Freeport McMoRan (FCX) is spending its cash on the Amarc Resources (AHR.V) owned JOY property in British Columbia in an attempt to establish a majority stake in the property. Freeport has spent almost C$6M in the first year of the option and has confirmed it will continue its earn-in plan in 2022 as it plans to drill the PINE deposit and other potential targets at JOY.

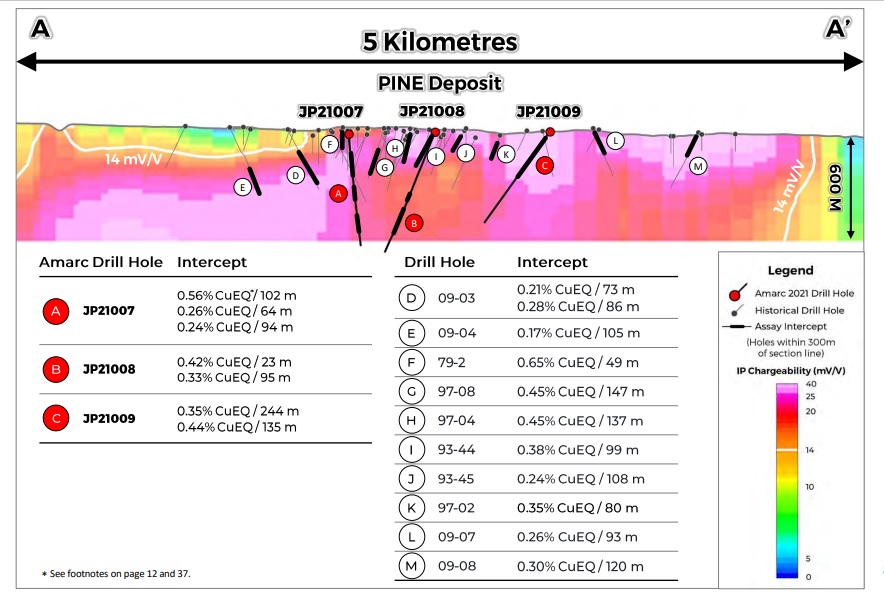

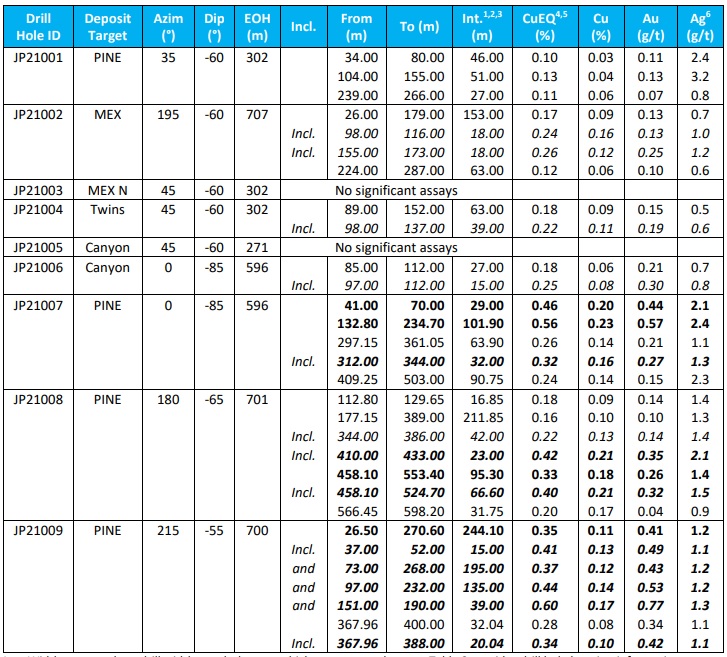

The drill results from JOY were a mixed bag. The headline result of 102 meters containing 0.56% copper is obviously good but some of the other holes were a little bit more disappointing as you can see in the table above. It’s now easily understandable why the PINE deposit appears to be an important area of interest for Freeport. While hole 7 obviously was the best one, we shouldn’t entirely discard holes 8 and 9 either as 66.6 meters of 0.40% copper-equivalent in hole 8 is decent but it’s a pity the mineralization was encountered rather deep downhole. In hole 9, the mineralization appears to be closer to surface with an interval of 244 meters containing 0.35% CuEq starting just 26.5 meters downhole. 0.35% on an equivalent basis still isn’t anything to get wildly excited about as using a copper price of US$4 per pound the gross rock value would be just around $30/t (and that’s before taking recovery rates and payability percentages into account).

Disclosure: The author has no position in Amarc Resources. Please read our disclaimer.