“No rest for the wicked”.

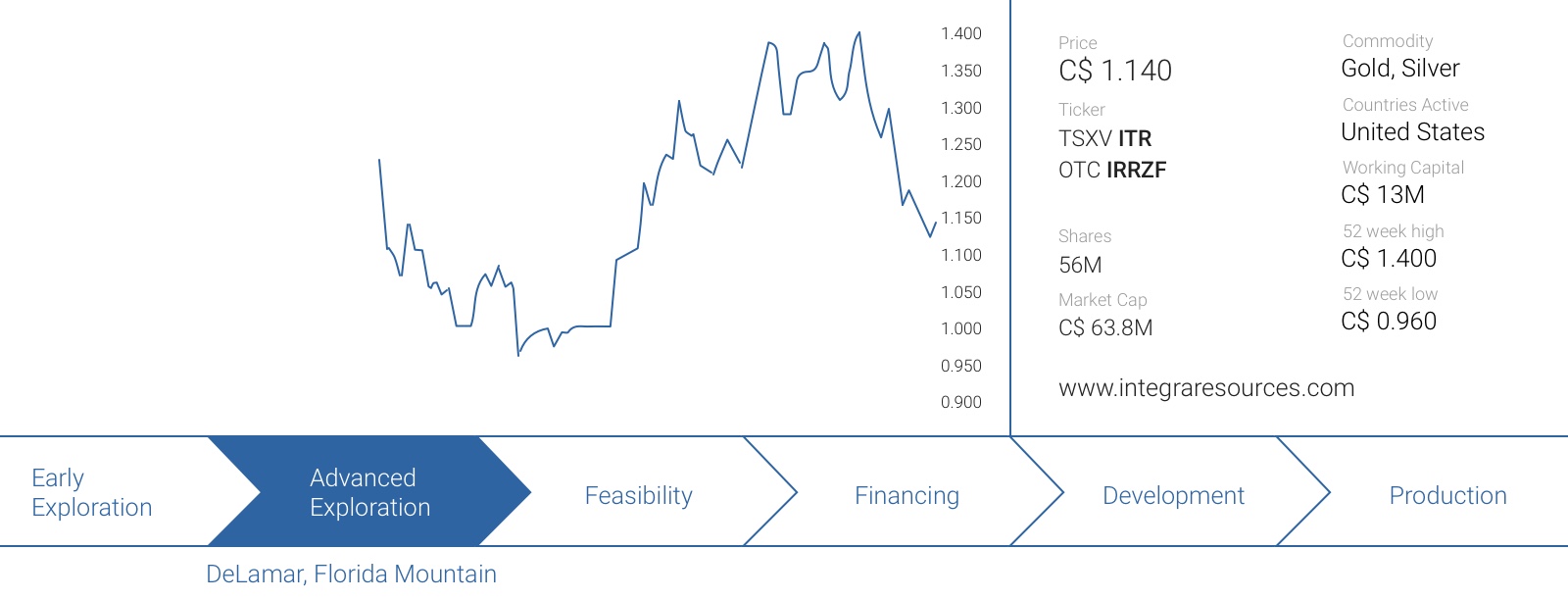

Just a few months after successfully selling Integra Gold (ICG.V) to Eldorado Gold (EGO, ELD.TO) right before the latter’s share price crashed, the ex-Integra Gold management team got together again to start Integra Resources (ITR.V), also known as ‘Integra 2.0’.

Once you have been successful in proving up an exploration theory and capitalize on that by monetizing a company, you have to act fast as Big Money has a short-term memory and would quickly forget your achievements. The Integra team found a shell, acquired a project from Kinross Gold (KGC, K.TO) and quickly raised C$27M to fill up the treasury. And there you go. Less than four months after selling Integra Gold, Integra Resources was up and running with a multi-million ounce gold project and currently still has approximately C$13M in cash in the bank.

And whereas Integra Gold started with just a few hundred thousand ounces of gold, the maiden resource estimates of the DeLamar and Florida Mountain projects already pushed the total resource in Idaho to 3.5 million gold-equivalent ounces. With more to come.

