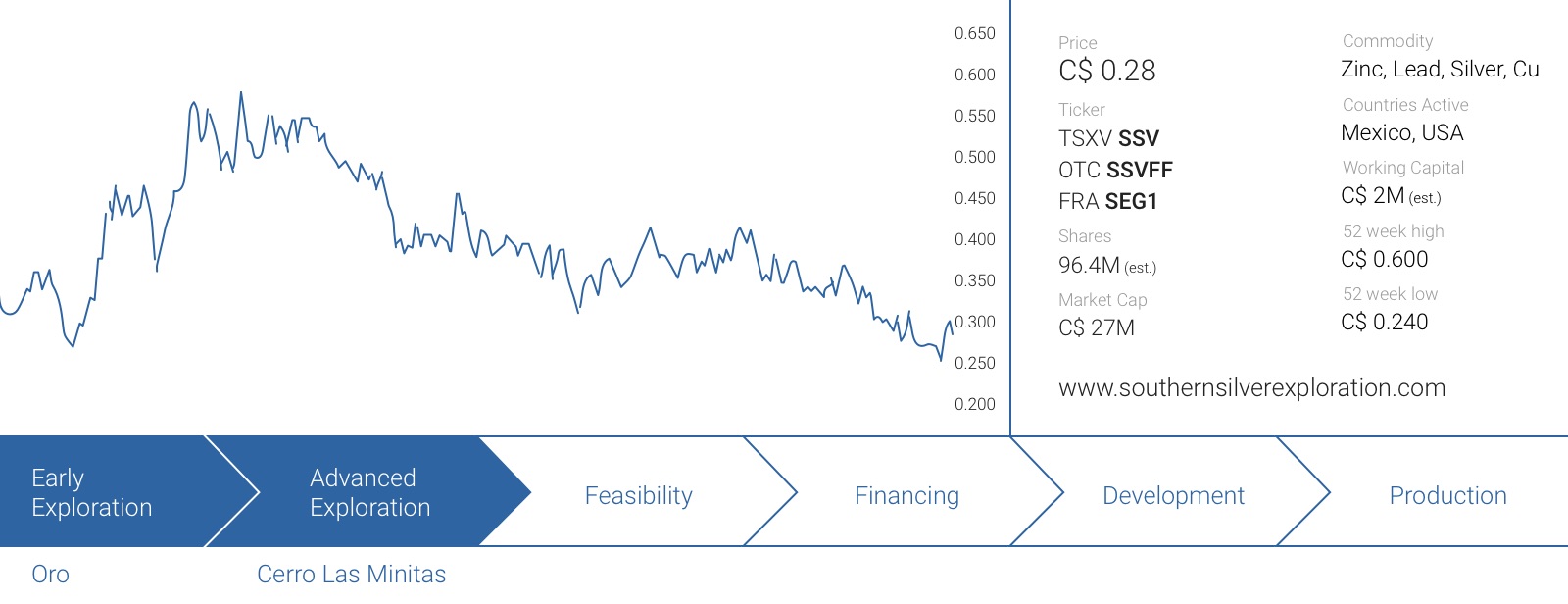

We were able to catch up with Jay Oness, VP Investor Relations and Robert MacDonald, VP Exploration of Southern Silver Exploration (SSV.V). We obviously aren’t happy with the recent performance of the company’s share price, but we left the meeting with a relatively good feeling.

