Fremont Gold (FRE.V) seems to be changing its corporate strategy after this year’s drill program at Gold Bar failed to identify additional gold-bearing mineralization. With McEwen Mining (MUX, MUX.TO) bordering the Gold Bar and Gold Canyon projects, Fremont Gold was already widely expected to sell its Gold Bar/Canyon assets to McEwen after defining a resource estimate on these projects.

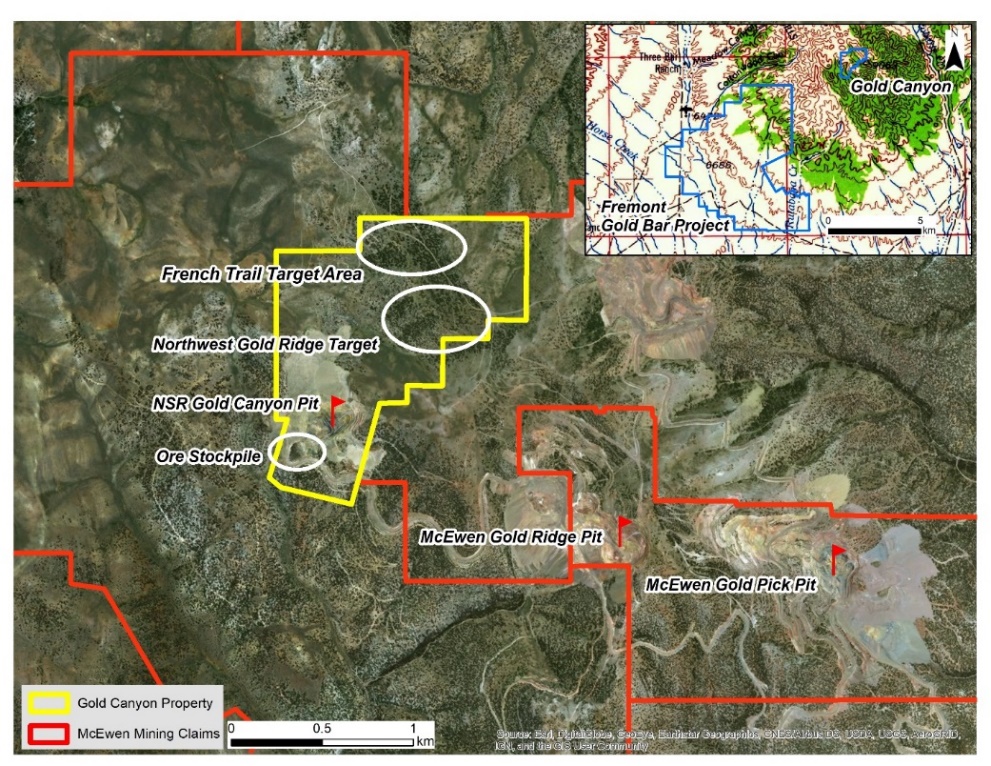

Unfortunately time ran out on Fremont Gold and after drilling duds at Gold Bar, the company decided to try to sell the option to earn into those Nevada assets to McEwen Mining. This resulted in the recent deal whereby McEwen Mining will issue 300,000 shares in order to acquire Fremont’s right to earn a 100% interest in Gold Canyon. McEwen doesn’t appear to be interested in Gold Bar as that project isn’t covered by the Fremont-McEwen agreement (which subsequently received the seal of approval from Ely Gold Royalties (ELY.V), the company Fremont was completing its earn-in procedure with.

Perhaps this means Fremont will offload additional assets as the company continues to pursue the acquisition of ‘an advanced stage gold project that has the potential to host an economic deposit with a minimum of 1 million ounces in the Western US’. With the payment of 300,000 shares (with a current market value of almost C$800,000, the equivalent of C$0.015 per Fremont share), Fremont has bought some time to find and secure a new asset. Unfortunately competition for those types of assets will be fierce now gold continues to trade around and above $1500/oz.

Disclosure: The author has a long position in Fremont Gold. Fremont Gold currently isn’t a sponsor of the website but has been one in the past 12 months. The author also has a long position in Ely Gold Royalties.