Prize Mning (PRZ.V) kept its word last year as the company completed additional sampling and geophysical surveys on the Kena-Daylight gold project in British Columbia, but unfortunately the market didn’t seem to care at all.

That’s a pity, but Prize never wanted to be a one-trick pony and in the fall of last year, it added the Manto Negro copper project in Mexico to its portfolio. At first, we thought this was ‘just another project’ to keep the shareholders happy (the fact it took months before the copper project got its dedicated spot on the Prize website and was included in the company presentation didn’t help), but after reviewing the technical report that was filed, we realize there’s much more to see here.

The newly acquired Manto Negro copper project seems to have its merits

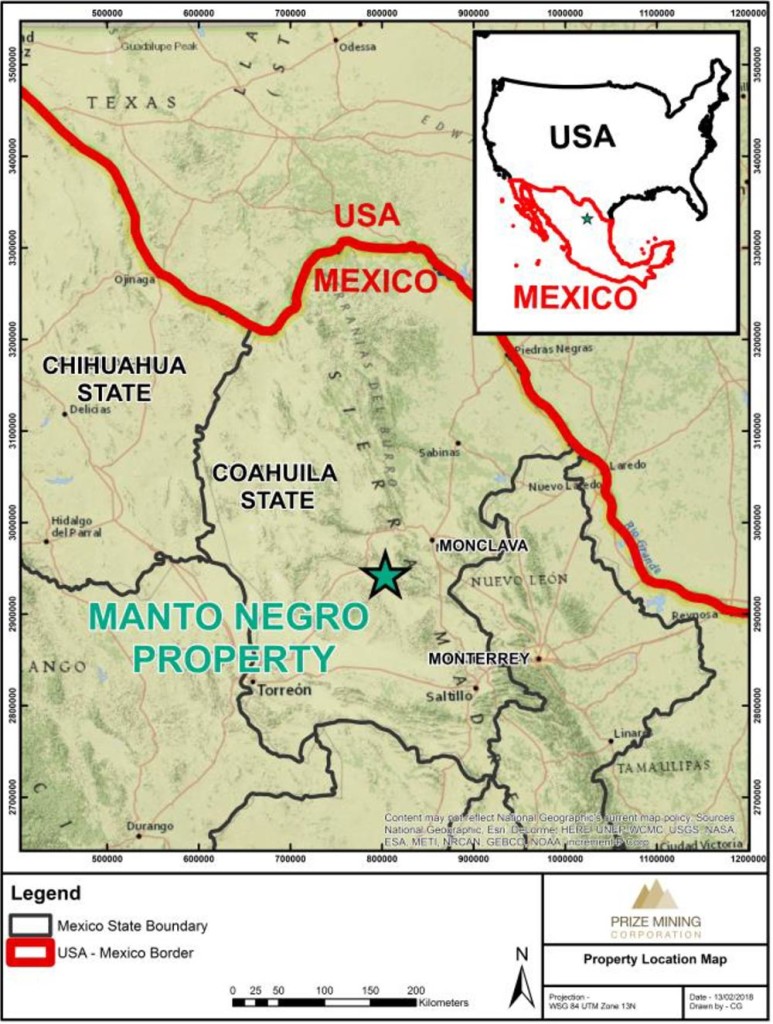

The Manto Negro project is a 17,659 hectare project located in the Mexican state Coahuila de Zaragoza, in an area where for instance Discovery Metals is also exploring. Coahuila is perhaps not as well-known as other Mexican states like Sonora and Zacatecas, but it’s clear there’s some serious mineral endowment in Coahuila.

The Manto Negro project is a 17,659 hectare project located in the Mexican state Coahuila de Zaragoza, in an area where for instance Discovery Metals is also exploring. Coahuila is perhaps not as well-known as other Mexican states like Sonora and Zacatecas, but it’s clear there’s some serious mineral endowment in Coahuila.

There’s only limited data available about the historical ownership of the property, and the technical report mentions there’s no information from the pre-1993 era. Several public and private companies have taken ownership of the property (or some of its concessions) over the past 25 years, which includes BHP Billiton (BHP), Noranda, Santa Fe Metals and Outokumpu. These companies were attracted to this region after discovering old data on the artisanal mining activities at Manto Negro.