The recent exploration results

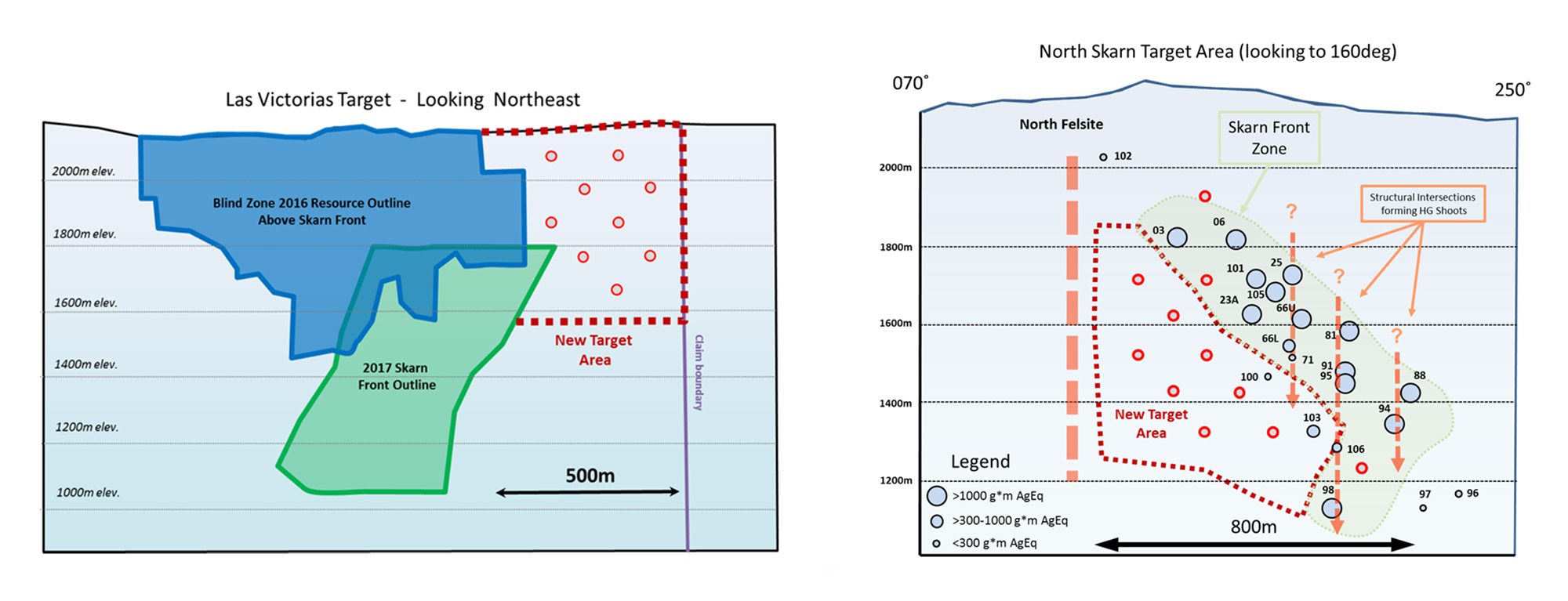

Southern Silver has now completed a 13,600 meter drill campaign and released all assay results. As we explained in a previous report, the most important achievement of the 2017 exploration season was the confirmation of the Blind Shoulder zone (underneath the El Sol and Blind zones) which has now been modelled to have an 800 meter by 600 meter footprint.

