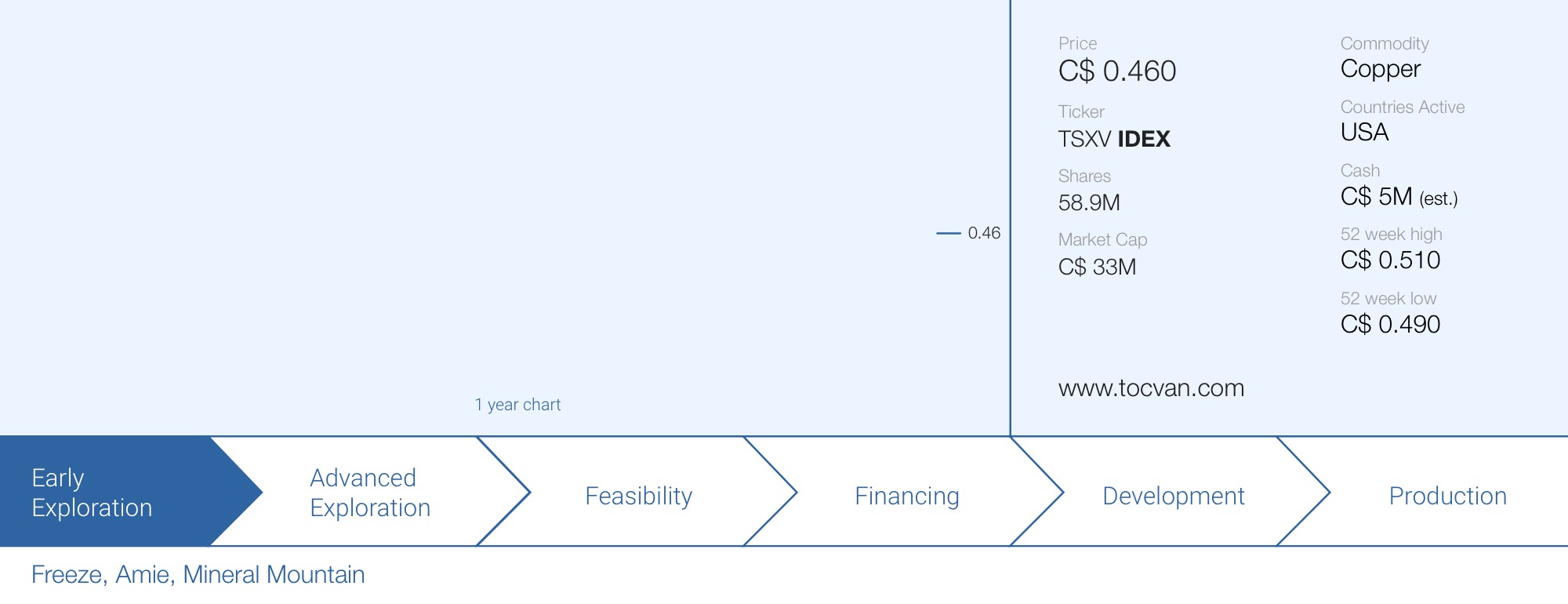

IDEX Metals (IDEX.V) is the newest listing on the TSX Venture Exchange. The go-public transaction has been in the works for about a year, but the company finally completed all requirements to complete the reverse takeover of an existing shell. The recently raised C$5M will help IDEX to hit the ground running on its Freeze project in Idaho’s newest copper porphyry belt. Although the company has several projects in Idaho, most of the attention (and dollars) will be directed to Freeze where IDEX already outlined two copper-in-soil anomalies it would like to follow up on.

