The gold price has been pretty strong lately but unfortunately, this has not yet trickled down into the junior gold exploration & development space as share prices have barely moved. That’s surprising and frustrating and it indicates companies better not get complacent as even a high(er) gold price is no longer a guarantee to attract more attention and to be able to secure funding at good prices.

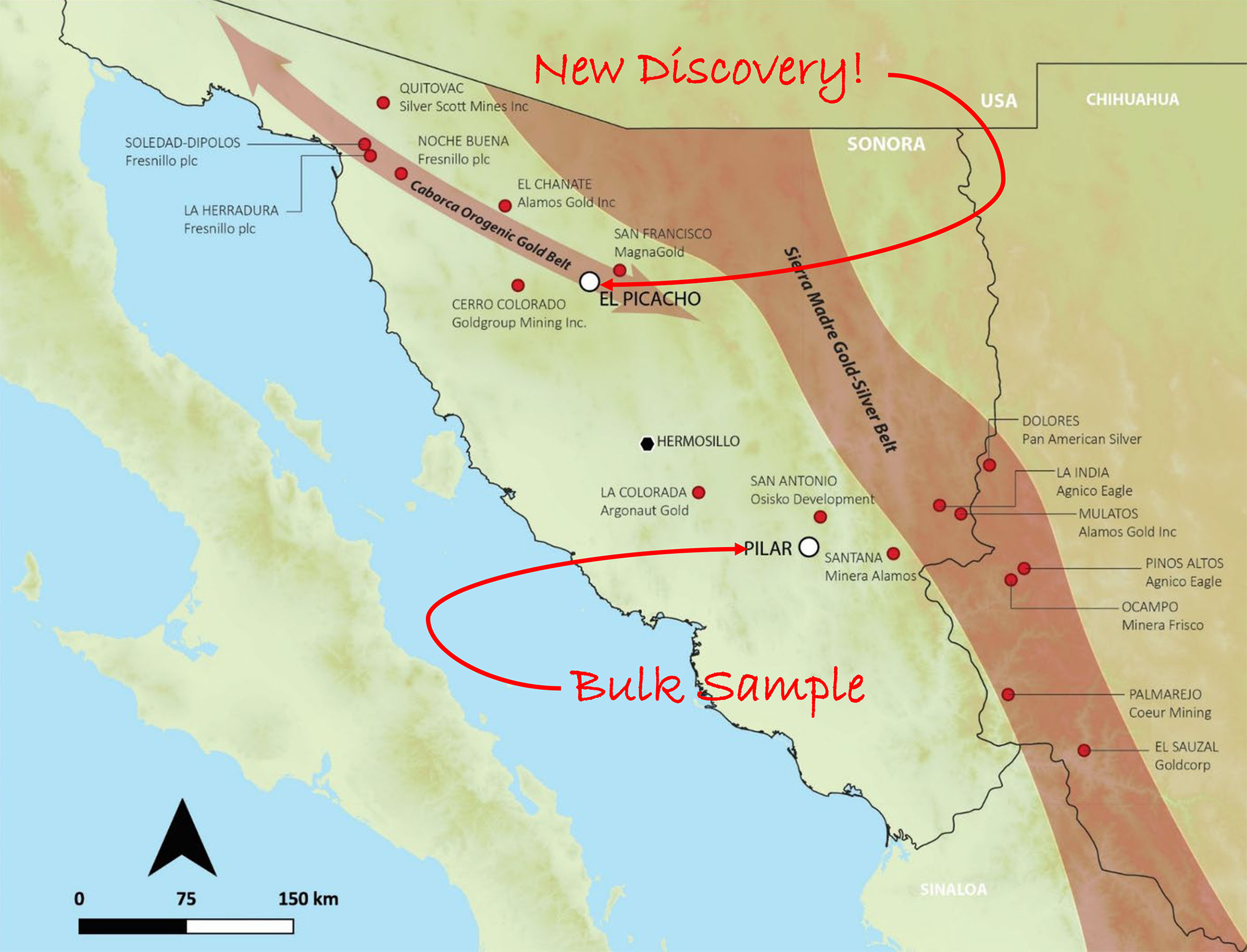

Tocvan Ventures (TOC.C) has taken its relationship with private equity fund Sorbie Bornholm to the next level. After signing the initial funding agreement in the second quarter of last year (which we discussed in this update), Tocvan and Sorbie have entered into an additional agreement to up the ante as the latter is making more cash available for Tocvan to continue its activities in Mexico’s Sonora state.

