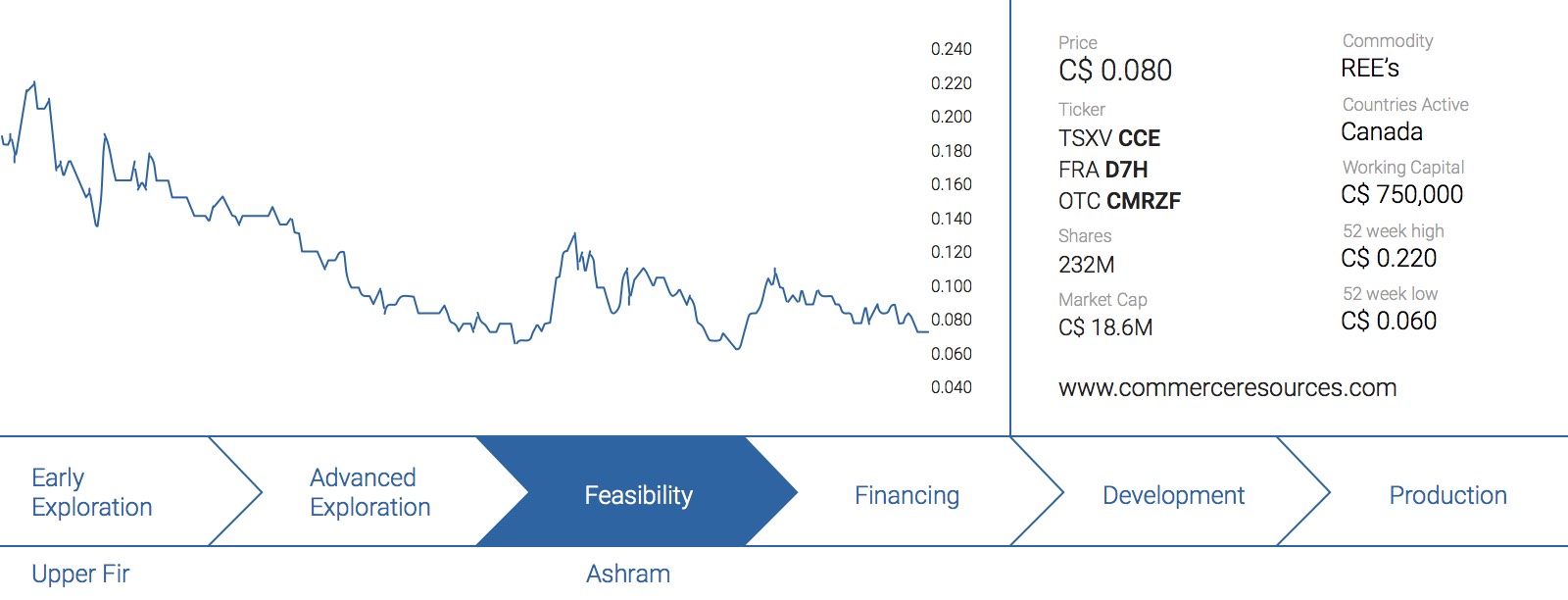

Earlier this quarter, we reported on Medallion Resources (MDL.V), a small Vancouver-based company that is aiming to recover rare earth elements (REEs) from a mineral source called monazite. This is quite a ‘special’ and a potentially relatively low-risk method to indeed be able to produce REEs from a mineral which is considered to be waste by many beach sand operators. In this report we would like to present you another potential opportunity in the REE-sector, Commerce Resources (CCE.V), a company belonging to the Zimtu Capital (ZC.TO) umbrella group.

When a story sounds too good to be true, it usually is, but we have to confess that after reviewing some materials and spending several hours with Chris Grove, Commerce’s president, we indeed agree this might be one of the very few viable REE-plays as the current basket price is still (much) higher than the expected production cost per kilo of product.

