Newly appointed CEO Blaine Monaghan has hit the ground running at Pacific Ridge Exploration (PEX.V). Since his appointment in January, the company is now fully cashed up and has entered into an agreement to acquire an additional project. Meanwhile, the start of the drill program at Kliyul is getting closer and with the price of gold and copper on fire, and with known encouraging assay results from historical exploration, a lot of eyes will be on Kliyul this summer. The anticipation is clearly building, and Pacific Ridge’s share price has tripled since the beginning of the year.

We caught up with Monaghan to discuss the recent capital raise and the newly acquired RDP copper-gold property.

The capital raise

You closed a C$1.1M raise in March, when you issued 8M flow-through units to DELPHI, a German fund, but less than two months later, you announced another financing. You plan to raise C$1.5M in non-flow-through financing at C$0.15, about 35% higher than the March flow-through financing price. Could you elaborate on how you and Crescat Capital, the lead order, got together?

Sure, well, everyone in the junior resource space knows Crescat Capital. If you are a small junior, they should be at the top of your list when contemplating a financing. I had an introductory call with Quinton Hennigh, an advisor to Crescat, some time ago. This was followed up with a conference call with certain members of technical committee, Borden Putnam III, an independent director, Jim Logan, a technical advisor, Dr. Gerald Carlson, Executive Chairman, and Danette Schwab, Vice President Exploration. Based on that conference call, I believe that Quinton felt confident enough in our team and our plans to recommend Pacific Ridge as an investment to Crescat.

Crescat has strong ties with Quinton Hennigh, who sits on a few dozen (advisory) boards. Has Crescat asked you to allow them to nominate someone to your team as well?

No, they haven’t. Perhaps it’s because they have a high degree of confidence in our technical team. I know that I do!

Crescat is subscribing for C$1M of the total placement. Are the remaining subscribers existing shareholders or are there some new investors?

The offering was fully subscribed before it was even announced. The remaining subscribers will be comprised of new investors, several smaller funds. When the financing closes, we will have 53 million shares issued. DELPHI will own 15%, insiders/friends 15%, and Crescat 13%, with the remainder being retail shareholders. A very good mix!

Obviously, you are mindful of dilution, but with the stock now trading at C$0.18, up by over 200% since your appointment, has the thought of raising more flow-through funds crossed your mind? No one would blame you if you raised another C$1.5-2M in flow-through. We’re sure you could find a way to spend those flow-through funds on Kliyul, Redton, and RDP, your latest acquisition.

That is an option but I don’t see the need to raise additional flow-through for several reasons. When the financing with Crescat closes we will have C$2.9M in the treasury. That is more than enough to complete the 2,500-metre program at Kliyul, budgeted at C$1.6M, and for early-stage exploration at RDP. Also, don’t forget that we are due C$1.0M from BMC by the end of the year, for Fyre Lake, and I fully expect them to make that payment.

The flagship Kliyul project

All eyes will be on Kliyul this summer. Could you elaborate a bit on your planned drill program? Are you considering upsizing the originally planned 2,500 meters now that you have more cash in the till?

Drilling should be underway by mid-July and with a healthy treasury, we will have the flexibility to increase the size of the proposed 2,500-metre program.

