Blackheath Resources (BHR.V) has successfully completed an exploration program on the Bejanca tungsten-tin deposit in Portugal. The results of the program were excellent, and Blackheath is now even considering its options to bring the project into production. Don’t expect a large scale operation, but even a small production scenario could result in some free cash flow for Blackheath which would allow the company to continue its exploration efforts on its other Portuguese properties.

We sat down with CEO Alexander Langer and Chairman James Robertson for an extensive update.

The Bejanca project: near-term cash flow?

The Bejanca project is a so-called ‘eluvial’ deposit. Could you elaborate a bit more on what an eluvial deposit actually is?

We indeed don’t often see the geologic term “eluvial”, sometimes we see “alluvial” which refers to eroded material like sand and gravel and minerals which have been broken down over time and transported by river action. This is quite common with placer gold deposits.

“Eluvial” materials are similar but they have not been transported by water and are generally found close to the location of the original veins. Of course, we already know from our work that there are significant hardrock showings and excavations at Bejanca and it will be very interesting to see the bedrock below the eluvial materials and to assess the vein potential of the area in more detail.

The interesting thing for us right now is to investigate the possibility of early production from the eluvial zones at Bejanca which would allow us to continue work on our projects at Borralha and Covas in particular.

It’s very interesting to see the high levels of tin being confirmed, and we are expecting tin to perform quite well as the supply deficit is expected to increase by 50% in 2016. Do you consider Bejanca to be a tin project with tungsten as a by-product credit?

Absolutely. It is very encouraging to see these tin values at Bejanca. We have always considered our projects to be potential tungsten mines with tin as a by-product but in this case, it is the other way around. Tin is such an important metal in relatively short supply and this looks very good for price increases in the future. We are delighted to have the diversification with both tungsten and tin.

The press release said you are working together with a local university to design a test processing plant. Could you elaborate a bit more on your ‘partnership’ with this university?

Our team of geologists and engineers in Portugal have very close working relationships with the Universities and with the government and are highly respected in the industry. Our relationships allow us to use the services of the National Laboratory for Energy and Geology, which includes a pilot plant suitable for testing our Bejanca material.

The plant includes the required equipment such as screens, trammels and screens, mineral jigs and gravity tables, and would replicate the commercial operation on a smaller scale. The results from the metallurgical testwork at this plant will assist in the development of the design of a full-scale plant.

We have the impression recovering the tin (and tungsten) through a gravity circuit might definitely work. However, as this is an uncommon approach for a Canadian mining company, we were wondering if you could provide some sort of summarized step to step overview of the production process?

You are quite correct; the process is quite different from those typically used for copper, lead or zinc and other metals. However, the tin and tungsten minerals – cassiterite and wolframite respectively – are very heavy and conventional processes allow the use of gravity for separating them from the waste rock. We will not require the same processes of crushing, grinding, flotation and leaching and our process will be more similar to a gold placer operation.

We obviously still need to do the testwork before finalizing the flowsheet but it is likely to include simple screening and sizing followed by gravity separation of the coarser material using mineral jigs and gravity separation of the finer material using spiral concentrators and vibrating tables.

These are all common processing items but the key thing is that the costs would be considerably less expensive than a full scale hard rock operation which would require the expensive capital and operating costs of crushing and grinding equipment.

It sounds like you are considering to fast-track Bejanca towards small-scale production. This operation will very likely remain quite limited to reduce the initial capital expenditures, but how do you intend to market the small batches of concentrate? Is there appetite in the market to buy small quantities?

We have not yet undertaken any formal economic analysis at Bejanca but we are encouraged by the comments of an engineer with extensive experience in this type of deposit who has reviewed our results so far and believes that we have a small mine at Bejanca.

We would expect the Bejanca operation to be scalable as we make progress – smaller initially to minimize capital expenses then adding modules as funds become available, thereby minimizing debt. Depending on how far we go with processing on site, we expect that the concentrates will be high grade with very low impurities. They will either be sold on a “spot” basis or added as a piggyback to concentrates from other mines. As we grow, we would expect to contract our output with a smelter company.

Now the test pits have confirmed your expectations, what are the next steps to develop the Bejanca project?

We need to carry out the metallurgical testwork and pilot plant work on our Bejanca samples so that we may proceed with economic assessment and preliminary process design. At the same time, we will excavate further sampling pits to confirm the best areas to start mining and to extend the area of the deposit as well as to undertake some environmental work.

Following this, we will be arranging financing, probably as debt financing, to construct the plant. For the first phase, we anticipate that this will be a very reasonable amount, perhaps around $1.5 million.

