Before we could release this update report, SSR Mining decided to bite the bullet and launched an all-cash offer to acquire Taiga Gold. In this report we will discuss that offer, and will also publish the draft we had in mind anyway, completed with post-deal details to explain the situation, and why this all-cash offer seems to be fair to all parties involved.

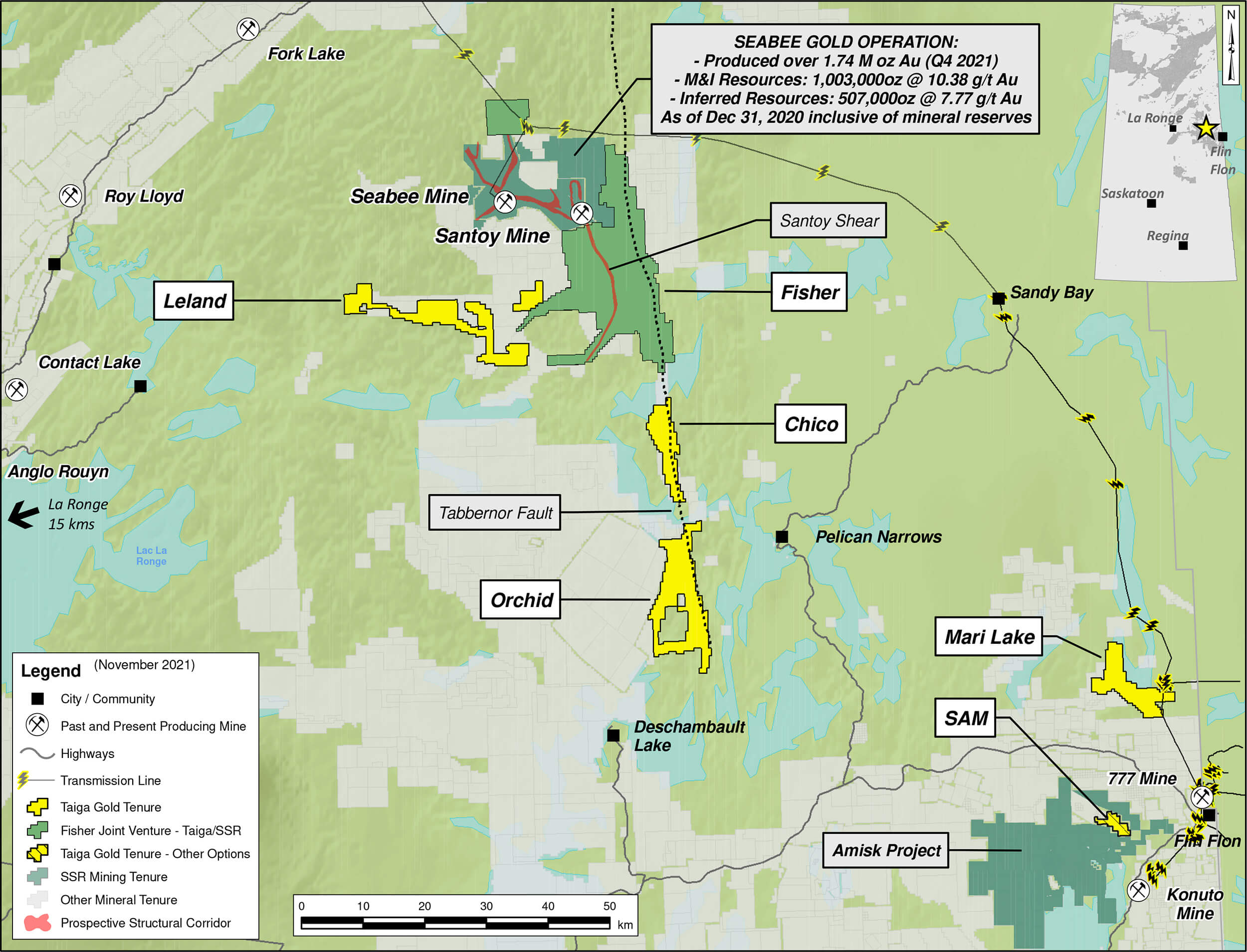

Taiga Gold (TGC.C) had recently disclosed additional drill results from the Fisher project where partner SSR Mining (SSRM, SSRM.TO) is still exploring the claims in an attempt to find more mill feed for the nearby Seabee mill. SSR Mining has clearly communicated the Fisher project has the potential to provide additional plant feed, and has included the project in the Seabee Growth Pipeline. And of course, this has now materialized as SSR launched an offer to acquire the company sooner than we had expected. Taiga was trading at just C$0.095 when our initial report on the company was published, so we have no complaints about the share price performance and the exit strategy.

