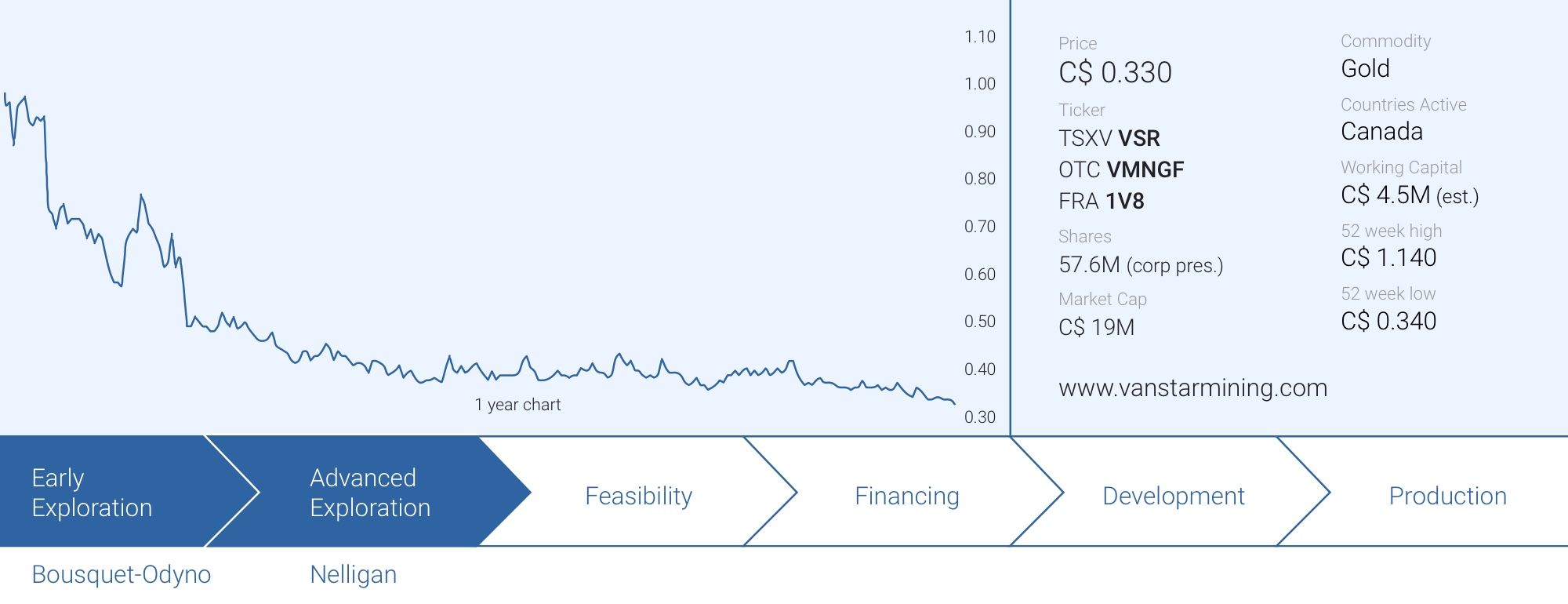

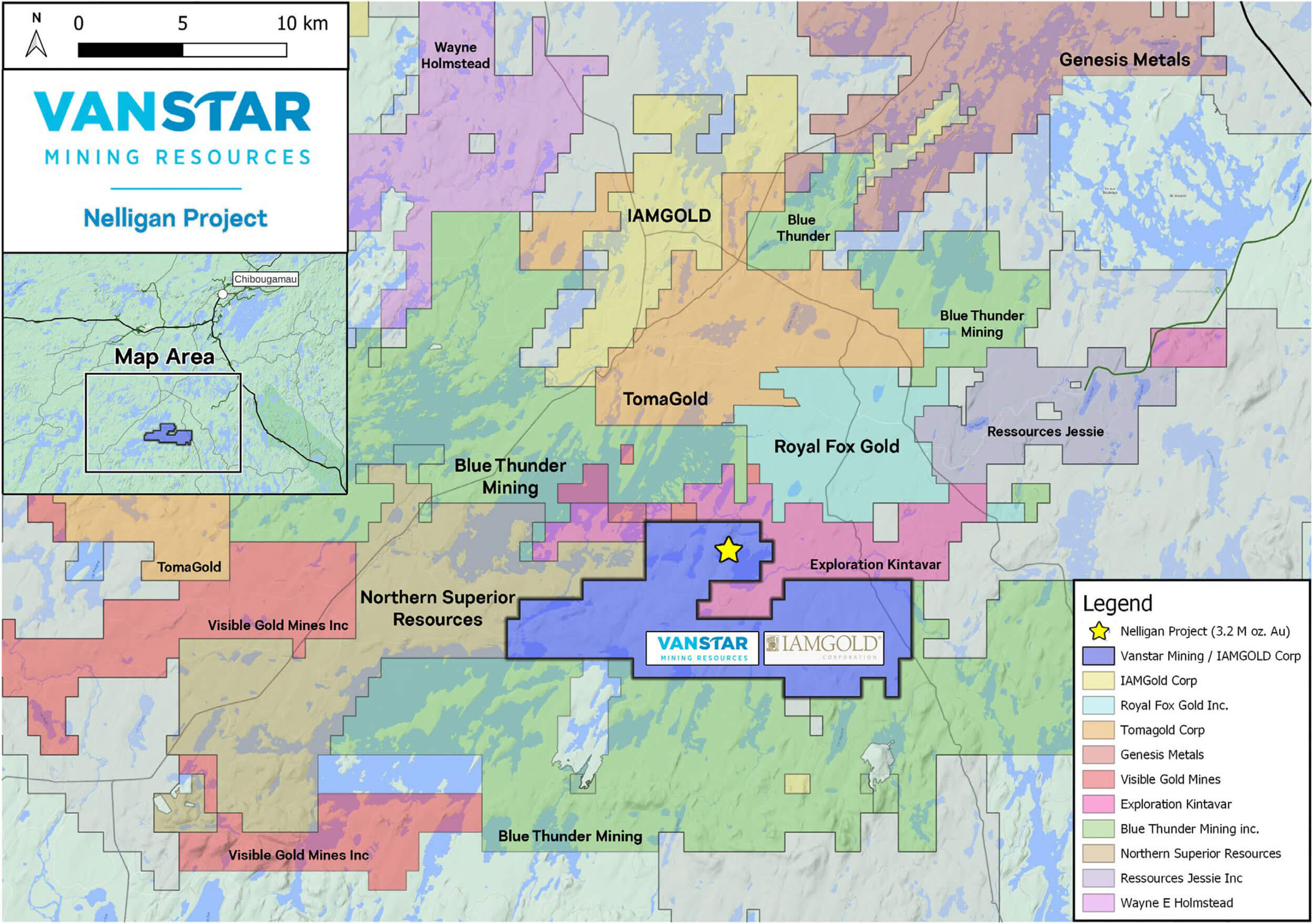

Vanstar Mining Resources (VSR.V) used to be a one-trick pony as the company’s main asset was its 25% stake in the Nelligan project where IAMgold (IMG.TO, IAG) is taking care of all exploration expenditures in order to reach the 80% ownership level. Vanstar did have some other exploration projects in its portfolio, but those were very early stage and did/do not have tangible value.

That changed in 2021 when Vanstar entered into an option agreement with IAMgold (yes, them again) to earn up to a 75% stake in the Bousquet-Odyno gold project in Québec. One could interpret this as IAMgold using Vanstar as an exploration vehicle with an ultimate goal of rolling up the stake in Nelligan it doesn’t own yet as well as the more advanced Bousquet project in one go. But perhaps that’s just wishful thinking and CEO St-Amour confirmed it was Vanstar who reached out to IAMgold regarding this property and not the other way around.

