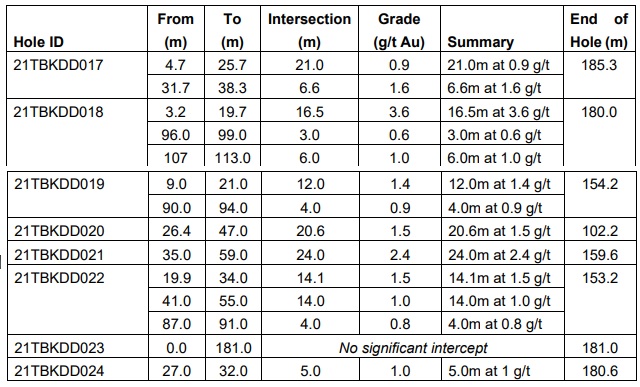

Altus Strategies (ALS.L, ALTS.V), which owns 49% of the Tabakorole gold project in Mali with ASX-listed Marvel Gold (MVL.AX) owning the balance, has released additional drill results. The drill rig tested a zone parallel to the known resource, and as such, the 8 holes the company recently reported on fall completely outside of the known resource.

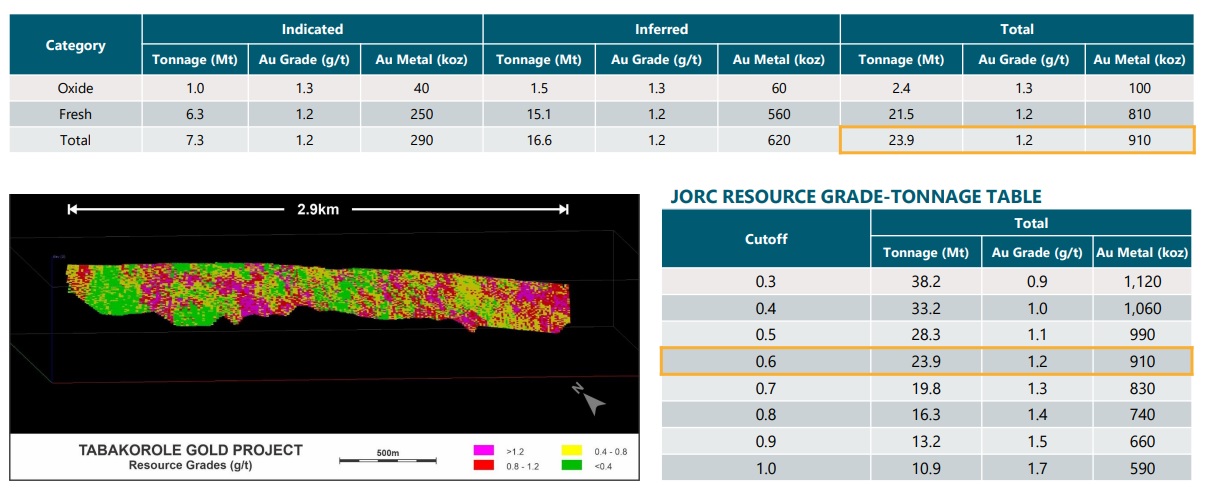

The joint venture partners are now in the final stages of preparing an updated resource estimate which will incorporate almost 10,000 meters of additional drilling this year. As Marvel was successful in expanding the strike length of the mineralization and more high-grade gold discoveries have been made closer to surface than previously modelled, the expectation is that the updated resource estimate will contain more tonnes at a higher average grade, resulting in what should be a substantial increase of the gold resource. As a reminder, the current resources stand at 620,000 ounces in the inferred resource category while an additional 290,000 ounces of gold are classified as an indicated resource, and we would be surprised if the total gold resource wouldn’t exceed a million ounces when the updated resource will be published later this month.

That means Marvel Gold will likely go ahead with economic studies on the project which is required anyway in order to obtain an 80% stake in the project (Marvel now owns 51% but is nearing the completion of the requirements to increase this to 70%). That would dilute Altus Strategies down to just a 20% stake, but Altus will retain a 2.5% NSR as well (of which 1.5% could be repurchased by making a cash payment of between US$9.99M and US$15M depending on the total resource size), which could be valuable as well.

Disclosure: The author has no positions in Altus Strategies. Please read our disclaimer.