Generation Mining (GENM.C) has formally appointed Drew Anwyll as its Chief Operating Officer, and will be responsible for overseeing the definitive feasibility study on the Marathon Palladium project in Ontario and the potential start of the mine.

Anwyll is an experienced mining engineer and his previous job was Interim COO and Vice President Technical Services at Detour Gold’s (DGC.TO) Detour Lake gold mine in Ontario, which was just acquired by Kirkland Lake Gold (KL.TO, KL) so Generation Mining should be happy to scoop him up. Anwyll was awarded 750,000 options with an exercise price of C$0.45, which means the Generation Mining share price needs to move up by 35% before the options even get into the money, making this set of options truly incentive options whereby a strong share price appreciation is needed before the new COO will make any money on his option position.

Meanwhile, Generation Mining has now also filed its financial statements as of the end of 2019, which shows a cash position of C$1.2M and a working capital position of C$1.5M. This confirms Generation Mining did the right thing in January by raising money while the appetite was there, and the net proceeds of approximately C$10.2M (after paying finders fees) will boost the net cash position to in excess of C$10M as of the end of March (those financial statements should be filed in a few weeks).

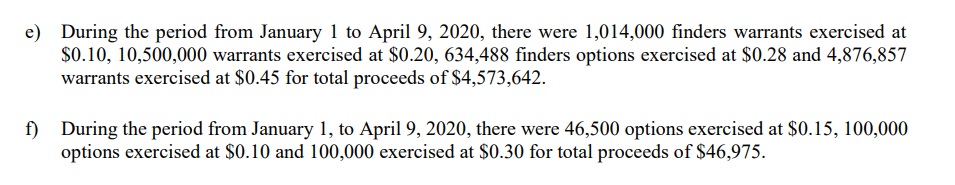

Additionally, between January 1st and April 9th a total of 17 million warrants and 246,500 options were exercised at various strike prices, raising in excess of C$4.6M which means there is a good chance Generation Mining will end H1 2020 with close to C$10M in cash on the bank, putting it in an extremely enviable position. An additional 10 million warrants with a strike price of C$0.45 remain outstanding, and this should result in additional cash proceeds to Generation Mining once these are getting exercised if/when the share price exceeds the C$0.45 level. Looking at insider filings, it looks like Lundin’s Zebra Holdings first sold 950,000 shares at C$0.60-0.62 and used those proceeds to spend C$500,000 on exercising 2.5M warrants at C$0.20.

Considering Generation Mining needed to spend C$10M on the Marathon property, spent close to C$4M in 2019 and raised C$14M in cash in H1 2020 to fund the remaining C$6.1M earn-in requirement, it’s now pretty much a guarantee Generation Mining will be able to complete the required expenditures to earn its 80% stake in Marathon.

Disclosure: The author has a long position in Generation Mining. Generation is a sponsor of the website.