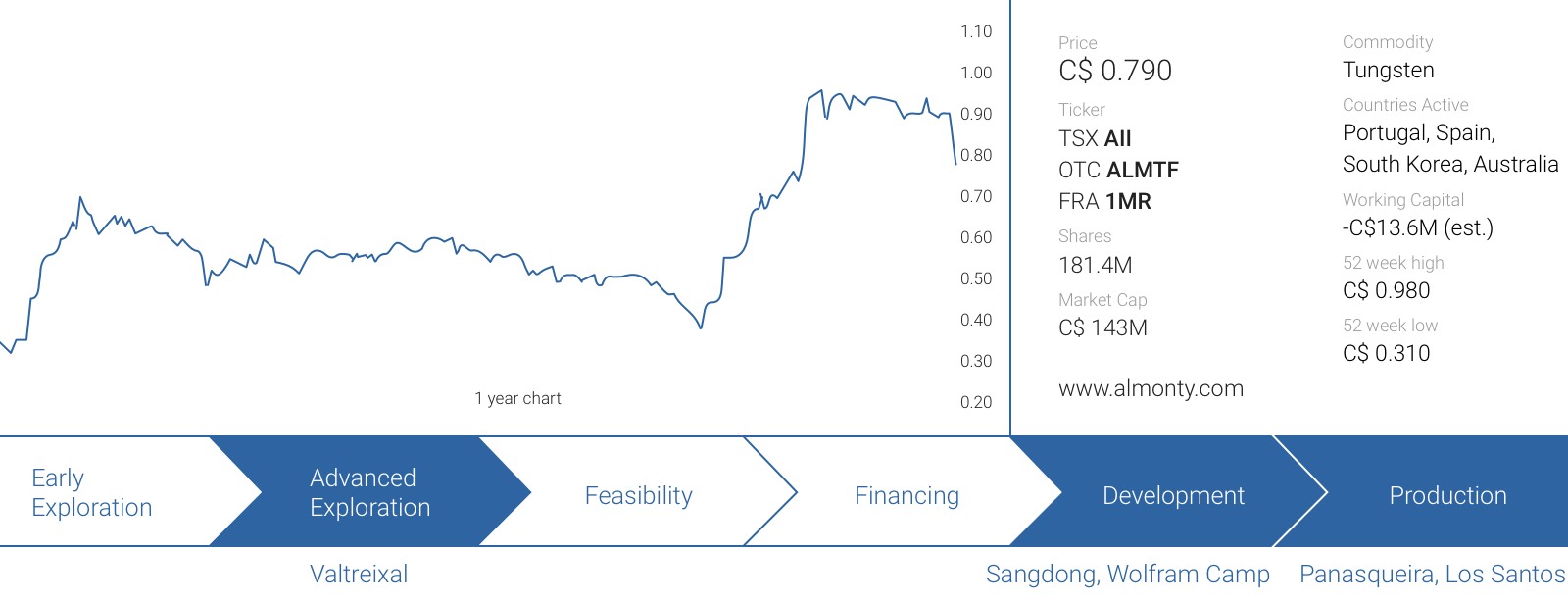

In our initial report on Almonty Industries (AII.TO), we were expecting the company to take advantage of some serious tailwinds in the tungsten sector. After several years of depressed prices for APT and tungsten concentrate, the future started to look bright again for producers in reliable countries. China still is the most important producer and net exporter of tungsten, and Almonty has done a great job in positioning itself on the market as a reliable and credible producer with operations in first world countries.

We noted the company generated a positive free cash flow in the second quarter of the year, and were expecting the company to improve its financial performance as it locked in higher tungsten prices for the concentrate it planned to sell this year. Almonty has now released its Q3 results, and we weren’t disappointed.

The mining operations are humming along nicely

Almonty hasn’t published the exact production and sales results of the Los Santos mine in Spain and the Panasqueira mine in Portugal, but both mines were able to show a substantial increase in their quarterly production rates. Based on previously published quarterly production results and the percentual increase in the most recent quarter, we were able to figure out the production rates for both mines (note that there is a small margin of error).

If those numbers are correct, Almonty can be very proud of its Spanish and Portuguese operations.

The company is also taking advantage of the high tungsten price, which remains at an elevated level. The next table shows the evolution of the tungsten price in the past two years.

