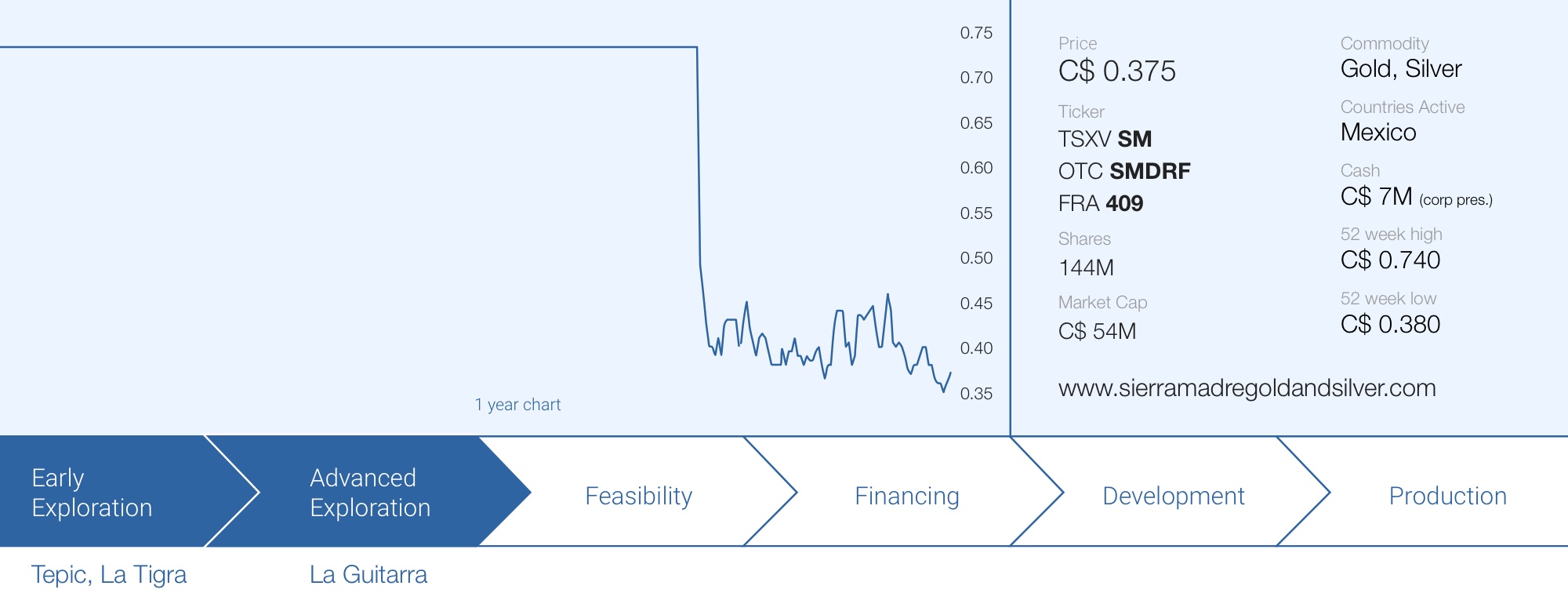

Sierra Madre Gold and Silver’s (SM.V) share price seems to have stabilized around the 40 cent mark. The company raised C$10.3M at C$0.65 and used that share price level to acquire the La Guitarra silver-gold mine from First Majestic Silver (FR.TO, AG) in an all-share deal valuing the past-producing, fully permitted mine at US$35M.

The US$35M sounds like a steep price to pay for a non-producing mine, but a lot of capital has been invested in the project so far.

