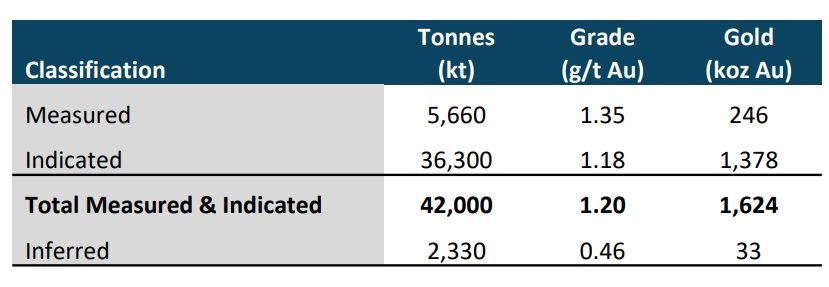

Chaarat (CGH.L), the London-listed exploration company focusing on gold exploration in the Kyrgyz Republic has published an updated resource estimate on its flagship Tulkubash gold project in the country. The company has now added 210,000 ounces of gold to its measured and indicated resource categories (JORC-compliant) which now consists of 1.6 million ounces at an average grade of 1.2 g/t, a decrease from the previous 1.35 g/t as Chaarat has now included a lower grade zone in the current resource estimate. As the company correctly notes; the impact of the lower grade will (probably?) be mitigated by an improved continuity of the mineralization, which could make mining more economic.

The drill program has now also provided Chaarat with a better understanding of the geology at Tulkubash which should enable it to finetune its metallurgical test work, while the 630,000 extra ounces in the measured and indicated categories since the publication of the feasibility study should have a substantial impact on the viability of the project.

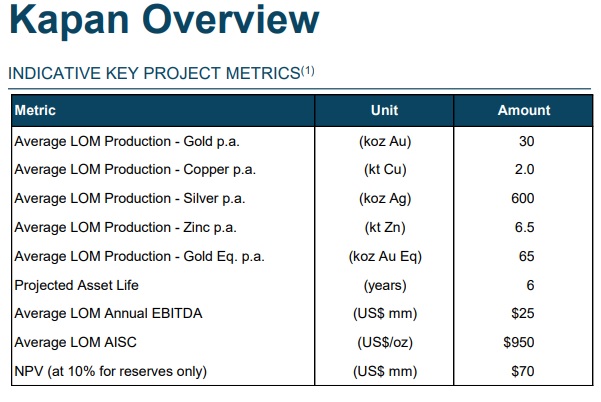

Despite a resource of just 1.6 million ounce resource estimate and an after-tax NPV5% of just US$12M for the feasibility study on the 971,000 ounce resource, Chaarat is currently valued at in excess of US$150M in London as investors are banking on the possibility Chaarat will be allowed acquire the Kumtor mine and coming through on its expectations of sitting on a potential gold district. Its US$55M offer to purchase the Kapan mine in Armenia from Polymetal International (POLY.L) would also help to put the company ‘on the map’ by converting it into a producer overnight.

Go to Chaarat’s website

The author has no position in Chaarat. Please read the disclaimer