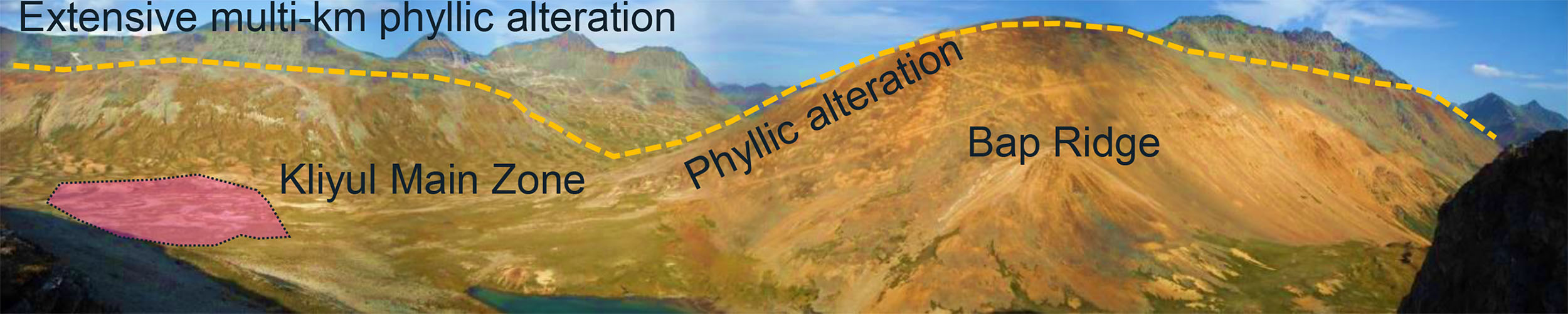

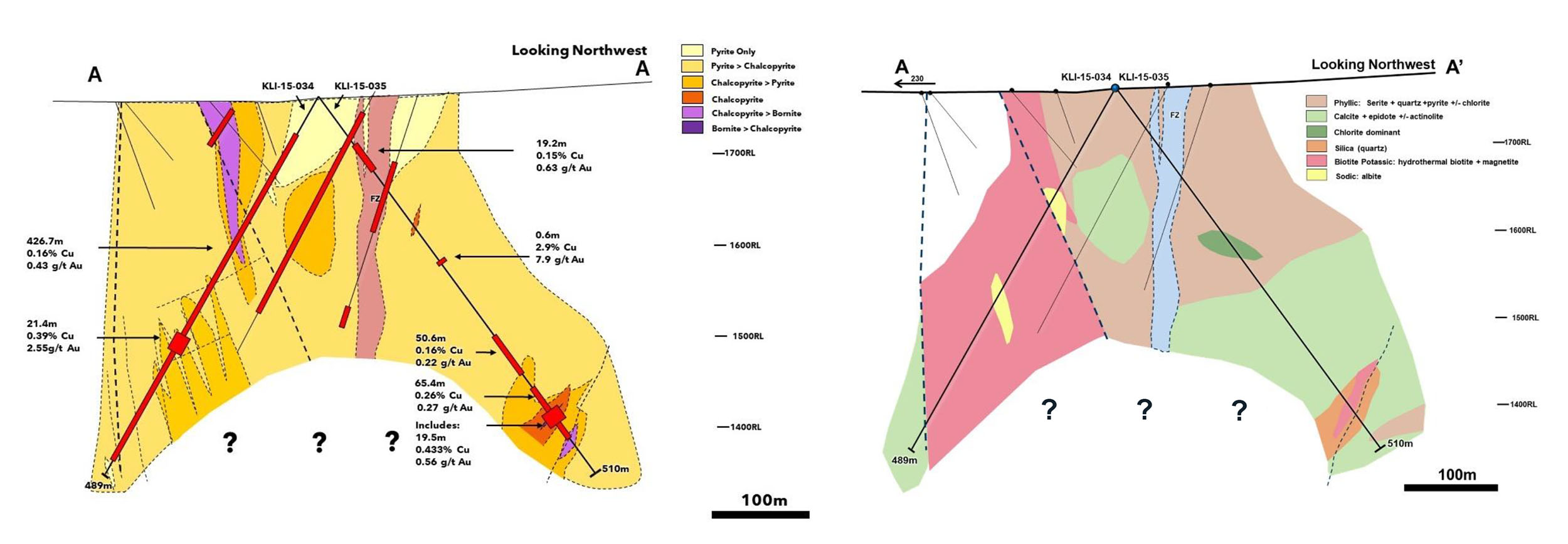

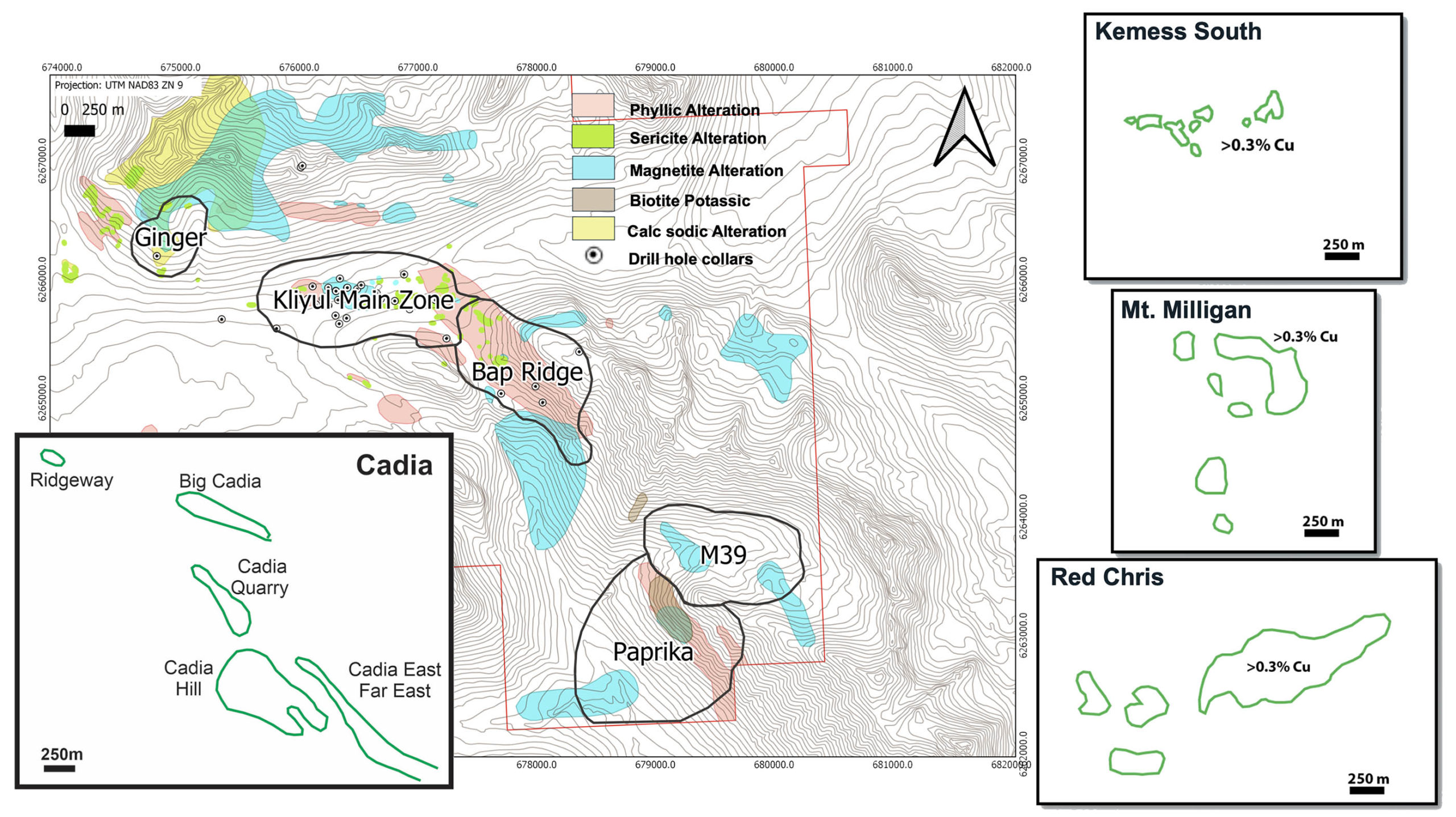

This could be the perfect time to drill Kliyul as both gold and copper are very much in demand these days. An interval like historical hole KL5 (which started extremely close to surface at a depth of less than 11 meters) containing 0.32% copper and 0.99 g/t gold currently has a gross rock value of almost US$90/t (using $4.50 copper and $1800 gold) which is sky-high for an open-pit mine. Do you see this as a copper project with a gold kicker or vice versa these days?