How easy will it be to secure all necessary permits to start a small-scale operation?

Any mine must operate in an environmentally sensitive manner, in accordance with all laws and requirements. Bejanca will be no exception and we will implement the Canadian standards at any operation in Portugal.

Given the nature of the gravity operation, there will be no hazardous chemicals being used in the plant which is certainly a plus in obtaining permits. We have been assured that by following all the due process properly, there is every reason to believe we will have our permit applications approved quickly. Starting now, with all environmental and economic assessments underway, we anticipate that we have the opportunity to commence operations early next year.

About the other assets

Have you planned any exploration activities at Borralha and Covas this year?

At Borralha, which is a very large possible open pit development, we pulled one of the best tungsten holes anywhere outside China and we are anxious to return to undertake another round of drilling. Also, we will be undertaking a very preliminary study of the economics at Borralha in preparation for a preliminary economic assessment of the project.

At Covas, we announced an attractive resource estimate last year and want to follow up with experimental mining in the area of the old open pit. Also, we will be looking at a program of metallurgical testing and an outline of requirements for environmental assessment of the project in preparation for a feasibility study.

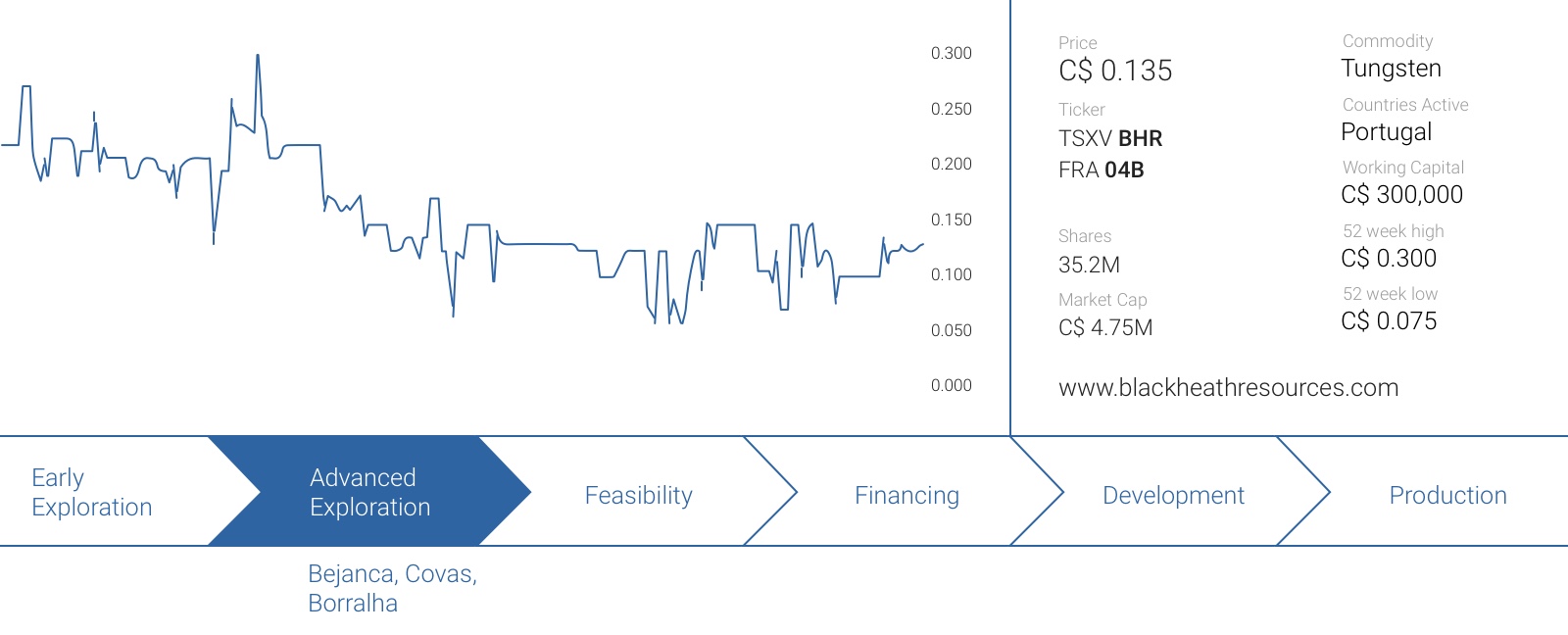

Blackheath Resources is a sponsor of the website, we hold a long position. Please read the disclaimer