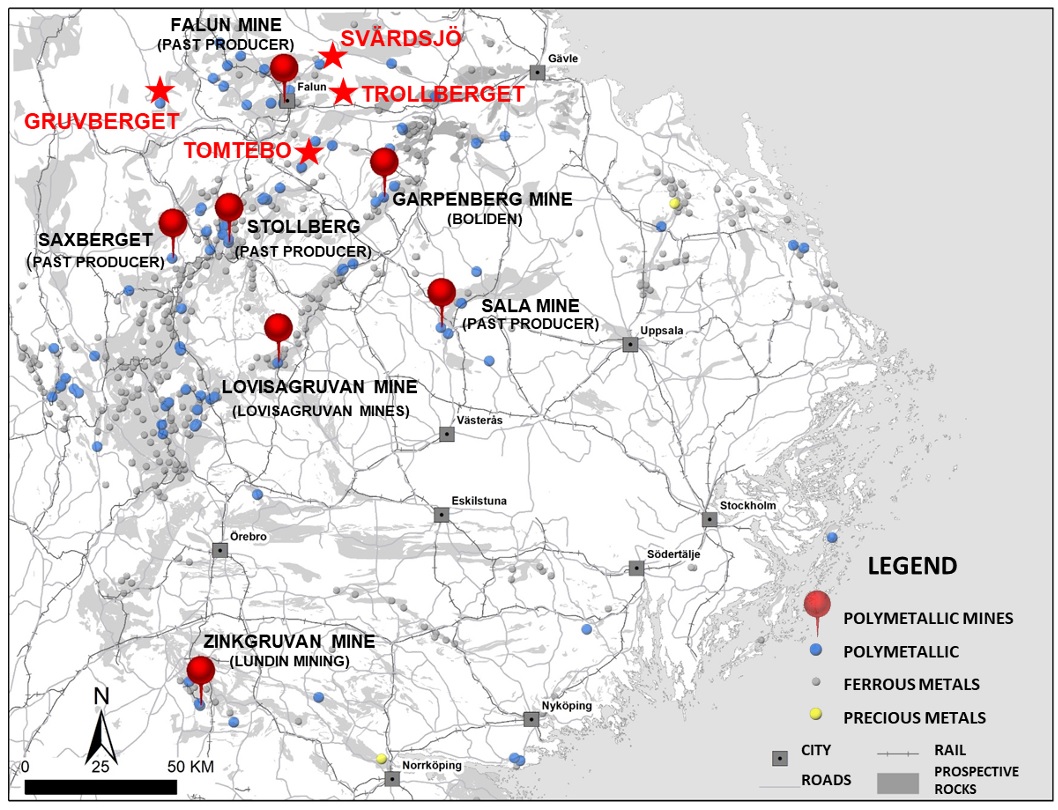

District Metals (DMX.V) has recently announced two additional acquisitions in the Bergslagen district in Sweden, where it already is drilling the past-producing Tomtebo mine, where the initial drill results are excellent. We will discuss both acquisitions in more detail in a report, but we already wanted to provide a brief overview.