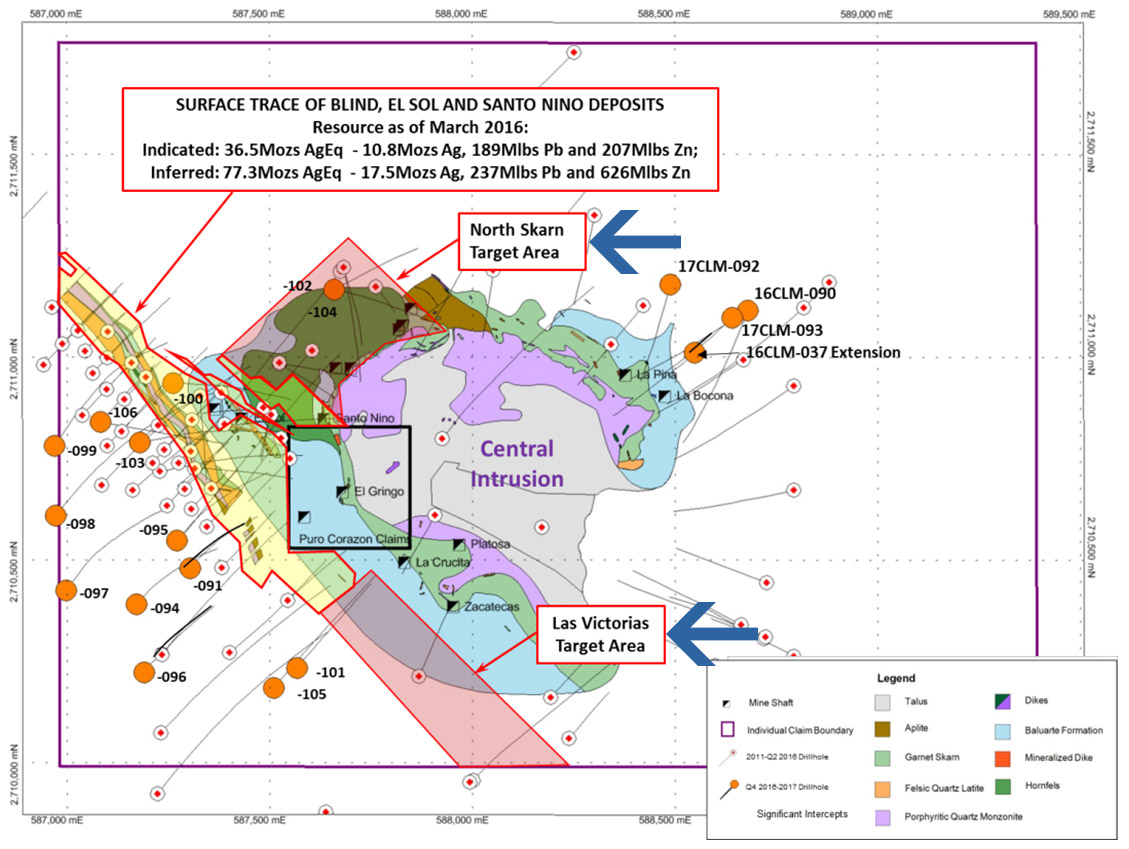

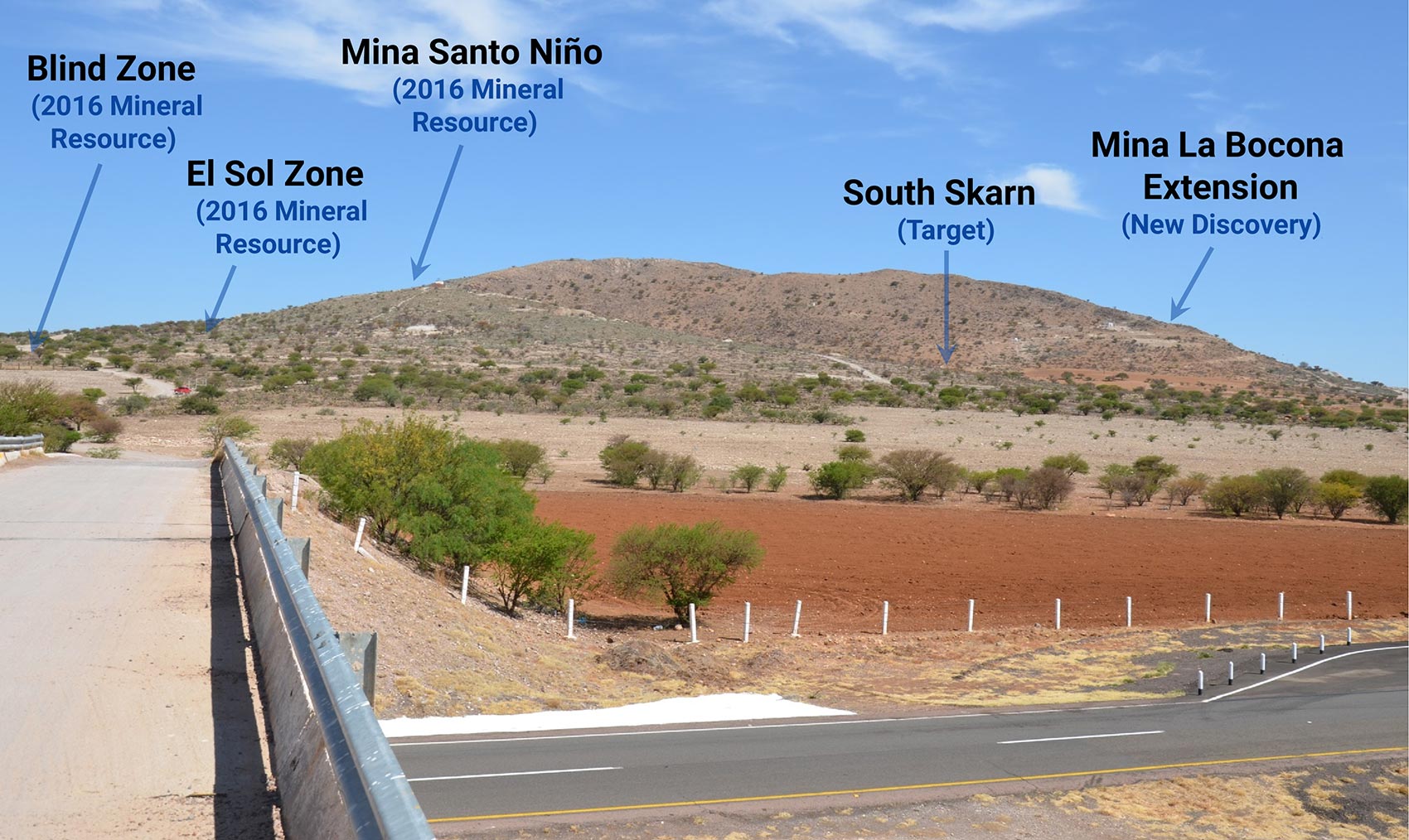

The drill program also allowed the company to get a much better understanding of the geological structures which control the outline of the project, and this will be a tremendous help to continue to expand the mineralized zones at Cerro Las Minitas. After all, the company has now defined two target areas (Las Victorias and North Skarn; see the next image to get a good understanding of the location of both zones) which will be drill-tested in 2018.

As you probably expected, this year’s 13,600 meters of drilling will add a substantial amount of tonnes to the existing resource estimate, and we think there’s more to come as both Las Victorias and North Skarn seem to be very promising exploration targets.

A resource update is imminent

Southern Silver will release an updated resource estimate within the coming weeks (the company has been guiding for an update mid-November) as it has now completed a successful 2017 exploration campaign. As a reminder, the current resource estimate contains 114 million silver-equivalent ounces consisting of approximately 28.5 million ounces of silver, 426 million pounds of lead and 833 million pounds of zinc.

Although both Oness and MacDonald didn’t want to comment on the size and grade of the resource update, we would expect the company to get pretty close to its overall exploration target of 200 million silver-equivalent ounces; partly due to the exploration success, and partly due to the possibility of using a higher zinc price which translates into more silver-equivalent ounces as well. Should this indeed be the case, we wouldn’t rule out an increase of the exploration target, especially as the North Skarn and Las Victorias target zones could potentially add more tonnes, ounces and pounds to the resource.

Grade-wise, we don’t expect any huge changes at all, but after seeing the recent exploration results we think the zinc grade will increase whilst the silver grade might decrease. Both factors will very likely compensate each other in a silver-equivalent calculation.

Should our expectations be confirmed, Southern Silver could start to consider re-branding itself as a zinc project as it represents the largest part of the in-situ value of the metals. As zinc will be one of the most important drivers of the economics (even at $1.15-1.20 per pound rather than the $1.5 per pound), it could make sense to develop the project as a zinc-silver property.

