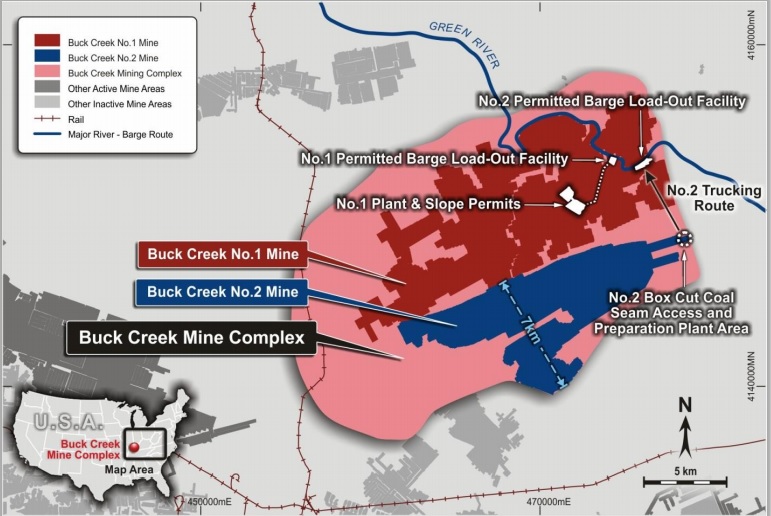

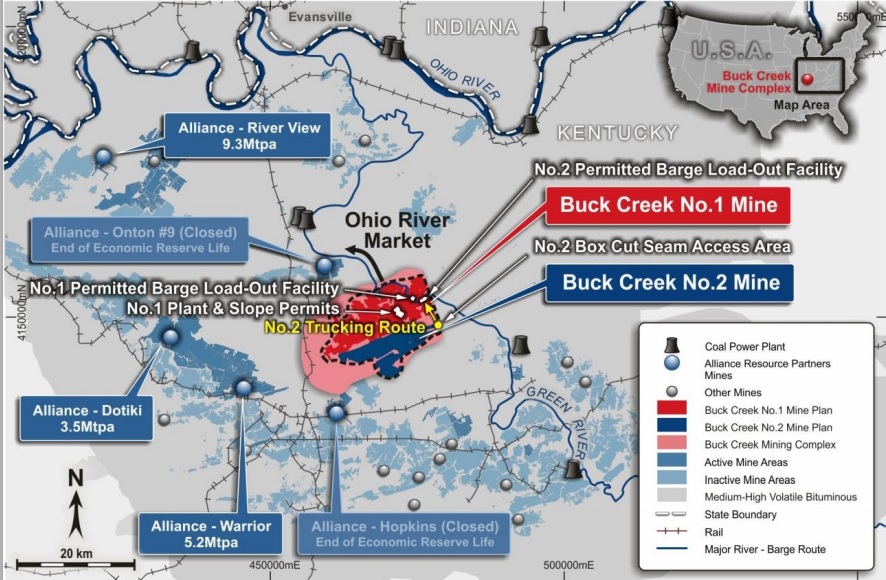

Paringa Resources (ASX:PNL) has completed a scoping study on the Buck Creek no 2 mine it owns in the United States, and the final result of the scoping study is quite positive and allows the company to re-think the production phase at Buck Creek.

Whereas the original mine plan was calling for the Buck Creek 1 mine to be developed first, the nr 2 mine might now make more sense. The initial capex of Buck Creek 2 is just $44.4M and according to the company’s base case scenario, it will generate an average annual EBITDA of $33M, resulting in a very low payback period and a higher yield. That’s also the main reason why the company has now decided to start a bankable feasibility study on the project.

Paringa is now expecting to start the construction activities at Buck Creek 2 by the summer of next year which should result in a production start around mid-2018. According to the company, it has been working with the offtake parties to see if they would agree to accept coal from the no 2 mine rather than the no 1 mine.

Go to Paringa’s website

The author has no position in Paringa Resources, but likes the story. Please read the disclaimer