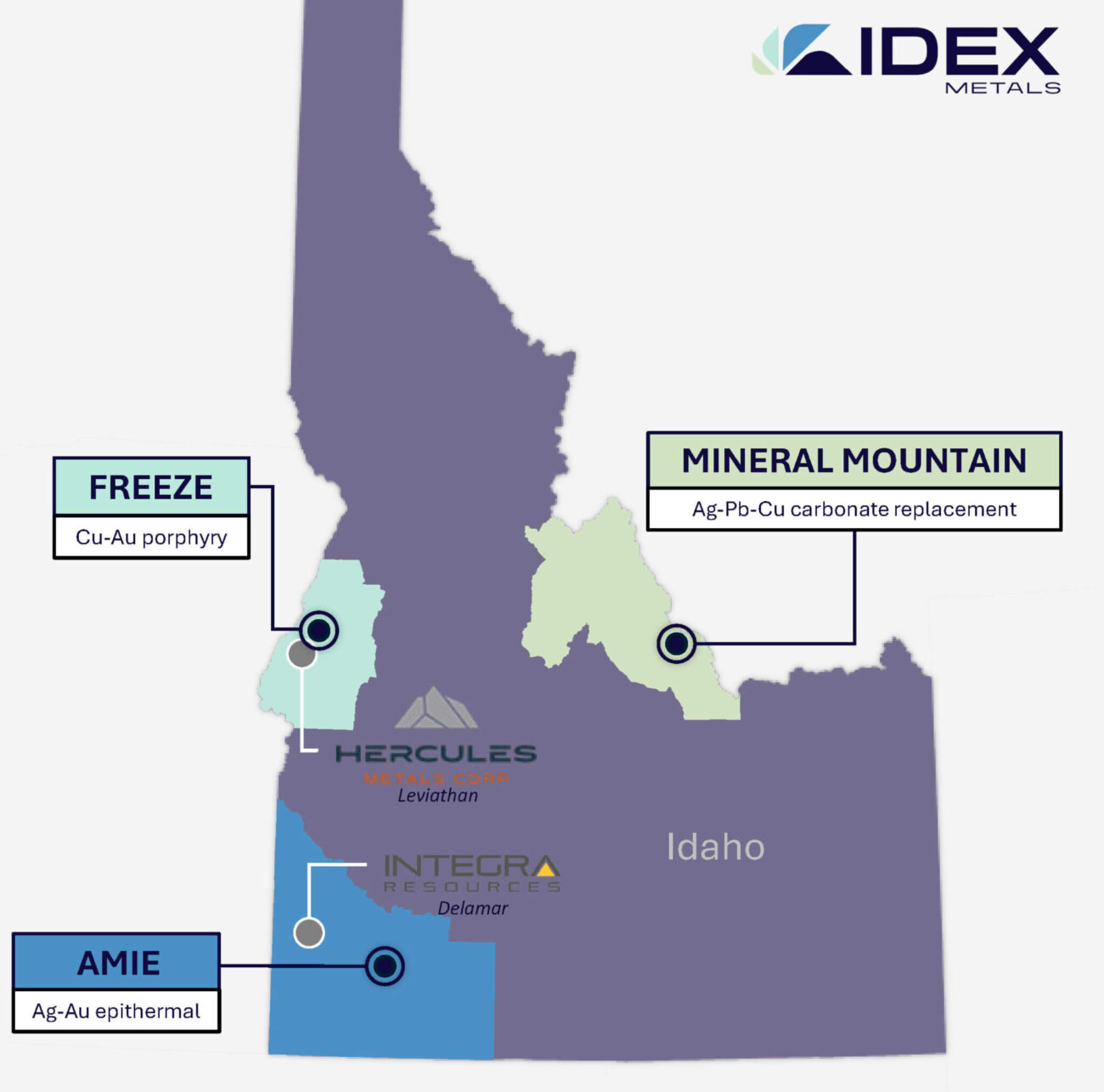

The company acquired a broad portfolio of assets in Idaho through staking and data compilation totalling over 46,000 acres across 15 projects. As the financial resources of an exploration-stage company are limited, IDEX will focus on its flagship Freeze project which is located in close proximity to the Hercules Metals and Barrick Mining land packages. The other two standout projects of the 15 project portfolio, Amie and Mineral Mountain, are also interesting but we don’t expect IDEX to do any significant exploration there this year.