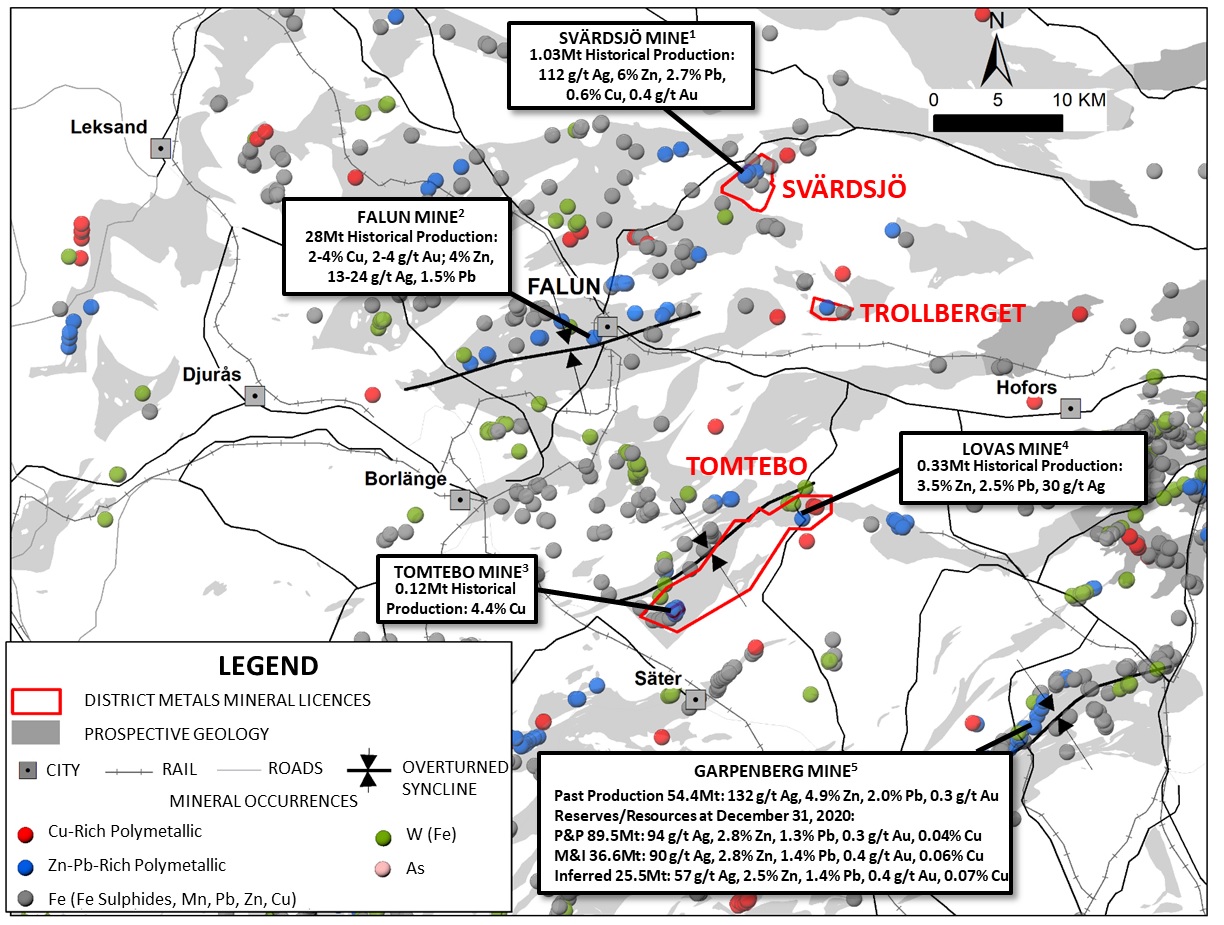

In a first deal, District Metals executed a definitive purchase agreement with EMX Royalty Corp (EMX.V, EMX), which also was the vendor of the Tomtebo projects, to acquire the Svärdsjö project. Svardsjo is located about 25 kilometers north of Tomtebo and as it’s less than 50 kilometers away from Boliden’s Garpenberg mine and just 15 kilometers from a past producing mine, the Svardsjo property clearly has the right zip code.

The Svardsjo project is hosting a past producing mine with known mining activities going back hundreds of years, and more recent records indicate at least one million tonnes at an average grade of 112 g/t silver, 8.7% ZnPb, 0.4 g/t gold and 0.6% copper were mined. Mining was conducted all the way to a depth of 390 meters and the mineralization appears to continue at depth. While Boliden conducted exploration activities between 2009 and 2019, its exploration license was not renewed and EMX scooped up the property which it is now selling to District Metals for C$35,000 in cash and 1.66M shares of District Metals while there are some milestone payments attached to that as well.