That being said, one could also argue it could make more sense to continue to consider CLM as a silver project as although the ‘pure’ silver production might be relatively low, the operating expenses would very likely be negative due to the by-product credits (thanks to the strong zinc and lead prices).

Long story short, a case could be made for both cases and it will be interesting to see what Southern Silver will come up with (as we obviously understand the audience for a zinc story might be different from a silver-focused company).

An updated resource estimate would allow us to run some numbers

Once the technical report of the updated resource estimate will have been filed on SEDAR, we will be in a position to start building an economic model – pretty much like we did with Vendetta Mining’s (VTT.V) Pegmont lead-zinc project earlier this year. Several inputs such as a mining cost per tonne, processing cost per tonne, etc… will be provided in that technical report. Putting all these parameters together in a back-of-the-envelope model will allow us to have a better understanding of the true value of the open pit component of Cerro Las Minitas ahead of an official Preliminary Economic Assessment which should be completed by the end of next year.

Additionally, Southern Silver is planning to complete more metallurgical test work in December & January, which we will incorporate in our model as well. Although the recovery rates which were reported a few years ago are already very decent, every additional increase of the recovery rate will add more value. A 1% increase on a 200Moz AgEq deposit would result in the sale of an additional 2 million silver-equivalent ounces and whilst the value of these additional ounces will be discounted, every dollar ending up in Southern Silver’s treasury instead of in the tailings will add value.

Conclusion

We expect Southern Silver to have a decent news flow in the next few months as the company will release an updated resource estimate and complete more metallurgical test work. We think the market will be positively surprised by the resource update, and we will predominantly focus on the viability of the open pit component of Cerro Las Minitas.

Right now, Southern Silver has a market capitalization of C$27M for a 40% stake in Cerro Las Minitas. This means the entire project is valued on a C$68M basis and that’s just slightly over US$50M. Whilst we still have to wait for the updated resource estimate, the NPV of the project will definitely be a multiple of this value, even if we would just take the “open pittable” resource into consideration.

The author has a long position in Southern Silver Exploration. The company is a sponsor of the website. Please read the disclaimer