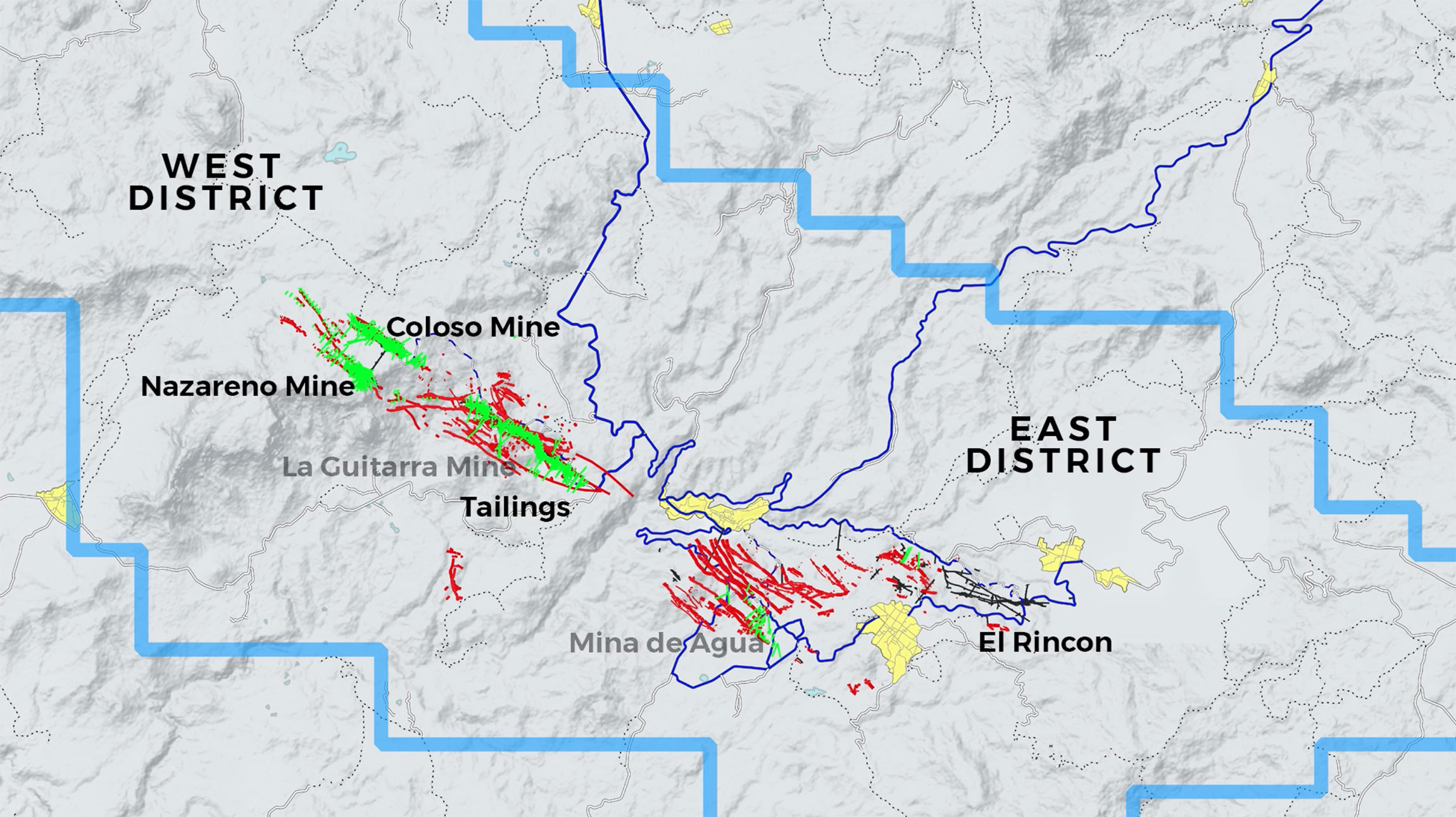

First, to replicate 239,000 meters of drilling would cost in excess of US$35M alone. Building a new 500 tonnes per day facility with crushing, grinding, flotation, storage, tailings would probably set you back over US$60M. And if you subsequently add over 50km in underground development, the intangible value like the goodwill of the local community, the o”zéver 52km of mineralized showings at surface, and the price tag appears to be very reasonable – if Sierra Madre can make the mine work.

The company is diligently working towards reopening the silver mine and this will likely (and hopefully) happen within the next 12-16 months. Sierra Madre Gold & Silver recently presented the story in Europe and it was good to hear the company’s timeline remains unchanged and the next 9-12 months will be catalyst-rich.