In any case, working on an advance-stage project should add more value for the Vanstar shareholders as the Bousquet project has reached the resource definition drilling stage.

Drilling has now been completed at Nelligan. Next stop: a resource update

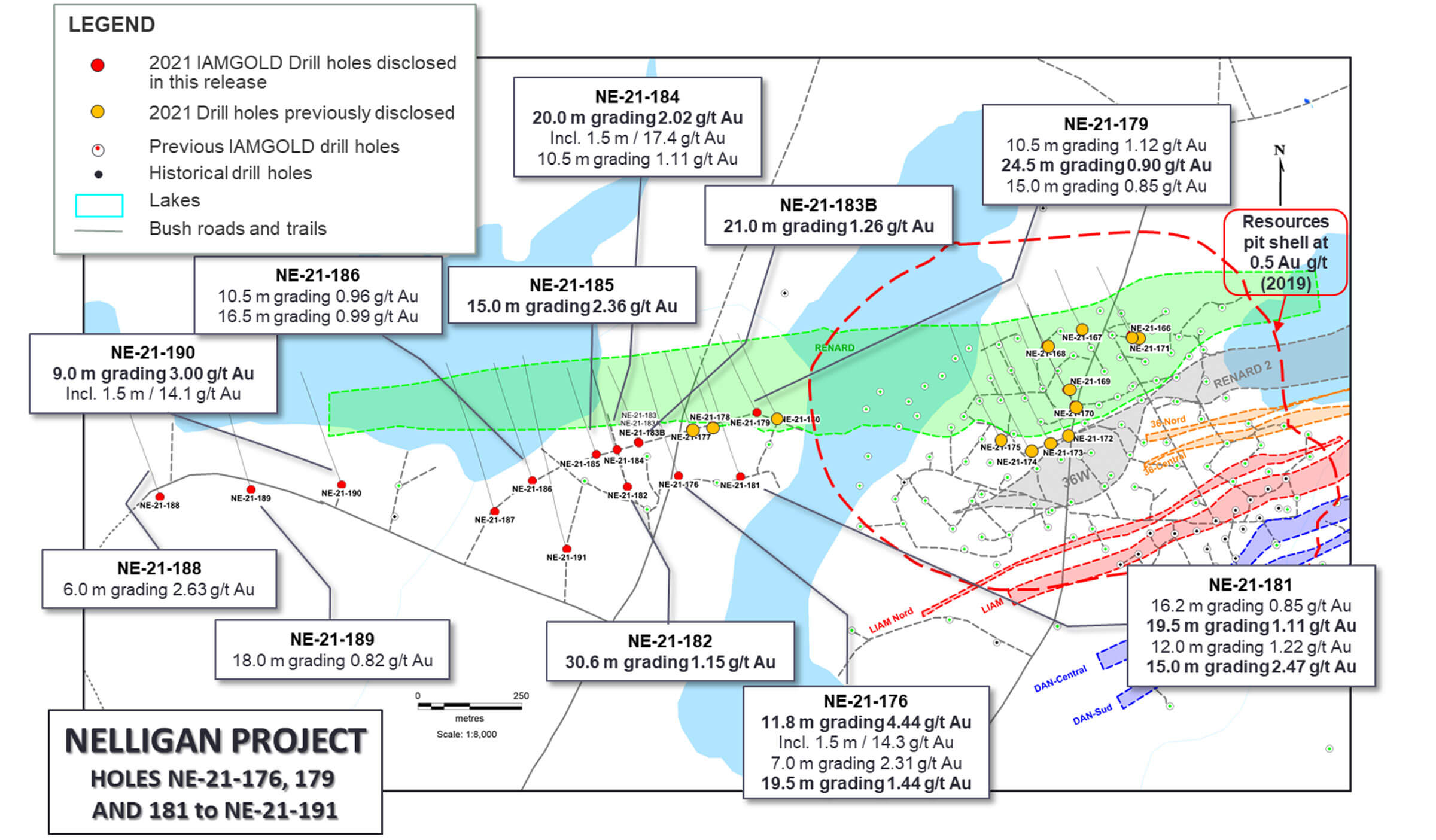

As labs have been backed up for the better part of the past two years, Vanstar Mining only released the assay results from the winter drill program at Nelligan in the final week of March, when the 2022 exploration program was already in full swing.