The Freeze project

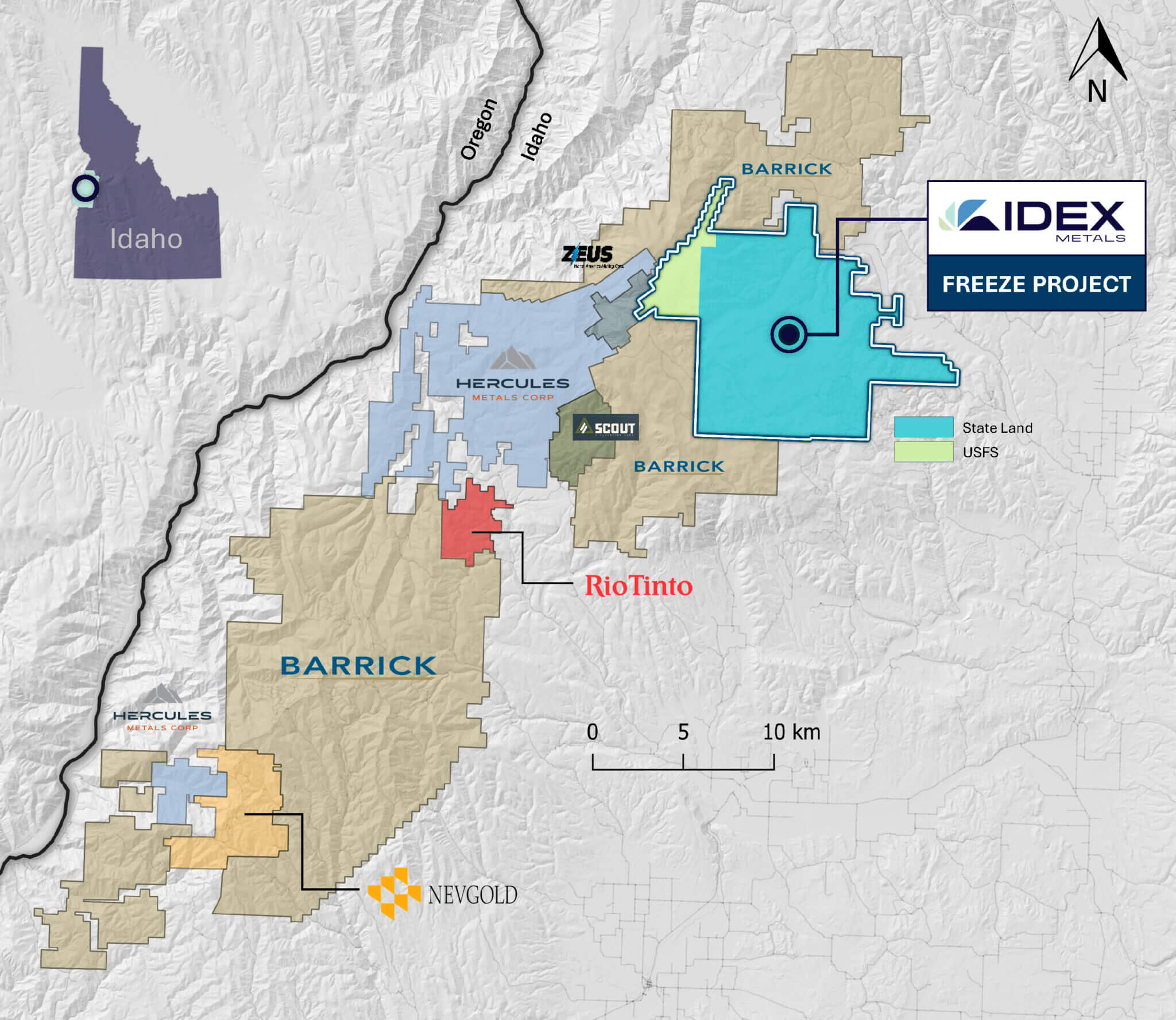

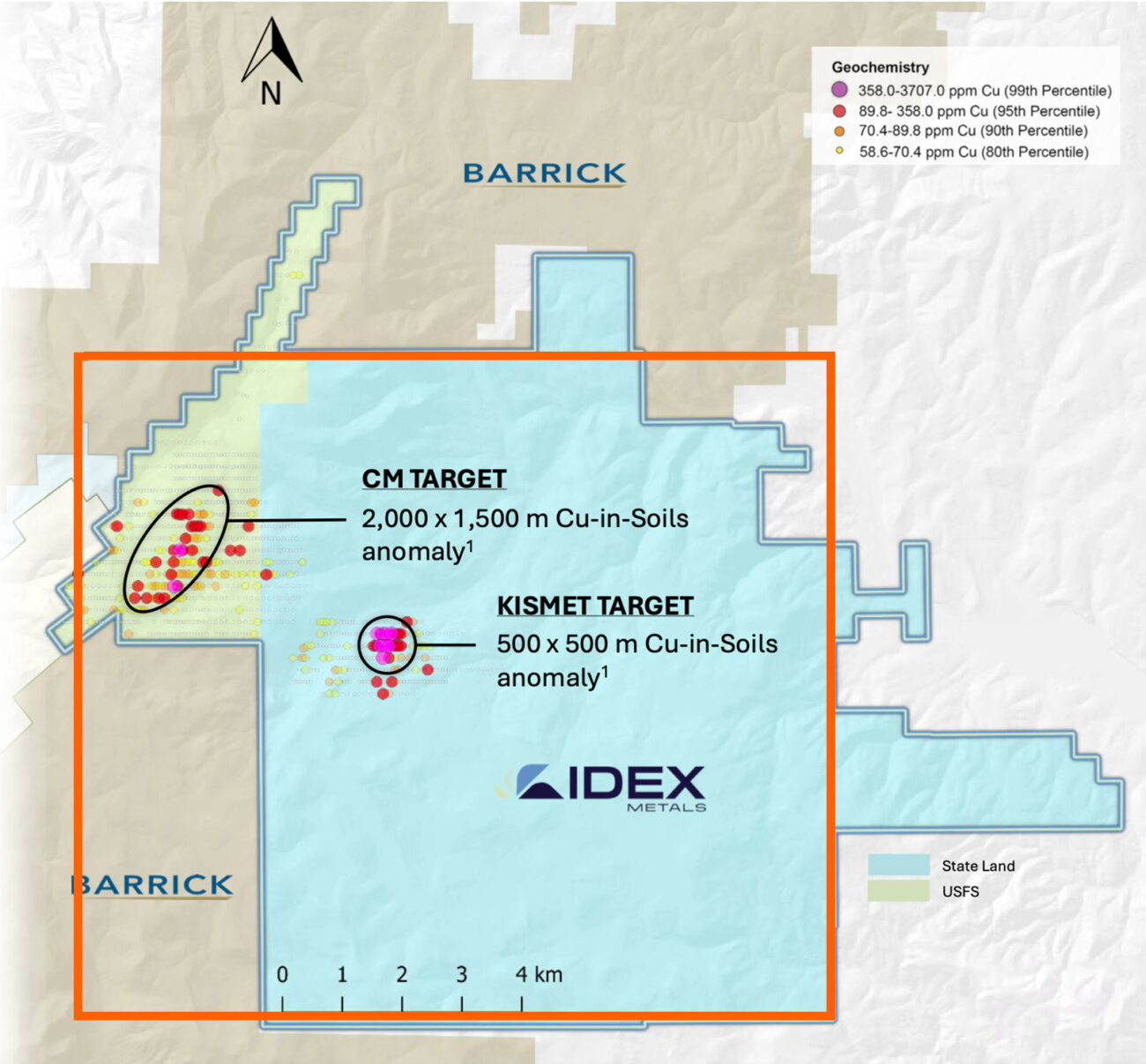

While the company has three main assets in three counties in Idaho, we will mainly focus on the Freeze project, as that’s where most of the exploration dollars will be spent. The Freeze property consists of 31,000 acres with the vast majority of these acres on state land (as shown in the image below) while the westernmost portion of the property is located on US Forestry Service land.

IDEX Metals now has the largest block of contiguous State Land claims in Idaho, and the second-largest land position in the district behind Barrick.

The image above already tells and shows half of the story. IDEX Metals’ 31,000 acres are in the hotspot of Western Idaho’s newest copper-gold discoveries. It all started in 2023 when Hercules Silver (now renamed to Hercules Metals) discovered porphyry-hosted copper in the area and this resulted in an incredible staking rush.

When you talk about ‘nearology’ plays, it’s usually a bunch of junior companies that do their best to wave their arms and try to get some attention (and raise money) by acquiring land next to a bona fide discovery. You rarely see senior mining companies rush to stake claims as well, yet that’s exactly what happened. Barrick Gold (now Barrick Mining, as it conveniently wants to be seen as a diversified mining company with exposure to copper as well) became a strategic investor in Hercules Metals ànd staked so much land that it is now by far the most dominant land holder in the area.

But Barrick wasn’t alone and Rio Tinto also staked some claims relatively close to the Hercules discovery while only a handful of juniors were able to ‘get in on the action’. NevGold (NAU.V) has a land package to the southwest of Barrick’s land, while Zeus North American and privately-held Scout Discoveries attracted Canadian mining giant Teck Resources as a shareholder, as well as selection for participation in BHP’s Xplor program, which saw additional funding dollars

If anything, the presence of (very) senior mining companies lends additional credibility to the original discovery by Hercules Metals and to its claim that the area is a new ‘porphyry belt’. By calling it a belt, Hercules clearly sees the opportunity for more discoveries. And it’s only through dedicated exploration programs that the owners of the surrounding land packages may find out if their respective properties could potentially host something of economic significance (none of the projects and prospects currently have an economic study, so the entire porphyry belt is still just a large-scale exploration play).