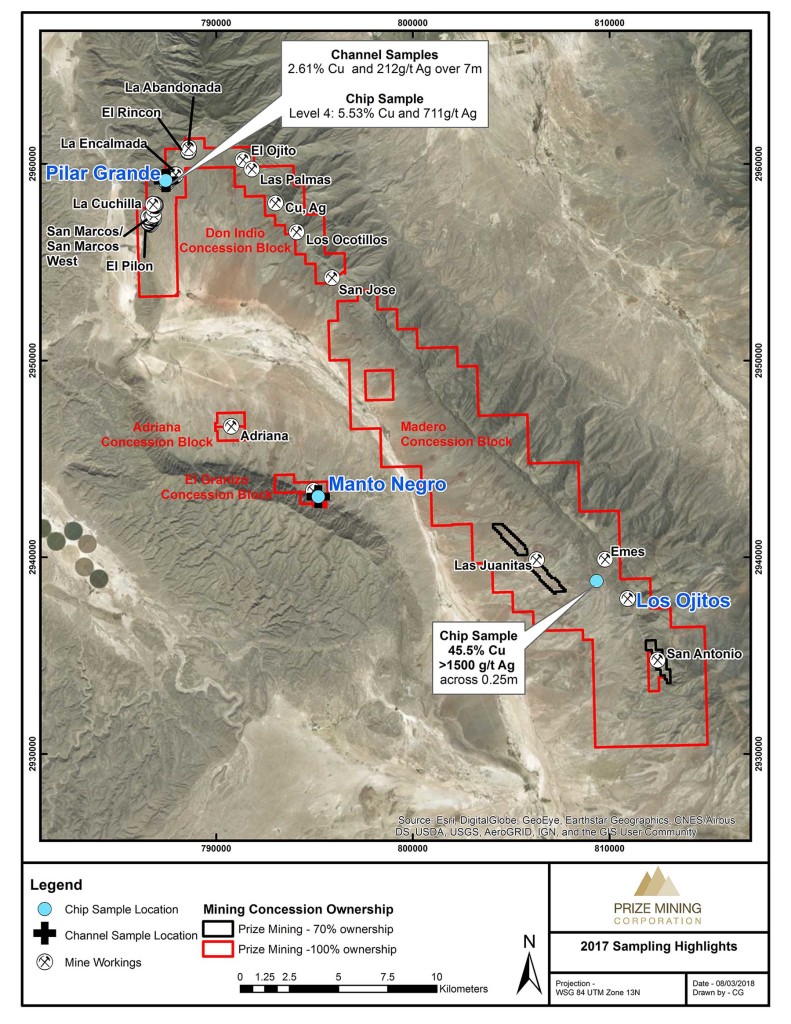

There’s no reliable data available on the exploration and production activities in the first half of the 20th century, but there are reports about small-scale mining activities in the Sixties and Seventies where hand-sorting ore resulted in a head grade of 7% copper which was subsequently leached in a small plant in Cuatro Cienegas. Also, the Pilar Grande Mine, mined for high grade oxide copper in the 1940’s, is situated in the norther portion of the Prize property and has four underground levels. This area is a primary target for Prize in the future as there are significant oxide copper (> 2 %) and silver (>700 g/t) grades found here over a wide strike length. The area has never been drilled but is characterized by extensive on-surface mineral exposure.

The ‘more professional’ companies like Noranda and BHP did a lot more groundwork, and thousands of samples were taken. This allowed BHP Billiton to initiate an RC drill program in 1995 which consisted of 17 holes, as well as a 13-hole diamond drill program in the wider area (10 RC holes and 3 diamond drill holes were effectively drilled on the claims that now contain the Manto Negro property).

Although it has been in excess of 20 years since anyone drilled the Manto Negro property, it appears to be pretty clear the claims are hosting a sediment-hosted copper deposit, not unlike the large Zambian copper deposits or the German/Polish Kupferschiefer zone. Whilst we won’t go too much into technical details here (it’s great to have an exploration theory, but ultimately the drill results will have to show what Prize Mining really has), but there are two additional things we’d like to mention here: the historical metallurgical test results and the access to existing infrastructure. Two important things that could make or break a project.

With regards to the metallurgy of a project, Prize has access to historical data on the processing side of things. According to test work completed by the university of San Luis de Potosi on a 40-kilogram test sample, 93% of the copper was recovered after a 21-day column leach process, with in excess of 75% recovered after an initial 15 days. Considering the high additional recoveries between day 15 and 21, it does look like it would make a lot of sense to continue to effectively use the longer leaching period as the trade-off situation appears to be favorable for a 6 day longer leaching period in return for reaching a 17% higher recovery rate.

On top of that, the acid consumption appears to be relatively low (at 16.4 kilograms per tonne of rock), thanks to the low carbonate levels in the sample sent to the university. Of course, these results should only be considered to be very preliminary, but it does give you an idea of what you could expect when Prize Mining does some more thorough metallurgical test work.

