Approximately two years ago, we had our first look under the hood of Great Bear Resources (GBR.V), as we were very interested in the Company’s Surprise Creek project in British Columbia’s Golden Triangle area. With a market capitalization of just C$2M, the company’s risk/reward ratio appeared to be very favorable.

By the end of 2016, it became clear Great Bear was starting to focus more on the Red Lake gold district in Ontario, as it acquired the West Madsen project. One of the West Madsen blocks was located directly adjacent to Pure Gold Mining’s (PGM.V) past-producing Madsen mine, and at first, Great bear appeared to be a great ‘nearology’ play capitalizing on the increased interest in the Red Lake district. Following the sale of its BC properties to Mountain Boy Minerals (MTB.V) in June 2017 Great Bear’s sole focus was on its Red Lake properties.

The Dixie Project: the best C$210,000 ever spent?

The two Madsen blocks were interesting, but in addition, Great Bear also owned a 67% stake in the Dixie gold project, which is just a few kilometers to the southeast of the two Madsen Blocks, and almost straight south from Pure Gold’s Madsen mine.

Just one month after the change in the strategic direction to focus on the Red Lake Gold district, Great Bear entered into an agreement to purchase the remaining 33% stake in the Dixie project it didn’t own yet from Newmont Mining (NEM, NEM.TO). As a senior gold producer, Newmont didn’t care too much about a minority stake in an early stage exploration project, so Great Bear was able to negotiate a good deal for the property: it agreed to pay C$80,000 for Newmont Mining’s 33% stake. As it previously negotiated a deal with a private vendor in December 2015 to purchase the first 67% ownership in the property for C$130,000 in cash and 100,000 shares, the total cost to acquire the Dixie property was just C$210,000 and 100,000 shares. A great deal brokered by the savvy minds at Great Bear, taking advantage of the horrible gold market in December 2015 and the lack of interest from a senior producer to contribute to an early stage exploration property.

But why was Great Bear so interested in Dixie?

Unlike, for instance, Pure Gold’s Madsen project, there was no historic production on the Dixie property, but the land package is located on the same greenstone belt in the Red Lake Gold camp that produced approximately 30 million ounces of high-grade gold.

And Dixie wasn’t a virgin piece of land: previous operators did drill 160 holes with mixed results (some of the holes did contain the typical high-grade Red Lake gold mineralization, other holes intersected just a few short low-grade zones), and this resulted in an exploration theory focusing on a mineralized zone with a strike length of almost 2 kilometers with a few additional satellite zones. With direct access to existing infrastructure like paved roads, a power line running right through the property and being just 20 minutes away from the town of Red Lake, the location of this project is as good as it gets.

And those historic drill results were very attractive as well. The previous operators drilled 2.2 meters at 17.2 g/t gold, 2 meters at 15.05 g/t gold, 5.25 meters at 6.03 g/t gold, and a few narrower intervals of for instance 1 meter at 9.25 g/t gold and 1.09 meters containing 9.34 g/t gold. These intercepts appear to be pretty narrow, but those widths and grades are representative for the typical Red Lake mineralization which is generally characterized by vein widths of 2-4 meters carrying an average grade of 10-15 g/t gold.

So right off the bat, Great Bear was successful in following up on these older intervals as its drill results confirmed an exceptional continuity of the veins. And that’s positive as it will make the mineralized system more predictable which bodes well for the efficiency of the current and future exploration programs. This should ultimately result in a maiden resource estimate, perhaps towards late 2019.