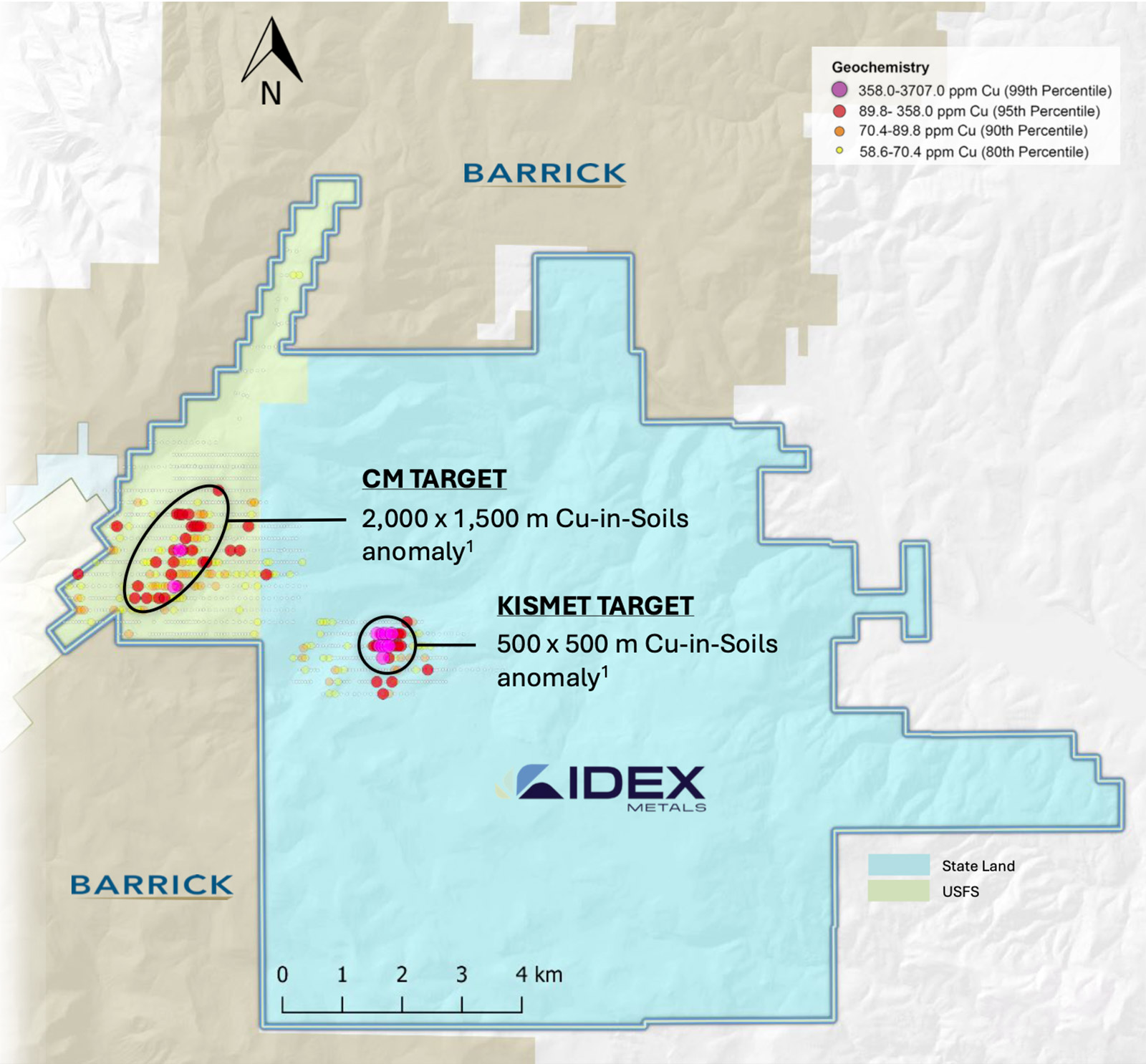

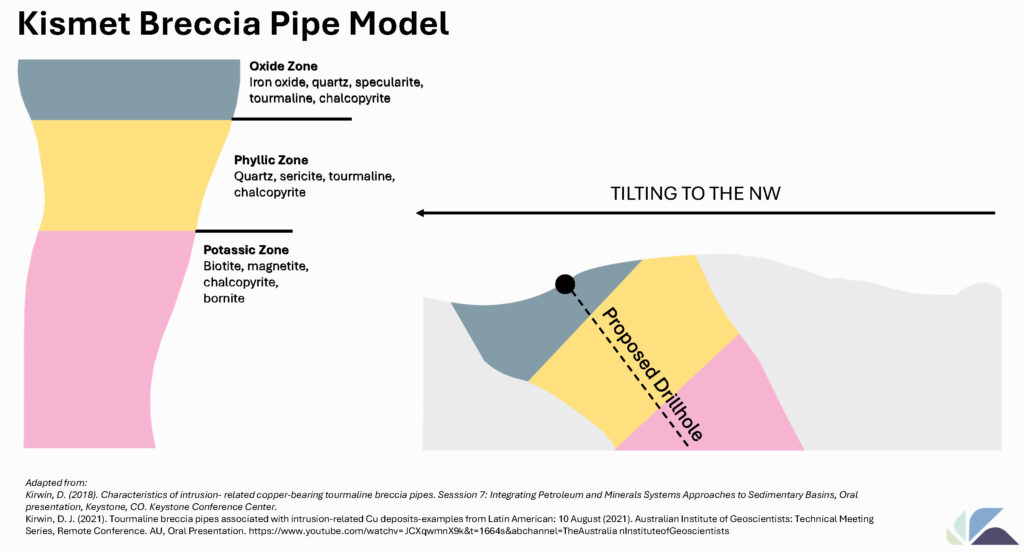

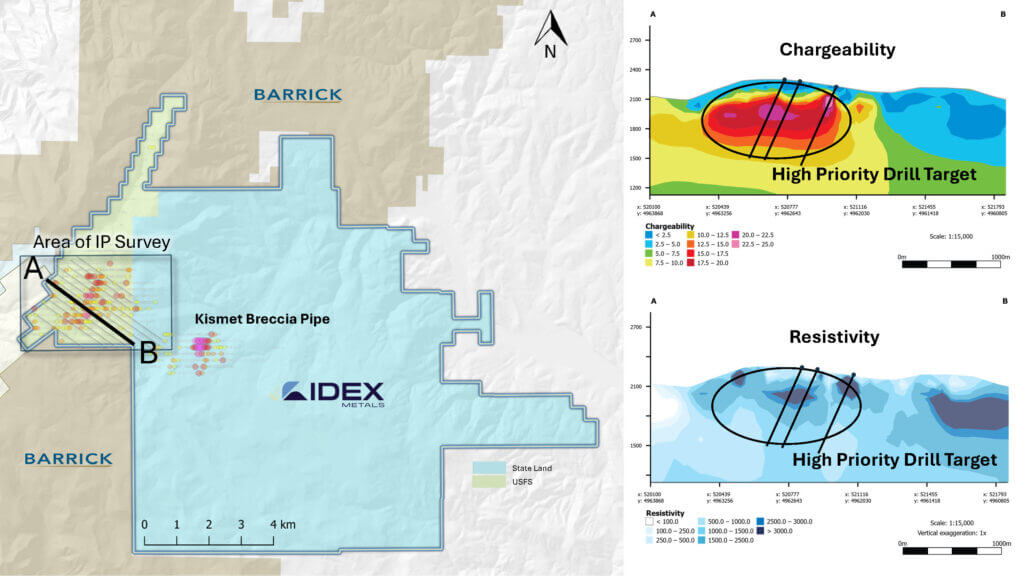

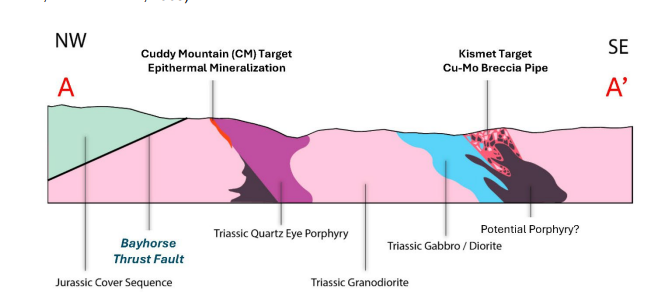

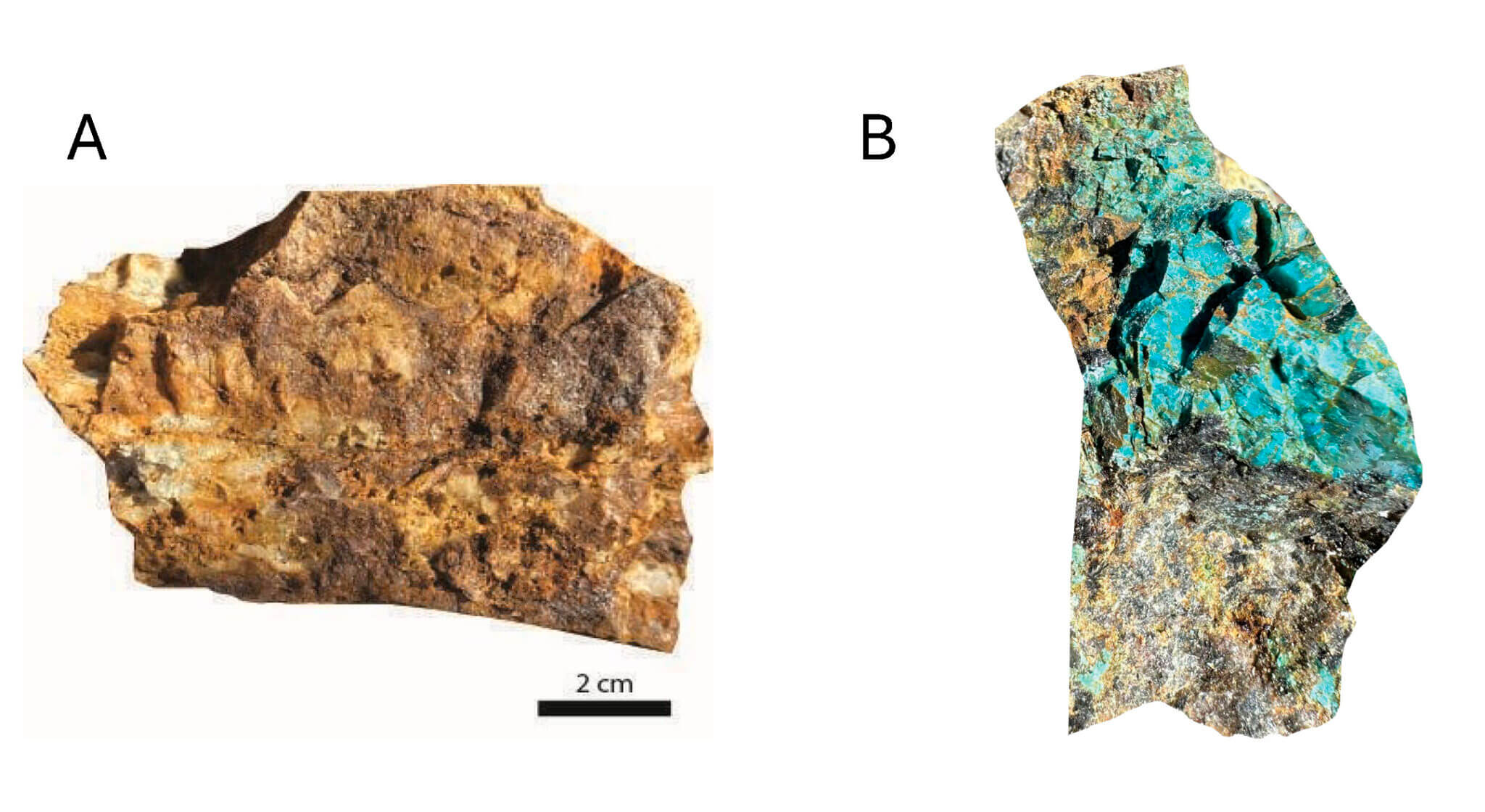

And this brings us to IDEX’s land package. The company feels it has (at least) two shots at exploration success. Previous rock and soil sampling programs have confirmed the presence of two large anomalies. The Kismet Target is a 500 by 500 meter copper-in-soil anomaly, where historical drilling reported significant copper mineralization, while the larger Cuddy Mine target hosts a 2,000 by 1,500 meter copper-in-soil anomaly. Two interesting anomalies are the starting point for IDEX to apply its recently raised funds to get a better understanding of the anomalies.