The next twelve months will have an abundance of catalysts

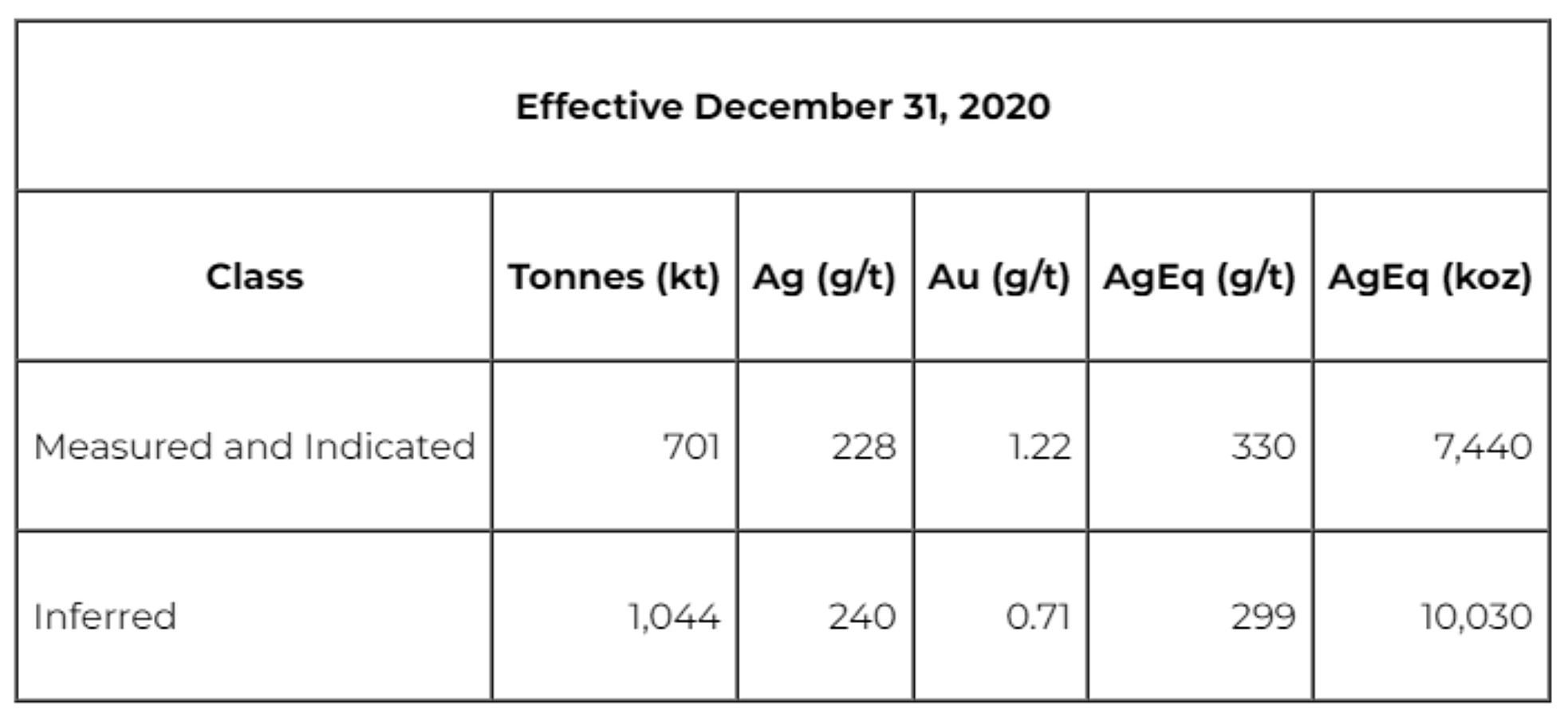

The company’s independent consultants are currently working on updating the currently known resource. As a reminder, there only is a historical resource calculation on the La Guitarra asset, and that calculation was done by First Majestic Silver and disclosed in one of its annual reports. As you can see below, the historical resource contains about 700,000 tonnes in the measured and indicated resource categories and at an average grade of 330 g/t silver-equivalent, there’s about 7.4 million ounces of silver-equivalent in those resource categories. There also is an additional 1.04 million tonnes of rock in the inferred resource category at an average grade of 299 g/t AgEq for about 10 million ounces of silver-equivalent.

This means the historical resource calculation contains about 17.5 million ounces across all categories with about 40% of the ounces in the measured and indicated resource category.

The company is currently running the numbers using modern standards and this should result in a new NI43-101 compliant resource calculation. The updated resource calculation should be out later this month and it will be very interesting to see what number Sierra Madre can end up with. Needless to say, the higher the total number; the better, as the company will have to ‘prove’ to the market its mine restart plan will be backed by a robust resource.