View PDFThe Ashram REE project – a brief background

Commerce’s Ashram Project is located in Québec’s Nunavik Territory and is approximately 130 kilometers south of Kuujjuaq. The remote area where the project is located could be seen as a challenge as there isn’t a labour pool directly available around the proposed mine site, but that shouldn’t be an issue down the road as a lot of mines in the wider region have operated successfully for years (e.g. Glencore’s Raglan mine), flying their staff in and out on regular intervals. The Preliminary Economic Assessment at Ashram does include the cost of a camp and an airstrip, so the location issues are definitely being dealt with.

Despite the remoteness, we consider the fact the project is located in Québec as a huge plus as it remains one of the most mining-friendly regions in the world. Further, being in the Nunavik Territory, the project is located in an area under aboriginal treaty with clear mechanisms in place for consultation and resource management. Additionally, the further development of the Plan Nord could bring a lot of advantages to the Ashram Project as the government of Québec still wants to invest heavily in infrastructure to unlock the mineral potential of the northern part of Québec. This would be great news for Commerce as a new access road connecting the property to the road/rail network in the south and through to Kuujjuaq in the north would result in huge cost savings further down the road (pun intended).

Back in 2007 and 2008, Commerce considered Ashram to be primarily a Niobium-Tantalum project and it was only during an exploration program in 2009 that REE mineralization of significance was discovered outcropping at surface. The company followed up on these first results and soon discovered the average grade of the samples in the Ashram area looked very promising with in excess of 50% of the samples returning a grade of in excess of 1% TREO. After this surface mineralization was discovered, Commerce pushed through with a drill program which indeed confirmed the existence of wide-spread REE mineralization and in the first quarter of 2011, the company was able to release a maiden resource estimate of 117 million tonnes of inferred resource at an average grade of 1.74% TREO (using a 1.25% cut-off grade).

Additional exploration activities revealed there was a higher-value zone within the existing resource envelope which contained an enrichment in the middle and heavy rare earth oxides, as well as neodymium. This zone is also expected to form the majority of the starter-pit.

The total deposit size almost doubled with a resource updated in 2012 with a measured resource of 1.6 million tonnes (Mt) at 1.77% TREO, indicated resource of 28 Mt at 1.90% TREO, and an inferred resource of 220 Mt at 1.88% TREO, at a 1.25% cut-off grade. And there’s much more to be found at Ashram, as the mineralization remains open to the north and south as well as at depth (despite having reached a total depth of 600 metres).

The company swiftly moved to complete a PEA which was completed in 2012. This gave the market a first indication of how valuable this project could be. The project has continued to advance, albeit slowed by the recent market environment, and has improved much many aspects of the project. Despite the lower REE prices, Ashram appears to remain profitable, anchored by a projected industry-low cost of production.

Why does this project stand a chance, compared to all these other REE hopefuls?

As we all know, the current REE prices are low. Terribly low. This means that a lot of projects with either a low average grade or a difficult rock type will have a lot of difficulties to prove their viability to the market, and it’s uncertain those companies will obtain any funding as long as the REE prices are where they are right now.

Just three years ago, Commerce was still focusing on two projects, the Upper Fir Tantalum and Niobium Project in British Columbia and the Ashram REE Project in Québec. The Tantalum project has taken a back seat as Commerce has made considerable progress at the Ashram Project which now seems to be shaping up as an interesting and promising REE project in a mining-friendly region.

One aspect that sets Ashram apart from many of its peers is its sheer size. It is a mammoth deposit with an initial mine life of 25 years, but there are enough resources already delineated to potentially sustain an operation for several hundred years. As many projects struggle to define resources, this is a distinct advantage for Ashram and frees up capital for other value added development work. No other project in development exists of comparable resource size that is also host to simple mineralogy, and is amenable to standard processing techniques. Coupled with a leading global jurisdiction for mine development and the Ashram Deposit quickly appears as a standout for development.