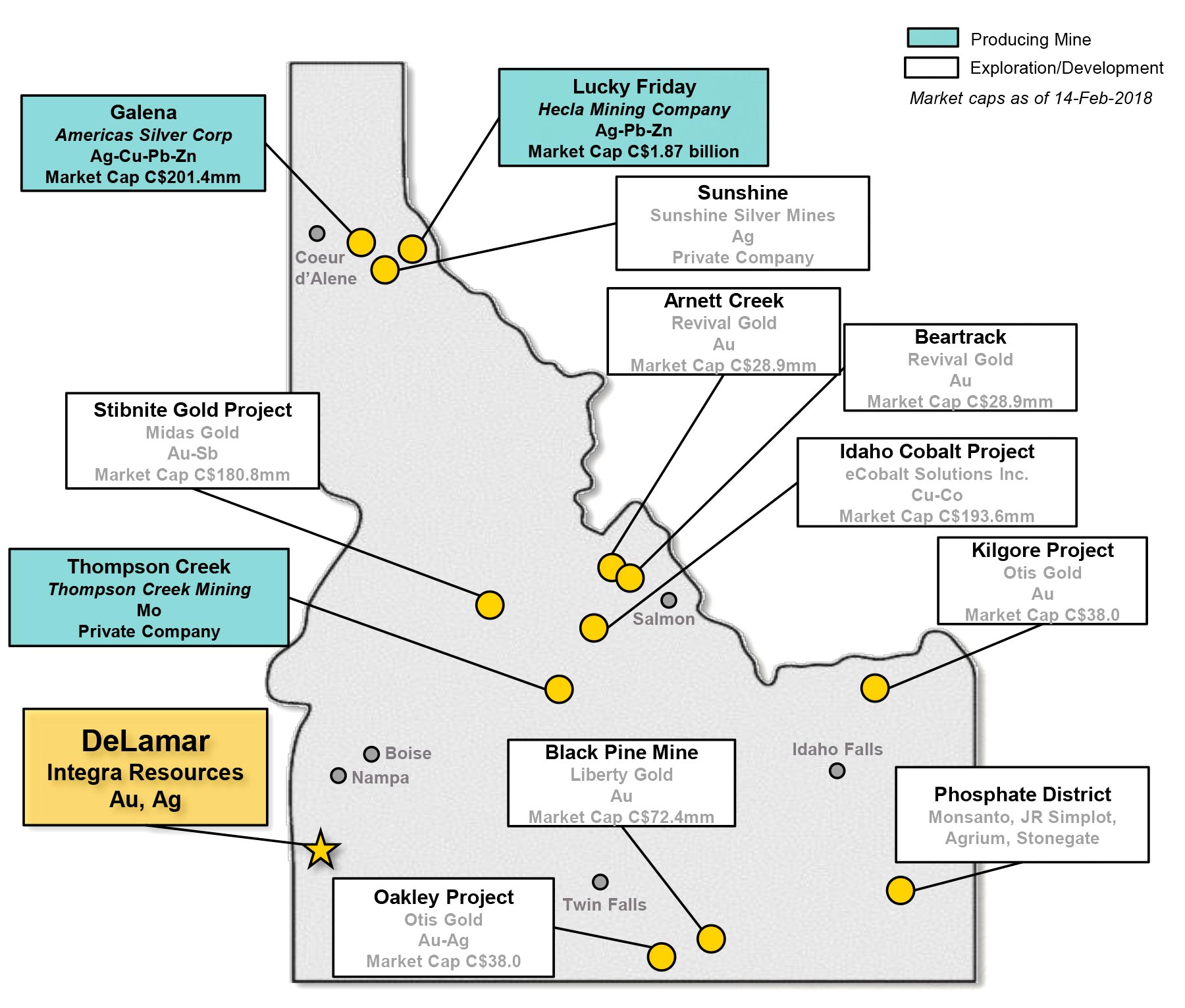

The project location, history and existing infrastructure

The DeLamar project is located in Owyhee County (pronounced as oh-why-hee), in Southwestern Idaho less than 100 kilometers away from Boise. The entire region appears to be breathing mining as the project is located next to a historic mining town, appropriately named Silver City (which still is a summer holiday destination for ‘a few dozen’ people). Whilst operating right next to the city of Val-d’Or is probably as good as it gets on the exploration scene, the DeLamar property can be easily and quickly accessed as well. The roads will obviously have to be cleared from snow in the winter, but that’s nothing that can’t be dealt with.

