Uranium is hot, and some companies will be able to capitalize on the renewed interest in the energy commodity. ASX-listed Haranga Resources (HAR.AX) owns 70% of the Saraya uranium project in Senegal. The potential of this area was first highlighted in the late 1950s by the French Atomic Energy Commission. The project was subsequently drilled in the 1970s by the predecessor of what is now Orano (with almost 500 holes) before the French started to shift their attention to Niger for their uranium needs.

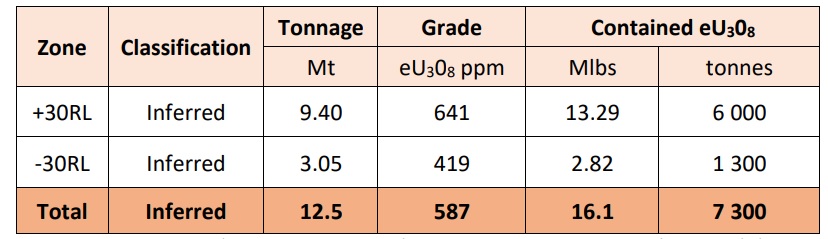

After completing its own drill program consisting of 541 historical drill holes and the 22 holes drilled by Haranga in 2022, the company has now published a resource estimate for the project. There currently are about 12.5 million tonnes in the inferred resource category with an average grade of 587ppm. This results in a total resource of 16.1 million pounds of uranium, and this appears to be just a start for the project as there are several anomalies that are even larger than the are the resource was based on. Haranga has identified at least six additional uranium anomalies which it will likely wants to drill pretty soon.

As mentioned, Haranga currently owns 70% of Mandinga which owns 100% of the Saraya permit. Subsequent to a positive pre-feasibility study, the 30% in Mandinga becomes dilutionary and once the other party drops below 6%, their ownership will be converted into a 2% NSR.

Disclosure: The author has no position in Haranga Resources. Please read the disclaimer.