Falco Resources (FPC.V) has released the preliminary economic assessment on the Horne 5 project located at its Rouyn Noranda mine camp, in Canada’s Québec province.

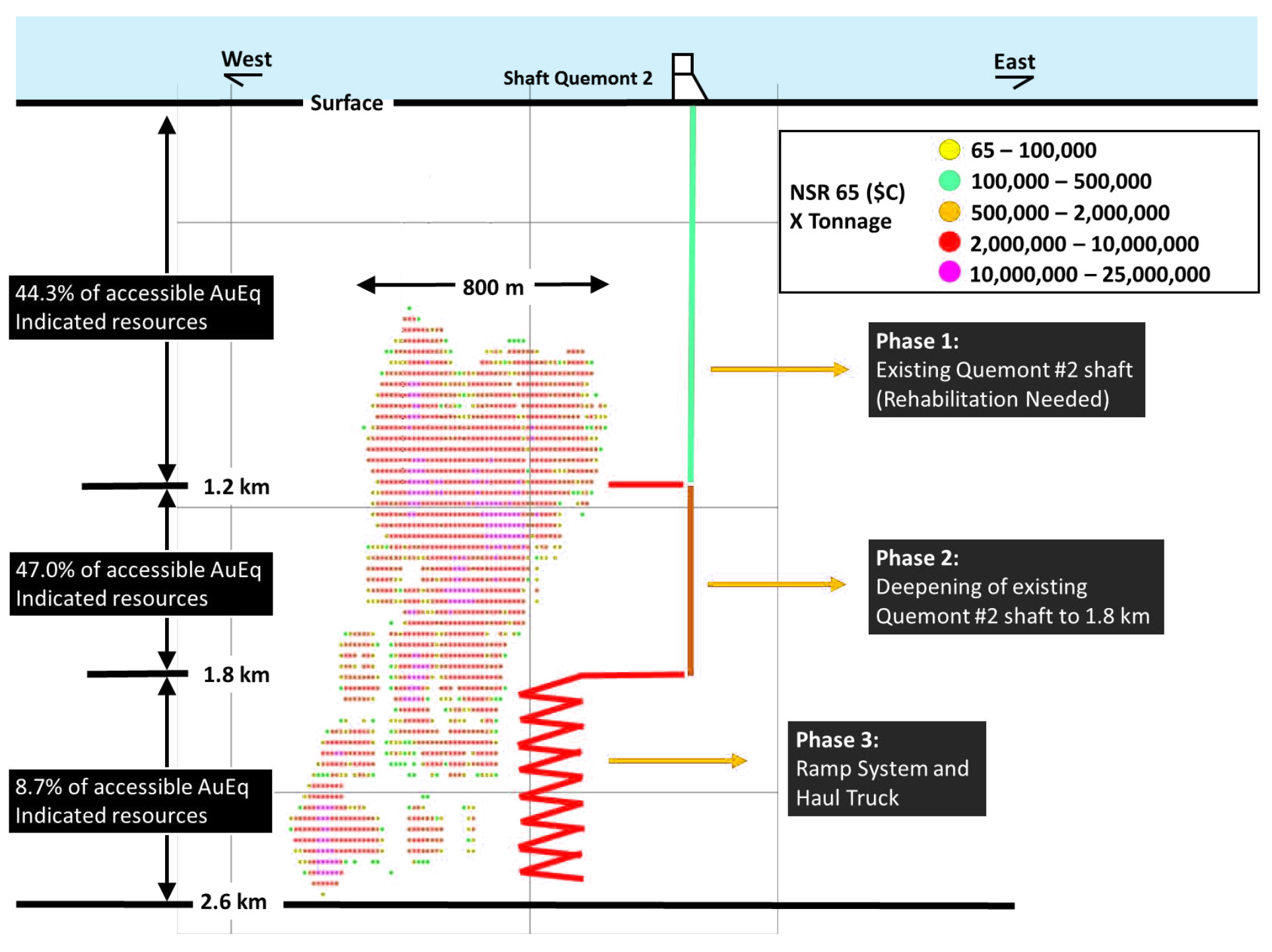

As expected, the company will be able Horne 5 as a bulk tonnage underground mine and as Falco intends to install a Ball mill and crushing circuit with a capacity of 15,000 tonnes per day, the benefits coming from the economies of scale are quite high as the AISC per ounce of gold (after deducting the revenue from selling the zinc, copper and silver as by-products) would be less than US$450/oz, for an average annual output of 236,000 ounces of gold per year (with a peak production rate of 274,000 ounces of gold).

That’s great, but it’s also necessary as the initial capex was estimated at C$905M (or approximately US$700M), so the low production cost is definitely needed to make the project viable. Due to this relatively high initial capex, the payback period is 4.1 years post tax, and the IRR is just 16% (at $1250 gold) which actually is a little bit disappointing. The IRR doesn’t surprise us considering the average annual net operating cash flow would be just $200M per year, and it looks like a gold price of $1475 will be needed to generate an after-tax IRR of 20%, which would be our minimum requirement.

On the other hand, the net present value (using an after-tax basis and a 5% discount rate) at $1250 gold would be approximately C$667M which means the company is still trading at less than 0.1 times the NPV. A PEA also always is just a first pass at the project and once the technical report gets filed, we will have a very thorough look at the document to find out how the project’s economics could be enhanced. And of course, we would never dare to bet against Luc Lessard, who seems to be determined to build the Horne 5 mine.

We will also meet with CFO Vincent Metcalfe in Montréal next week, and we’re looking forward to hear his take on the PEA.

Go to Falco’s website

The author has a long position in Falco Resources. Falco is a sponsor of the website. Please read the disclaimer