The project is also blessed with the existence of a 69 Kilovolt electrical power line coming straight to the site whilst the existing water wells are sufficient to cover the needs of mining and processing activities. So DeLamar enjoys the benefits of being connected to the civilized world (power, road, water), but without harassing any close neighbors (the town of Jordan Valley is approximately 30 kilometers away and has less than 200 permanent residents, whilst Silver City is less than 10 kilometers away and only attracts a few dozen people during just a few months per year.

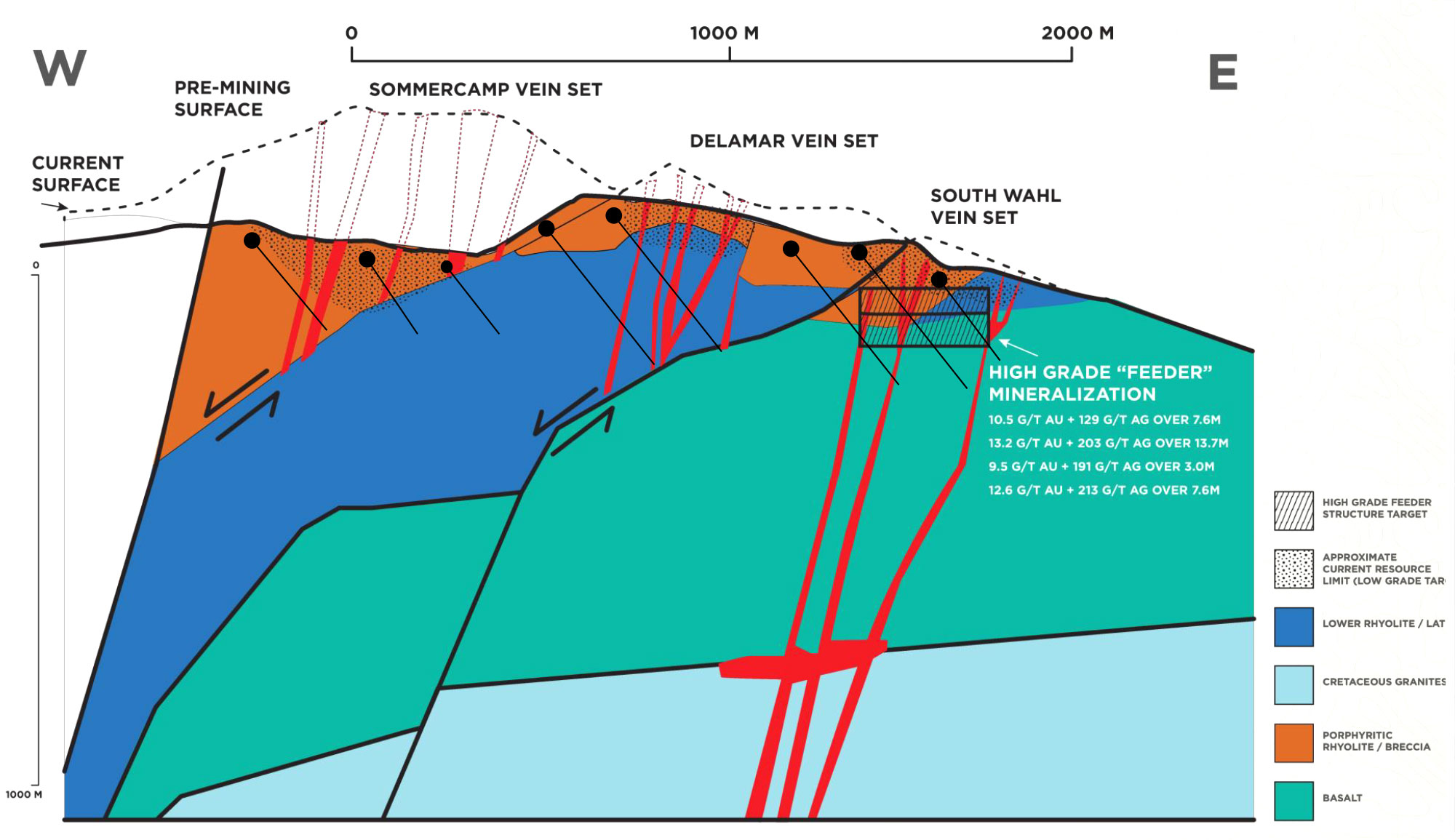

The first signs of gold in the wider DeLamar region were discovered approximately 150 years ago, resulting in Silver City as the first settlement in the region. After more high-grade gold-silver veins were discovered in the 1870’s and 1880’s, a renewed ‘gold rush’ excited the area and according to historical records, a total of 400,000 ounces of gold and almost 6 million ounces of silver were produced between 1891 and 1913 when the mines were closed. Those are very respectable amounts of previous metals, but it becomes even more impressive when you know the gold and silver was produced from just 726,000 tonnes of rock. This means the recovered grade was approximately 17 g/t gold and 252 g/t silver, indicating the ‘real’ head grade was probably substantially higher than that.

After the war, the attention of the operators shifted from high-grade veins to large bulk tonnage operations as leaching made large earth moving exercises possible due to the economics of scale. An additional 400,000 ounces of gold and 26 million ounces of silver were produced by Kinross Gold and the predecessor in the 1990’s, before the mine was put on care and maintenance and ultimately almost wholly reclaimed in the current decade. Note that the most recently mined zones were particularly silver-rich, and reports indicated a gold grade of 1.17 g/t and a silver grade of almost 3 ounces per tonne.