Tocvan is working towards completing a comprehensive metallurgical test program that will hopefully de-risk the Pilar gold project. While we don’t think the company has reached the critical mass to start considering developing the project just yet, metallurgy is a key component to actually figure out what the minimal critical mass is.

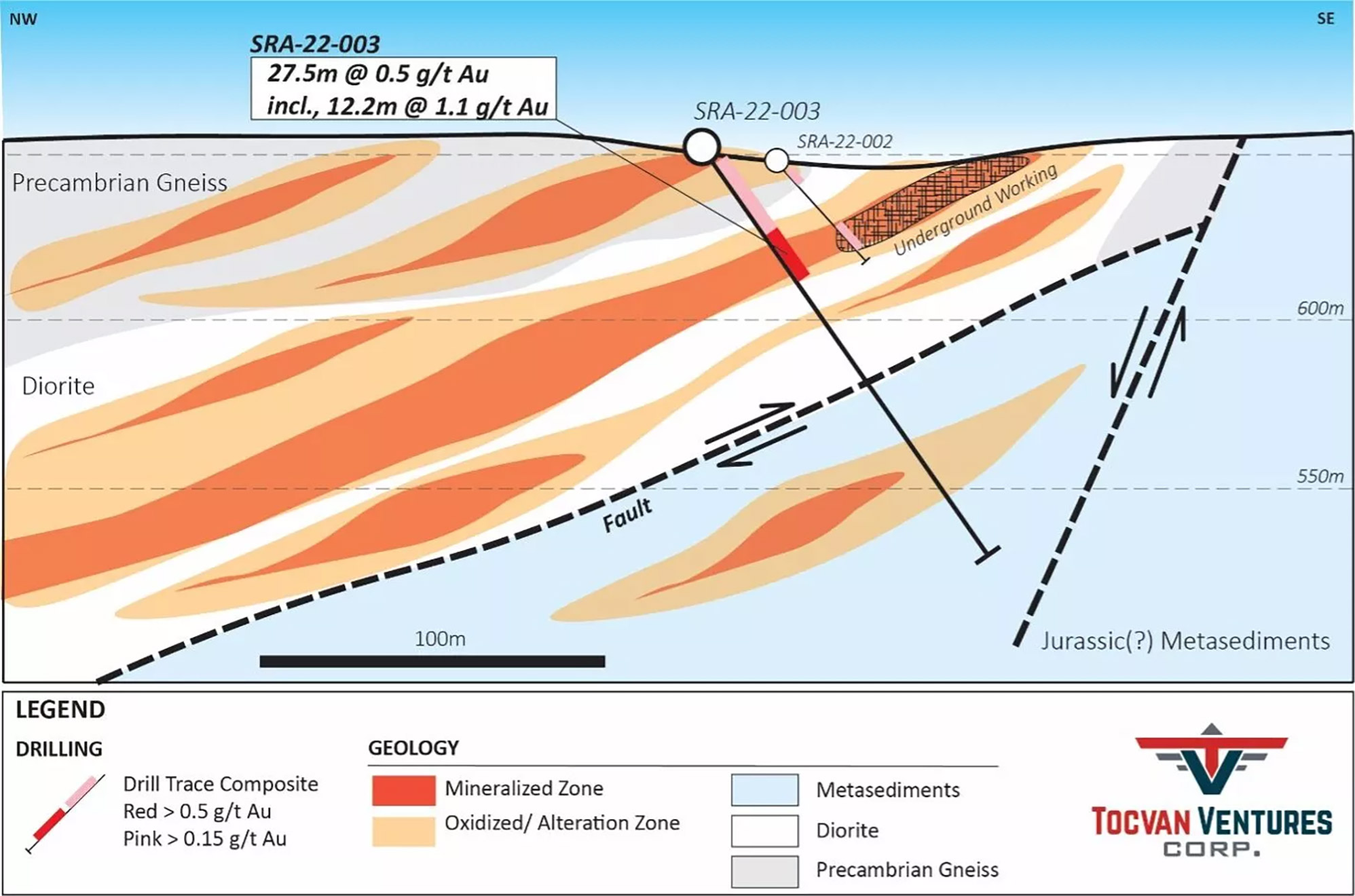

And while El Picacho is temporarily on the backburner as Tocvan is focusing on Pilar for the time being, let’s not forget the assay results from the initial drill program which was completed at the end of last year which confirm the exploration theory and will result in a follow-up drill program subject to funding.

We sat down with CEO Brodie Sutherland to discuss the ongoing metallurgical test program, the exploration plans and the recent update and upgrade of the financing agreement with its US-based private equity group.

Tocvan Ventures is advancing Pilar at a fast pace – Sitting down with CEO Brodie Sutherland