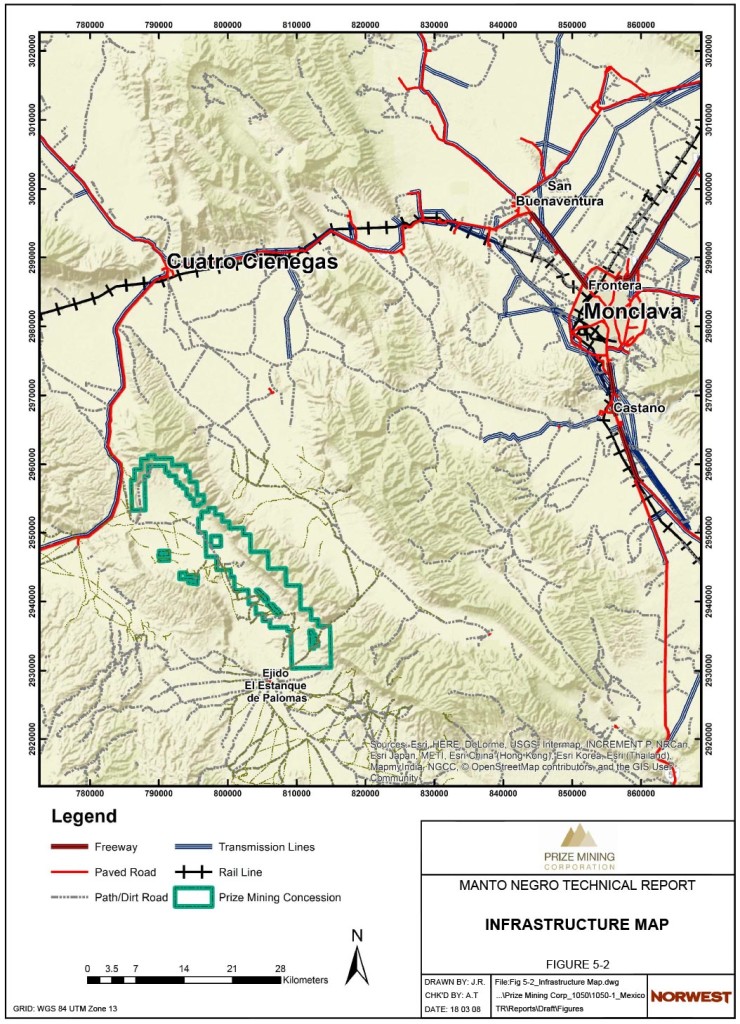

The existing infrastructure isn’t too bad. The property is accessible by a Federal Highway which provides a  direct connection to Monclova which is approximately 120 kilometers away. With almost a quarter of a million people living in Monclova and an additional 13,000 in the city of Cuatro Cienegas, Prize should definitely be able to tap the local population to source labor.

direct connection to Monclova which is approximately 120 kilometers away. With almost a quarter of a million people living in Monclova and an additional 13,000 in the city of Cuatro Cienegas, Prize should definitely be able to tap the local population to source labor.

Not only are there sources of local labour nearby, a railway is linking Cuatro Cienegas with Monclava, which isn’t too far away from Torreon where Penoles operates a zinc and lead smelter (which confirms there’s plenty of ‘human capital’ available in the province). The distance between both cities (80 kilometers) might be too short to favor rail over just trucking the copper cathode sheets from the mine gate to Monclava. However, trucking the cathode sheets to the railhead could be a viable solution should the company ship its products to a smelter elsewhere.

Two other important components to support a potential mining operation are the access to cheap power and water. And once again, Prize’s Manto Negro project is really blessed with apparent easy access to both. There’s a 240 kilovolt powerline running just north of the property (which will keep the development and operating costs of a potential SX/EW plant low) whilst gaining access to water shouldn’t be an issue either.

Historical hydrogeolocial studies have indicated the water table is located on an elevation of 680-780 meters above sea level, whilst the nearby Valle del Jabali hosts a regional aquifer. This aquifer has been mentioned in some theoretical papers but apparently there are no public records on this aquifer. That’s weird, but it could also be an advantage, as nobody could claim the aquifer should be protected from being drained by mining operations. If nobody knows about the aquifer, there could hardly be any economic impact on the local population should the Manto Negro copper project drain water from it to support mining activities. And of course, let’s first see what Prize Mining can come up with, as the road towards copper production is still very long. A resource estimate would be a good first step to complete.