Is there “gold in them thar hills”? You bet. Combined with the Florida Mountain mine (see later), a total of 1.6 million ounces of gold and 107 million ounces of silver have been recovered from these mountains.

What’s the plan at DeLamar?

So, we have a reclaimed mine site which hasn’t seen any gold production for the past 20 years, but this doesn’t mean nothing was left behind. Without drilling a single hole, Integra Resources was able to publish a maiden resource estimate on the DeLamar project consisting of 118 million tonnes at 0.41 g/t gold and 24 g/t silver. Low-grade indeed, but according to the technical report and available data, the average recovery rate for the gold and silver (in a milling scenario) was 95% and 80%. With an anticipated mining cost of US$2.2/t and a processing cost of $10/t, you don’t really need an ultra high-grade ore body to be profitable at $1325 gold and $17 silver.

Using a conservative strip ratio of 2.5:1, the recoverable rock value appears to be US$27.5/t whilst the anticipated production cost is just $18.5/t. These are just very preliminary results, but they indicate the low-grade DeLamar pit would actually work at the current precious metals prices.

But whilst the low-grade zones are the obvious low-hanging fruit, that’s not what Integra Resources is after.

Back in the day, Kinross Gold discovered several higher grade gold veins, but couldn’t care less about these ‘occurrences’ as it was solely focusing on the low-grade leachable rock to ‘fill the mill’ (which was running at a capacity of 3,000-4,000 tonnes per day). This frustrated some of Kinross’ ex-employees who clearly saw the value of these high-grade intervals. And don’t forget: the district was created based on these high grade zones.