The resource calculation will indeed be followed by a mine restart plan. We aren’t sure if the company will be allowed to publish its findings (i.e. will the study meet the NI43-101 requirements?) but in any case, the technical team of Sierra Madre should get a much better understanding of how the silver mine could be reopened and what the focus should be on.

The mine restart plan will likely kick off with a production scenario of 300-350 tonnes per day and hopefully the cash flow potentially generated in that stage will be sufficient to further expand the processing capacity. From there, the company is eager to greatly increase the throughput of the mine and is looking at possible scenarios perhaps quadruple or quintuple the daily production.

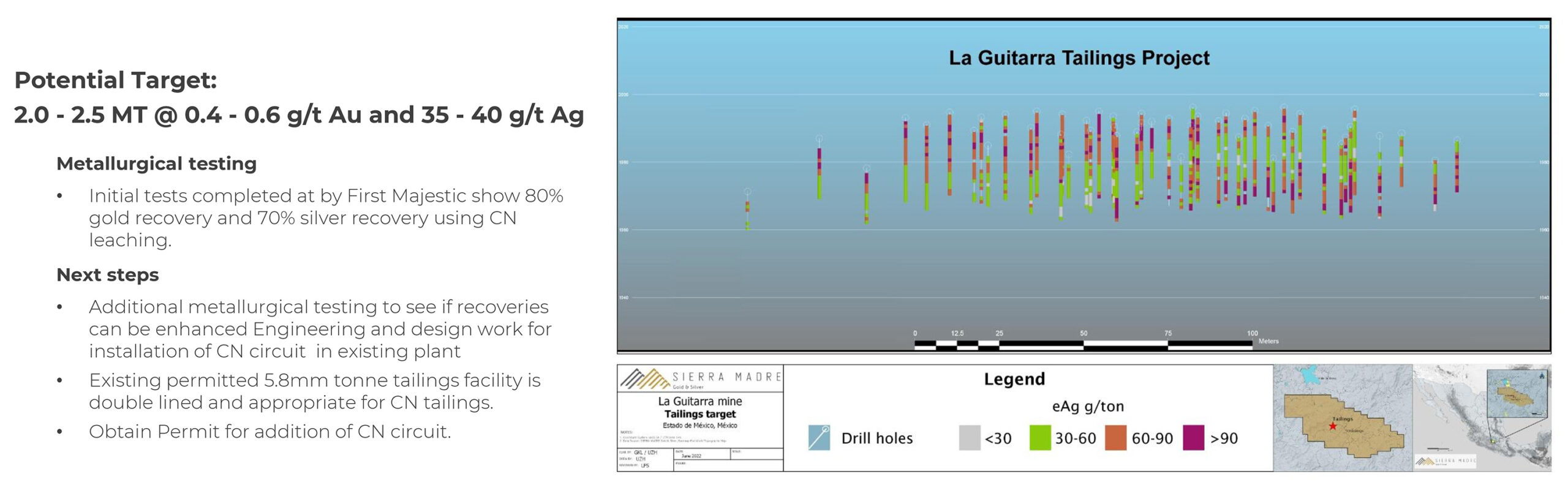

We are also curious to see if the company is able to secure the permits to use cyanide at La Guitarra. As you may remember the project comes with an additional bonus feature.The easy access to the existing tailings which could potentially be reprocessed. Initial metallurgical test work (completed by First Majestic Silver) shows about 70% of the silver and about 80% of the gold can be recovered using cyanide leaching. Considering the total targeted tonnage on the tailings facility is 2-2.5 million tonnes at 0.4-0.6 g/t gold and 35-40 g/t silver, applying the respective recover rates on the lower end of those grades would result in a recoverable production of 1.5-2 million ounces of silver and about 20,000 ounces of gold. Using the higher end of the potential target you are looking at 2.5 million ounces of silver and 35,000 ounces of gold.

Of course there are no guarantees the company will be able to secure the cyanide permits but processing those tailings could add value to a potential mining scenario. Keep in mind the company’s tailings permit includes almost 6 million tonnes of dry stack tailings, which would be allowed to handle the cyanide-treated rock.