Pilar

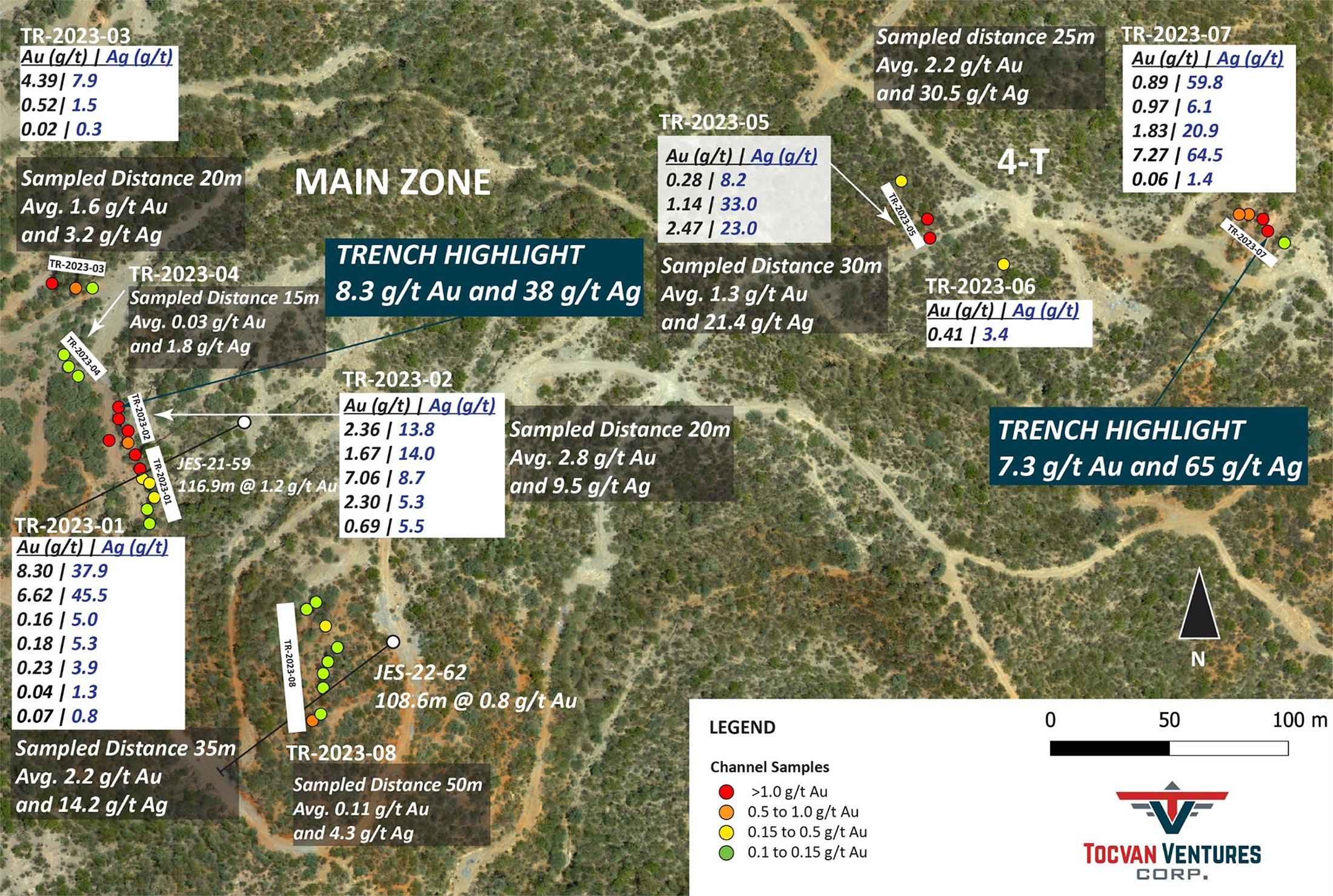

Pilar dominated your headlines recently as you have reported on the metallurgical test work conducted on the project. Those initial results are actually remarkably positive with recovery rates ranging from the mid-90s to the high 90s using gravity and agitated cyanide leach. How important could a gravity circuit be in the greater scheme of things?

This was a big eye opener for us, other deposits in Sonora don’t have the ability to recover a high percentage of the gold using gravity. Ultimately it gives us optionality as we evaluate conventional heap leach recovery versus gravity with later agitated leach.

When we see such high recovery rates, could this indicate your assay results from the drill program may actually underestimate the average grade of the zones due to a certain nugget effect? Or how should we interpret this (also considering the average grade of 15 samples that were sent to the lab exceeded 1.6 g/t gold).

We have always known there is a significant high-grade portion to the mineralized system. The data so far is suggesting that after blending that high-grade with the low-grade portion we get an average grade above 1.5 g/t Au. This is substantially higher than what our expectations were from past trenching (which pointed to grades of approximately 0.7 g/t Au). This looks to be similar for the silver component as well. We have more results pending to support this further, but overall it is extremely encouraging to see the results come in this high.

Were all 1,400 tonnes from the bulk sample tested or do you have more in the pipeline?

