Fireweed Zinc (FWZ.V) has decided to raise some cash ahead of designing the 2022 exploration plans, and the company is issuing 4.5M shares at C$0.80 per share on a flow-through basis to raise C$3.6M. As the company is likely aiming to spend more than that on exploration next year, we assume Fireweed took advantage of a window to complete a small financing to get the balance sheet in a slightly better shape and avoid the market starting to bet against the company.

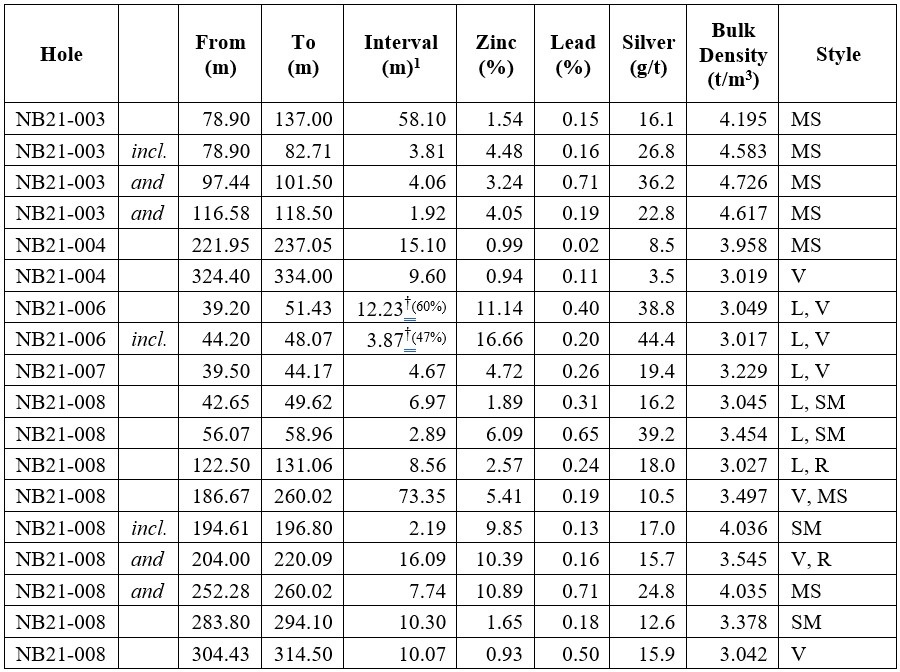

The financing comes on the heels of two important exploration updates issued by Fireweed. The day before the financing was announced, Fireweed Zinc disclosed the assay results of a few step-out holes at Boundary West, an attempt to further expand the known mineralized zone. Hole NB21-008 was the best hole of the batch with 73.35 meters of 5.41% zinc, 0.19% lead and 10.5 g/t silver including a higher grade interval of 16.1 meters containing 10.39% zinc, 0.16% lead and 15.7 g/t silver.

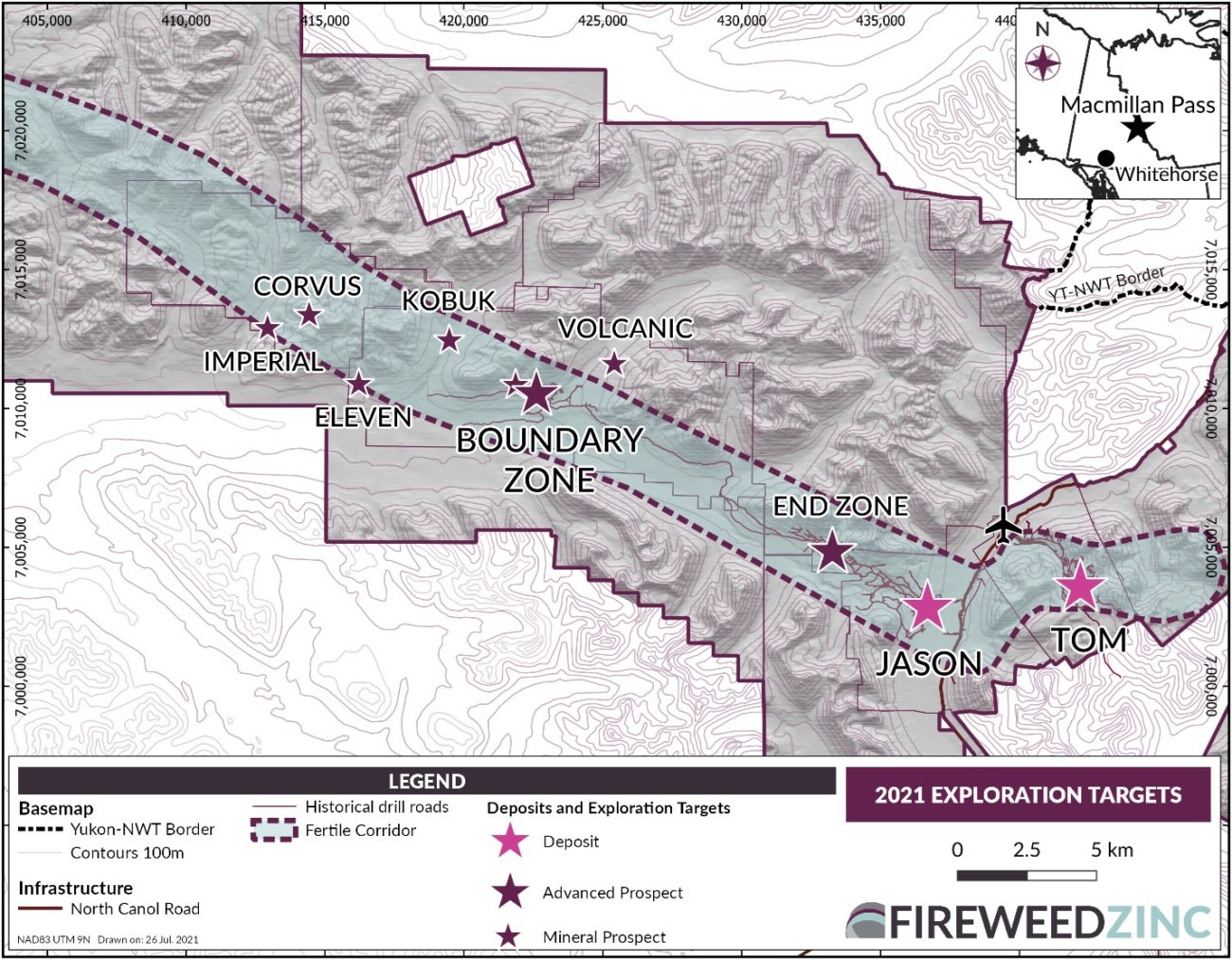

According to CEO Macdonald, the drill results from Boundary and Boundary West have confirmed the company’s exploration thesis which means the Boundary zone and Boundary West zone are now an key piece of the Macmillan Pass project.

Over the past few years, Fireweed Zinc has done everything right to advance the Macmillan Pass project which has really grown into a large-scale zinc-lead-silver deposit from the original exploration activities at the Tom and Jason deposits. The recently announced flow-through financing is rather small, but we are sure there’s a plan to make sure more value can be added in 2022.

Disclosure: The author has a long position in Fireweed Zinc. Please read our disclaimer.