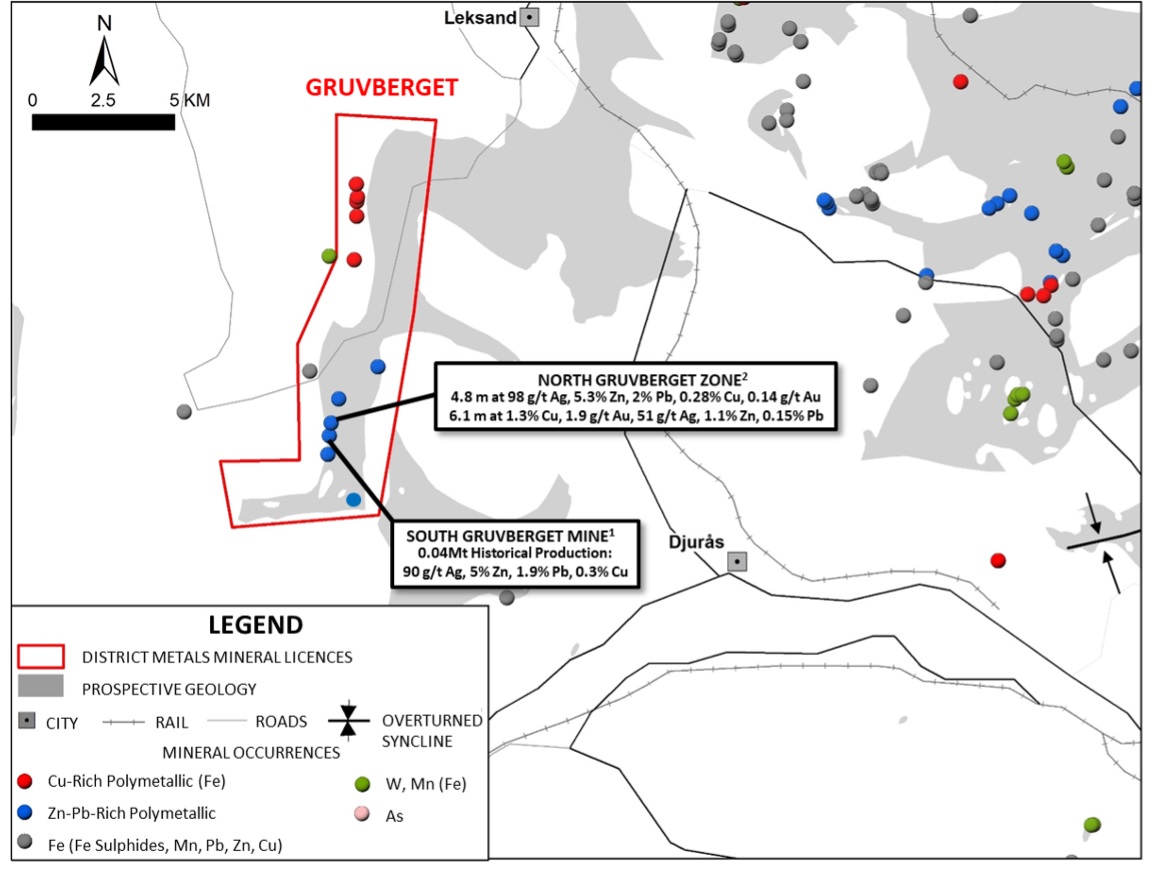

In a separate transaction, District Metals acquired the Gruvberget property from Explora Mineral, a privately held Swedish company. This project is also located in Sweden’s Bergslagen district, this time further west. This property also has a past-producing mine but only about 40,000 tonnes were mined and subsequently hauled to the Falun mine to be processed. The grade was good with almost 3 ounces of silver per tonne of rock, 7% ZnPb and 0.3% copper, especially keeping in mind this was an open pit mine.

Historical drill programs seemed to indicate higher grade mineralization could be found across the property with for instance 6.4 meters containing in excess of 4 oz/t silver, 11.9% ZnPb and 0.48% copper which would be highly economical at today’s prices. The most recent drill program was conducted about 10 years ago, so this once again is a project in a proven district that has barely seen any modern exploration activities.

District Metals can acquire full ownership of the Gruvberget property by making a C$20,000 cash payment, issue 1 million shares and incur at least C$0.5M in eligible expenditures on the project within two years. Additionally, a 2.5% NSR will be issued to the seller, and that entire NSR can be repurchased for C$8M.

Disclosure: The author has a long position in District Metals. District is a sponsor of the website. Please read our disclaimer.