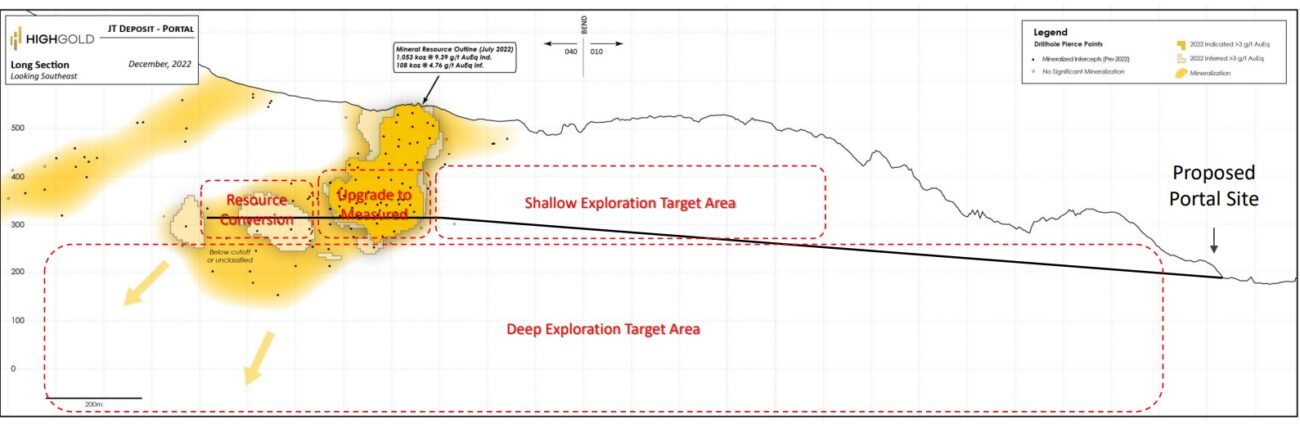

HighGold Mining (HIGH.V) has initiated plans to spin out its Ontario and Yukon exploration assets into a new company that will be named Onyx Gold. Spinning out these assets makes sense as HighGold does not get any value as the flagship Johnson Tract gold project in Alaska gets all the attention while the company also gets the biggest bang for its buck expanding and further exploring the Johnson Tract area where the company has outlined a total resource of 1.15 million ounces gold-equivalent across all categories (with 1.05 million ounces gold-equivalent in the indicated resource category at an average grade of 9.39 g/t while the 108,000 ounces in the inferred resource have an average grade of 4.76 g/t gold-equivalent.

The assets will be spun out using a plan of arrangement with Onyx Gold, a fully-owned subsidiary of HighGold. When the deal gets consummated, HighGold shareholders will receive 0.25 shares of Onyx for every share of HighGold they own while HighGold will also be awarded 5M shares of Onyx. As HIghGold currently has just over 73 million shares outstanding, this implies Onyx Gold will have a pre-money share count of just over 23 million shares (before taking the impact of an anticipated concurring placement into account). HIGH will schedule a shareholders meeting at the end of May to vote on the spin-out deal but that vote likely will be just a formality.

HighGold also recently announced it aims to raise C$7M in a non-warrant financing priced at C$0.66 per share. HighGold expects to issue 10.6 million new shares (subject to upsizing of course) and the proceeds from this financing will be used to fund the exploration and development activities at the flagship Johnson Tract project in Alaska.

Disclosure: The author has a long position in HighGold Mining. Please read our disclaimer.