It’s a great commodity mix to be sure and that is the wonderful thing about copper-gold porphyry deposits, they are of interest to both copper and gold producers. For example, look at GT Gold (GTT.V). Newmont (NEM) is looking to acquire it for approximately $450M. Very exciting not only from an M&A perspective but also from a geological perspective, Kliyul is in a similar geological environment as GT’s Saddle North deposit.

Is Kliyul a pure copper-gold project, or has it simply never been assayed for other elements?

It’s a copper-gold project.

How expensive is it to drill in BC these days? Have you seen costs escalate as drill companies are getting close to full occupancy?

I’m more concerned about the availability of technical staff and drill rigs. Luckily for us, we have a great technical team in place and have secured a drill rig.

The new acquisition

Perhaps a surprising update last week when you announced that you had entered into an agreement to acquire 100% of the RDP copper-gold porphyry project, which is within hiking distance from Kliyul. How did you come across this new project? And how were you able to secure it given the current frenzy in the copper market?

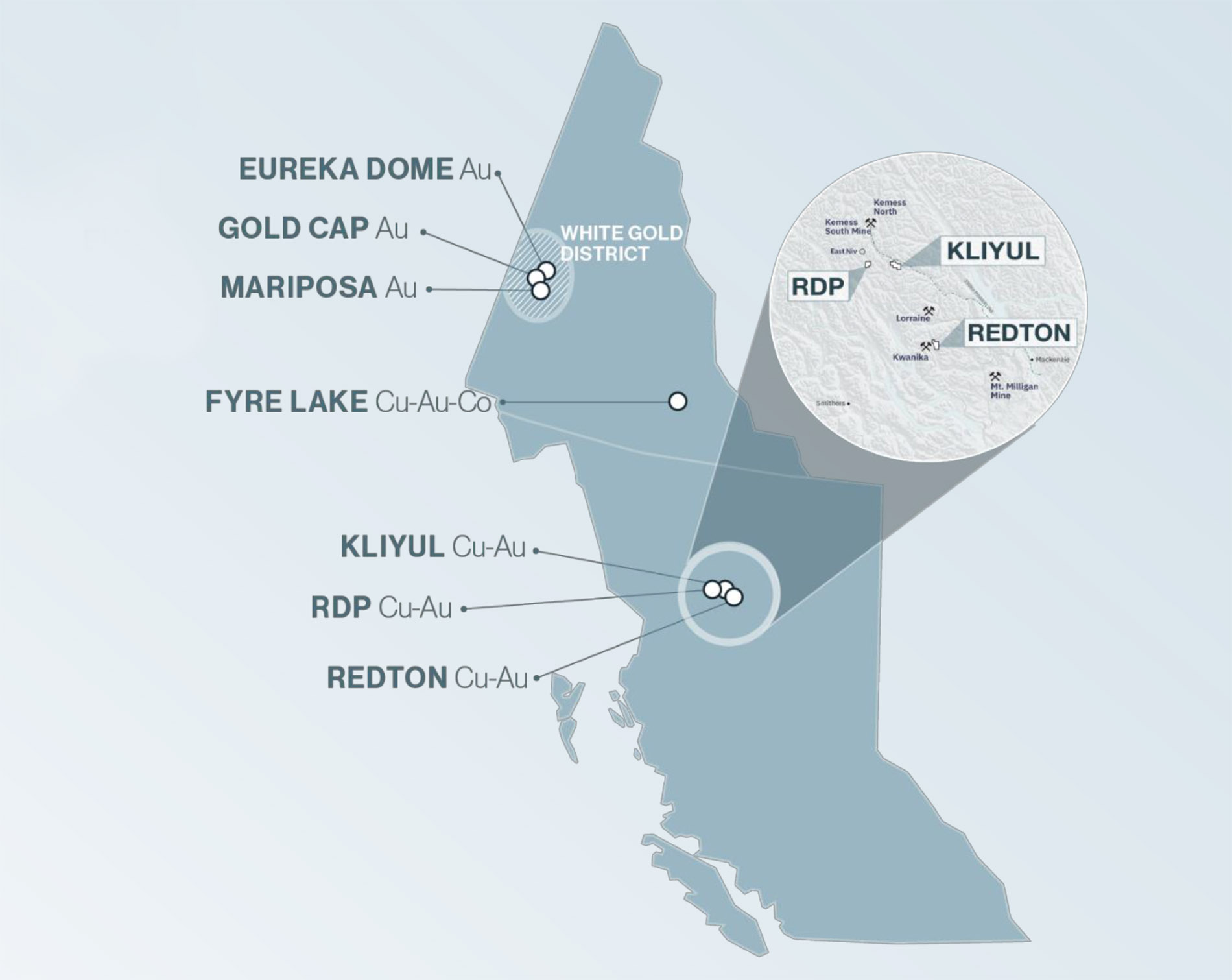

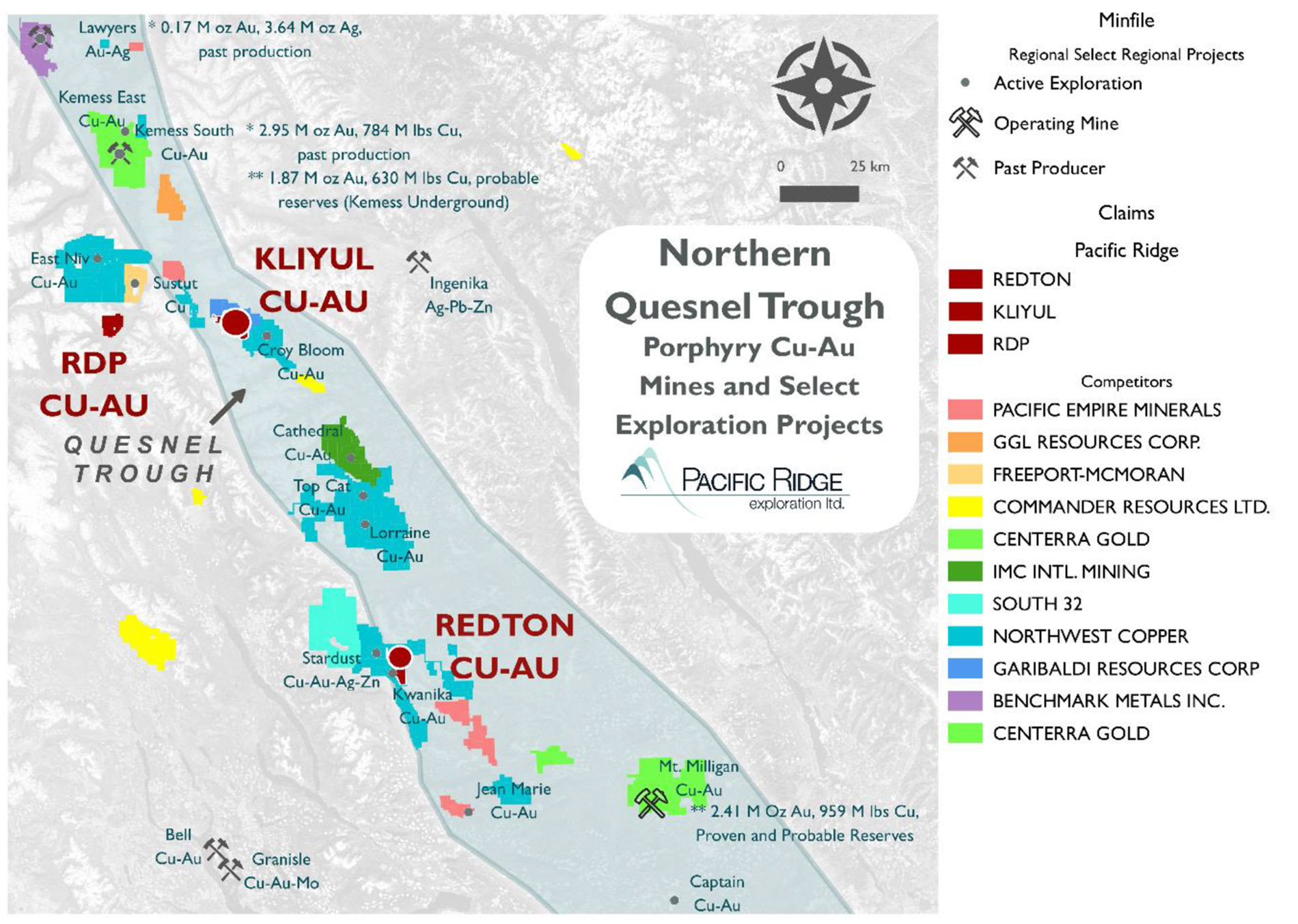

