Integra Resources (ITR.V) has now released the assay results of an additional three RC holes that were drilled on the DeLamar gold-silver property in Idaho. The results are astonishing, as the drill bit intersected long, thick and relatively consistent intervals of gold and silver mineralization in an area that was barely explored and where no mining has ever taken place. Kinross (KGC, K.TO) didn’t drill deep enough as the few holes it drilled at Sullivan Gulch didn’t go much deeper than 100 meter.

Last week’s assays where the result from a 100-meter step-out target. The encountered widths and grades indicate the DeLamar mineralization remains open in several directions.

Without further ado, these are our key takeaways.

The resource grade may have been underestimated

According to the press release, 64% and 59% of the intercepts were encountered outside of the mineralized resource envelope. Logically, this means 36% and 41% of the 221 meters and 198 meters were drilled within the existing resource.

This does seem to indicate the average grade of the current resource at DeLamar (118Mt at 0.7 g/t AuEq) might have been underestimated. It would be an incredible coincidence if most of the holes drilled at DeLamar would encounter abnormal grades of in excess of 1 g/t AuEq (keep in mind the first batch of drill results in May also contained thick and consistent intervals with a higher grade than the average resource grade).

Of course, it’s still too early to tell, and we don’t know the exact grade of that specific zone of the block model (nor the exact grade of the intercept within the existing block model), but if you drill 221 meters at 2.16 g/t AuEq of which roughly 1/3rd is located within a resource block model of 0.7 g/t AuEq, something could be off about the economic model.

We know the company’s consultants wanted to err on the cautious side with the maiden inferred resource, so we consider a consistent underestimated grade of the resource to be quite plausible and realistic.

The sulphides could (potentially) be heap leached as well

It’s important to realize the top layer of the DeLamar project appears to be fully oxidized, and could thus be amenable to be heap leached. Kinross Gold didn’t care too much about a heap leach, and its ‘experiment’ was far from optimized. The rock wasn’t crushed to the optimal size for a leaching pad, and the pad was built in the wrong place anyway.

It’s a common misperception only oxide mineralization can be leached. Although that’s a valid assumption for most oxide-sulphide deposits (especially in for instance Nevada), you can’t cut corners here. Although we would like to emphasize Integra Resources still has to conduct (and publish) results from its own metallurgical test work, there are plenty of cases where sulphide mineralization can be leached with acceptable recovery rates.

The first example coming to mind is Minera Alamos’ (MAI.V) Santana project. The oxides are the easy target, but you should keep in mind even the sulphide mineralization has decent recovery rates in a heap leach operation: approximately 70% of the gold could be recovered. A similar scenario is possible at DeLamar, but the upcoming metallurgical test results (expected in Q4) will provide more clarity. The company’s metallurgical test program will be one of the most important pieces of the puzzle.

Integra used a very conservative Gold:Silver ratio

We noticed the gold-equivalent calculations were based on a very conservative 85:1 silver/gold ratio. That’s interesting, as this once again emphasizes the conservative nature of Integra’s reporting. Applying a more common 75:1 ratio would boost the grades to 2.28 g/t AuEq over 221 meters and 1.89 g/t AuEq over 198 meters.

Although the average recovery rate for the silver will be lower than for the gold part of the deposit (which might be the main reason for this conservative equivalent-calculation), Integra’s peers use a more optimistic gold/silver ratio. This indicates ITR might be ‘underreporting’ its gold-equivalent grades compared to other gold-silver exploration companies.

The depth of the long 221-meter interval is only slightly relevant

‘But the long 221-meter interval only starts at a depth of 175 meters, isn’t that too deep for an open pit?’

A valid question. But no, this shouldn’t be an issue at all. First of all, open pits can go pretty deep these days, so there’s no technical issue here. Also, the 175 meters is the depth down hole, not the depth starting at surface.

One might also be worried about the strip ratio, but we see no big issue here either. If you look at the cross-section of the drill results (the first image of this Flash Update), you’ll see hole 11 was drilled towards the northeast of the long 221-meters. Not only did this effectively extend the mineralized envelope at DeLamar, the mineralization there appeared to be much closer to surface. A potential mining operation could start there, which means the waste excavation to reach the 221-meter zone would be classified as sustaining capex and wouldn’t have to be part of a pre-stripping program.