The 2021 drill program consisted of just under 9,500 meters of drilling in 27 drill holes. The assay results from the first 13 holes were released in December last year, and IAMgold and Vanstar released the assay results from the final 14 holes which were drilled on the western extension of the deposit in march. And it looks like that western extension could host more ounces than we had anticipated.

As you may remember, the 2020 drill program successfully extended the mineralized area by 700 meters beyond the 2019 resource while the 2021 drill program has now confirmed the mineralization is still continuing further west although the intervals are narrower but with higher grade gold values and this could shed new light on the westernmost part of the project.

The company rightfully singled out hole NE21-190 which encountered 9 meters of 3 g/t gold including 1.5 meters of 14.1 g/t gold (which confirms the narrower but higher grade nature of the mineralization towards the west) but more important than grade and width is the location of this interval. The gold mineralization has now been traced to about 1,500 meters towards the west from the pit outline used for the 2019 resource estimate

Meanwhile, the 2022 exploration program has also been completed now. IAMgold was expected to drill up to approximately 6,000 meters with a specific focus on the areas directly below the pit outline, up to a vertical depth of 500 meters. That’s interesting as the previous resource estimate only took the mineralization up to a depth of 200-300 meters into account and – if the strip ratio permits – being able to deepen the pit could add a lot more ounces. We will only know for sure when the drill results are published but being able to add 0.7-1 million ounces per 100 vertical meters of additional depth does not seem unrealistic. But the company will then of course have to determine the viability of those additional ounces and that will be a trade-off between grade, continuity and consistency and the strip ratio needed for a deep pit.

But one thing is pretty obvious: since the previous resource estimate was released in 2019, IAMgold has done a lot of additional work and the gold mineralization has been expanded towards the west (and likely at depth) and all these elements will be incorporated in an updated resource estimate which should be completed by the end of this year. While the results of the 6,000 meter 2022 drill program will be important to form our final opinion, we now see a clear path forward towards a larger total resource with decent portion of the gold resource in the measured and indicated resource categories (mainly indicated, would be our guess). We would for sure be happy to see, say, 4 million ounces in total with 1.2-1.5 million ounces in the indicated resource category.

A resource expansion to the west is a given. A resource expansion at depth seems likely, but the final confirmation will only follow when the drill results are released.