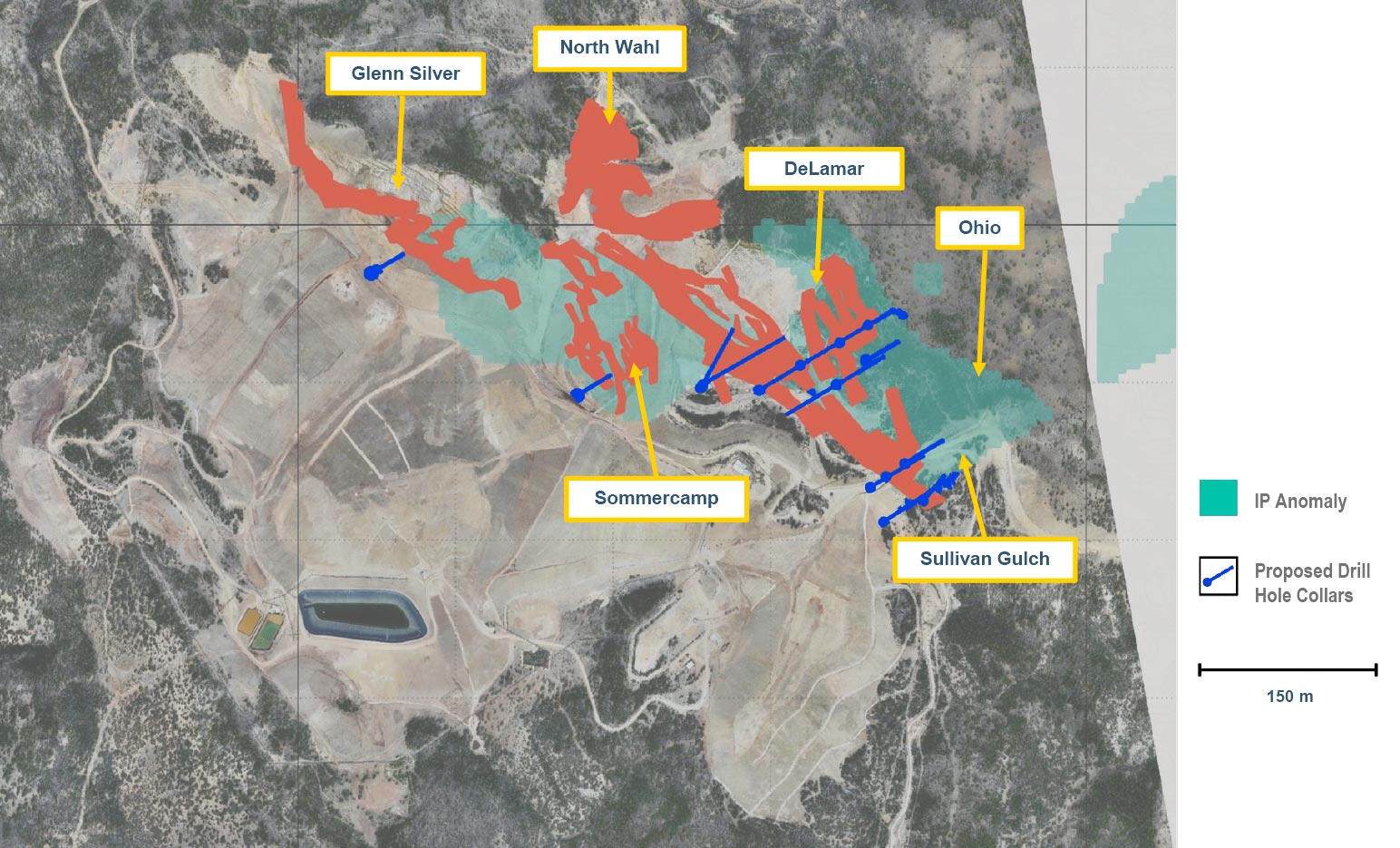

They also are the target of Integra Resources’ recently started exploration campaign. In line with the recommendations in the technical report, a Phase I RC drill program consisting of 6,000 meters has started.

This 18-hole program will focus on the DeLamar deposit where Integra Gold aims to confirm its high-grade vein theory. The holes will be relatively deep as they will reach a vertical depth of 265 meters, but that’s necessary to ensure Integra doesn’t just scratch the surface as the previous operators appeared to do (before shrugging their shoulders and walking away).

The results of this initial 6,000-meter drill program will then be used to design a follow-up exploration program which should consist of an additional 14,000 meters of drilling.

The acquisition of Florida Mountain fits the bill to consolidate the district

Earlier this year, Integra Resources ticked another important box with the acquisition of the Florida Mountain project. As we explained before, we think this is an interesting acquisition because of the following reasons:

First of all, this past-producing mine is located less than 10 kilometers away from Integra’s DeLamar gold project. Whilst DeLamar is intriguing enough to be considered on a standalone basis, we firmly believe one should not turn down an opportunity to become a district play by acquiring similar projects within walking and trucking distance, especially if the price tag for the Empire claim group is just US$1.6M.