This is pretty much ‘virgin territory’ as there has been no modern surface exploration or significant drilling on the Greater Freeze property.

As mentioned before, the Freeze project currently consists of 31,000 hectares and a portion of the land package, the area that hosts the Cuddy Mine zone, is located on US Forestry Service land. While drilling and exploration activities shouldn’t be an issue (and the company expects the drill permits to be issued by the end of the third quarter of this year), it could indicate a development permit process further down the road could take more time. That being said, it is not impossible to get things done on USFS land as Perpetua Resources recently got their Stibnite project approved for development.

The plans

IDEX Metals will start its 2025 summer exploration program with a MT geophysical survey, with a specific focus on the breccia zone on the Kismet prospect. This MT survey should only take a few days which will allow IDEX’s technical team to interpret the data ahead of a drill program which is slated for later this summer. The MT survey should hopefully provide the company with some high-priority drill targets and perhaps provide a model and ideal angle to improve the odds of the drill program intersecting a hidden porphyry at depth. As drilling costs about US$500/meter (on an all-in basis) in that part of the world, a sub-$100,000 MT survey followed up on by a ZTEM survey is a good way to refine the high-priority drill targets.

A historical drill hole at Kismet intersected just over 41 meters at an average grade of 0.85% copper, starting at just 9 meters down hole.

At the old Cuddy Mine prospect, the company has found a large copper-in-soil anomaly which coincided nicely with the IP chargeability and resistivity response in a 2024 survey.

We expect to see the results of the MT survey over the summer and the company will follow up on those results with an initial 2,500 meter drill program which could start as early as July (with assay results rolling in after the summer). Meanwhile, the surface mapping and sampling efforts will continue throughout the summer as IDEX Metals still has some ground to cover on the recently-leased Idaho state land and other underexplored areas.

The recently completed RTO transaction

IDEX Metals completed its go-public transaction through the Reverse Takeover of Goodbridge Capital, an existing shell. Concurrent with the RTO transaction, IDEX raised just over C$5M (C$5.01M to be precise) in a C$600,000 brokered private placement and a C$4.4M brokered financing which consisted of subscription receipts. Those sub-receipts will be converted into one common share and ½ warrant with the warrant terms consistent with the brokered unit offering. Warrant holders will be able to acquire an additional share of IDEX Metals at C$0.70 per full warrant during a two year period.

The shares that will be issued as part of the sub-receipt financing will be immediately tradeable, the shares that were part of the unit offering will be subject to a four month hold period.