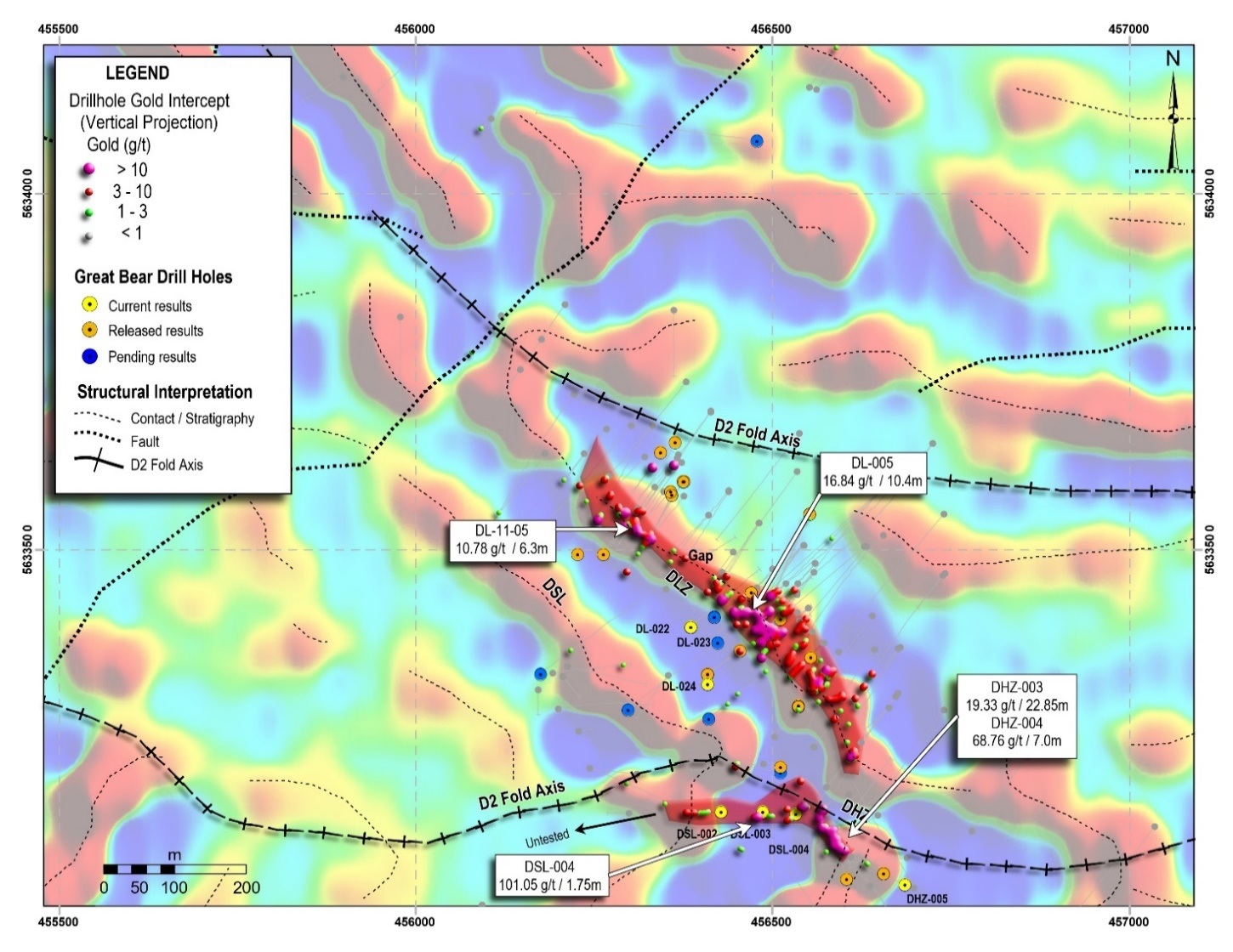

Although Great Bear has been intersecting gold mineralization on a consistent basis, the market didn’t seem to care too much about the initial drill results. That’s a surprise as the company released some excellent drill results over the summer: almost 17 meters of 5.6 g/t gold including 2.7 meters containing the typical half ounce material is excellent by any standard, the apathy on the market was shocking. This one hole confirmed the continuity of the gold mineralization at the Dixie Limb zone at depth as it was drilled under a previously reported 10.4 meters of almost 17 g/t gold. The market simply didn’t care.

But this changed at the end of August.

An eye-popping 16.4 meters at 26.91 g/t gold sounds great and even after isolating the high grade zones of that hole (5 meters at 51.39 g/t gold and 1 meter of 112.6 g/t gold), the average grade of the remaining 10 meters still is a very respectable 7 g/t gold. Typical Red Lake area stuff, and a great hole overall. And just to make sure this wasn’t a ‘one hit wonder’, Great Bear drilled a second hole 15 meters below the discovery hole before it got carried away with excitement related to finding high-grade gold within 100 meters from surface.

Not only did the second hole confirm the continuity of the gold zone, the assay results were initially equally as impressive with 7 meters of 44.47 g/t gold. Great Bear was a bit surprised by some parts of this zone as one interval assayed just 1.7 g/t gold despite the occurrence of visible gold. Great Bear then requested SGS Canada to re-assay this dubious interval and the updated assay results indicated the average grade of the 7 meter zone wasn’t 44.47 g/t gold, but a stunning 68.76 g/t gold. Indeed, GBR drilled 7 meters containing more than 2 ounces of gold per tonne of rock. It’s tough to find the right superlative to use, but the Hinge zone on the Dixie project is shaping up to be the discovery of the year.

After the initial drill results from holes 3 and 4 were released, some readers asked us if this was a one hit wonder. We don’t think that’s the case given the numerous high-grade gold intervals all over the Dixie property (including the South Limb zone, the ‘normal’ Limb zone and the Northwest step-out), it looked like Great Bear is really onto something massive.

This was confirmed with yet another positive exploration update from Great Bear.

