Equitas Resources (EQT.V) had some very exciting news to share in January, as the company announced it had entered into an agreement with a private company to acquire an initial 60% stake (with the right to earn a 70% stake) in the Alta Floresta project in Brazil. However, the initial agreement also provides this very interesting bulletpoint:

Prior to closing, Alta Floresta Gold will use commercially reasonable efforts to become the legal and beneficial owner of 100% of the issued and outstanding equity interests of Alta Floresta Mineração.

Based on our first discussions with Equitas’ management team, it’s quite likely the owner of the remaining part of Alta Floresta would indeed entertain an offer to sell its stake, so we do expect Equitas to end up with the full ownership of the project. Alta Floresta is already producing minimal amounts of gold through processing alluvial mineralization.

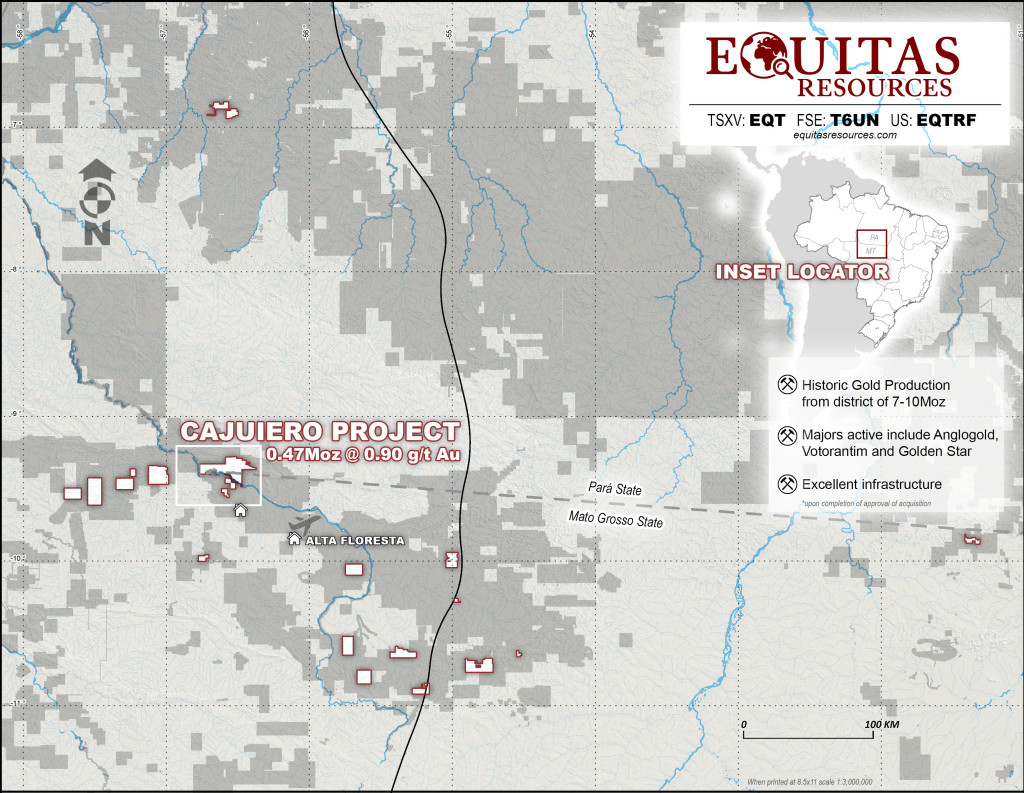

Of course, Equitas doesn’t plan to remain an alluvial gold producer forever, and is currently working on a plan to maximize the value of the Cajueiro-project. This isn’t just some sort of amateur operation as the project has a NI43-101 compliant resource estimate (containing 270,000 ounces of gold at an average grade of 0.9 g/t. The alluvial gold production is just a very first phase, and Equitas aims to quickly develop the saprolite and sulphide zones of the project as well.

The market hasn’t been provided with a lot of details just yet, but Equitas plans to release an update technical report the moment the deal closes. This should be the starting point of a very busy year wherein we expect the company to develop the project by adding a gravity circuit to the current operations. On top of that, Equitas is aiming to release a PEA on the project by the end of this year.

The moment more information will be divulged, we will most definitely let you know. We are also anticipating to conduct an in-depth Q&A session with Kyler Hardy, Equitas’ CEO once the deal closes. For now, keep in mind Equitas Resources is on the cusp of generating a positive cash flow.

Go to Equitas’ website

The author holds no position in Equitas Resources. Equitas is not a sponsor of the website, but Zimtu Capital is. Please read the disclaimer