We extracted over 1,400 tonnes. Due to the discovery of abundant ‘free’ gold and silver, we decided to use 800 tonnes for the heap leach test and the remaining 600 tonnes to test gravity methods for recovery. That should give us an excellent comparison and sufficient data to decide what makes the most sense for Pilar going forward.

As the metallurgical test work is conducted at a nearby mining operation, will you be able to use the data to determine cutoff grades in a resource and developing a pit shell, or would you need more ‘official’ met work results?

All of the work and data is being managed by a local, ISO-certified group of internationally trained independent metallurgists and mine engineers from LTM in Hermosillo. The data collected and reviewed will give us insight into evaluating potential cut-off grades that would be appropriate for Pilar. Given the potential nugget-effect from higher-grade zones, we feel this will be far more representative then data from conventional lab run column leach tests. So yes, we will be able to work this information into future resource estimates and cutoff analysis.

You are gearing up for your next exploration phase at Pilar which could see you reach the critical mass needed to start considering the actual development of a mine. It sounds like you will initially focus on channel sampling to determine the high-priority drill targets. Will this prove to be helpful based on the recently encountered old workings?

We have a number of target areas to follow-up on at Pilar already, but want to prioritize on key infill areas at Pilar where we can add significant ounces towards a resource estimate. The target areas further out look very promising, but they can wait for now.