With the acquisition of Kliyul and Redton from Centerra Gold (CG.TO) last year, we pivoted away from gold projects with the goal of becoming one of BC’s leading copper-gold exploration companies. Kliyul and Redton laid the foundation but we needed to continue building our portfolio of copper-gold projects in BC. With respect to RDP, we’ve been evaluating BC copper-gold projects for well over a year and the vendor trusts that we will advance it. We have our eyes on a few other opportunities. We aren’t finished yet!

What attracted you to RDP? Do you see the same signature elements you have at Kliyul, or is there something else at play here?

A number of things attracted us to RDP. It contains several porphyry copper-gold targets (Roy, Day, and Porcupine), that have returned some pretty interesting drill results. Only a single hole has been documented at Roy and it encountered 0.11% Cu and 0.64 g/t Au over 122.95 metres. The Day target has seen 19 drill holes, with the highlight hole returning 0.67% Cu and 0.93 g/t Au over 58.8 metres. Porcupine returned float samples that assayed as high as 17.2% Cu and 0.19% Cu with 7.98 g/t Au. Some very interesting numbers from all three target areas!

RDP’s proximity to Kliyul also attracted us. Only 40km to the west, it will be easy to advance RDP while the drill program is taking place at Kliyul.

You briefly mentioned an exploration plan in your press release, with a focus on compiling historical data and do some mapping. When do you think the project may be drill-ready? In 2022?

We’ll mobilize a crew to RDP in July once drilling starts at Kliyul. In addition to compiling historical data, mapping, and soil sampling, we may conduct ground and airborne geophysical surveys. We will seek the required permits and agreements to conduct a drill program at RDP if we like what we see.

Conclusion

Pacific Ridge Exploration already had a sufficient amount of cash to drill Kliyul but adding C$1.5M to the treasury obviously doesn’t harm them. The company is now fully cashed up, and more importantly, it has been able to raise the money at a higher share price thereby reducing the dilutive impact of the financing.

Some of the historical results from the Kliyul project are very encouraging as previous drilling intersected thick layers of copper-gold mineralization, which should have high gross and net rock values in today’s copper and gold climate. Adding the RDP project to the asset portfolio clearly indicates Pacific Ridge is focusing on becoming a copper play and while gold is, and will always be a nice by-product, the focus will be on copper.

Pacific Ridge started the year valued at only C$1.5M. It has made great strides since then but is still only valued at about C$11-12M (including the recently announced raise) and an enterprise value of just C$8-9M which is less relevant as the cash will obviously be used to drill Kliyul and advance the RDP project. This represents a very intriguing risk/reward ratio and a lot of eyes will likely be keeping track of this drill program.

Disclosure: The author currently has no long position in Pacific Ridge Exploration. Pacific Ridge Exploration is a sponsor of the website. Please read our disclaimer.