M2 Cobalt (MC.V) has been in a trading halt since yesterday and although the company hasn’t issued a press release yet, an ASX-listed company released an interesting piece of information last night.

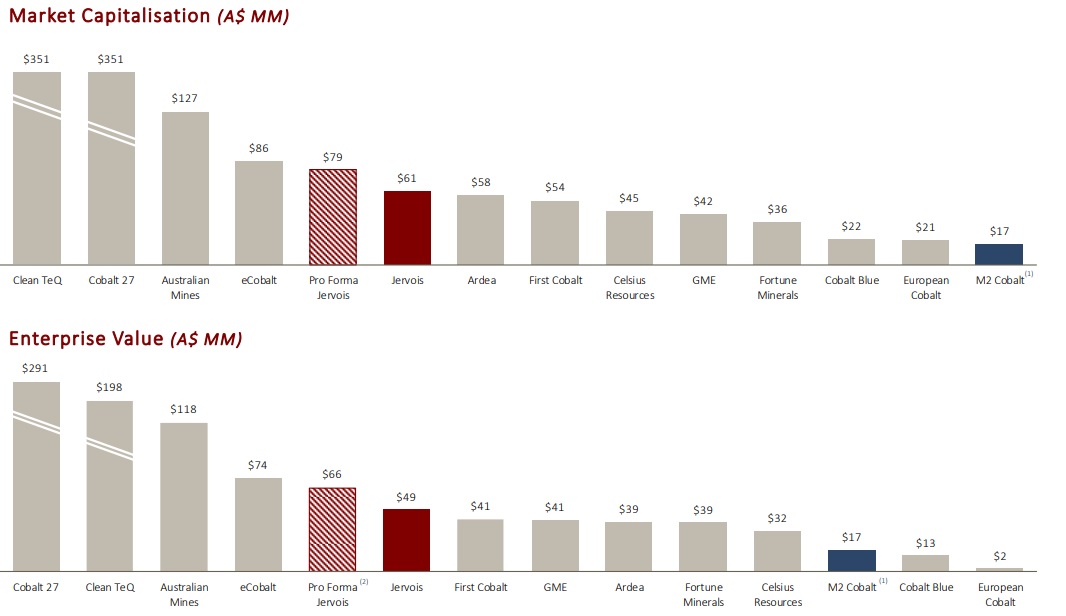

Jervois Mining (ASX:JRV), an Australian company with a market capitalization of just over A$60M, has entered into a definitive agreement to acquire all outstanding shares of M2 Cobalt in an all-share deal ‘at market’. Shareholders of M2 Cobalt will receive one new share of Jervois Mining (which will also be trading on the TSX Venture Exchange upon the completion of the merger) and using Jervois’ closing price of A$0.275 and the current C$/A$ exchange rate of 1.05, this implies a valuation of C$0.262 per share of M2 Cobalt, a small premium of less than 5% over the share price before the halt.

This is indeed substantially lower than the C$0.50 level M2 Cobalt previously raised money at, but there seems to be a bigger picture here. First of all, shareholders of M2 Cobalt will receive stock in Jervois Mining, so we will still be able to participate in the further progress on the properties. Secondly, rather than going through a painful raise at these levels, the merger with Jervois seems to be an elegant solution to solve the funding issues. Jervois has A$9M in cash and securities, and a 4.54% stake in eCobat Solutions (which has a value of approximately C$3.7M). The Australians have already committed to extend a US$3M line of credit to M2 Cobalt so it can continue its exploration activities in Uganda.

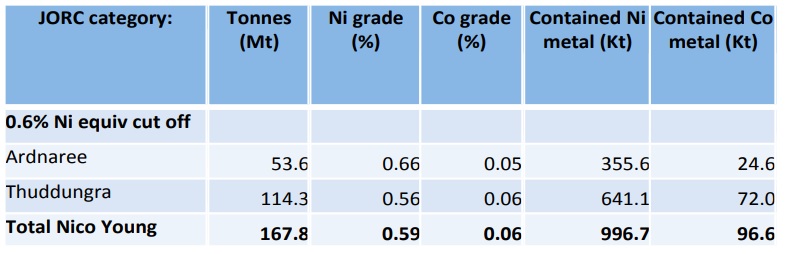

And finally, Jervois also owns a large nickel-cobalt asset in Australia. The Nico Young project in New South Wales has an inferred resource estimate of almost 168 million tonnes of 0.59% nickel and 0.06% cobalt. A pre-feasibility study should be completed soon, focusing on a 3 million tonnes per year heap leach operation and was originally expected to be completed by the end of last year. Initial metallurgical test work indicated a recovery rate of 70-75% for the nickel and 80-85% for the cobalt, but the acid consumption levels remained very high (and will be the main focus going forward).

Additionally, Jervois has applied for a prospecting license over the Kabanga Nickel project in Tanzania in May 2018. No decision has been taken yet, but should the license be awarded, Kabanga will be an interesting asset for the combined entity of Jervois and M2 Cobalt as the project has a JORC compliant resource estimate of 57 million tonnes at an average grade of 2.62% nickel, 0.2% cobalt and 0.35% copper. The grade is exceptional, but Tanzania hasn’t been the most stable African mining jurisdiction lately as it’s sorting out tax issues with Acacia Mining (ACA.L). That being said, should Jervois be able to make the Tanzanian project work, it could probably even become the flagship asset with the 3.3 billion pounds of nickel, 440 million pounds of copper and approximately 250 million pounds of cobalt (the combined in-situ value of the deposit is in excess of US$20B using $5 nickel, $2.75 copper and $16 cobalt. As far as we know, there are no economic studies on Kabanga, so the viability of the property will still have to be determined.

We are now waiting for M2 Cobalt’s press release to be published, and will provide a longer update soon. Based on what we now know, we are in favor of the transaction, and will tender our shares to the Jervois offer when it opens.

Go to M2 Cobalt’s website

The author has a long position in M2 Cobalt and will accept the offer. M2 Cobalt is a sponsor of the website. Please read the disclaimer