An all-cash offer that makes sense

SSR Mining is launching an offer to acquire all outstanding shares of Taiga Gold, its 20% joint venture partner on the Fisher gold project in Saskatchewan.

SSR will be paying C$0.265 in cash per share of Taiga Gold, which is a premium of approximately 36% to the closing price before the announcement. The company’s management and board have entered into an agreement with SSR to tender their shares, and large shareholder Eagle Plains Resources (EPL.V) will also vote in favor of the agreement.

When the transaction is completed, SSR Mining will acquire the 20% in the Fisher project it doesn’t own yet while it will also retain full ownership of the nearby Chico and Leland exploration properties which are also located within trucking distance from the Seabee mine and mill. Additionally, SSR Mining will basically extinguish the NSR on Fisher that was granted to Taiga Gold as part of the original agreement, and removing that NSR could be valuable for SSR Mining down the road.

So it’s not really a surprise SSR Mining is making a move for Taiga Gold and it’s very much understandable why SSR sees merits in acquiring full ownership of two exploration projects, the 20% in the Fisher project it doesn’t own yet and the NSR on the Fisher claims. From Taiga Gold’s side, the exit strategy also makes sense.

The all-cash offer is not subject to any financing conditions (as SSR Mining has plenty of cash on its balance sheet) and provides an opportunity to monetize the investment in an orderly fashion as this exit strategy will be very orderly.

One could argue the price is a bit low, but there are some arguments to be made as to why this is a reasonable offer. First of all, it’s an all-cash offer with zero financing risk. As of the end of September, SSR Mining had a positive working capital position of in excess of US$1.2B, of which almost US$900M was cash. This transaction will require SSR Mining to spend less than 3% of its existing cash position, so that will hardly make a dent in the company’s robust cash position.

Secondly, the timing actually works out quite well. We had expected SSR Mining to have a closer look in 2023 or even 2024 after completing more drill programs. If you’re applying a discount rate of 10%, C$0.265 today is the equivalent of C$0.35 in three years. While this is a rather arbitrary approach, keep in mind SSR Mining could have played the game very different by aggressively stepping up its exploration plans and continuously issuing cash calls to Taiga Gold. You could ask Golden Arrow Resources (GRG.V) how the joint venture with SSR Mining on the Chinchillas/Punas worked out for them. ‘Not very well’ is the answer, as Golden Arrow had to sell its minority stake when financial issues and cash calls have put the company with its back against the corner. When a small company is going head to head with a senior producer with almost $1B in its treasury, it’s hardly a surprise the big boys usually win.

And thirdly, there realistically was only one logical suitor. SSR Mining already owned 80% of the Fisher project and there’s no real logical acquiror in the region. That limits Taiga Gold’s options and accepting a decent (but no knock-out) all-cash offer likely is the best way out for all shareholders. The only pity is that SSR Mining didn’t offer a cash or stock option as it would have been nice to elect a stock option.