Don’t get us wrong, the thick layer of waste rock would obviously still have to be removed to access the paydirt, but there appear to be options to mitigate the impact on the economics.

Conclusion: this appears to be a 5Moz AuEq deposit

Taking everything into consideration (the apparent under-estimation of the average resource grade, and the results of this expansion-focused drill program), we are now pretty certain Integra Gold’s combined DeLamar and Florida Mountain projects host a total resource of 5Moz AuEq.

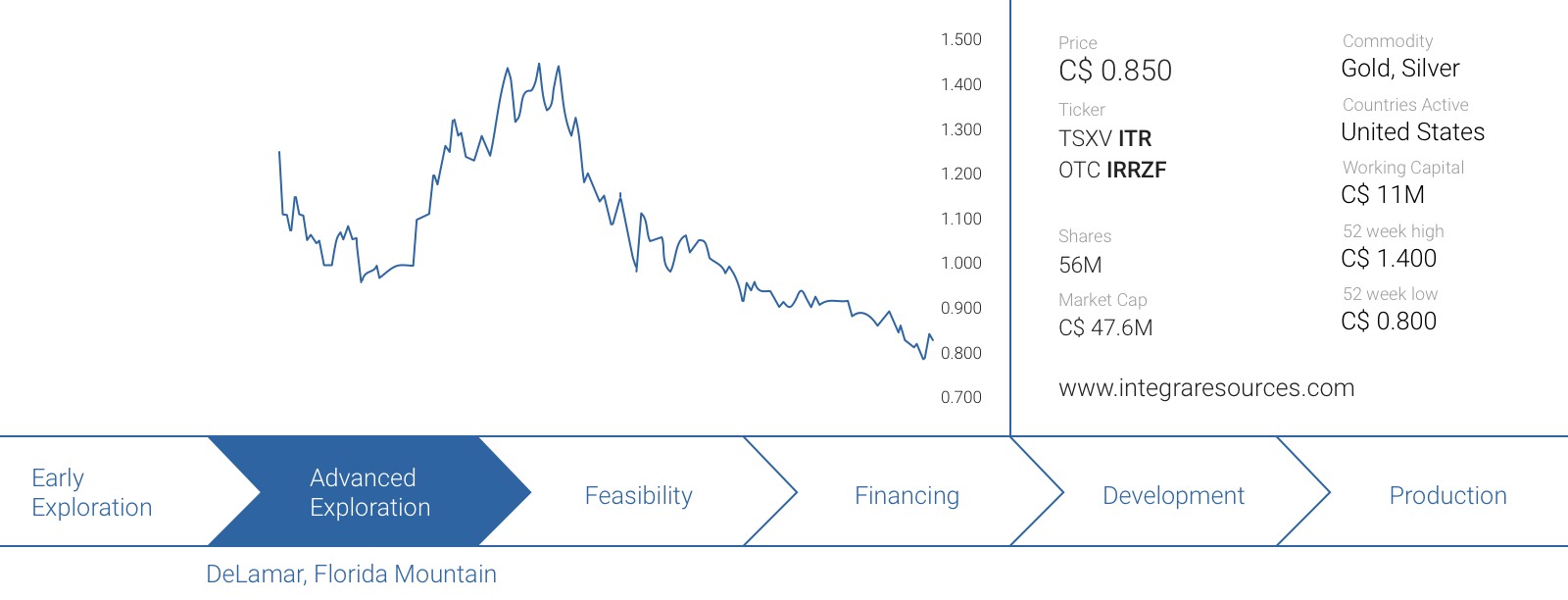

Time will tell, but it does look like the market misinterpreted the results published by Integra Resources. These assay results are best described in superlatives, and the current market capitalization of C$48M doesn’t reflect the true underlying value of the assets.

The author has a long position in Integra Resources. Integra Resources is a sponsor of the website. Please read the disclaimer