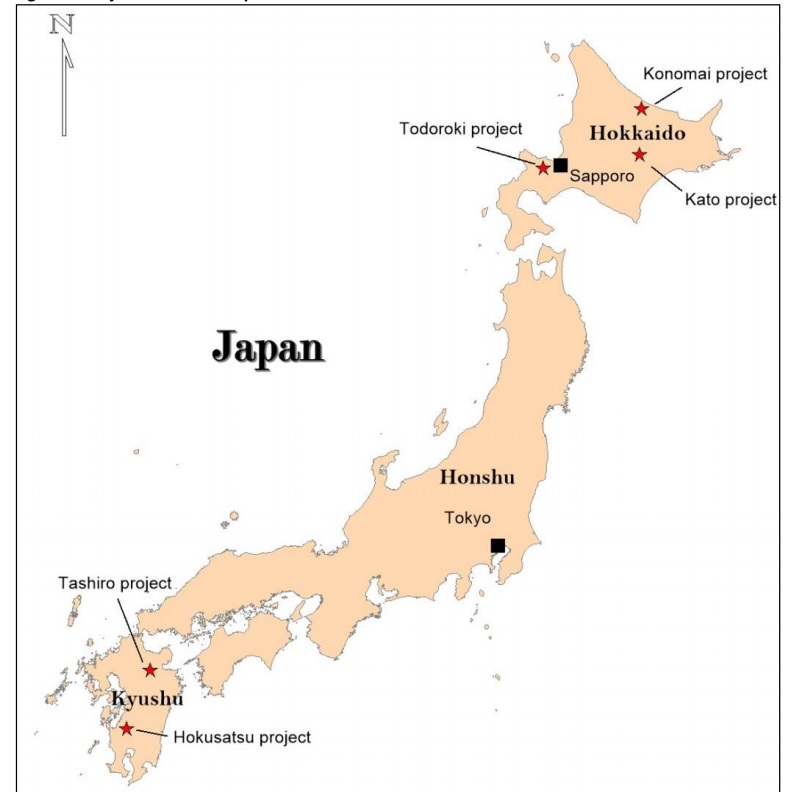

BeMetals (BMET.V) has announced it is acquiring Kronk Resources, a privately held company which holds the rights to a portfolio of gold exploration projects in Japan. As BeMetals confirmed ‘several directors of BeMetals are also directors or officers of Kronk and B2Gold’, it will be interesting to see more details on this transaction as BeMetals will issue about 32.6 million shares to the shareholders of Kronk. That being said, BeMetals has found an elegant solution for this potential conflict of interest, as the ‘interested parties’ receive a lower consideration for their Kronk shares. A good solution.

Simultaneous with the acquisition,BeMetals will be issuing 17.05M shares priced at C$0.44 per share to B2Gold (BTO.TO, BTG) which will become BeMetals’ largest corporate shareholder with a stake of 19%. The C$7.5M cash infusion means BeMetals will be able to hit the ground running from day 1. The Kronk portfolio contains four earlier stage gold exploration assets that seem to be interesting.

However, the most advanced project in the portfolio is the Kato gold project on Japan’s Hokkaido island. The project has been explored by the Metal Mining Agency of Japan in the nineties, which intersected some very intriguing gold values with for instance 17.5 meters of 8.15 g/t gold and 18.65 meters of 5.01 g/t gold. Kronk tried to follow up on these results but was unable to replicate the high-grade nature as the target depth wasn’t reached in 2019, and a 2020 hole encountered two distinct mineralized areas with 7.4 metes of 2.99 g/t gold and 2.8 meters containing 3.1 g/t gold. 2020 clearly wasn’t an easy exploration season, so let’s see what 2021 brings for BeMetals and its new portfolio of Japanese projects.

Disclosure: The author has a long position in BeMetals. Please read our disclaimer.