On top of that, the average rainfall per year is 213 millimeters but the majority of the rain falls on just a few days (26 rain days). And whilst capturing the rain to support mining operations might not work year-round, it could reduce the need for Prize Mining to effectively tap into the aforementioned aquifer.

Prize Mining will have to be mindful of the environmental limits of working in Coahuila, as the project is bordering a protected area (Area de Proteccion de Recursos Naturales y Forestales). This shouldn’t be an issue at all, as Prize’s claims are located outside of the protected area.

The original acquisition terms appear to be quite favorable

Usually the really good projects are also really expensive. However, in the case of the Manto Negro copper project, it’s increasingly looking like Prize Mining ended up with a really good deal. Forget about lengthy earn-ins or milestone payments, Prize structured its deal so it would immediately end up with full ownership of Scion Mines, the Mexican company which owned all of the assets.

The price tag? No cash, and 6 million shares. The shares were valued at C$0.28 each, putting the total value of the deal at C$1.68M. Not only is this a cheap deal, Prize has also included selling restrictions on the stock it issued. 10% of the stock payment (600,000 shares) was tradeable on the day the deal closed, and additional tranches of 15% (900,000 shares) will become tradeable in 6 month intervals (with the next batch of 900,000 shares coming out of lockup on June 7th).

Considering Prize Mining issued 28.25M shares to acquire an option on the Kena-Daylight property when the company completed its qualifying transaction and considering there were additional milestone payments and spending requirements that had to be made on the BC properties, paying just 6 million shares for Manto Negro appears to be relatively cheap. The proof is always in the pudding, but Prize Mining is definitely getting the benefit of the doubt here.

Fresh blood in Prize’s management team: an additional quality injection

Together with the transition from a gold exploration company to a copper (oxide) exploration company, CEO Feisal Somji stepped aside and moved to an executive chairman role which allowed Michael McPhie to be announced as Prize Mining’s new CEO.

You might remember Mike McPhie from his previous ventures in the mining sector, as he was the CEO of Curis Resources (CUV.TO) which was aiming to develop the Florence copper project near Florence, Arizona. When Curis was sold to Taseko Mines (TGB, TKO.TO), McPhie moved on to become managing director of JDS Gold and JDS Copper Ltd. which were subsidiaries of the well-known and successful JDS Mining & Engineering group. Not only did this allow him to continue to keep his finger on the pulse in the mining sector, he continued to sit on the board of directors of several junior mining companies in the exploration phase, so he never really ‘left’ the sector.

Perhaps even more interesting was seeing how Bob Archer was appointed to Prize’s board of directors. Archer founded Great Panther Silver (GPL, GPR.TO) and acted as the company’s CEO before announcing his retirement last summer. We believe Archer’s appointment is a solid move as Prize’s board needed some Mexico-focused inputs.

Overall, these two appointments definitely add quality and depth to the management team and the company’s board of directors, and if anything, the credibility of the company is definitely increasing. McPhie and Archer aren’t the types of people to just ‘fool around’ and will very likely do their best to help the company to move forward.

A short Q&A with Mike McPhie, Prize Mining’s new CEO

How did Prize come across the Manto Negro asset, and what was the main reason to effectively buy the property?

How did Prize come across the Manto Negro asset, and what was the main reason to effectively buy the property?

Prize came across the Manto Negro Property through our relationship with Mr. Raul Ramirez whose company owned the land. Raul is a successful businessman and native of Mexico whose family have been involved in mining for generations. Raul and our Chairman, Feisal Siomji, previously did business together through Mexican Silver Mines which a 2008 was merged with Rio Alto to create Rio Alto Mining which later went on to be purchased by Tahoe Resources in 2015. Raul acquired a number of pieces of our current land package over the last five years and was responsible for assembling this district scale high grade copper opportunity.

Readers will remember you from your tenure as CEO of Curis Resources (CUV.TO) that owned the Florence Copper project and was sold to Taseko Mines (TGB, TKO.TO). You subsequently were responsible for two of the subsidiary companies of the successful JDS Energy and Mining group, but are now back leading a mining company focused on copper as the Chief Executive. What convinced you to take the helm at Prize Mining?

I really like the Manto Negro project. It is high grade, copper, has big size potential, is in a great jurisdiction and area of Mexico and the Capex for development will be low. I am a big believer in the copper space and particularly for projects that could see near term development which Manto Negro represents. Finally, the people involved in Prize are excellent. The board and executive management team have all had real success and built a lot of value for shareholders and that’s what we intend to do here.

We would assume the activities at the Kena-Daylight will be put on the backburner. Are there any additional work requirements you’d need to complete/meet from both an earn-in and a regulatory perspective? How long will the properties remain in good standing?