But the cyanide permit could be important for the ‘main operations’ as well. Right now, the anticipated recovery rates are 80% for the silver and 50% for the gold. Adding a cyanide circuit will likely boost the gold recovery rates. The average gold grade in the historic resource calculation is 1.22 g/t in the measured and indicated resource categories. A spread between a 50% and 70% recovery rate would allow the company to recover an additional 0.24 g/t of gold, adding about $15/t in net recoverable rock value based on $1900 gold.

While the company is NOT taking the additional cyanide circuit into consideration for its mine restart plan, it does provide upside potential and receiving the relevant permits would be a positive catalyst for the company.

And finally, it will be interesting to see what First Majestic plans to do with the share consideration it received for the sale of the La Guitarra mine to Sierra Madre.

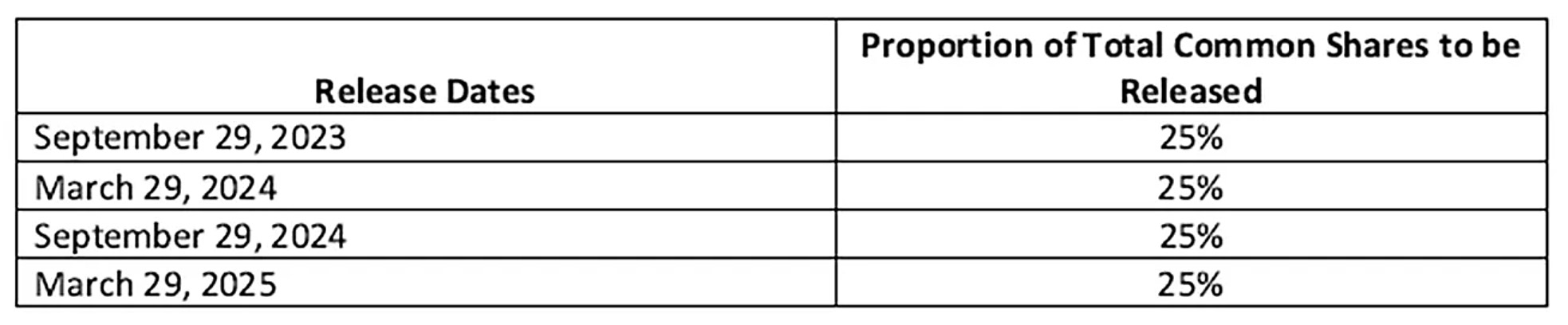

As a reminder, Sierra Madre acquired the asset from First Majestic Silver for a total consideration of US$35M. The entire consideration was payable in common shares (no cash payments were required!) and was settled at a deemed price of C$0.65 per share. As First Majestic took only shares in the transaction, it is fair to assume that First Majestic appears to be still quite convinced about the potential of La Guitarra and Sierra Madre’s management team. First Majestic ended up with just over 69 million shares, which are all escrowed. The escrowed shares will be released on a six month rolling basis with 25% of the share block coming out of escrow on each release date.

It was First Majestic’s original intention to distribute the Sierra Madre shares (or at least the portion exceeding the relevant number to maintain a 19.9% stake in the company) to its own shareholders but we haven’t seen an update on that front yet. We would assume those plans are still valid but we haven’t seen an update from First Majestic on this matter and we don’t know if First Majestic plans to distribute those Sierra Madre shares as they come out of lock-up or if the company will wait until all shares have exited the lock-up period. In any case, that distribution will add north of 10,000 new shareholders to Sierra Madre’s database. Some First Majestic shareholders will for sure try to sell the shares, but any investor believing in the silver narrative may want to retain their shares or even add in the market to their new Sierra Madre Gold & Silver holdings.

Conclusion

The next 12 to 18 months will be extremely important for Sierra Madre Gold and Silver. Acquiring a fully permitted and past-producing silver mine with a substantial gold credit was a good move but we are entering the phase where the company will have to prove to the investment community it can run the mine at a profit.

That’s the key element for the company as the incoming cash flow, even at a relatively low initial throughput of a few hundred tonnes per day, should generate enough cash flow to embark on an exploration program while increasing the production rate from the initial 300-350 tonnes per day to unlock economies of scale.

We are looking forward to seeing the resource update as that should be an important stepping stone for the company to continue to advance the mine towards reopening.

Disclosure: The author has a long position in Sierra Madre Gold & Silver. Sierra Madre is a sponsor of the website. Please read our disclaimer.