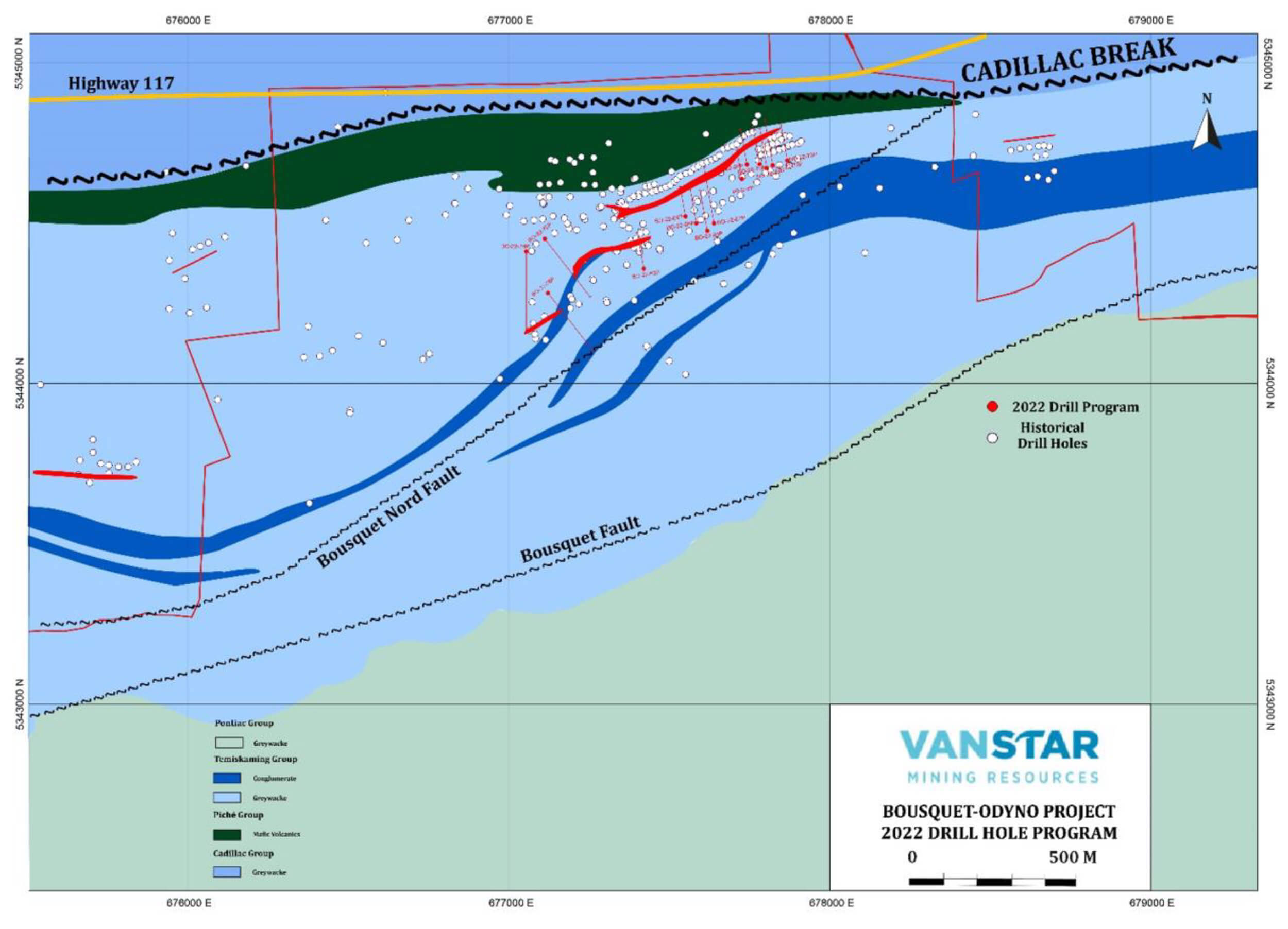

Drilling has started on the Bousquet-Odyno gold project

Vanstar has now kicked off its initial 4,000 meter drill program at the Bousquet-Odyno gold project in Québec where the company is earning in towards a 75% stake in the project from IAMgold (IMG.TO, IAG).

As per the agreement, Vanstar can earn a stake of up to 75% in the project. An initial 25% stake will be obtained by spending at least C$2M in exploration expenditures on the project before March 11th 2024 where after Vanstar can earn an additional 50% stake (for a total of 75%) by spending an additional C$2M within four years after the effective date (which was March 11, 2022).

IAMgold has retained the right to back in and increase its ownership to 50% again by spending four times the amount spent on exploration after the initial 75% stake has been established. So if Vanstar spends the C$4M required to get to 75% and spends an additional C$1.5M before IAMgold exercises its back-in right, IAMgold would have to cough up C$6M to exercise its right to go back up to 50%. That sounds like a good deal but if IAMgold elects right away to get back up to 50% immediately after Vanstar completes the C$4M earn-in, Vanstar likely won’t see too much cash. But at that point a 50/50 joint venture will be established and both partners will contribute in equal parts to the exploration programs.