Kena-Daylight is our secondary asset for sure. It’s a good property with a lot of upside potential but we have made the decision to focus on near term copper production in Mexico. We have a little over $800,000 in the treasury right now that is from a flow through financing we did in the 4th quarter of last year. That money needs to be spent this year and so we will have a program at site including targeted drilling in prospective areas. Then later in the year we will look at options for Kena-Daylight that could include holding it, doing additional work next year or considering a transaction. We are in year 1 currently of a 4-year option agreement of the property. Various payments and work commitments are a part of that and we are all up to date on these for 2018.

Conclusion

Prize’s Manto Negro copper project in Mexico’s Coahuila state appears to be interesting, and we wouldn’t be surprised if the market would generally be more open to a high-grade copper project in Mexico compared to low-grade gold in British Columbia. With Mike McPhie and Bob Archer, two mining veterans have been added to the team which will allow Prize to hit the ground running.

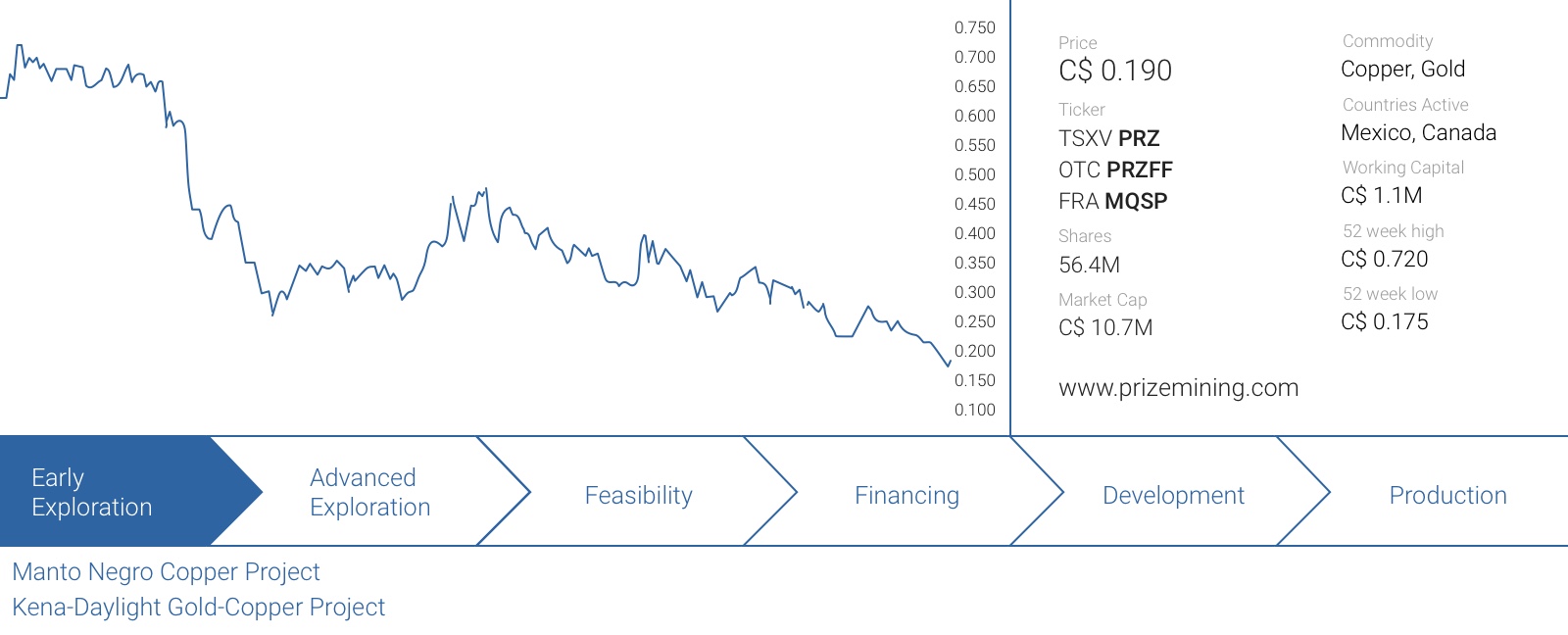

As of at the end of February, Prize had a total working capital position of C$1.1M and C$1.37M in cash, so the company will probably have to tap the equity markets before the summer to make sure it doesn’t have to slow its exploration program down. We expect Prize Mining to announce an exploration program in the next few weeks, and we are looking forward to see the company further advance the Manto Negro copper project.

The author has a long position in Prize Mining. Prize is a sponsor of the website. Please read the disclaimer