Secondly, the history of both projects is pretty similar. Both were past-producing mines and have high-grade gold potential. The underground mine at Florida Mountain produced approximately 133,000 ounces of gold and in excess of 15 million ounces of silver approximately 120 years ago, whilst more recently an additional 125,000 ounces of gold was recovered from the open pit. But just like at DeLamar, the historical Florida Mountain owners didn’t care too much about drill-testing the deposit at depth, and only very few holes were drilled below 150 meters (which actually still is an ‘open pit depth’…).

Thirdly, Integra Resources was already able to publish a maiden (inferred) resource estimate at Florida Mountain. What’s particularly interesting here is the 40% higher gold grade (0.57 g/t) whilst the silver grade fell by approximately the same percentage (14 g/t). Assuming a similar recovery rate for the gold (95%) and silver (80%) as at DeLamar, the recoverable rock value at Florida Mountain is worth in excess of $29/t, or 5% higher compared to DeLamar.

A brief Q&A session with VP Exploration Max Baker

Could you elaborate a bit on your history at DeLamar? It’s our understanding that you have been involved with this project for a few years now, and were instrumental in bringing the project to the Integra-team.

I first became involved with DeLamar and Florida Mountain in early 2016 when Kinross contracted Joe Kizis and I to review the historic information and put together a sales document for the project.

The historic data on the project was well organized and of excellent quality. The digital data from modern mining was in multiple formats, and detailed files were found in several offices on site. Once we organized the data, which took some time, we were able to really start understanding the past, present and potential future of DeLamar. After a few weeks of analyzing the data, we began to realize that the project had considerably more exploration upside than we initially envisioned. At around the same time we were discovering the potential of DeLamar, Kinross began looking for a group with experience advancing brownfield assets while managing on-going environmental reclamation.

The timing for Kinross’ search couldn’t have been more serendipitous. Integra Gold had just been acquired by Eldorado, and with Integra’s experience advancing a past producing asset, the Lamaque Project in Val-d’Or, Quebec, I approached George Salamis to see if he was interested in putting a group together to pursue this asset. A few months later, and here we are.

During the low-grade open-pit mining by Nerco and subsequently by Kinross, was there any attention paid to the narrow high-grade veins which had been mined from underground in the previous century and had produced over 700,000 ounces of gold and 50 million ounces of silver? What was the reaction of the technical team at DeLamar when the higher grade vein-type mineralization was pulled out of the ground during the exploration activities at the DeLamar pit? Were these findings and the exploration theory discarded by the management as the main (only) focus was on the lower-grade resource?

