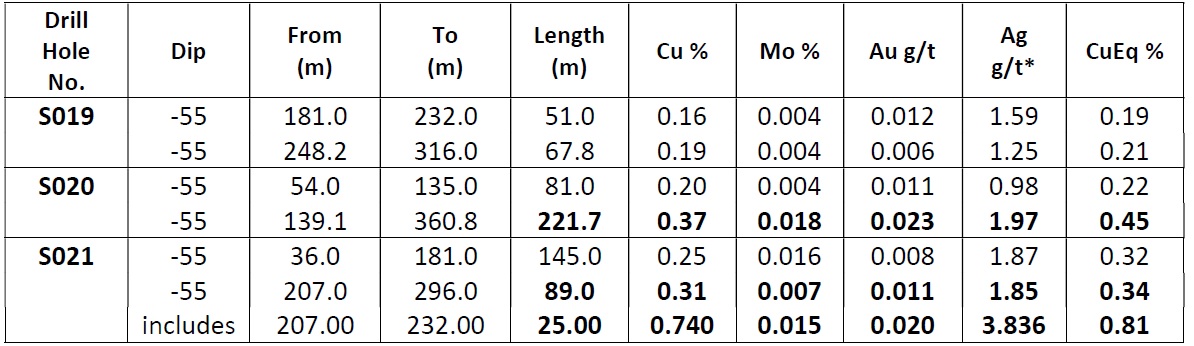

Oroco Resource Corp (OCO.V) has released the assay results from three holes drilled on the South Zone of the flagship Santo Tomas copper project in Mexico’s Sinaloa State. Hole S019 was mildly disappointing with relatively narrow and low-grade intervals like 51 meters of 0.19% CuEq followed by 68 meters of 0.21% CuEq just a little bit deeper. Holes S020 and S021 are materially better as you can see below.

Hole S020 encountered two distinct zones with 81 meters of 0.22% CuEq (not great) and 222 meters containing 0.45% CuEq (much, much better) and keep in mind the company still uses a moly price of $12 per pound while the current spot price is approximately twice as high.

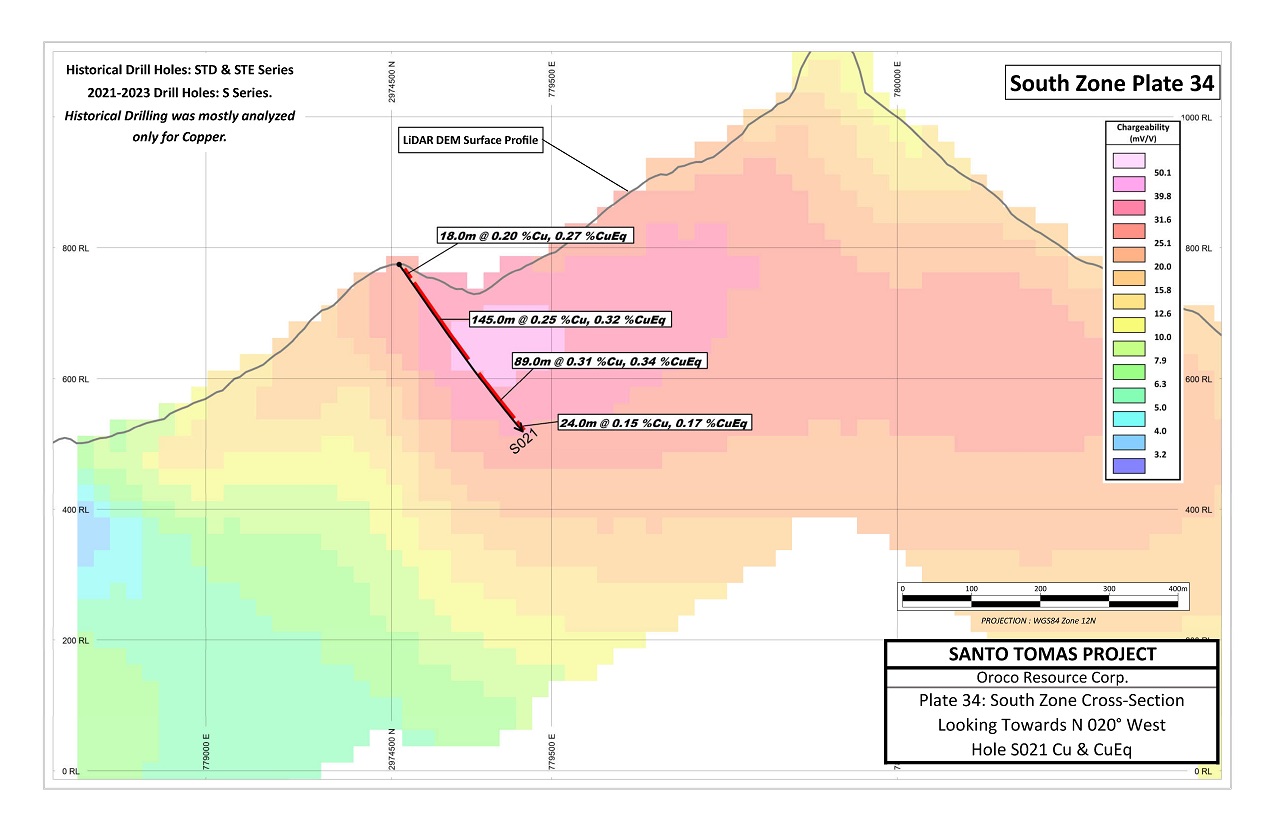

Hole S021 is an interesting one with once again two separated mineralized zones. The 145 meters of 0.32% CuEq is fine. Not great but fine (and slightly higher than the average grade in the historical resource on the South Zone) and will for sure be mined and processed as Oroco will have to dig through it to reach and mine the slightly lower zone. That zone, with 89 meters of 0.34% CuEq, is very interesting as well, not in the least because the upper portion of that interval, starting at 207 meters down hole carries an excellent grade of 0.81% CuEq of which 0.74% is copper with 0.015% molybdenum as important by-product credit. At a moly price of $25/pound the 0.015% moly would add 0.12% CuEq to the equation instead of the current 0.056% and using that price would push the copper-equivalent grade to close to in excess of 0.85% CuEq. Which also guarantees the 0.32% zone above will have to be mined as well as Oroco for sure wants to reach the lower but higher grade zone.

Assay results from all 21 holes completed on the South Zone have now been released while Oroco is continuing its horizontal drill program on the North Zone. The company is drill-testing the southernmost 400 meters of the North Zone and has so far completed three of the planned four hole drill program. Assay results should be forthcoming and the company should have its maiden resource estimate and PEA ready in the next few weeks.

Disclosure: The author has a long position in Oroco Resource Corp. Oroco is a sponsor of the website. Please read our disclaimer.