One advantage of opening up new ground for the bulk sample was the ability to come across key structural trends for the first time. This not only exposed some very interesting wall rock sections, but we also encountered several buried artisanal workings that were clearly chasing high-grade structure. From past experience we know these can host significant gold and silver values. Obviously looking at a bulk target, we are interested in what is going in the altered wall rock around these structures as well.

Channel sampling across these new exposures will give us some new information from surface that we can use for enhancing our drill targeting, it can also be used in future resource estimation and tied into our overall model with the drill database. The results should be very interesting, and we look forward to reviewing that data when available.

El Picacho

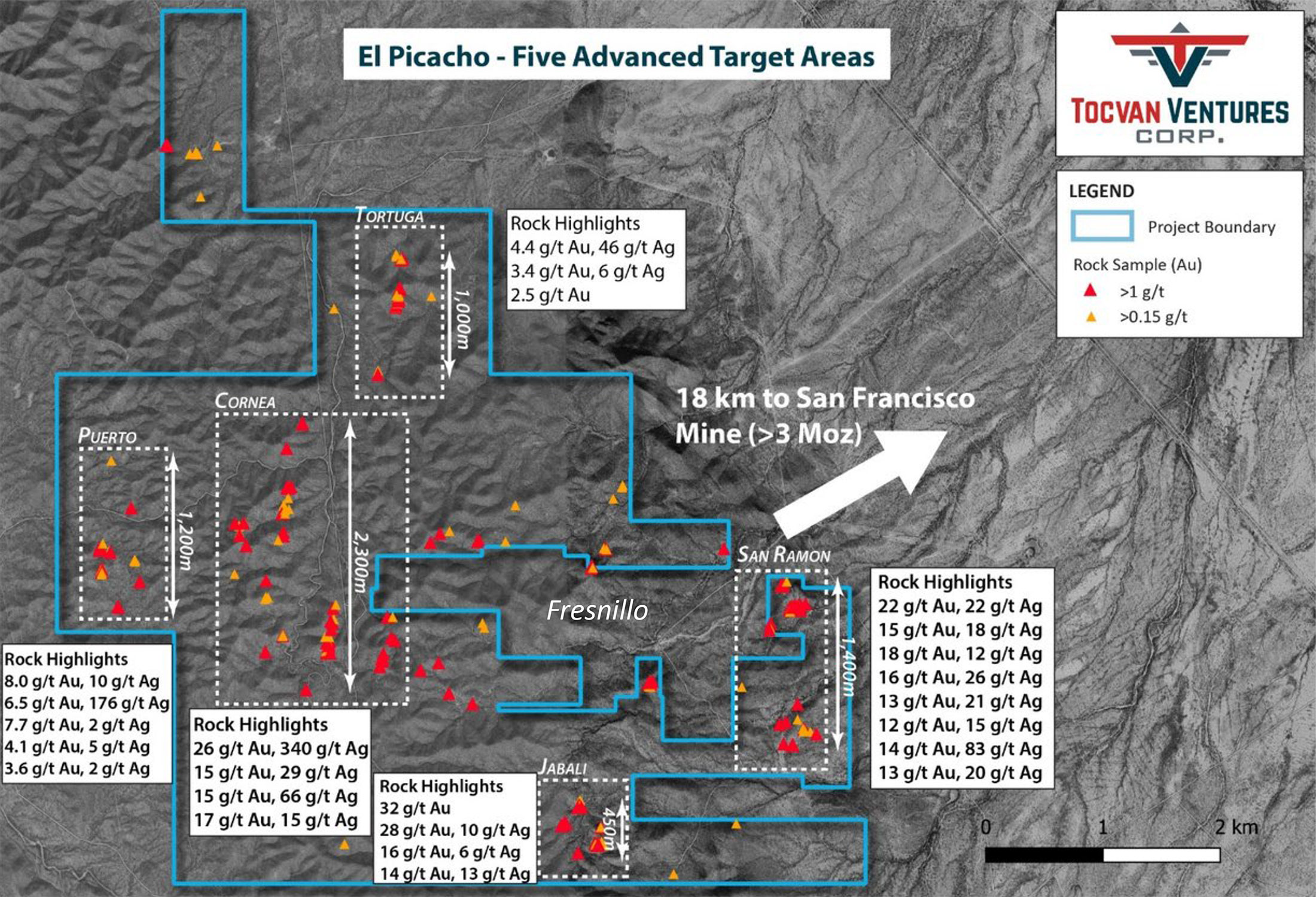

You had some interesting assay results from the El Picacho drill program. What was/is your main takeaway from the drill program, and what would you like to follow up on right away?