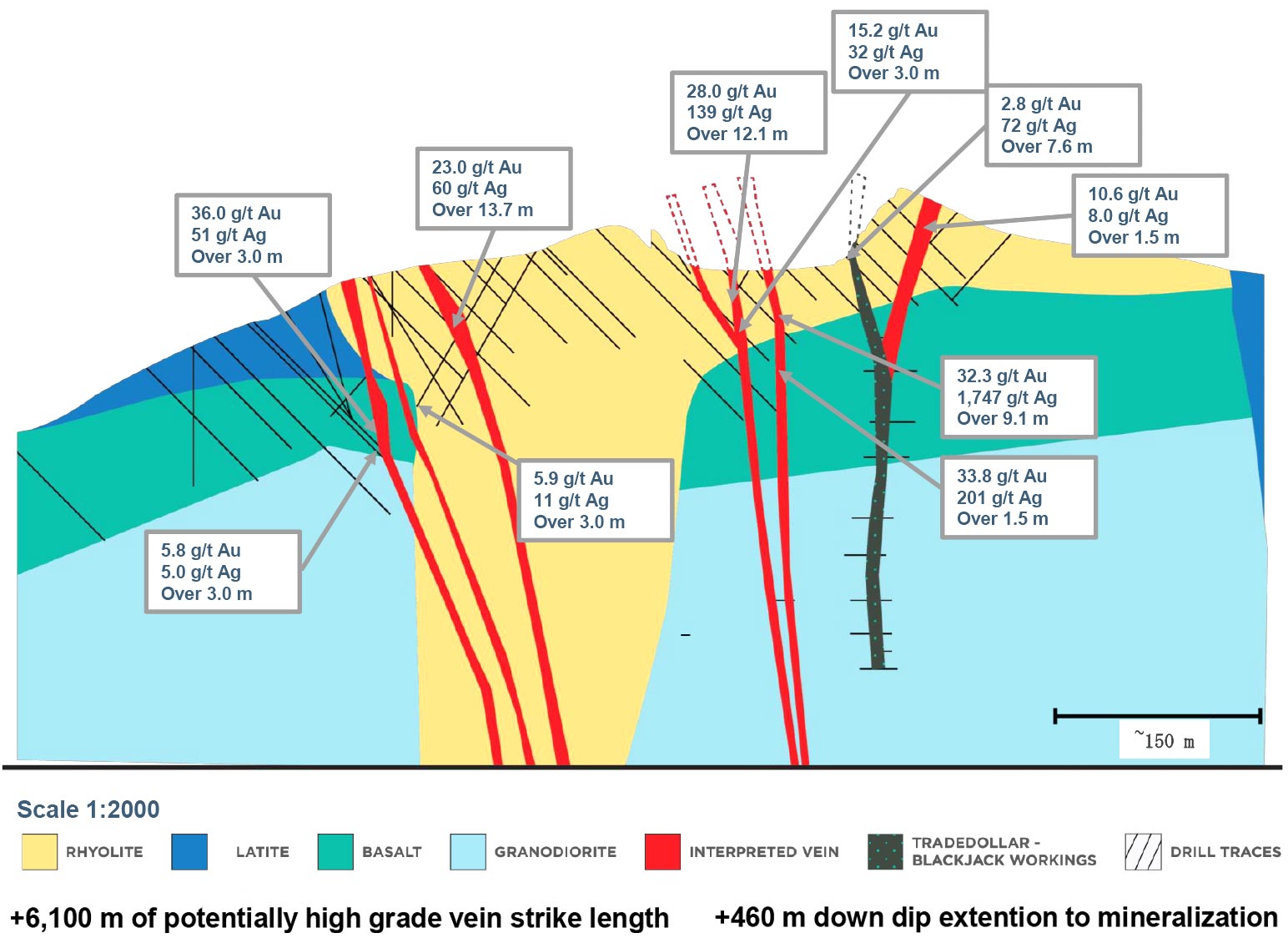

DeLamar and Florida Mountain both contain an upper cap of low-grade stockwork vein mineralization hosted within rhyolite flows surrounding narrow higher-grade veins structures which were the focus of historic underground mining in the late 1800s, early 1900s. In the underlying Basalt and Granodiorite the vein zones narrow down into high-grade very continuous veins, some of which were mined to depths of over 400m below surface. Part of Integra’s focus this year is to drill test the veins which were not mined historically.

Though we know these high-grade feeder veins were known to Nerco (and subsequently Kinross) from historical drilling, the focus at the time for DeLamar and Florida Mountain was low-grade, high volume, open-pit mining. Nerco/Kinross wanted to go after the low-grade stockwork vein mineralization, hosted within the rhyolite. The operation, which began in the 1970s, fed a 3000 to 4000 ton per day Agitated Leach Mill, with the emphasis being on maintaining a constant supply of +1g/t Au, +70g/t Ag mill feed. High-grade veins were mined during this time; however, the mineralized material was blended with low-grade and milled.

In the late 1990s, as gold prices slipped below $300 per ounce, Kinross decided to shut down the operation and re-focus elsewhere. This decision made sense for the operation at the time, it also paved the way for Integra Resources to aggressively test, for the first time, the high-grade feeder systems below the historic open pit.

Why was the mine shut down and reclaimed if the current resource estimate indicates the existence of several millions of ounces gold in a low-grade open pit scenario? Was it purely an economic decision based on the gold price back in the day?