The final batch of the Fisher assay results

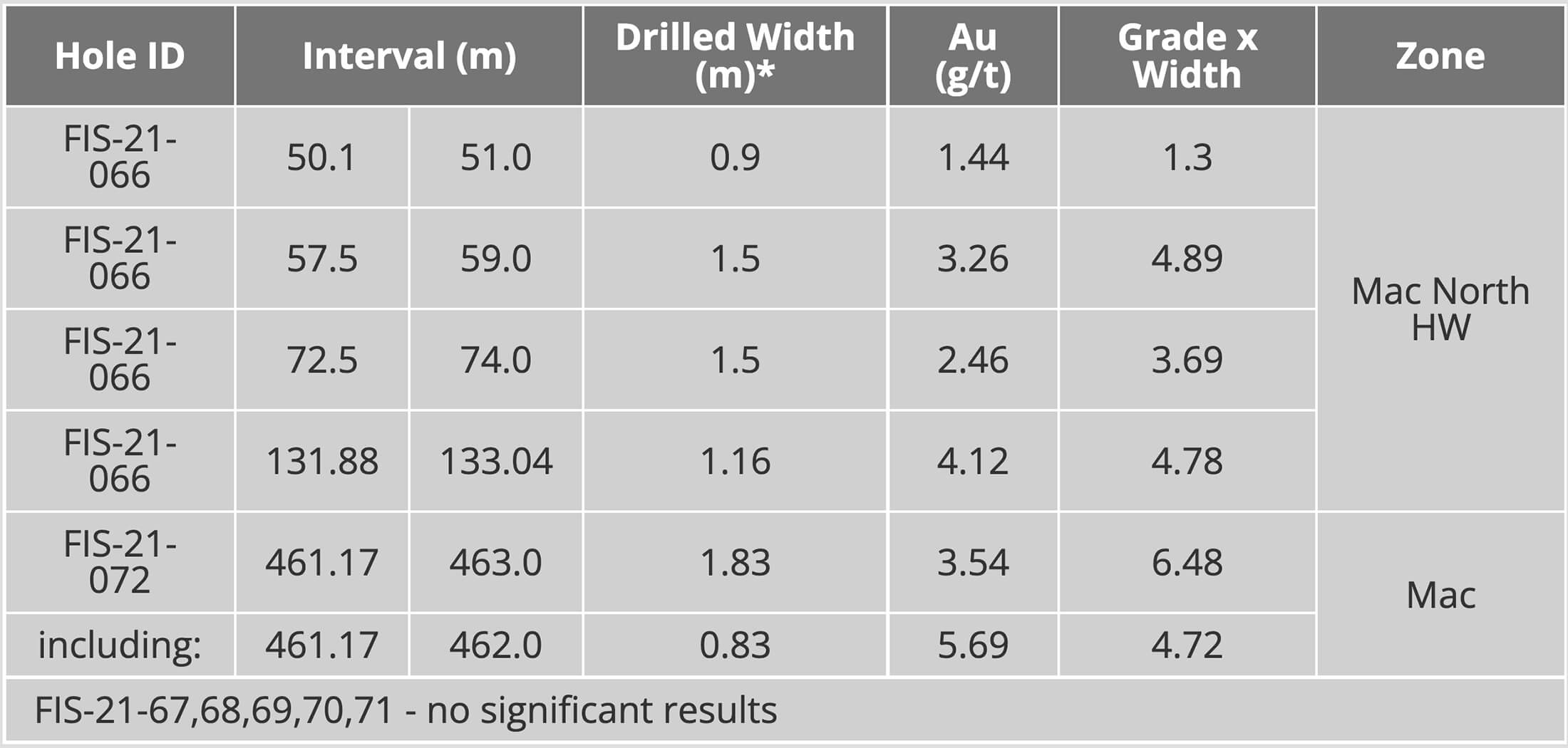

Before the deal was announced, Taiga Gold released the results of a total of seven holes which were drilled in the 2021 summer drill program for a total of just over 2,800 meters bringing the total to almost 37,000 meters drilled in 95 holes. Two holes were drilled in Mac, two holes were targeting the Mac North hanging wall while the previously undrilled Jasmine Zone was the target of three drill holes.

Unfortunately of the seven holes drilled, only two (the first hole and the last hole) returned decent gold values as all other holes labeled as ‘no significant results’ were encountered. Hole 66 appears to be interesting as there appear to be four layers of gold mineralization. All four are pretty narrow (0.9, 1.5, 1.5 and 1.16 meters) but do contain gold in varying grades, as you can see below.

It’s also interesting the mineralization in the Mac North hanging wall appears to be so close to surface, which isn’t the case for the Mac area where gold mineralization was encountered at a depth of 461 meters down hole with an interval of 1.83 meters of 3.54 g/t gold (including a narrower higher grade interval of 0.83 meters containing 5.69 g/t gold).

The exploration activities on the Fisher project are obviously ongoing and the company also provided an update on the sampling program on three new areas; George’s Lake East, Gold Island and Bone North.

Reacquiring the Chico project

Taiga Gold also recently announced it had reached an agreement with Aben Resources (ABN.V), which optioned the project from Taiga, whereby Taiga Gold is essentially reacquiring the project. Aben originally optioned the project from Eagle Plains Resources and after spinning out Taiga Gold, the Chico project was assigned to Taiga, with a 0.5% NSR reserved for EPL. The original option agreement goes all the way back to December 2016 but very little work has been done on this property. A drill program was initiated in early 2018 but was suspended due to local opposition, which essentially put the option agreement in suspension due to force majuere where it has remained as consultation continues.

