Ceylon Graphite (CYL.V) has announced it received the official confirmation of the renewal of the environmental protection license from Sri Lanka to continue to develop its K1 graphite mine.

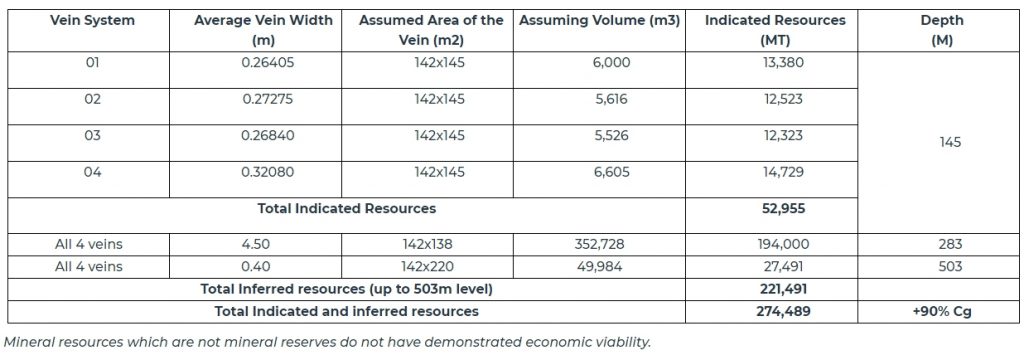

This positive news is welcome as company recently was slapped on the wrist by the BCSC because its ‘compliant’ resource estimate wasn’t compliant at all as the company didn’t follow the proper form. As such, the indicated resource of 53,000 tonnes and inferred resource of 221,000 tonnes at an average grade of in excess of 90% (as shown in the image at the top of this blog post) should not be relied upon until a compliant technical report will be filed.

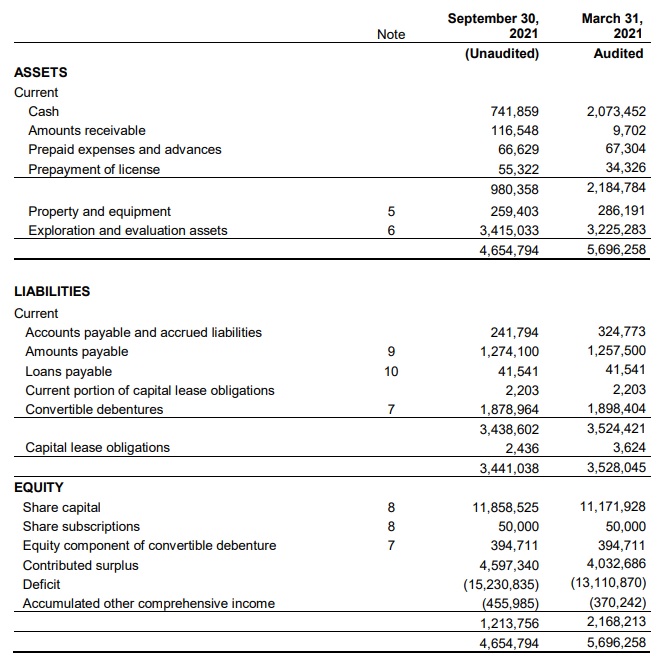

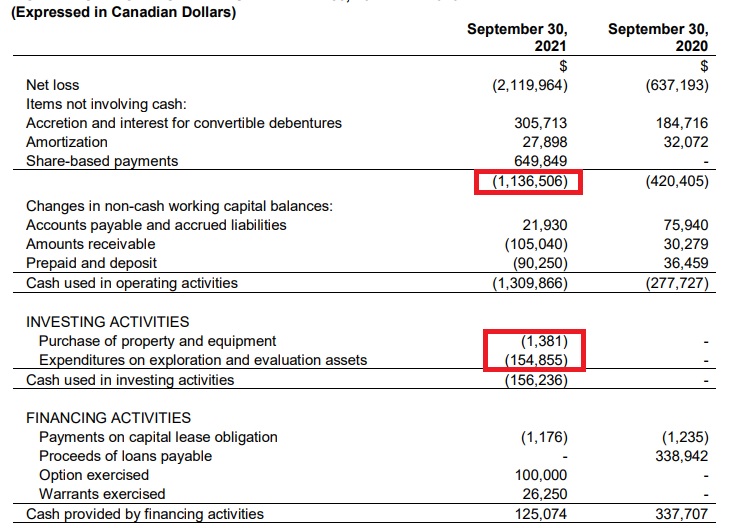

Ceylon Graphite’s balance sheet isn’t in a great shape either and we’ll have to wonder if the company will be able to raise funds on the back of a non-compliant resource estimate with an average vein width of less than 30 centimeters. As of the end of September, the balance sheet shows a negative working capital of around C$2.5M and a large portion of the working capital deficit was related to the total amounts payable on the balance sheet (C$1.27M) and a convertible debenture (almost C$1.9M). Meanwhile, Ceylon continues to burn cash. Excluding changes in the working capital, the company burned through about C$1.3M in the six month period between March and September 2021. And unfortunately only C$150,000 was actually spent on the property.

The vast majority of the expenses was related to consulting and professional fees (C$750,000) and advertising and promotion (almost a quarter of a million of which about C$100,000 was paid to North Equities) but it doesn’t look the advertising push has been very helpful. Ceylon may be facing an uphill battle in trying to raise funds in the near future.

Disclosure: The author has no position in Ceylon Graphite. Please read our disclaimer.