Now the iron ore price remains quite stable (thanks to the reduced volumes coming out of Brazil), some second tier iron ore assets could become more interesting again. Oceanic Iron Ore (FEO.V) released an update Preliminary Economic Assessment on its Hopes Advance iron ore project in Canada.

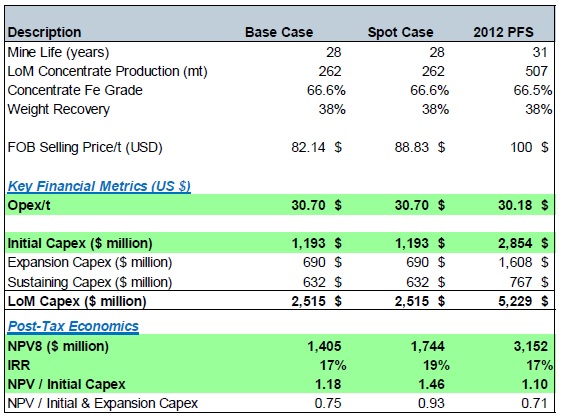

This PEA follows a pre-feasibility study that was completed in 2012 as Oceanic has been re-thinking its approach to the project and is now focusing on a lower capex (US$1.19B) and lower production (around 9 million tonnes per year) scenario. Additionally, the shipping schedule has been revised as well as Oceanic no longer plans to ship concentrate on a year-round basis to avoid the issues during the winter. The downside of this is obviously that the working capital requirement throughout the year will change dramatically as anyone who buys the project (we don’t assume Oceanic is planning to bring it into production themselves) will have to incur the operating expenses during the winter season and will only be able to ship the iron ore concentrate later on.

This is still just a PEA, and more finetuning will be needed in the next few years before Oceanic needs to make a production decision anyway so let’s see how the iron ore price evolves in the next few years.

Disclosure: The author has no position in Oceanic Iron Ore.