Great Bear released the assay results from the South Limb Zone at its Dixie project in Ontario. The holes were drilled just 100 meters west of the two discovery holes at Dixie which sent the stock 200% higher over the past 6 weeks, and the gold grade encountered in hole 4 at Dixie South Limb is the highest grade ever drilled at the project. The drill bit intersected 1.5 meters at 101.05 g/t (including 0.5 meters at almost 347 g/t gold) within a wider interval of 10.35 meters at 18.23 g/t. Most operators like to smear these ultra-high-grade results over an interval that’s as long as possible, but Great Bear is playing it fair: outside of the 0.5 meter interval, the residual gold value in the remaining 9.85 meter intercept is approximately 1.55 g/t. And when looking at the grade distribution of that hole, the assay results seem to confirm the typical crack-seal nature of the veins at the Dixie South Limb. Additionally, Given the total width of 10.35 meters, any operator would very likely mine and process the entire zone, so we do believe Great Bear is providing a fair interpretation and overview of the drill results.

Just like the other holes drilled at both SLZ and the Hinge Zone, the gold mineralization occurred very close to surface (starting less than 75 meters below surface in hole 4), and that explains why the average depth of the holes of the ongoing drill program is just 200 meters. Great Bear simply doesn’t have to go deeper than that to test its exploration theory.

A little bit further north of the Hinge Zone and South Limb zone, GBR also drilled a few holes at the main ‘limb’ zone. All four holes intersected shallow gold mineralization as well with for instance 6.8 meters containing almost 3 g/t gold starting at a vertical depth of less than 76 meters, while other holes encountered 2.9 meters of 7.56 g/t gold and 3.8 meters containing 6.27 g/t gold:

Great Bear also drilled a geological hole to the southeast of the Hinge Zone discovery to gain more information about the features of the so-called D2 fold axis. This fold plays a very important role in Great Bear’s exploration strategy as this D2 fold is exactly what’s controlling the gold structures at Goldcorp’s (GG, G.TO) Red Lake gold mine, a little bit further up north. Despite this hole being just a technical hole, it did encounter gold mineralization as well (1.4 meters containing 1.17 g/t). Nothing too impressive, but it’s really intriguing to see Great Bear finding gold all over the place.

Great Bear appears to be far beyond the ‘smoke’-phase and it looks like it has hit a full-blown fire on the Dixie project where the gold mineralization appears to be widespread.

The ongoing 30,000 meter drill program will tell us a lot

Great Bear initially planned to complete a 10,000 meter drill program this year, drilling 60-70 relatively shallow holes, but the discovery of those ultra-high grade gold zones changed everything. Not only did those grades warrant a substantial additional drill program, Great Bear now also has the financial resources to punch a lot more holes in the ground at Dixie.

The company has now started a 30,000 meter drill program at Dixie which will ensure a continuous news flow as the 150 hole drill program will continue well into 2019. Although Great Bear will focus on the known mineralized structures on the Limb Zone (and nearby Hinge Zone and South Limb Zone), it does plan to drill-test the greater Dixie Limb Zone area, that currently appears to have a strike length of approximately 10 kilometers.

On top of the 10 kilometer long Dixie Limb Zone, Great Bear will very likely also want to follow up on the parallel structural trends that have been identified to date. As these parallel structures (and new geological contacts) appear to be related to the aforementioned D2-fold structure, conducting additional exploration programs on these potential satellite zones is definitely justified.

We realize this introduction report is predominantly focusing on the Dixie project and doesn’t discuss the West Madsen blocks at all, but Dixie is where the action is, and what the market is currently focusing on.

The financial situation: Great Bear is fully cashed up

The company’s treasury was in a pretty decent shape before the two discovery holes, but Great Bear made the smart decision to top up the cash balance announcing a financing just two days after the discovery. Using Rob McEwen and McEwen Mining (MUX, MUX.TO) as lead orders (for C$5.7M), Great Bear closed a C$10M placement. Although this placement was more than twice oversubscribed, GBR remained disciplined and kept the capital raise limited to a hard dollar raise to the tune of C$10M instead of upsizing it.

The units were priced at C$1.45 and consisted of one common share and ½ of a warrant with each full warrant allowing the warrant owner to acquire an additional share of Great Bear at C$1.75 within two years. On top of the C$10M from the placement, Great Bear received an additional C$1.13M from warrant exercises from previous financings.

Now everything is said and done, Great Bear’s share count is still just 35M shares and the existing cash position of in excess of C$11M will take care of the ongoing 30,000 meter drill program and will still allow Great Bear to end the year with a net cash position of in excess of C$5M. This means GBR appears to be fully funded until the summer of 2019, which puts the company in a very enviable position.

Not increasing the size of the placement is a sign of strength to minimize the dilution and maximize the impact of a drill program by keeping the share count limited. But as we’re getting closer to the end of this financial year, we would expect the company to receive some offers from flow-through funds to invest in Great Bear, as some funds are always scrambling to spend funds before the end of a year.

