Millennial Lithium (ML.V) has provided the market with an extensive update on the progress it’s making at Pastos Grandes where a feasibility study is still expected to be completed before the summer.

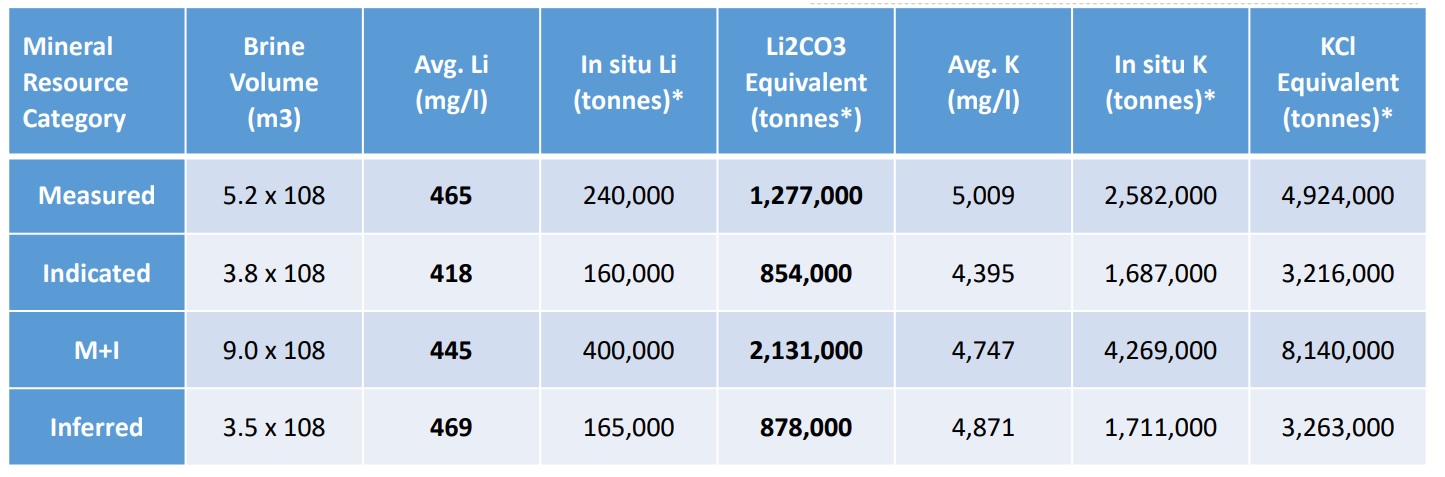

Right now, two drill rigs are still active on the REMSA license where they are testing the extensions of the known lithium-bearing brine on the ‘original’ Pastos Grandes land package. As the lithium content in the brine appears to be improving, Millennial will dispatch a drill rig to the western edge of the REMSA license to collar hole PGMW19-21 later this quarter. That’s a bold move, but should the lithium brine indeed be continuous all the way to the western edge, the currently known resource estimate of 3 million tonnes LCE at an average grade of approximately 450 mg/l could be increased in such a substantial way it could change the entire scope of the project.

As the recent holes also encountered higher-grade mineralization than the average grade of the current resources (236 meters at 500 mg/liter) as well as thicker intervals with a similar grade (545 meters at 444 mg/l), we think there’s now very little doubt the upcoming resource update (which should be completed after completing the new well 19-21) will contain a much higher overall resource.

And this could have important consequences for the feasibility study as re-calculating the most optimized way to develop the Pastos Grandes lithium could result in a new mine plan. It’s also pretty clear now the initial 25 year mine life in the PEA could be substantially longer, making the project more appealing for a strategic end-user of the lithium looking for a long-term source of supply.

The evaporation tests in the pilot ponds is also progressing as planned, and approximately 50% of the volume has already evaporated since the start of the trials in September. The brine is currently being transferred to smaller ponds as part of the evaporation trials, and this will result in the concentrate feed that will be used for the pilot plant which should be completed over the summer.

Millennial’s share price got hammered during 2018 as it lost almost 80% of its value. However, with a current market capitalization of C$100M and C$50M in cash on the bank, Millennial is in an enviable position to complete its studies without having to go back to the market.

Go to Millennial’s website

The author has a long position in Millennial Lithium. Millennial is a sponsor of the website. Please read the disclaimer