The Chico property is located in Saskatchewan, just 45 kilometers southeast of the Seabee gold mine, owned and operated by SSR Mining (SSRM, SSR.TO). The project has been intermittently subject to exploration programs by the previous owners of the project. The historical data records indicate Hudson Bay Exploration was the first company to do some preliminary work at Chico as it completed an Electro-Magnetic survey in the early 70’s. Other operates came and went over the course of several decades, but it took until 2002 when the property was acquired by Northwind Resources, before the exploration activities accelerated as the latter discovered a new gold zone: the Wingnut zone. Grab samples from this zone returned anomalous and high grade gold values (up to 41.35 g/t gold), and Eagle Plains Resources was obviously keen to continue to work on this property.

It may sound counter-intuitive to see the optionor (Taiga) actually paying the optionee (Aben) to reacquire the property as Taiga had to pay C$200,000 in cash take possession of the project, but there may be a straightforward reason. Chico partner Aben Resources had spent over C$400,000 exploring Chico prior to declaring force majeure due to local opposition, so it is no surprise that they wanted something in return for their investment.

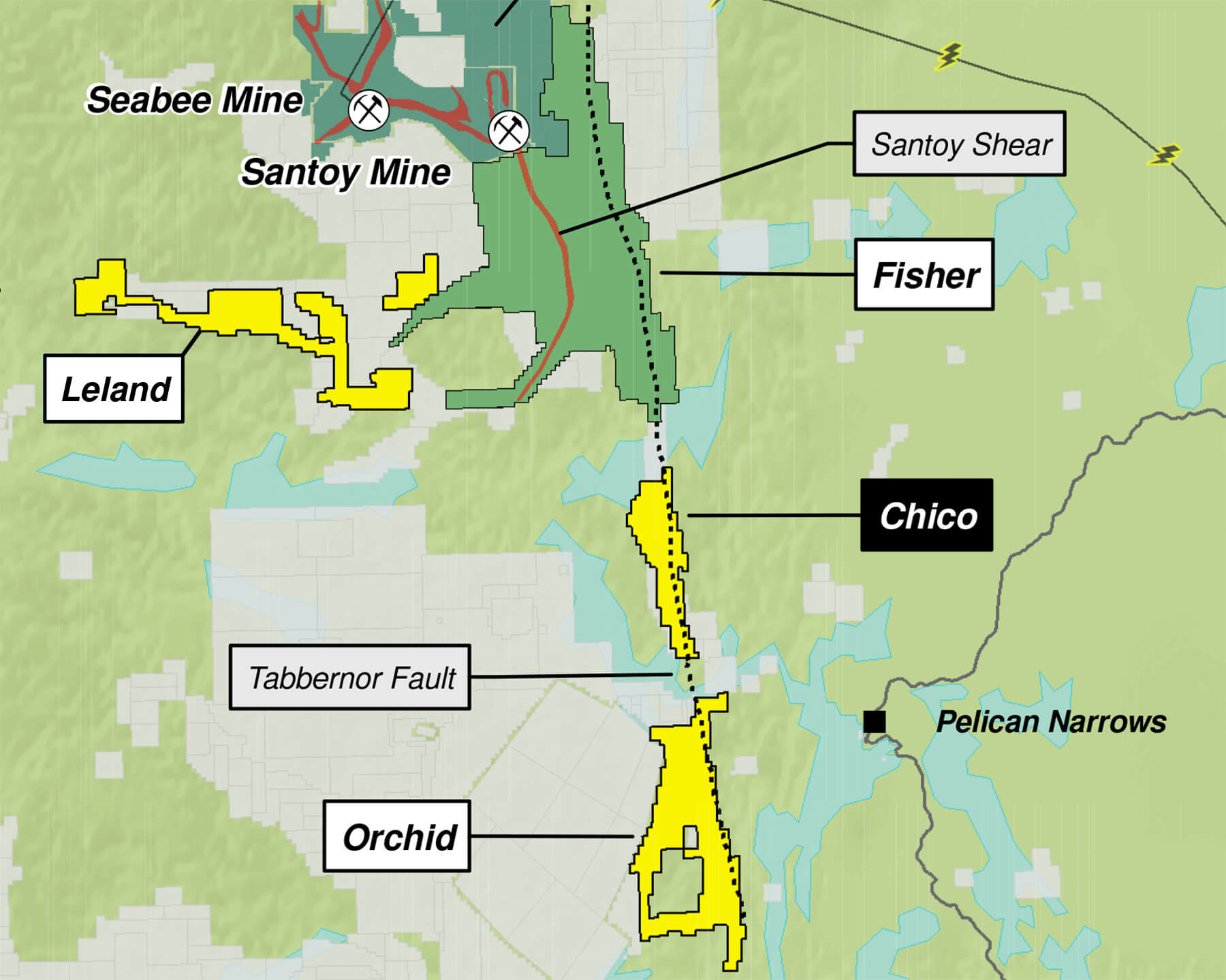

Let’s have a look at the exact location of Chico, which we highlighted here below.

Indeed, Chico is basically the extension of the Fisher project where SSR Mining has spent almost C$15M in figuring out if the project could host some satellite deposits. The entire Tabbernor fault is an area of interest and although Taiga is now paying to extinguish the option agreement with Aben, this piece of real estate could become very valuable to Taiga Gold (post scriptum note: all pieces of the puzzle have now fallen into place as buying back the Chico option was indeed a first step to give SSR Mining an unencumbered land package).

SSR Mining is clearly looking at the Fisher project to keep its Seabee-based mill up and running. It has now repeatedly said so in its official documents, including the quarterly reports which have been filed with the Canadian and American regulators. While Fisher seems to be the obvious choice and target, the reality likely is that SSR Mining is looking at everything along the Tabbernor fault that could make economic sense. In other words, anything that would be within trucking distance from the mill could be seen as a potential area to generate more mill feed. It should be noted that the Chico project is located south of the Churchill River, which will certainly introduce increased logistical complexities if ore were to eventually be shipped northward to the Seabee mill.