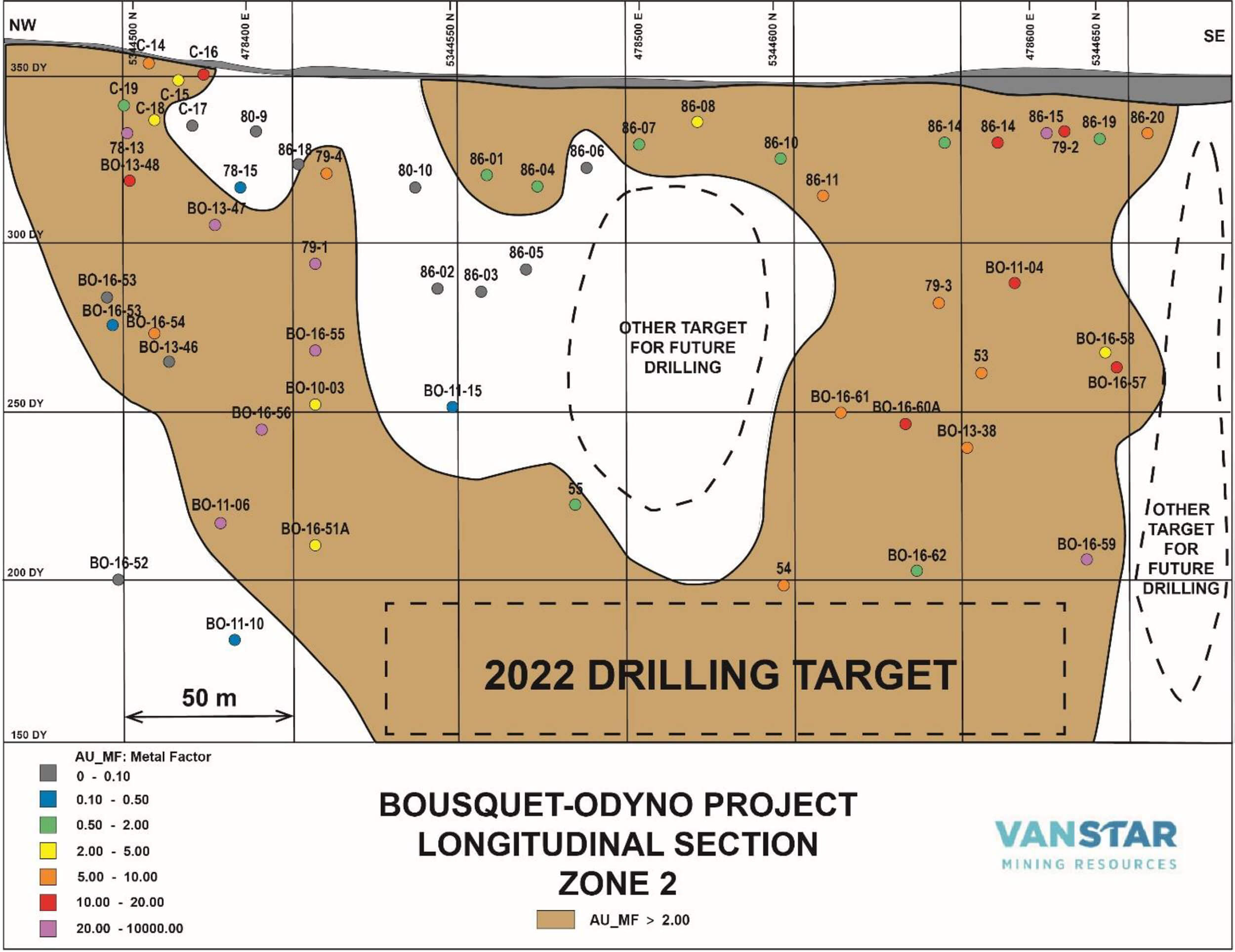

Plan map of Bousquet-Odyno indicating proposed drill holes

The current drill program will focus on the areas down plunge from the known high grade zones at Bousquet-Odyno. Historical drill results from IAMgold-executed drilling for instance encountered 3.3 meters of 29.3 g/t gold and 16.5 meters of 9.6 g/t gold. No drilling has taken place since 2016 and Vanstar Mining is obviously hoping to replicate the historical drilling success and expand the mineralized footprint. Thanks to the excellent infrastructure and the close proximity to cities and mining centers, drilling at Bousquet is rather cheap. CEO St-Amour estimates the all-in cost per meter to be just C$150-200. The ‘pure’ drill cost per meter – excluding assays – is just C$75.

The Bousquet project hasn’t been drilled since 2016 which is when IAMgold had to cut its exploration budget and prioritize its cash flows on drilling and building the Coté Lake multi-million ounce gold project. This means Bousquet was put on the backburner and has been gathering dust on the proverbial shelf ever since. And after seeing IAMgold’s recent horrendous capex update on its flagship Coté Gold project, it’s very unlikely the company will soon make decent exploration budgets available. So it makes sense for both parties to leverage their existing relationship to try to figure out the gold mineralization at Bousquet.

Longitudinal section showing targets at depth

Although the project has seen some drilling, most of these programs were just barely scratching the surface and IAMgold barely drilled any holes below 200 meters. The company wasn’t very interested in making a new big discovery but was merely looking for satellite deposits to supply its Westwood mill (which is literally just a few kilometers down the road) with additional mill feed.

Vanstar’s exploration plan is relatively ‘simple’: it will chase the grade and the mineralization at depth, as the company thinks that’s where the low-hanging fruit can be found to rapidly add tonnes and ounces to the Bousquet profile. We should see assay results by the end of this month or early next month, especially as Vanstar may decide to ‘rush’ some of the assays.

