to a threshold that could get the bigger companies interested and start to use modern exploration methods to generate targets on what is apparently the second largest land package in Kazakhstan focused on copper.

Disclosure: The author has a long position in Arras Minerals. Arras Minerals is not a sponsor of the website. Please read our disclaimer.