As I mentioned previously, mining ceased in 1998 and milling ceased in the following year due to low gold and silver prices. At sub-$300 an ounce, continuing a lower-grade, open pit mining scenario didn’t make sense for Nerco/Kinross. According to Idaho Law, once a mine has been inactive for 5 years the owner is required to commence reclamation. Kinross, being responsible corporate citizens, spent 9 years working on the reclamation and did an excellent job. In fact, Kinross won awards for their thorough and impressive reclamation of DeLamar. Today, Integra Resources will continue to test and treat mine runoff water.

The beauty of DeLamar is that it has not been explored in over 25 years. The existing resource is a great start for Integra and any success we have at depth will provide great optionality moving forward in a potential production scenario.

Integra commenced an initial 6,000-meter drill program at DeLamar in mid-February, consisting of approximately 17 holes reaching a vertical depth of up to 500 meters. Will this be sufficient to confirm the existence of these higher grade veins, where after a core drill program will drill deeper to chase the veins at depth to build a higher grade resource estimate?

The current drill program has several objectives, firstly we started with a rather limited program to get all our procedures straightened out as this is a new project and we need to get familiar with the drilling conditions and challenges.

The program will start at DeLamar because access to Florida Mountain can be challenging in winter, though we have some high-grade vein targets at Florida Mountain ready to go. In terms of targets and testing concepts, this initial program is focused on the Ohio and Sullivan Gulch Vein Systems in the south east portion of the currently defined mineralized zone at DeLamar. The Ohio and Sullivan Gulch Vein systems are located on the margin of the vent, where we know the veins pass downward through the rhyolite into the underlying basalt – at Florida Mountain the basalt (and granodiorite) are the host rocks for the large high-grade veins systems, to date DeLamar has not been tested / explored for similar veins at depth.

Also, Ohio and Sullivan Gulch were not mined by either the early underground mining or the later open-cut operations. The current drill program is RC with 5 foot runs designed to provide additional assay data through the low-grade stock work mineralization within the rhyolite and establish the location of underlying high-grade veins within the basalt. This drilling will provide additional data to validate the historic drilling within the low-grade stockwork zone, thus helping to upgrade the existing resource.

Once we have defined the location of the high-grade veins in the underlying basalt, these veins will need infill diamond drilling in order to come up with an reliable resource estimate.

The C$0.85 shares become tradeable soon. An opportunity?

At the end of October, Integra Resources closed a C$27M capital raise, priced at C$0.85. This placement becomes tradeable on Wednesday, March 7th, the final day of the PDAC conference, and we do anticipate some weaker hands will be selling into the market, creating a liquidity event which could put the share price under pressure.

Although Integra isn’t expensive at C$1.14, we would imagine it will be possible to buy stock at a lower share price. Even if just 10% of the stock becomes available on the market, this represents 3.2 million shares and the market might need some time to fully absorb that. So, keep an eye on the share price action in the next few days as the share price might become under pressure due to this anticipated release date.

One additional advantage: there was no warrant attached to this C$0.85 raise, so at least we won’t see any selling pressure from pure ‘warrant clippers’.

Management and share structure

‘Never change a winning team’ also is a valid proverb in the mining sector, and Integra Resources was able to keep the old Integra Gold team together. Andrée St-Germain is still running the abacus, Chris Gordon remained on post as Director Business Development whilst the IR team remained unchanged as well. The only real change is the swap between George Salamis and Steve de Jong with Salamis taking up the CEO role whilst de Jong is now banging his gavel during board meetings in his position as Chairman.

Integra Resources currently has a share count of 56 million shares (of which 5.45 million shares are owned by Kinross Gold (KGC, K.TO)), whilst the fully diluted share count remained limited to 62 million shares. There are 4 million options priced at C$1, whilst the 1.8 million broker warrants have an exercise price of C$0.85. Both the options and warrants are currently in the money and would add C$5.5M to the treasury when exercised.

Conclusion

Integra Resources would dishonor the DeLamar history if it wouldn’t at least follow up on the high-grade gold-silver veins. Those veins are what created this mining district in the first place. With C$13M in cash, Integra Resources is ready to tackle its 20,000-meter drill program heads on. First drill results are expected by the end of March/early April and if the company confirms the existence of high-grade veins, all bets are off.

The author has a long position in Integra Resources. Integra Resources is a sponsor of the website. Please read the disclaimer