The PEA is outdated, and applying today’s parameters would improve the quality of the project

The 2015 PEA was very interesting to read, but now, several years after the report has been released, it’s already obvious a major upgrade will be needed to incorporate the updated parameters.

A. A new starter pit

We think an updated PEA, or Prefeasibility Study (PFS), will be able to incorporate an even more fine-tuned production scenario that is completely zoomed in and focused on the MHREO-zone, extending from surface. Even though the strip ratio in the original PEA was just 0.19 (which indeed is extremely low), it’s not unlikely this ratio could be reduced even further. Additionally, the 2012 PEA used a pit slope of 45 degrees, and this might be fine-tuned even further as SGS just used the standard of 45 degrees based on a study from 1974 .

B. Updating the currency effects

The original PEA used an USD/CAD exchange rate of 1, whereas the current ratio is more like 1.38 which means the expenses in Canadian Dollar have suddenly become quite a lot cheaper! The strong USD relative to the CAD is a large benefit to a project like Ashram that will have its operating expenditures (OPEX) in CAD but its saleable products sold in USD. Couple this with low oil prices (reduces OPEX) and lower steel prices (reduces CAPEX), and the project ends up with several significant tailwinds for its PFS that were not present for its PEA.

It is often said the most expensive place in the world to build a mine is the United States, primarily due to the strength of the USD. However, just north of the border in Canada, it often noted as one of the best, if not the best, places globally to build a mine; that being Quebec, which is exactly where Ashram is located. Let’s have a look at how the REE prices evolved in US Dollar:

[table caption=”REE Price Evolution” colalign=”left|left|left|left”]

REE;Price used in PEA (US$/kg);Recent price (US$/kg and rounded);REE Distribution in years 1-5 (in %, rounded)

Lanthanum;15;2;24%

Cerium;10;2;46%

Praseodymium;76;52;4,90%

Neodymium;77;42;17,30%

Samarium;12;7;2,40%

Europium;905;150;0,60%

Gadolinium;45;32;1,50%

Terbium;980;400;0,10%

Dysprosium;800;230;0,60%

Yttrium;28;6;2,60%

;;;DELTA

Basket Price;US$35/kg;US$14.7/kg;-58%

;C$35/kg;C$20.3/kg;-42%

[/table]

As you can see, the basket price for the REE mix that will be produced in the first five years of the mine life at Ashram has fallen by 58% in USD-terms. However, thanks to the cheaper Canadian Dollar, the lower REE prices will partly be compensated by the weaker CAD.

Keep in mind the calculated basket price is the gross value per kilo, and potential buyers of the concentrate will obviously base the paid price taking the additional separating expenses into consideration. There’s no fixed cost per kilo as it mainly depends on the different elements in the REE basket, but in Commerce’s case a discount of 25% is an acceptable expectation.

C. Removing the cerium

A huge kicker for the economics at Ashram could be the removal of the cerium before sending it off to a separator. Due to the high weighing of the Cerium in the concentrate and the current ultra-low Cerium price (cerium is trading at just $2 per kilo), any REE processor will penalize Commerce for having the Cerium in its concentrate (as the extraction cost will be higher than the revenue after the solvent extraction phase). Commerce is evaluating the benefits of this process, but the final decision about what to do with the Cerium (and Lanthanum) will depend on the requirements of the market.

The simplest way to recover the cerium is through oxidation, but Commerce Resources is also thinking about installing a small solvent extraction circuit to remove both the Cerium and Lanthanum in one ‘sweep’ and separate the Ce and La from each other to get to two saleable concentrates.

In such a case, approximately 97% of the Ce and La would be removed from the concentrate and the value of the remaining concentrate would suddenly sky-rocket as in the first five years of the mine life, the (important) praseodymium and neodymium combined would represent almost two-thirds of the Cerium and Lanthanum-depleted concentrate.).