Should Great Bear be offered to raise flow-through funds at a price of in excess of C$3.50, we would expect the company to take at least some of it. Raising C$7M at C$3.50 per share would increase the share count by just 2 million shares, keeping the upside potential impact.

The management team

Chris Taylor – Director, President and CEO

Mr. Christopher Taylor is President, Director of Great Bear Resources Ltd since December 2010. Mr. Taylor graduated with a Bachelor of Science honours degree in Earth Sciences in 2000, and a Master of Science degree in Structural Geology from Carleton University in 2003; Operates an independent geological consulting practice, evaluating exploration and mining properties for acquisition purposes; Geologist with Imperial Metals, Inc., a TSXV company from 2004 to 2009.

Bob Singh – Director, VP Exploration

Mr. R. Bob Singh, B.Sc., PGeo. has been Vice President of Exploration at Great Bear Resources Ltd. since March 2015. Mr. Singh has been associated with the mineral exploration industry for over 23 years. He is Founder of North Face Software Ltd. and serves as its President. He has worked for both junior and major mining companies as well as developed new technologies for recording and analyzing geological data. Mr. Singh has managed several exploration programs in the Red Lake Gold district since 2003 and was a key member of an exploration team exploring for sediment hosted gold deposits in British Columbia.

David Terry – Director

Dr. Terry is a professional economic geologist, senior executive and corporate director with more than 25 years’ of international experience in the mineral resources sector. He has played key roles in the successful acquisition, exploration and development of a number of precious and base metal deposits, primarily in North and South America, and has expertise in advanced project evaluation, M&A, corporate finance, and design and execution of effective exploration programs.

In the course of his career Dr. Terry has held executive positions and directorships with a number of publicly-listed and private mineral resource companies; he currently serves as a director of Golden Arrow Resources Corporation. He has also worked with a number of senior mining companies including Boliden Limited, Westmin Resources Limited, Hemlo Gold Mines Inc., Cominco Limited and Gold Fields Mining Corporation.

Tony Ricci – Director

Tony Ricci is a Chartered Professional Accountant with 25+ years serving Canadian and US listed public companies. He is a former Director and CFO of mining companies with a combined market capitalization near $2 billion including Norsmont Mining, Keegan Resources (currently Asanko Gold Inc), Petaquilla Minerals and Petaquilla Copper. His was formerly with KPMG and AMEC Engineering Inc.

Douglas W. Ramshaw – Director

Mr. Ramshaw earned his B.Sc. (Hons) Mining Geology from the Royal School of Mines, Imperial College, in London, UK. For almost two decades Doug has been a senior executive (including President, CEO and Vice-President Business Development) and a director of several exploration companies headquartered in Vancouver but with mining properties around the world. Earlier in his career, Doug was a mining analyst for an independent brokerage firm in London, U.K. Despite his executive roles in exploration and mineral development, he is still active in the art and science of geological exploration, most recently spending time on field programs in both the Yukon, Canada and Mexico.

John Robins – Advisory Board Member

Mr. Robins, a Professional Geologist with over 30 years’ experience in the mining industry, was the Executive Chairman of Kaminak Gold Corporation and now still is a director of ValOre Metals., West Melville Minerals Inc., and Ethos Gold Corp. He has been a driving force within the Vancouver mining sector as founder of Hunter Exploration, Stornaway Diamond Corporation, Kivalliq Energy Corporation, North Country Gold Corp. and Kaminak Gold Corp. Mr. Robins was also involved in the successful sale/merger of several public companies including Grayd Resources Corporation (Agnico Eagle), Troon Resources (Grenville Strategic Royalty), Arauco Minerals (Kinross), Creston Moly Corporation (Mercator) and Northair Silver (Kootenay Silver).

Jim Paterson – Advisory Board Member

Mr. Paterson is CEO of Valore Metals , and served as director of Kaminak Gold Corp. from 2010 to 2016, when Goldcorp. acquired Kaminak for in excess of $500 million. Mr. Paterson has 19 years of corporate experience with several North American publicly traded companies, participating in acquisitions, joint-ventures, spin-outs, reverse transactions and IPO’s. Since January 2010, Mr. Paterson has been involved as an executive or as an active director of companies which have raised in excess of $175 million in equity financings.

Conclusion

Great Bear Resources’ share price is surfing on the waves of a strong momentum as a lot of eyes are now on the stock. It’s still very early days, but Great Bear might very well be on the verge of discovering a new gold deposit in an established prolific mine camp. We will know a lot more once the additional 30,000 meter drill program will be completed, but we dare to bet the technical team of Great Bear has a good shot at making the shortlist of the Thayer Lindsley Award at the 2020 PDAC Awards Gala.

The author has a long position in Great Bear Resources. Great Bear Resources is a sponsor of this website. Please read the disclaimer