Putting these data points in a chart will help to visualize the strong increase of the tungsten price:

This also creates a small issue with the reported revenues and the implied production rate. If we would multiply the output of tungsten concentrate with the average tungsten concentrate price and apply an USD/CAD exchange rate of 1.31, we would end up with a toal revenue of approximately C$18M, instead of the C$22M reported by Almonty. A part of this discrepancy could perhaps be explained by the sale of some copper and tin at the Panasqueira mine in Portugal. Another potential explanation could be the sale of WO3 concentrate that was held as inventory. Or maybe our tungsten price assumptions were too conservative.

The Los Santos mine is definitely the company’s most efficient asset. Whereas the revenue of both mines was comparable (C$10.6M at Los Santos versus C$10.9M at Panasqueira), the production costs at Los Santos were 47% lower. Of the C$10.6M of mine operating income (see later), 58% was generated at Los Santos, despite the 50% higher depreciation charges at the Spanish mine.

The numbers speak for themselves

A good production performance combined with a higher tungsten price creates high expectations. And Almonty definitely lived up to these expectations. The company’s Q3 revenue more than doubled from C$11M to C$22.5M, and as the production expenses only increased by approximately 30%, the operating income from mining operations has eightfolded (!) to C$10.6M.

That’s an excellent performance considering the other expenses remain pretty much ‘fixed’. It doesn’t matter how much mtu Almonty produces, the G&A expenses and interest expenses aren’t impacted by a higher/lower output/price. We see Almonty also decreased its G&A expenses by approximately 10% to C$2.16M, which boosted the pre-tax income by an additional C$200,000, to C$5.9M (note: this includes a FX loss of almost C$900,000 whilst the company recorded a FX gain of C$814,000 in the same quarter last year). And thanks to a deferred tax benefit, Almonty reported a net income of C$6.5M, or C$0.04 per share.

It was a great quarter, as Almonty generated 80% of its net profit in the first nine months of the year in the most recent quarter. This bodes really well for the next few quarters as we expect Almonty to be able to keep its momentum going.

Being profitable is great, but for mining companies, the cash flow statements are usually more important than the income statement as running a mining company ultimately boils down to one thing: how much cash is the company making.

Almonty reported an operating cash flow of C$10.5M, and after deducting the C$389,000 in interest expenses, the adjusted operating cash flow in Q3 was approximately C$10.1M. We don’t include changes in the working capital position in our calculations, as those changes could hide the underlying performance of the company. Comparing results on a ‘pure’ operating basis provides a better starting point to compare results on a quarterly or annual basis.

The total capex investment in the third quarter was just C$2.2M, which means Almonty reported a free cash flow result of almost C$8M. Some of the money was used to cover the working capital requirements (which were mainly related to an increase in receivables: Almonty’s offtakers still need to pay some of the invoices for the concentrate), but Almonty also repaid C$1.6M of debt. The net debt decreased to C$45M (including the restricted cash).

An update on the growth projects

Almonty’s operating mines are doing great, but let’s not forget about the company’s expansion plans.

The company is very likely in the final kilometer towards the finish line to complete the construction financing at its Sangdong development project in South Korea. As the project is fully permitted, the financing really is the final piece of this puzzle and given the current strength on the tungsten market and the high-margin nature of the Sangdong project the US$85M shouldn’t be too hard to find. Once funding has been secured, the 18-month construction period will start, followed by a 6-month commissioning process. Almonty Industries has been guiding for a non-dilutive financing, so we are really looking forward to see what Almonty will come up with.

Almonty Industries also expects to re-open its Wolfram Camp mine in Australia after having put it on care and maintenance in the summer of 2016. The mill refurbishment is almost complete, and Almonty is now guiding for the mine to restart operations in 2019 (that is, if the tungsten price remains at an acceptable level). We expect to see an update on this in the second half of the year.

Conclusion

Almonty Industries is laughing all the way to the bank as the high tungsten prices are allowing the company to generate above-average cash flows. Both producing mines in Spain and Portugal have performed very well in the past quarter, and this allowed Almonty to capitalize on the high tungsten prices. A free cash flow result of approximately C$8M in the most recent quarter is an excellent result, and it definitely helps the company to keep the balance sheet in a good shape.

The next catalyst will very likely be the completion of the financing package for the large Sangdong tungsten project in South Korea. Almonty Industries has promised a ‘non-dilutive’ funding package, so we are eager to see the final structure of a funding deal.

Disclosure: Almonty Industries is not a sponsor of this website, but we were compensated by a third party. We have no position. Please read the disclaimer