The big takeaway for us was proving our exploration model at El Picacho with the discovery of near-surface gold-silver mineralization. We can now apply that same model across the property as we look to evaluate the other target areas. Follow-up at San Ramon where we first drilled is the logical step, but we also want to drill the other target areas further west. For instance, the Jabali prospect has never been drilled…Cornea is another prospect that covers a huge area with very limited historic recon drilling completed with no follow-up.

Does the bankruptcy of Magna Gold have an impact (either positive or negative) on El Picacho? Perhaps you could attract some of their ‘human capital’?

Always tough to see a neighboring producer go through bankruptcy, it is just the nature of these older assets that require big capital to continue to advance. I like to focus on the positives; we have a neighboring deposit (the San Francisco Mine) that contained roughly 3 million ounces of gold. We see a lot of similarities related to how mineralization is hosted at El Picacho and San Francisco. When San Francisco was first discovered it was approximately 400,000 ounces at 2g/t Au; that kind of potential today gets me excited to explore El Picacho and now that we hit mineralization in our first drill program, we feel that potential is real. We have always relied on local experts and built our team locally.

Corporate

You recently closed a C$600,000 placement priced at C$0.544 per unit with Sorbie Bornholm. Just like the previous financing, you will receive monthly tranches (12 tranches of C$50,000 in this case). Considering the units are priced at a fixed price (unlike the initial agreement from last year), does this mean you will simply issue C$50,000 / C$0.544 = 91,911 units per month?

Details for the follow-on placement with Sorbie are posted in the Offering Document we filed on SEDAR. It is not a fixed price, but variable like the initial agreement, with a benchmark price of $0.725. We spent a lot of time discussing the follow-on financing with Sorbie to make sure we had the same goals in mind. Both the Company and Sorbie expect our share price to continue to perform (even though we are experiencing a pull back in the share price), we are optimistic we can get more out of this deal.

How does that work for the warrants? Is the issue date the date of the closing of the placement or the effective distribution date every month?

The issue date is effective on the closing of the placement for all the warrants considered.

With this new agreement, what is the approximate monthly cash inflow level based on both tranches (2022 and 2023)?

Based on 20-day VWAP, we are currently looking at approximately C$180,000 per month of working capital from the deal over the next 12 to 13 months (June of 2024).

Regarding the use of proceeds, will you use the proceeds for general working capital purposes or do you intend to ‘jumpstart’ some programs on either El Picacho or Pilar?

Once the bulk sample has been completed and our technical team is available again, we do plan to ‘jumpstart’ our exploration efforts on both properties. Permitting will also be a key piece for us in the coming months as we look to start our environmental application for development.

Conclusion

Although the company’s share price has come off its recent highs of around C$0.79, Tocvan still is one of the strongest performing gold stocks in the past six months (which of course is an arbitrary time frame). The initial metallurgical results are interesting and are starting to look good. Later this year it will be up to the drill bit to add more ounces to the currently known mineralized zones ahead of a potential maiden resource estimate.

Exploration isn’t easy, and early stage exploration companies like Tocvan Ventures will continuously have to battle the markets by generating enough (positive) news flow to keep (potential) investors interested. CEO Brodie Sutherland and his team are definitely aware of this and it is commendable to see they have been able to continue their exploration efforts without diluting the share count by too much.

Disclosure: The author has a long position in Tocvan Ventures. Tocvan Ventures is a sponsor of the website. Please read our full disclosure.