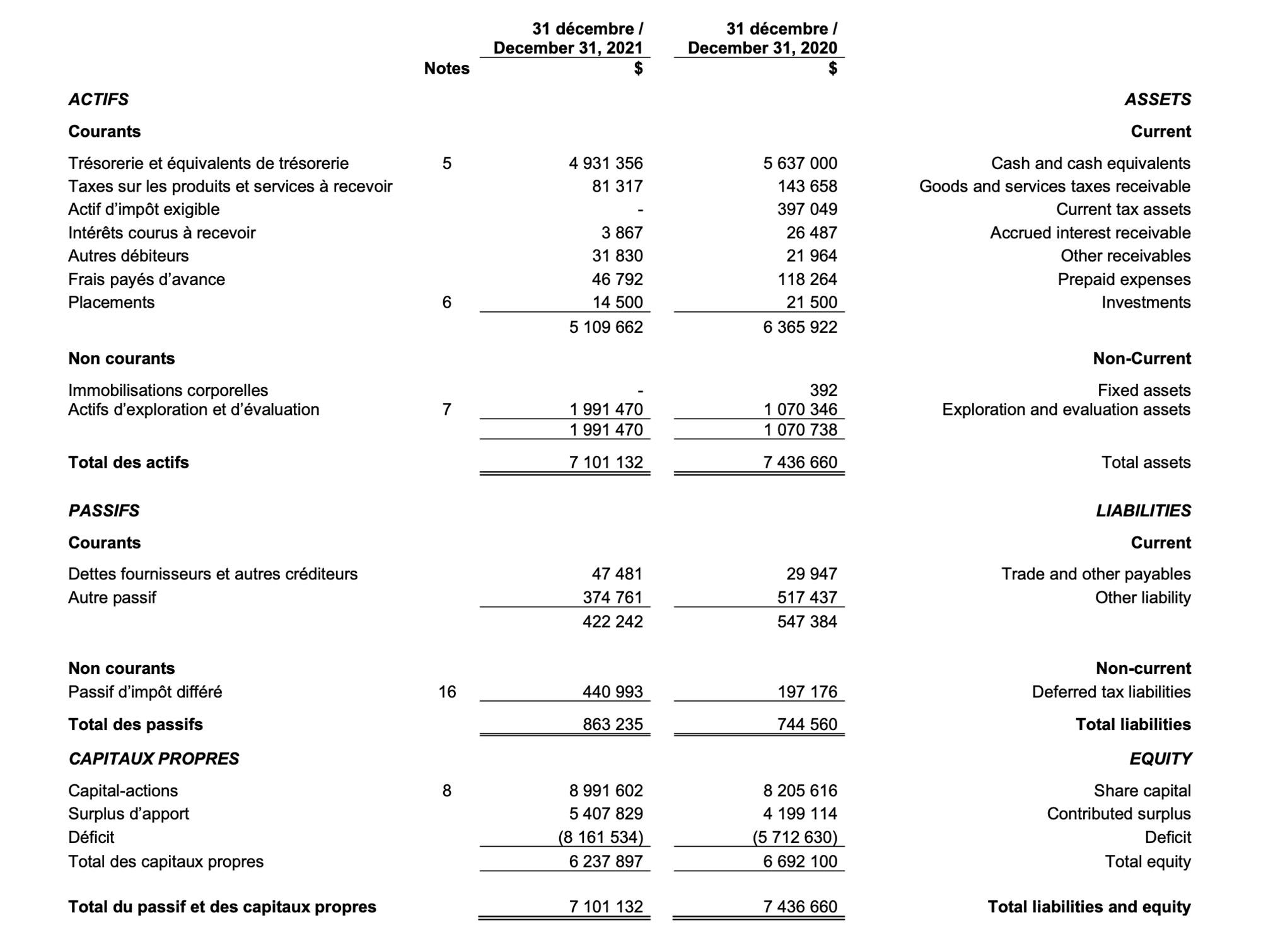

Vanstar’s balance sheet still looks very healthy

Vanstar recently published its financial statements for the year ending on December 31st 2021. The Q1 statements will now likely follow soon, but it is good to see Vanstar’s cash position remained very robust throughout the year and the company ended 2021 with working capital of C$4.7M with just over C$4.9M in cash.

Of the C$4.9M in cash, approximately C$1.4M is flow-through money, and those funds will have to be spent on exploration by the end of this year, as per the flow-through rules. This likely means Vanstar will continue to work on the Bousquet property after the summer to make sure it does spend the required amount of flow-through cash. Taking all other expenses and overhead costs into consideration, Vanstar will likely end the year with C$2-2.5M in cash, and the entire cash position will consist of hard dollars at that point.

This means there’s absolutely no need for Vanstar to tap the equity markets anytime soon as the current cash position should last the company well into next year. And CEO JC St-Amour has made it very clear he does not want to raise cash at the current levels so we would only expect potential financing upon the release of the Bousquet drill results and only if the price is right.

Conclusion

As Vanstar Mining (and IAMgold) will be active on two projects this year, we can expect a rather continuous news flow from June on. We expect to see the Bousquet drill results even before the Nelligan drill results will be disclosed and it’s not unlikely Vanstar will just continue to drill at Bousquet – should the first exploration results warrant this decision. As Vanstar has to spend C$1.4M in flow-through money before the end of this year, we can for sure see a second drill program happen in 2022 to make sure the company meets all regulatory requirements.

There will be no summer drill program at Nelligan. Vanstar anticipates receiving all data from the early 2022 drill program from IAMgold once all results are in, and this will be the basis of an updated resource estimate at Nelligan. It’s not easy to guesstimate what this all could mean for Vanstar, but we would like to see an overall increase in the total amount of ounces while we hope 25-30% of the total resource would be classified as indicated after the about 5,000 odd meters of infill drilling.

Disclosure: The author has a long position in Vanstar Mining. Vanstar Mining is a sponsor of the website.