Post scriptum note: in the announcement confirming the sale of Taiga Gold to SSR Mining, Taiga Gold also mentioned it has repurchased the Leland option from SKRR Exploration (SKRR.V) for a cash payment of C$900,000. Option partner SKRR had only recently spent approximately $1M exploring Leland (with mediocre results), so this appears to be case of “cost recovery” for SKRR. It’s understandable this news was withheld until the deal with SSR Mining was official as this would have been a very clear giveaway. As Taiga reversed earn-in agreements with third parties on the Tabbernor fault ahead of the sale to SSR Mining, it is now very clear SSR is ‘here to stay’. And while this will no longer be in a joint venture with Taiga Gold, we expect SSR Mining to accelerate its exploration programs in the Greater Seabee Region as it will have to scale up its efforts to drill out resources and draw up mine plans.

Conclusion

While the exploration results from Fisher weren’t great, keep in mind exploration isn’t easy, especially when you’re targeting cylinder-shaped mineralization at Fisher. It’s important to try to understand the system and the structures, and every drill hole adds more information and insight and it looks like SSR Mining has seen enough to be sufficiently confident in the future and prospects of the Fisher project and the other Taiga-projects along the Tabbernor Fault.

We were caught off-guard while initially writing this update as SSR Mining made a move faster than we anticipated and the all-cash offer of C$0.265 per share of Taiga Gold seems to be a win-win situation for all involved parties. Shareholders of Taiga Gold now have the possibility to exit their positions and redeploy the cash elsewhere and Eagle Plains Resources, the company Taiga Gold was spun out from, will emerge with about C$8M in cash on the balance sheet – and that likely also played a role in EPL’s decision to support the sale of Taiga Gold to SSR Mining. And so do we. The author of this report has a long position in Taiga Gold and plans to tender his position to SSR Mining.

And for the punters, it could be interesting to apply an arbitrage strategy here. Taiga Gold can currently be bought on the open market for C$0.255 while the all-cash offer will obviously remain unchanged at C$0.265. If the buyout goes through, and it looks like it will as Taiga’s main shareholders have agreed to the C$0.265 cash bid, it could be an easy 3.9% gain. We expect the transaction to close in the first quarter of 2022.

Disclosure: The author has a long position in Taiga Gold. Taiga Gold is a sponsor of the website. Please read our disclaimer.