D. An improved flow sheet and a higher REE-recovery

Since the first PEA has been published, Commerce Resources has worked to fine-tune the process and a recent update could be a pivotal point for the company. Not only was the average recovery rate boosted to 76% through to the final mineral concentrate (compared to 66.5% used in the PEA), the company has now also used considerably less steps in its flow sheet which will further reduce the initial capital expenditures and the operating expenditures (on top of the lower opex/kg due to the higher recovery rates). This means the initial capex of C$763M and the operating expenses of C$7.91/kg could be reduced even further. Also keep in mind the C$763M capex was also based on a parity in the US Dollar and CAD Dollar. Keeping the CAD-amount at the same level, the capex in USD has actually fallen to less than $600M. This amount also includes the sustaining capex as well as a 25% contingency, which is comfortably high.

On top of the better recovery rates and more streamlined process (single leach vs double leach), it will also be a viable option to reduce the daily throughput from 4,000 tonnes per day to, say, 2,000-2,500 tonnes per day. This will allow Commerce to reduce the initial capex even further whilst it would still be producing a significant quantity of REO per year.

Additionally, the value of the Cerium- and Lanthanum-depleted concentrate would be much higher than the current basket price. Of course, the amount of concentrate that would be produced will be much lower once you remove 97% of the cerium and lanthanum, but the total revenue (the (net) concentrate revenue+ cerium carbonate revenue + lanthanum carbonate revenue) should be higher than the current basket price as Commerce should be able to remove the cerium and lanthanum at a lower processing cost compared to the larger separators. Of course, this is just a theoretical thought from our side, and we will have to wait for the company’s final feasibility study before seeing which decision Commerce will make.

A recent marketing trip to Asia seemed to have been successful

Removing the Cerium from the concentrate before shipping it to the separator could have an additional benefit. Not only would the average price of the concentrate increase (as the Cerium content, which would very likely be penalized, is approximately 46%), Commerce would also be able to meet a certain demand from a potential customer.

President Chris Grove has indicated there’s Asian demand for a cerium product (and lanthanum product as well!) which is quite surprising given the current oversupply of cerium. However, security of supply (i.e. non-Chinese supply) is still a concern to many end-users. If the interest in the cerium product turns out to be correct and credible, then it would make even more sense to remove the cerium from the concentrate and ship it as an independent and different product to a prospective Asian buyer. Cerium is often treated as waste by juniors, but there is a market demand in certain product forms.

Removing the Cerium could be pretty straightforward through a process of oxidation and precipitation. But as explained earlier in this report, the Cerium and Lanthanum could be removed by adding a solvent extraction circuit to the processing plant which could remove up to 97% of the Cerium and Lanthanum from the final concentrate at relatively low cost. Not only would this increase the value of the remaining concentrate, it would also be easier for Commerce to fulfil the needs of some Cerium- and Lanthanum-hungry customers.

Conclusion

There have been quite a few self-proclaimed ‘leaders in the REE space’ in the past few years but once you start to insert the current REE prices in the production baskets, those ‘economics’ are crumbling. And that’s the difference between so many other REE company’s and Commerce Resources. Commerce resources is projected to be one of the lowest-cost producers globally and this is low a miner survives a commodity cycle. Even at today’s REE prices, the Ashram Deposit’s net basket price (so after applying the discount that will be used by the REE separators) is nearly double its projected operating costs.

One of the most important catalysts for Commerce Resources will be to complete additional metallurgical studies as well as trying to figure out what it should do with the Cerium and Lanthanum in the concentrate. If the majority of those two elements could indeed be removed, the value of the price basket would increase considerably.

Rare Earth Elements are unloved right now as there have been so many Canadian companies that claimed they would be the next low-cost REE producer, but Commerce Resources seems to be in the pole position to indeed effectively become a low-cost REE mining company.

The author holds a long position in Commerce Resources. Zimtu Capital is a sponsor of the website. Please read the disclaimer