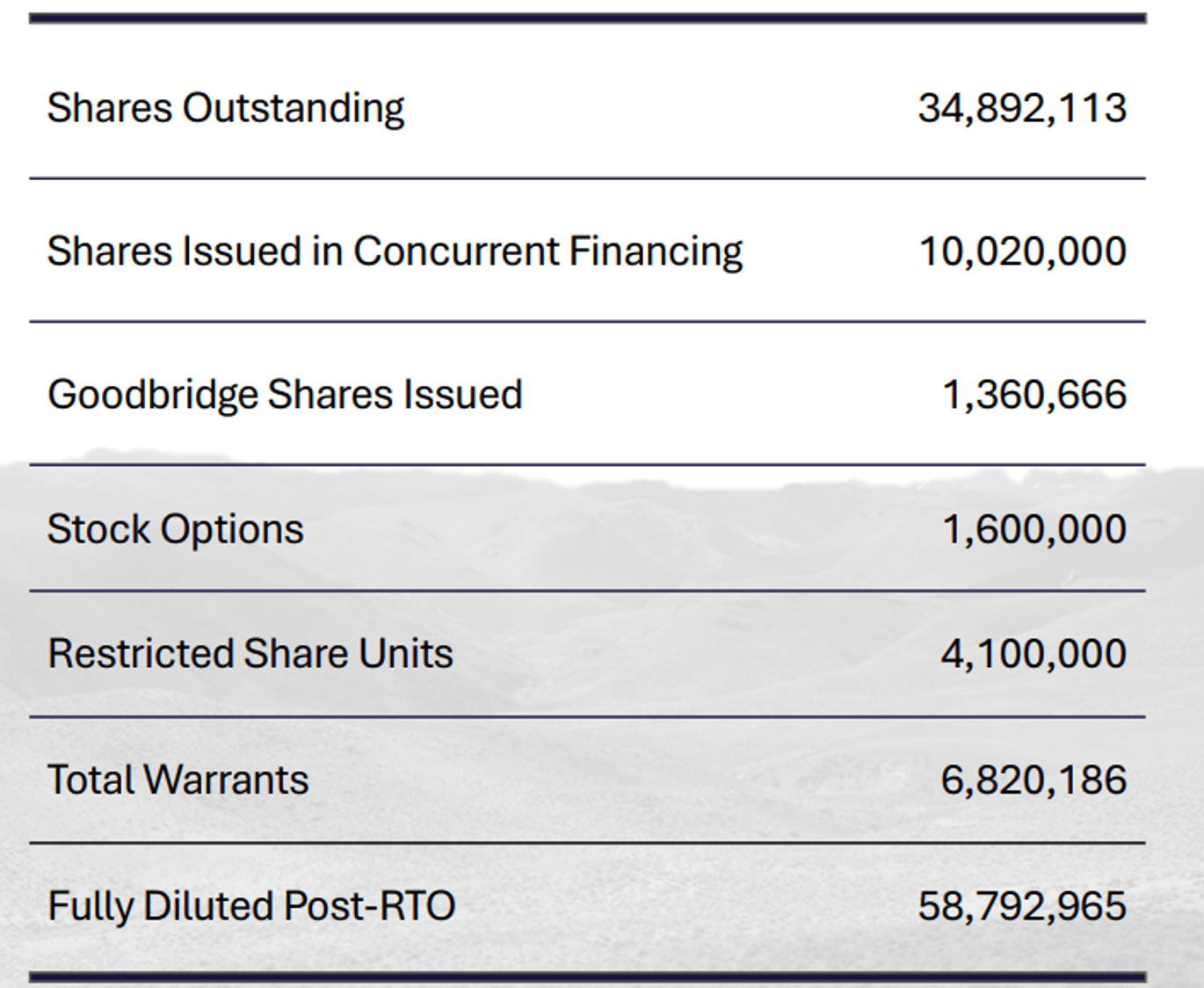

Now the dust has settled and the company has completed the financings, IDEX’s definitive capital structure looks interesting. The private company had just under 35M shares outstanding, and about 1.36M shares will be issued as part of the RTO while the C$0.50 financing adds just over 10M shares..

This means the company will come out of the gates with a share count of just under 46.3M shares while the fully diluted share count is approximately 58.8M. This includes 6.82M warrants with 5M of those warrants having an exercise price of C$0.70.

At the C$0.50 financing price, IDEX Metals will come out of the gates with a market cap of just over C$23M and with approximately C$5M in cash on hand. AAs with every RTO, some investors may head for the exit on this ‘liquidity event’.

The management team

Clayton Fisher, CEO & Director

Mr. Fisher has over 15 years in the capital markets sector and has played pivotal roles as CEO, director, and strategic advisor for both private and public corporations, with a focus on advancing mining ventures. Clayton holds a degree in Economics and Finance from the University of Victoria.

David Hladky, VP Exploration

Mr. Hladky is a Professional Geologist (registered in Alberta) with over 25 years of hands-on experience in Canada and Internationally, including in the US, Mexico, Brazil, Argentina and Peru. Recently, he has been working as a consultant for projects in Nevada, Ontario and Mexico.

Anne Labelle, Director

Anne Lebelle is a seasoned geologist, lawyer, and corporate director with a career in mineral exploration and development since the 1990s. From 2011 to 2018, she led operations at Perpetua Resources, where she was instrumental in advancing the Stibnite Gold Project in Idaho. Her experience also includes permitting for Capstone Mining’s Minto Mine in Yukon and key roles in high-value acquisitions, including Fiore Gold’s $151M sale to Calibre Mining and HighGold Mining’s $51M sale to Contango Ore.

Sharyn Alexander, VP of Corporate Development

Ms. Alexander is an accomplished mining professional with a 20-year background in the mining and mineral exploration industry. She specializes in business development, strategic planning, marketing and corporate communications, with a proven track record in raising capital for exploration. Her past roles include President of Sun Summit Minerals and technical positions with B2Gold, Barrick, and SRK Consulting.

Conclusion

Exploration isn’t easy. Hercules Metals made the initial discovery in the district and called it a ‘porphyry belt’ but that of course does not guarantee the presence of (other) economic deposits. That’s why it’s good to read the updates from other companies. Scout Discoveries has confirmed the presence of multiple porphyry centers while Barrick Mining thinks there may be in excess of a dozen porphyry centers across the belt. Having three companies, including a senior mining company, going on record and discussing the porphyry potential in the area strengthens IDEX’s exploration thesis and ‘raison d’être’.

IDEX Metals has two very intriguing anomalies it wants to follow up on, and fortunately, the company was able to raise C$5M as this will allow IDEX to embark on a meaningful exploration program. Expect the results of the MT geophysical survey to roll in throughout the summer and the company should announce more details on its anticipated drill program as those results are being published.

Disclosure: The author has a long position in IDEX Metals. IDEX Metals is a sponsor of the website. This report is for educational purposes only; be mindful that investing in junior mining stocks is risky, and you may lose your entire investment if things go wrong. Please read our disclaimer.